Shufti helps businesses onboard faster, fight fraud, and stay compliant

Trusted Globally By Leading Enterprises

Powering safe customer journeys across 2000+ businesses & 250+ regions

The Challenges Shufti Solves

Global Identity Verification

Onboard users anywhere, instantly with secure, AI-powered verification flows that keep genuine customers moving with minimal friction.

Identity Lifecycle Management

Secure the full customer journey with continuous identity assurance, re-verify when risk changes and monitor signals without disrupting real users.

Smart Fraud Prevention

Stop fraud before it starts with adaptive AI that detects deepfakes, synthetic IDs, and account takeovers as patterns evolve.

Compliance Assured

Meet global regulations confidently by automating KYC, KYB, KYI, and AML with accurate screening and clear audit trails across markets.

Trust, built-in. From first verification to every future interaction

One Platform. Full Identity Lifecycle

User Verification

Onboard and authenticate legitimate users in seconds

Business Onboarding

Perform global KYB and due diligence with confidence

Authentication

Detect and block fraud at every touchpoint

monitoring & Compliance

Proactively manage risk and maintain regulatory compliance

User Verification

Onboard and authenticate legitimate users in seconds.

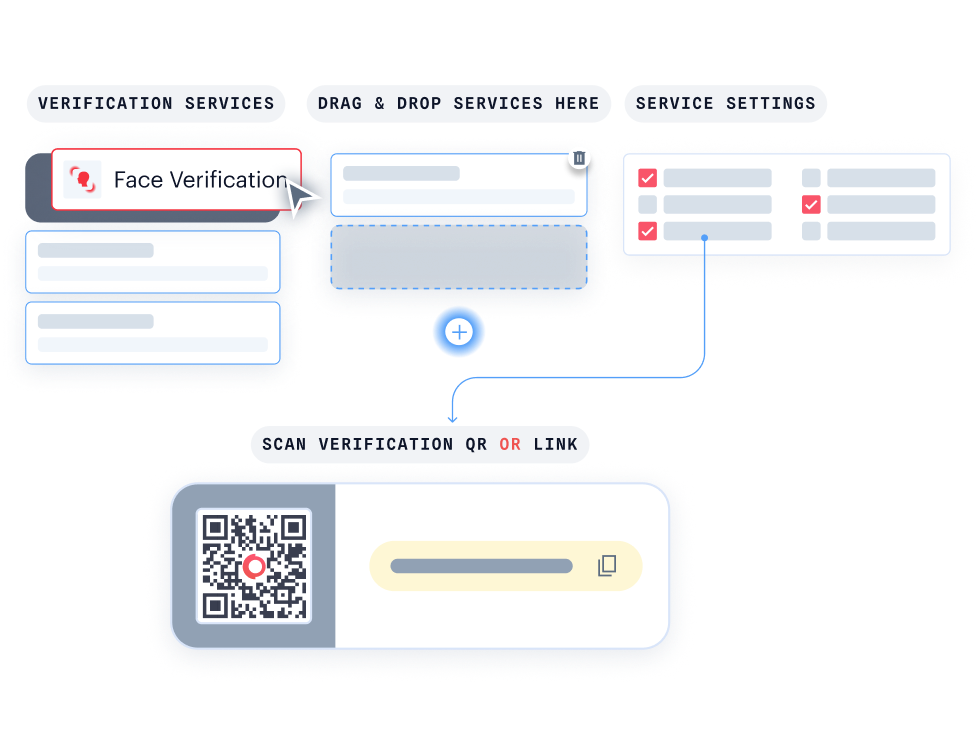

Face Verification

Confirm user identity and prevent spoofing with advanced 3D liveness detection and face verification.

Address Verification

Instantly confirm a user's address from utility bills, bank statements, and other documents against global database.

Document Verification

Instantly verify government-issued identity documents from over 230 countries and territories.

Video KYC

Conduct real-time, agent-led identity verification through live video interviews for high-assurance KYC.

eIDV

Confirm user details against trusted government and financial data sources for added confidence.

Business Onboarding

Perform global KYB and due diligence with confidence

Business Verification

Automate the verification of business entities by checking data from global corporate registries.

Due Diligence

Streamline your enhanced due diligence process with customizable risk assessment and data collection.

Authentication

Detect and block fraud at every touchpoint.

monitoring & Compliance

Proactively manage risk and maintain regulatory compliance with continuous user and transaction monitoring.

