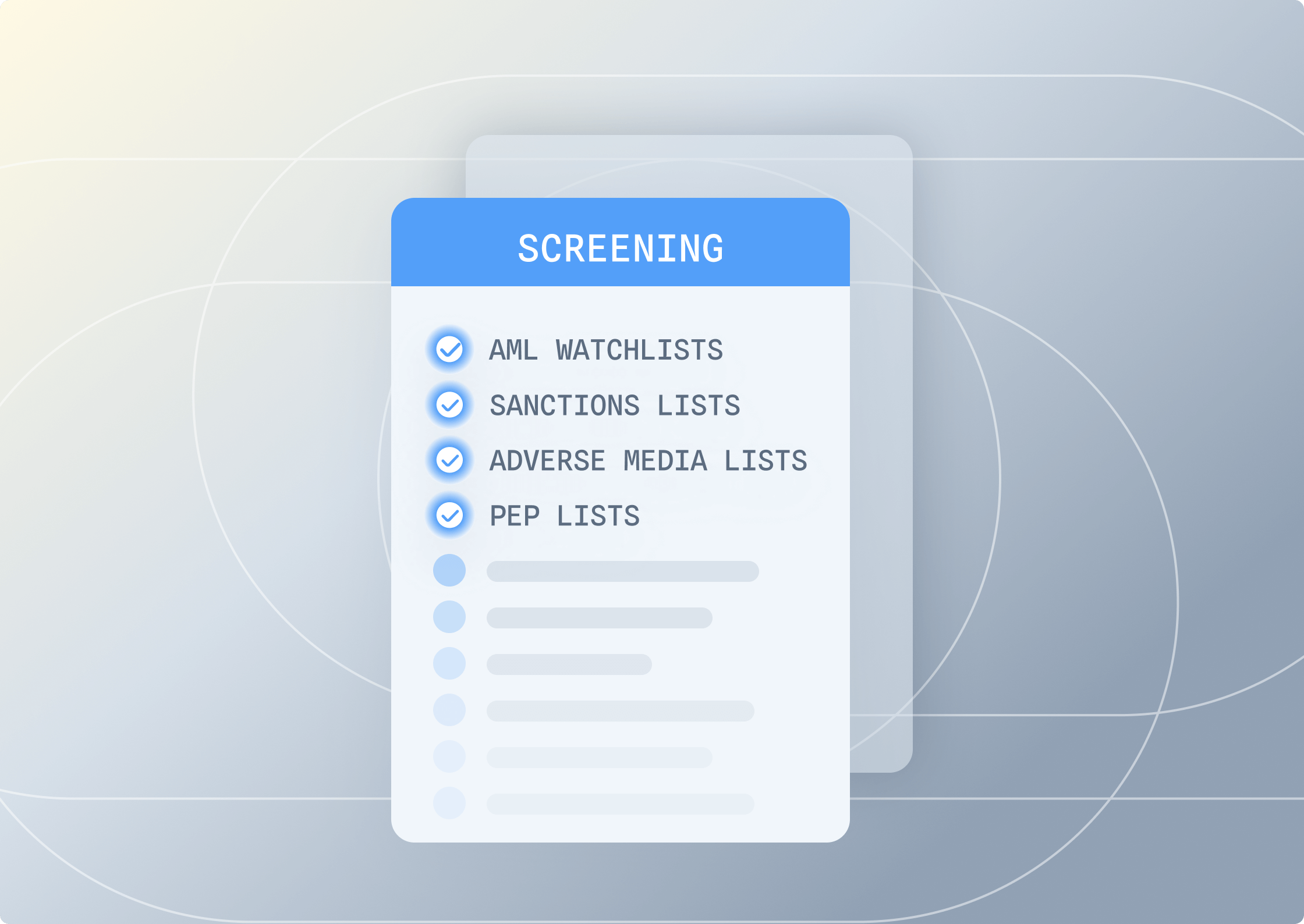

Screen against:

3,500 official

watchlists

2.6+ million

PEP profiles

80+ screening

languages

Comprehensive watchlist monitoring

Using data that’s updated every 15 minutes, screen a business against global sanction watchlists, and adverse media databases issued by the Office of Foreign Assets Control (OFAC), Financial Action Task Force (FATF), United Kingdom’s HM Treasury (HMT), and other global authorities. Shufti’s data coverage includes economic, diplomatic, UN Security Council, embargoes, secondary, and regional sanctions covering individuals, businesses, vessels, aircraft, and crypto wallets.

Ongoing risk monitoring

Immediately spot changes in risk status for a business with real-time alerts. Shufti screens businesses through a search-based process or by using batch screening to process multiple entities simultaneously. Quickly assess the severity of negative content by scanning more than 50K sources for advanced sentiment analysis.

AML for UBOs and business officers

Extend business screening to assess the risk of key business officers such as Ultimate Beneficial Owners (UBOs) or directors using Shufti User AML Screening. Watchlist monitoring includes Special Interest Persons (SIPs) and Special Interest Entities (SIEs) linked to financial crime.

What makes Shufti Business AML Screening different?

