Real Time KYC & AML Solution for New Zealand

Now Verify Identity & Know Your Customer in Seconds. Get started right away with easy API integration.

Form submitted successfully!

Thank you for your interest — your report is loading now.

Swift and Reliable KYC Service

Offering KYC for New Zealand. KYC and AML screening have never been this easy. Simply paste a few lines of code in your website or app, and integrate swift identity verification system.

240+

Regions

supported

10,000+

ID Docs

150+

Languages

Fast & Secure KYC

The Fastest Online Identity Verification Service, Shufti, is Proud to Offer KYC Services in New Zealand

KYC, KYB and AML Solutions

Under the Guidelines of FATF, as well as APG and OFAC for

Documents We Verify

Shufti gives you all the tools to verify and onboard new users faster with real-time KYC for New Zealand

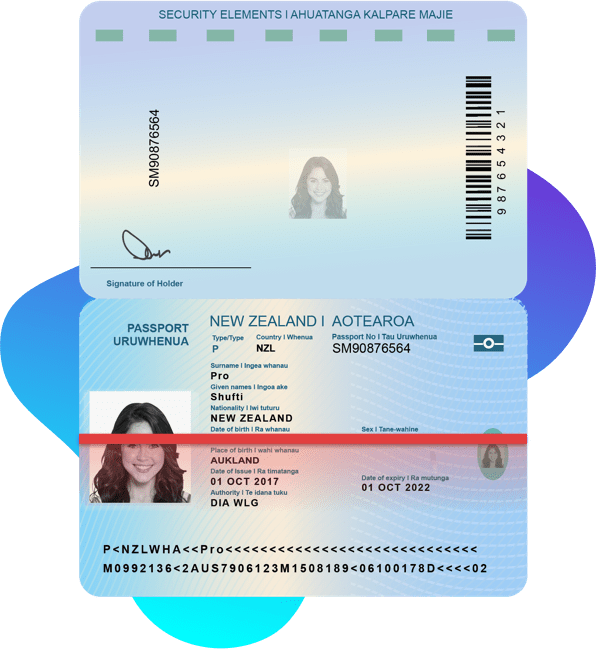

Passport

We offer KYC for New Zealand through passports. We verify New Zealand Passports issued by the Department of Internal Affairs (DIA – Identity Services).

Businesses can use it for CDD in New Zealand by verifying the nationality, name and DOB of customers.

For Passport Verification, Shufti:

Matches name, DOB and expiry date with MRZ

Detects fakeness through font, holograms

Checks for accuracy of format

Detects crumpled / folded edges

Identifies photoshopped / tampered / forged image

Verifies hologram / rainbow print

Checks blurriness / exposure

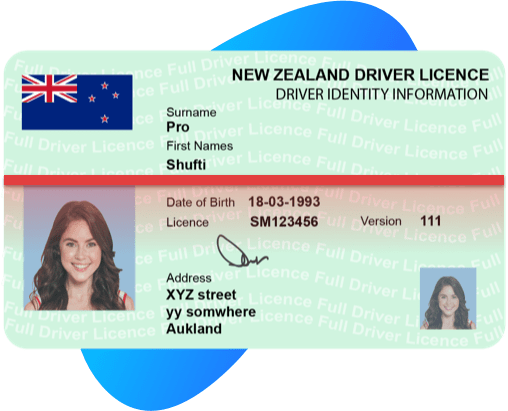

Driving License

We check the originality of a driving license issued by the New Zealand Transport Agency and verify licenses of all 53 districts and 14 city councils of New Zealand.

For Driving License Verification, Shufti:

Checks for accuracy of format

Detects crumpled / folded edges

Checks photoshopped / tampered / forged cards

Verifies hologram / rainbow print

Detects blurriness / exposure

Credit / Debit Card

Shufti verifies credit/debit cards to help you digitize your business, reduce manual labor, prevent fraud and chargeback, and increase conversions.