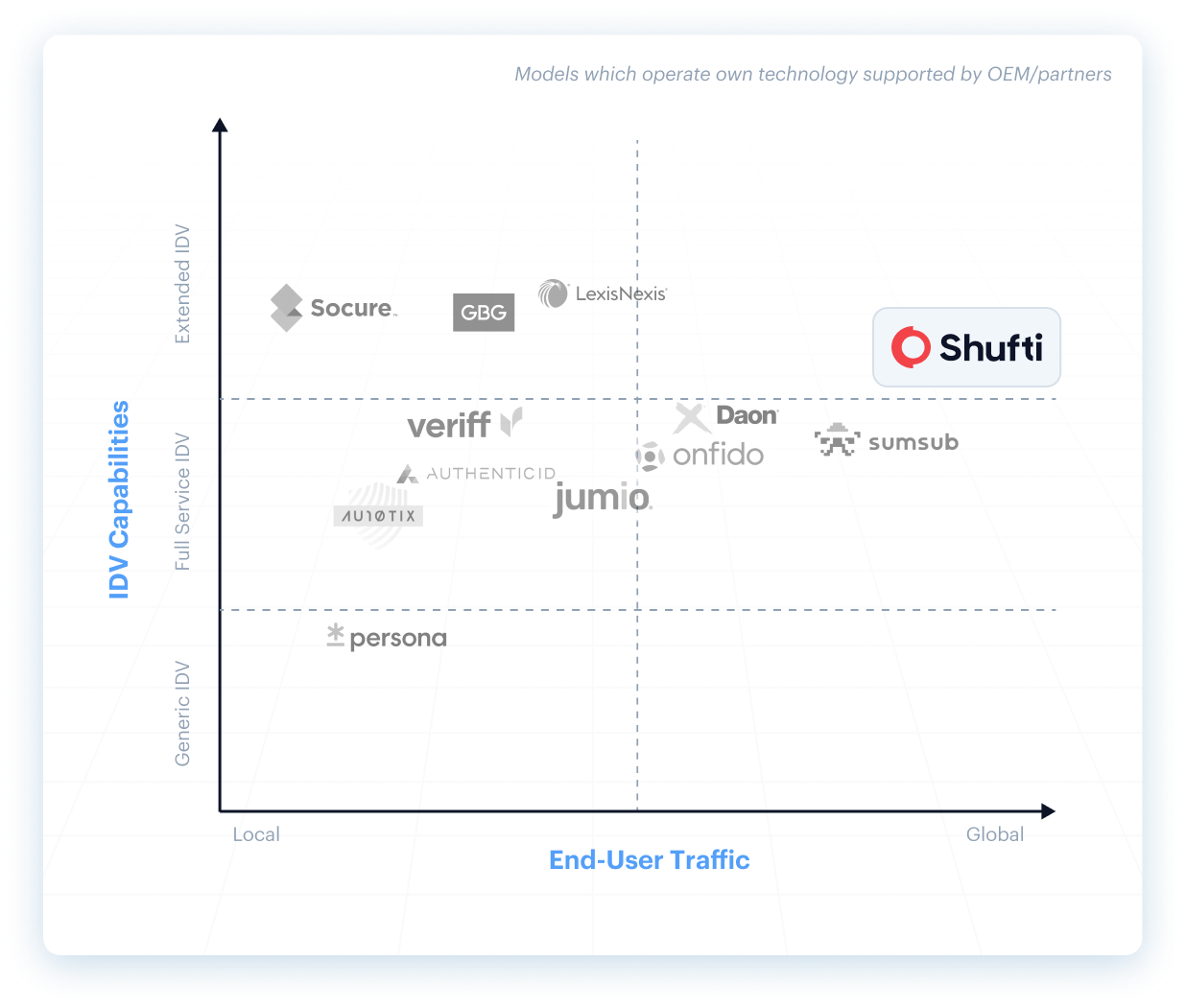

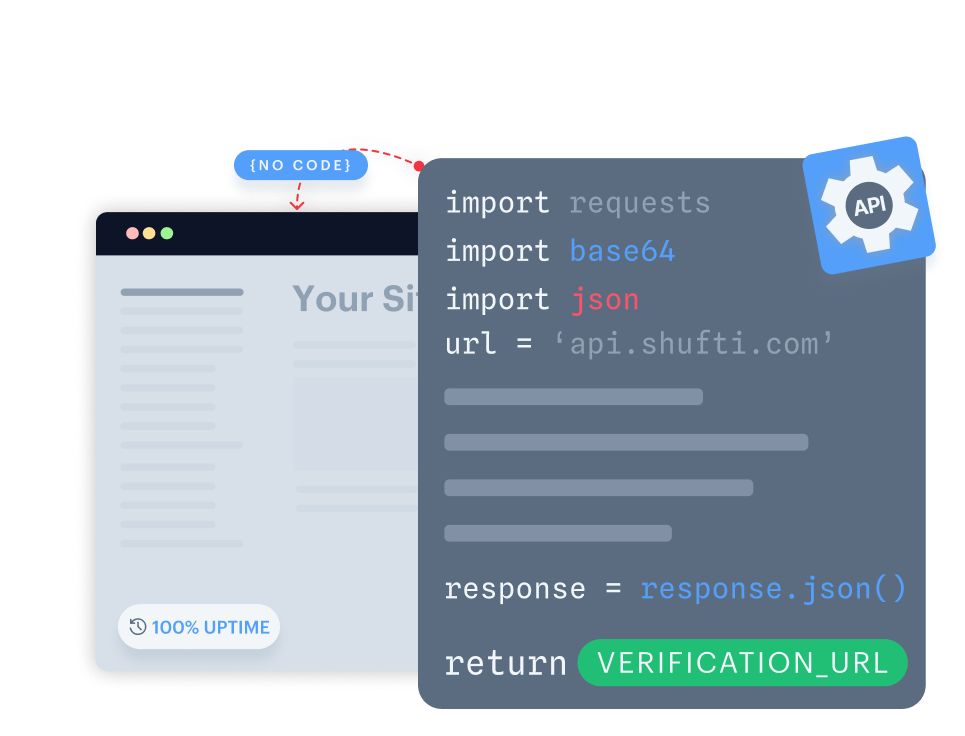

Single platform that adapts automatically & deploys anywhere

Why Leading Enterprises Trust Shufti

Complete, Proprietary

Technology

100% in-house identity stack

KYB

KYC

DOCUMENT

AML

Face Verification

No aggregators. No third-party dependencies. Full control, accuracy, and accountability.

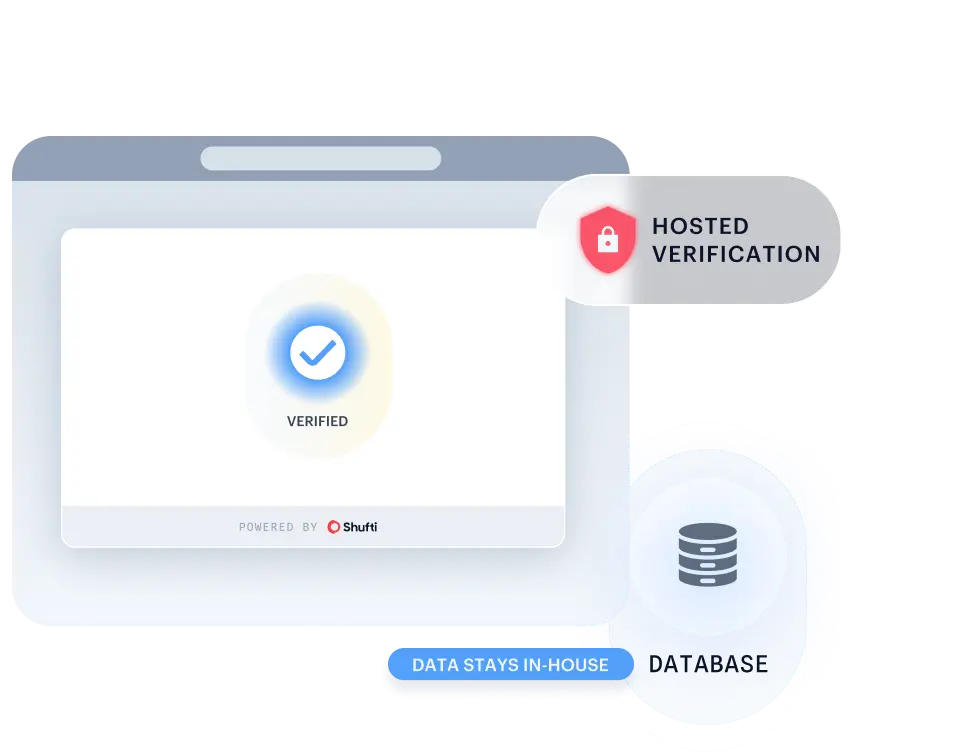

You Control Your Data

Full deployment flexibility on-premise, private cloud, or SaaS. Our full-stack ownership gives you the power to effortlessly comply with any data residency laws.

Customised Workflows

Stop forcing your business into a box. We build bespoke verification flows around your specific logic and complex global needs. Consider it done, with 24/7/365 enterprise support.

Scale Globally via Shufti AI

Don't just verify, scale! Shufti AI, trained on 10,000+ global documents, uses zero-shot learning to master new formats in minutes. Your global onboarding never stops.

Explore Now

Explore Now