China’s AML Framework and Regulatory Highlights of 2022

China has been fighting against money laundering and terrorism financing for a number of years.

Adm. Craig Faller, a senior U.S. military leader, testified before Congress in 2021 that money laundering in China, partially supported by the Chinese Government, has become the top-most significant risk for Western economies.

China, officially known as PRC (People’s Republic of China) is the world’s second-largest economy by GDP ($14.72 trillion), followed by the US ($20 trillion), and the largest in terms of population at 1.426.

This makes China an attractive target for money laundering. However, the government is launching AML initiatives to stay compliant with FATF’s (Financial Action Task Force) compliance requirements.

In the first quarter of 2021, China launched a 3-year Anti-Money Laundering (AML) policy to combat money laundering and convict launderers with capital punishment.

A Quick Recap of China’s AML Framework

- The US State Department claims China to be responsible for $154 billion in annual money laundering, a claim that China refutes.

- China launched 3-year AML initiatives that enabled FATF to improve compliance ratings for the country.

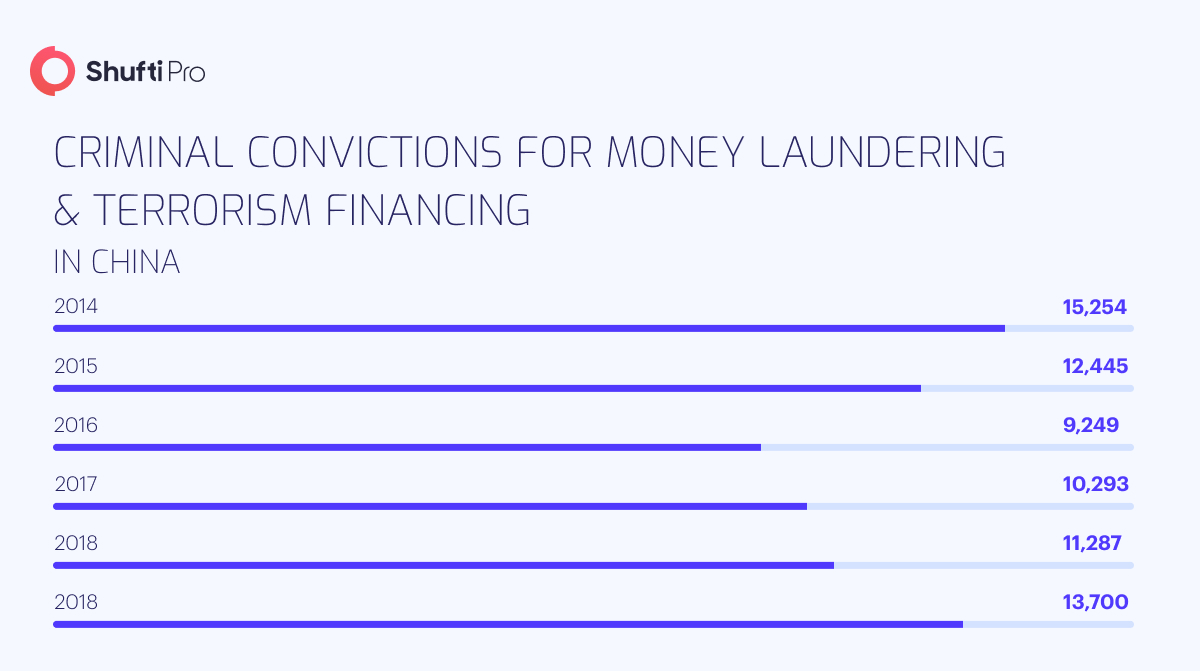

- Number of money laundering convictions in the country increased from 9,249 in 2016 to 13,700 in 2019.

- 11 official Chinese government ministries are working in tandem to implement the AML Framework.

- Scope of organisations subject to the AML and CTF requirements now broadened to include loan companies, non-banking firms, currency exchanges, and insurance agents/brokers.