- Distinguish the level of adverse information with advanced sentiment analysis

- Detect adverse media in 80+ languages, in over 50K new sources across more than 400 risk categories

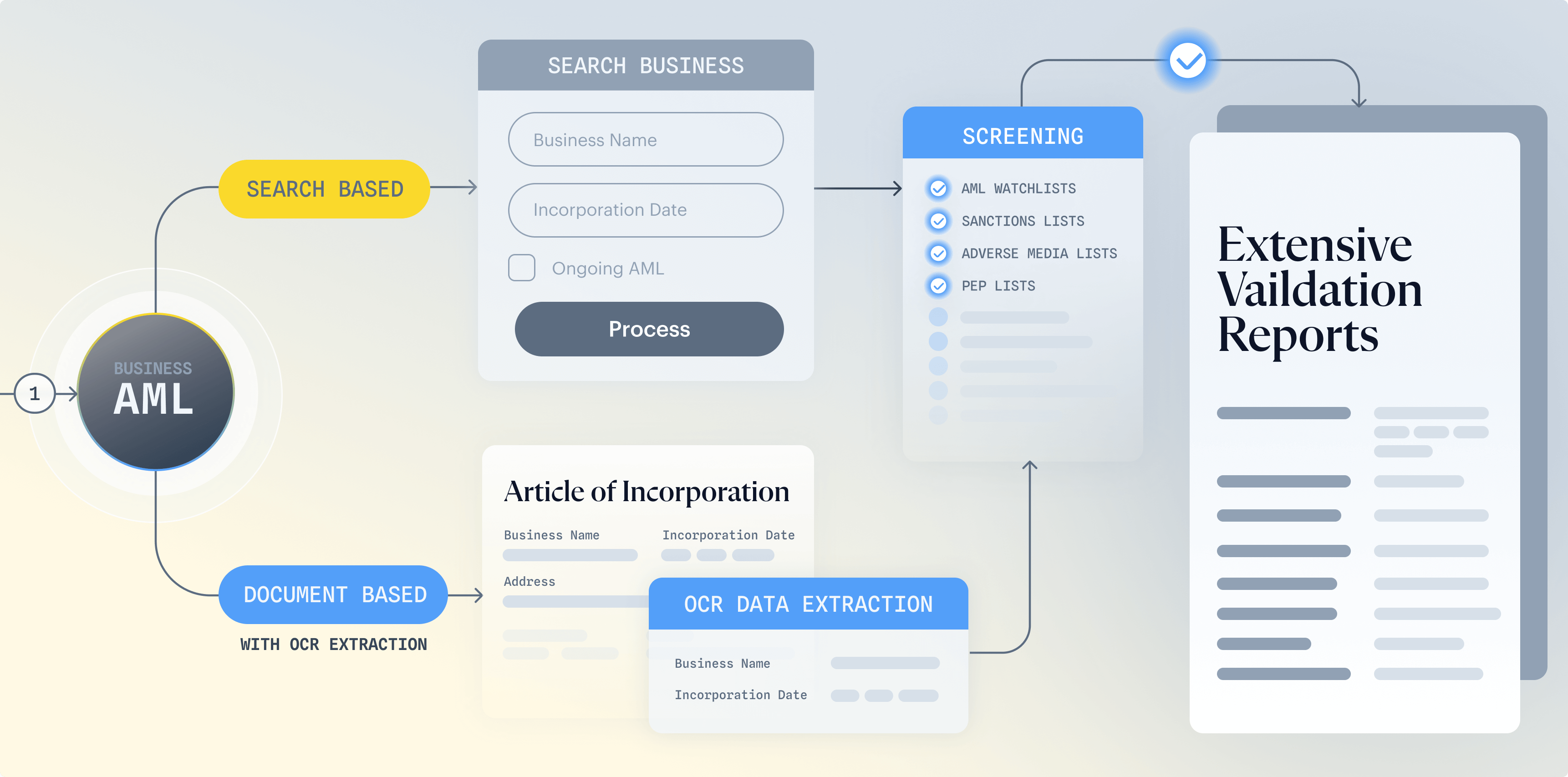

- Search for a specific business or scan a company name and other data from documents

- Flag high-risk businesses by performing ongoing AML screening

- Enhance security and compliance by seamlessly integrating with Document Verification and User AML Screening

How it works

Related Solutions

Know your Customer (KYC)

Simplify customer onboarding with efficient identity verification, reducing compliance burdens and boosting security across your operations.

Explore

Explore

Know your Investor (KYI)

Quickly verify investor identities and credentials to establish trust and comply with global AML and CFT directives.

Explore

Explore

Fintech

Expand globally with KYC solutions that meet your business needs and adhere to varied regional and country requirements.

Explore

Explore

Our platform has you covered

All in One SDK

Integrate effortlessly with our versatile toolkit, compatible with various platforms and devices.

Customizable orchestration

Adapt verification workflows to fit seamlessly with your business operations.

Global Coverage

Break through growth limits thanks to comprehensive reach and accessibility.

Explore the Shufti Global Trust Platform

Unlock your business potential with a verification platform built for worldwide scalability and reliability.

View Platformlearn more

Business Identification and Risk

Learn how Shufti Business Identification Risk provides continuous AML compliance, stops money laundering, and improves the financial stability of your organization.

Download the solution brief

Experience the power of seamless trust in your business relationships.

Contact us

Connect with our team for expert guidance on enhancing your business verification and compliance strategies.

Contact usRequest demo

Discover how our advanced identification solutions can streamline operations and build stronger relationships with your business partners and customers.

Get started