De-Risking and Anti-Money Laundering Screening – How Shufti Can Help FIs

Every firm providing financial services must stay put with the existing compliance and follow new updates, ever-evolving regulations, and trends in this industry. Although following such things is seen as a hectic job and time-consuming, failure to follow up results in non-compliance with the emerging regulations. This can further damage the institution’s reputation, lose clients and be subject to severe penalties or sanctions from global regulatory bodies.

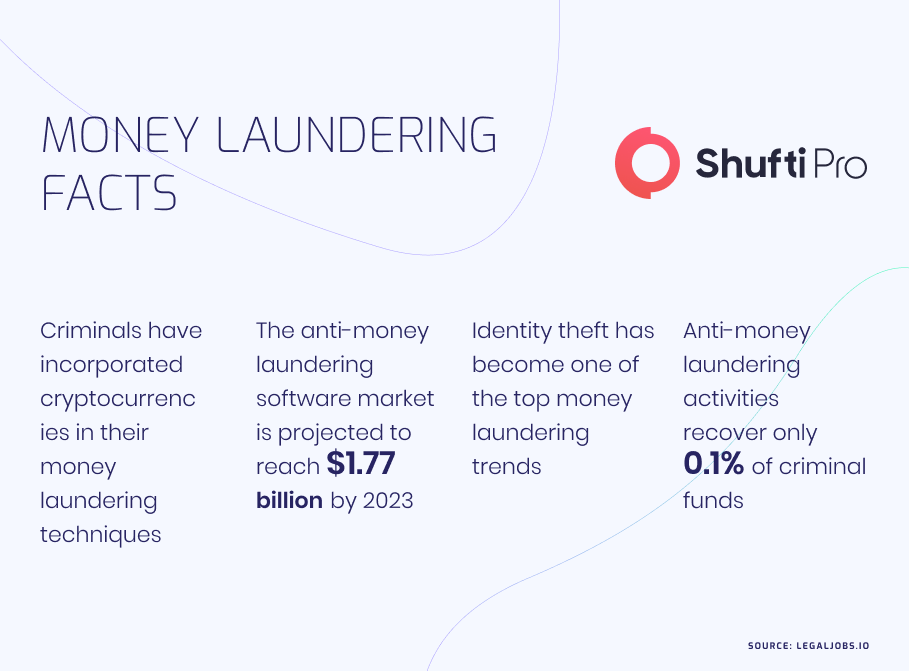

Therefore, banks and financial service providers across the globe seek to mitigate the potential risk they face and identify the shortcoming in their in-house Anti-Money Laundering (AML) control systems by adopting de-risking AML strategies. Thus, it’s viable for financial institutions to incorporate appropriate AML/CFT programs to fight crimes. De-risking, on the other hand, banks can apply if they find it hard to manage money laundering obligations.

De-Risking AML Strategy – An Effective Measure To Fight Crime

As money laundering, terrorist financing and other financial crimes are on rise, banks and other institutions need effective strategies that can help to overcome the risk. De-risking is an appropriate strategy that businesses need to practice when they fail or can no longer address the risk of financial crimes that a given corporate relationship presents. However, the reputational or financial cost of practising AML/CFT regulations is too high to establish or continue a business or customer relationship that can expose businesses to money laundering as well as terrorist financing threats. Financial firms may adopt one of the de-risking anti-money laundering strategies, from increasing their compliance budget or incorporating new procedures, in order to take more serious steps to restrict or terminate corporate relationships.

Thus, terminating a business relationship as a means of de-risking may be a case-by-case assessment that may take place on a blanket sectoral level and involve existing relationships with a group of clients. However, where the financial institutions take a sectoral approach to de-risk, they appear to terminate relations with high-risk entities, including Foreign Correspondent Banks (FCBs), Money Services Businesses (MSBs) or embassies. Furthermore, this strategy tends to be effective in certain jurisdictions across the world, particularly in developing countries with emerging or limited financial markets and an increased risk of crimes.

FATF’s Risk-Based Approach on De-Risking

In the light of the Financial Action Task Force (FATF) definition, de-risking is considered a critical situation where the banks or financial services providers restrict or exit business relationships with clients. The financial watchdog has some valuable information highlighting the need of determining the causes and impacts of de-risking in the private sector. FATF’s de-risking strategy is truly based on its own Recommendations. As a result, the regulatory authority obligated banks and financial firms to identify, assess, understand and incorporate anti-money laundering as well as countering terrorist financing compliance according to the degree of identified risk of crime.

Case-by-Case Assessment

Financial institutions need to evaluate new customers possessing potential risk of crime based on an individual basis instead of wholesale de-risking. In a statement on its website, the Financial Action Task Force made it clear that it mandates banks to terminate or restrict client relationships only in specific cases where money laundering and terrorist financing risk can not be handled.

Customer Due Diligence (CDD)

Among the key recommendations for reducing the risk, the financial watchdog obligates practicing customer due diligence procedures that include robust client identity verification using “reliable and independent information, data or documentation” as well as screening customers and business UBOs against global financial sanction lists.

Ongoing CDD and Transaction Monitoring

Once banks have successfully completed the CDD procedure, there still remains the need for ongoing monitoring and customer due diligence. It’s vital to ensure that only legit transactions get authorization, and remain consistent with banks’ knowledge of the client and the nature of the corporate relationship. However, if any changes to the business profiles are detected, additional CDD checks need to be practiced.

FinCEN and Federal Regulators Issued Warnings Against De-Risking

On July 6, the Financial Crimes Enforcement Network (FinCEN) the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the National Credit Union Administration, and the Office of the Comptroller of the Currency published a Joint Statement to “remind’ banks and financial firms to implement a risk-based approach to assess business relationships and conduct CDD. The Joint Statement also backs FinCEN’s June 22 Statement on Bank Secrecy Act Due Diligence for Independent ATM Owners or Operator, in which the financial watchdog also remind financial firms “that not all independent ATM owner or operator customers pose the same level of money laundering, terrorist financing (ML/TF), or another illicit financial activity risk, and not all independent ATM owner or operator customers are automatically higher risk.”

In addition to this, the Joint Statement, also stressed that it doesn’t change the existing Bank Secrecy Act/Anti-Money Laundering (“BSA/AML”) requirements or form new supervisory expectations, and announces that “the Agencies are reinforcing a longstanding position that no customer type presents a single level of uniform risk or a particular risk profile related to money laundering, terrorist financing, or other illicit financial activity.”

Instead of this, banks must “apply a risk-based approach to CDD, including when developing the risk profiles of their customers.” this is because, client relationships present different risk level of money laundering, terrorist financing and other bogus financial schemes. This risk level depends on the presence or absence of various factors including facts and circumstances specific to the customer relationships.

How Shufti Can Help

Banks and other financial firms are obliged to comply with local as well as international regulations in order to curb the risk of money laundering and terrorist financing. However, De-risking AML is another cost-effective response to mitigate financial crime risk but also lacks the sensitivity and diligence implicit in the AML risk-based approach, which mandates banks to seek and gather personally identifiable information about customers and ultimate beneficial owners. But, taking advantage of emerging technologies, automated AML solutions are designed to enhance CDD procedure, improving the accuracy of background screening and transaction monitoring that helps banks to create customer profiles based on the risk level they can present.

Shufti’s Anti-Money Laundering (AML) screening allows insurance firms to stay compliant with regulatory standards as well as prevent money laundering. Powered by thousands of AI algorithms, Shufti’s AML screening solution also screens customers against 1700+ global watchlists in less than a second with 98.67% accuracy.

Want to learn more about our AML Screening solution for Banks?