For Credit/Debit Card Verification, ShuftiPro:

Validates name

Validates expiration / issue date

Validates card number

Checks for accuracy of format

Checks photoshopped / tampered / forged cards

Verifies hologram / rainbow print

Detects blurriness / exposure

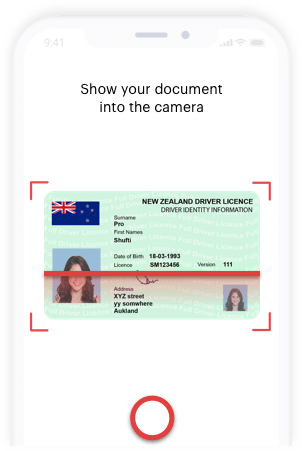

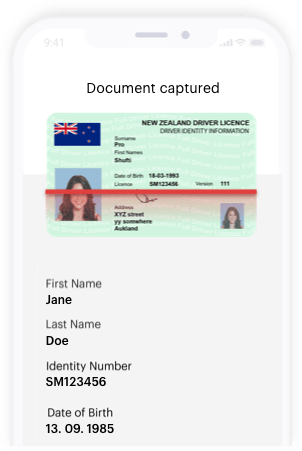

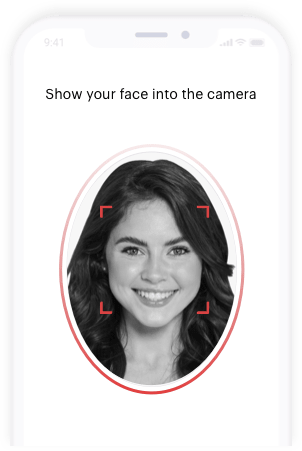

How Our Identity System Works

Step 01

Document Verification

Step 02

Data Extraction

Step 03

Face Verification

Step 04

Verification Status

Unlock opportunity with next-generation capabilities

Document Verification

Use advanced data extraction and AI-powered verification to process 10,000+ document types worldwide rapidly.

.

Facial Biometrics

Leverage advanced facial mapping and deep fake detection for secure customer identity confirmation and authentication.

.

eIDV

Verify customers remotely and paperlessly using e-IDs checked against government databases for quick, accurate results.

.

Business AML Screening

Screen businesses against PEP lists, sanctions watchlists and monitor media databases to support know your vendor, trader, or supplier requirements.

.

Investor Verification

Quickly and accurately vet investor identities and credentials to establish trust and achieve compliance AML and CFT directives.

.

Transaction Trust Screening

Enhance transaction screening with advanced AI and machine learning technology for efficient detection and reduced false positives.

.Shufti Offers OCR for Maori and English Language with 98.67% Accuracy

Truly Global Identity Verification

Banks

E-commerce

E-Payments

Ride Sharing

Online Service Providers

Automated AML for Businesses

Shufti pro’s AML services for New Zealand businesses help identify high-risk clients, improve client onboarding with faster PEP screening, and real-time sanction list monitoring.

Shufti uses FATF, EU, OFAC, HMT, Interpol, and other relevant watch lists in the provision of its AML services. Screening is done via our API utilizing global watch-lists and our AML source data is updated every 15 minutes.

Customer Due Diligence in New Zealand

New Zealand is a member of the Financial Action Task Force (FATF). FATF promotes efficient measures for combating money laundering, terrorist funding and other threats to the integrity of the international financial system. Its global standards are applicable to organizations operating in all member and non-member countries.

Realizing this, Shufti has expanded its operations to New Zealand banks, and financial and non-financial businesses to strengthen trustful business relationships.

Explore our ROI Calculator

Secure your business, achieve compliance, and accelerate growth effortlessly with our cutting-edge digital identity verification solution

ROI CalculatorGet the Shufti newsletter

Stay ahead of the curve with fresh takes on the latest identity innovations.

Take the next steps to better security.

Contact us

Get in touch with our experts. We'll help you find the perfect solution for your compliance and security needs.

Contact us