Key Departments Implementing AML Controls

There are 11 official government ministries working together to implement AML regulatory frameworks in China. These are led by The People’s Bank of China (PBOC) and the Ministry of Public Security. The 9 other government agencies are:

- Supreme People’s Court

- Ministry of State Security

- China Banking and Insurance Regulatory Commission (CBIRC)

- Supreme People’s Procuratorate

- National Supervisory Commission

- General Administration of Customs

- State Administration of Foreign Exchange

- China Securities Regulatory Commission (CSRC)

- State Taxation Administration

The AML framework and updated FATF guidelines require official ministries to coordinate with each other in mitigating risks, and implementing strong mechanisms in place to combat money laundering.

This can be done by:

- Creating a strong organisational and political leadership

- Providing training by AML experts to educate and increase awareness on the dangers of money laundering

- Imposing severe punishment against convicted criminal individuals and organisations

- Encouraging the use of plastic money

- Monitoring unusually high amounts of Dollar and/or Yuan based transactions flowing in/out of the country

Money Laundering Convictions in PRC

China has capital punishments for serious crimes and offences threatening national and social security. Corruption and bribery are punishable by death.

In 2021, China sentenced the death penalty to Lai Xiaomin, a financial regulator, former banker, party official, and one of China’s leading state-controlled asset management firms.

Mr. Xiaomin was accused of receiving 1.79 bn Yuan in bribes ($257 million) over a 10-year history of being employed with the company.

Capital punishments and convictions show that China is enforcing strict crackdowns on money laundering and terrorism financing.

The graph highlights the decrease in criminal convictions from 2014 to 2016, before registering an increase till 2019.

New Requirements for Customer Due Diligence (CDD)

PBOC, CSRC and CBIRC released a joint statement on Customer Due Diligence and Keeping of Customer Identification and Transaction Records’ (Order No.1 [2022] of the PBOC, CBIRC and CSRC).

The Measures are implemented in order to safeguard the country’s financial system and have best practices in place to combat corruption and money laundering. The new requirements went into effect on 1st March 2022 and now cover:

- Conducting CDD by adopting a risk-based approach

- Enabling low-risk customers or transactions to easily access the financial system

- Additional requirements to identify beneficial owners

- Ensuring the safety of customer identification and transaction records

The measures weren’t simply applied to financial institutions and banks. They now also covered non-financial entities, funds clearing centres, and currency exchange businesses. The purpose of the new amendments was to broaden the scope of companies making financial transactions and ensure compliance with AML regulations.

Fake High Returns Investments Project

The PBOC has enforced a crackdown on fraudulent financial activities, penalising individuals and companies found guilty of evading taxes and/or luring investors into fake, and scam projects offering abnormally high returns.

Perhaps one of the biggest decisions of China’s central bank was to permanently ban all types of cryptocurrency transactions including mining, buying and selling. It was announced in late September 2021 and till date, remains enforced.

Similarly, in February 2022, the CBIRC issued warnings to investors seeking unusually high returns on illegal Ponzi schemes and investment projects related to Metaverse, virtual real estate and digital currencies.

Non-bank payment institutions have been a target of China’s efforts in fighting against money laundering. In July 2021, China’s central bank registered several cases against neobanks on AML noncompliance imposing penalties and fines in millions of Yuan.

Key Takeaways

FATF, however, in its November 2022 FUR (Follow Up Report), highlights the People’s Republic of China’s significant progress in remaining compliant with AML Regulations.

However, there is a dire need to increase crackdown on money laundering and illegal financial activities in the country. Most of the financial crimes investigated involve funds obtained from corruption, bribery, smuggling, counterfeiting, and fraud.

Tax evasion still remains a big concern for mainland China. Businesses and individuals often launder taxes through shell companies in tax havens like the British Virgin Islands, Panama, etc. before returning them back to China as foreign investment.

Keeping up with AML compliance is no easy task. Shufti helps companies to remain compliant by verifying businesses and conducting AML background checks against 1,700+ global watchlists.

Want to learn about Shufti’s AML Screening solution?

Explore Now

Explore Now