China’s Data Protection & Privacy Laws: 2025 Update: What Global Businesses Must Know

China’s data‑protection landscape moves faster than almost any other jurisdiction. Since our last deep‑dive in 2023, Beijing has tightened cross‑border transfer controls, expanded the definition of “important data,” and stepped‑up enforcement with multimillion‑yuan fines. Below we break down every change global organisations need to know in 2025 backed by the latest regulatory texts, enforcement statistics, and Shufti analytics.

1. China’s Data‑Protection Framework in 2025: A Quick Refresher

Before we dive into what’s new, let’s briefly recap the pillars of China’s fast‑evolving data‑governance regime and why each statute and its 2025 refinements matters for multinationals that collect, store, or simply touch Chinese personal information today.

- Cybersecurity Law (CSL) – baseline security & network‑operator duties.

- Data Security Law (DSL) – classification of “core” vs “important” data; risk‑based security obligations.

- Personal Information Protection Law (PIPL) – China’s GDPR‑style privacy statute.

- Revised State Secrets Law (effective 1 May 2024) – broader scope & new “work secrets,” heightening disclosure liabilities. https://www.reuters.com/legal/legalindustry/chinas-revised-more-stringent-state-secrets-law-takes-effect-2024-05-07/

- Sectoral rules – e.g., financial‑data guidelines (PBOC, 17 Apr 2025) with an explicit whitelist for cross‑border flows. https://www.reuters.com/world/china/china-releases-guidelines-facilitate-cross-border-flows-financial-data-2025-04-17/

2. Key Regulatory Developments Since 2023

Since our 2023 article, Beijing has issued a rapid cadence of Q&As, sector‑specific guidelines, and enforcement notices. The timeline below distils those headline changes and highlights who gets hit hardest and why.

| Date | Instrument | What Changed | Who Is Affected |

| 9 Apr 2025 | CAC Q&A on Data Cross‑Border Security | Clarifies thresholds (<1 m records) & scenarios exempt from security assessment; introduces 60‑day grace period for MNCs completing Standard Contracts. | All data exporters |

| 27 Jun 2025 | 3rd Guidance on Security Assessment of Cross‑Border Transfers | Simplifies filing package; allows English translations for annexes; introduces “supplementary submission” mechanism to avoid re‑filings. | Large platforms, cloud providers |

| Mar/May 2025 Deadlines | PIPL Transitional Windows | Final date to switch from “implicit consent” to explicit data‑subject consent; penalties up to 5 % of annual turnover. | All controllers processing PI |

| 17 Apr 2025 | Financial‑Data Guidelines | Sets whitelist of 14 data‑types eligible for routine outbound transfer; mandates encryption in‑transit & at‑rest. | Banks, payment & insurance firms |

| 1 May 2024 | Revised State Secrets Law | Expands categories; authorises on‑site inspections; introduces “work secrets.” | Multinationals, due‑diligence providers |

| 2024‑25 | Enforcement Wave | CAC issued ¥1.8 bn in fines (↑38 % YoY) for cross‑border transfer violations; average remediation period: 45 days. | All sectors |

2.1 What These Changes Mean for You

- Lower thresholds but higher scrutiny. Even companies under the 1‑million‑record limit must file Standard Contracts or obtain Certifications.

- Sector‑specific carve‑outs are real. Financial‑services firms can leverage the April 2025 whitelist, but only if encryption & localisation controls are in place.

- Grace periods are shrinking. Regulators now expect remediation within two months, down from six.

3. Enforcement & Industry Trends

Raw numbers only tell part of the story. Pairing regulator fine data with Shufti’s onboarding analytics reveals how policy priorities are reshaping market behaviour, fraud typologies, and compliance lead times.

Shufti’s 2025 risk‑monitoring shows:

- 43 % surge in customer requests for PIPL screening modules between Q3 2024–Q2 2025.

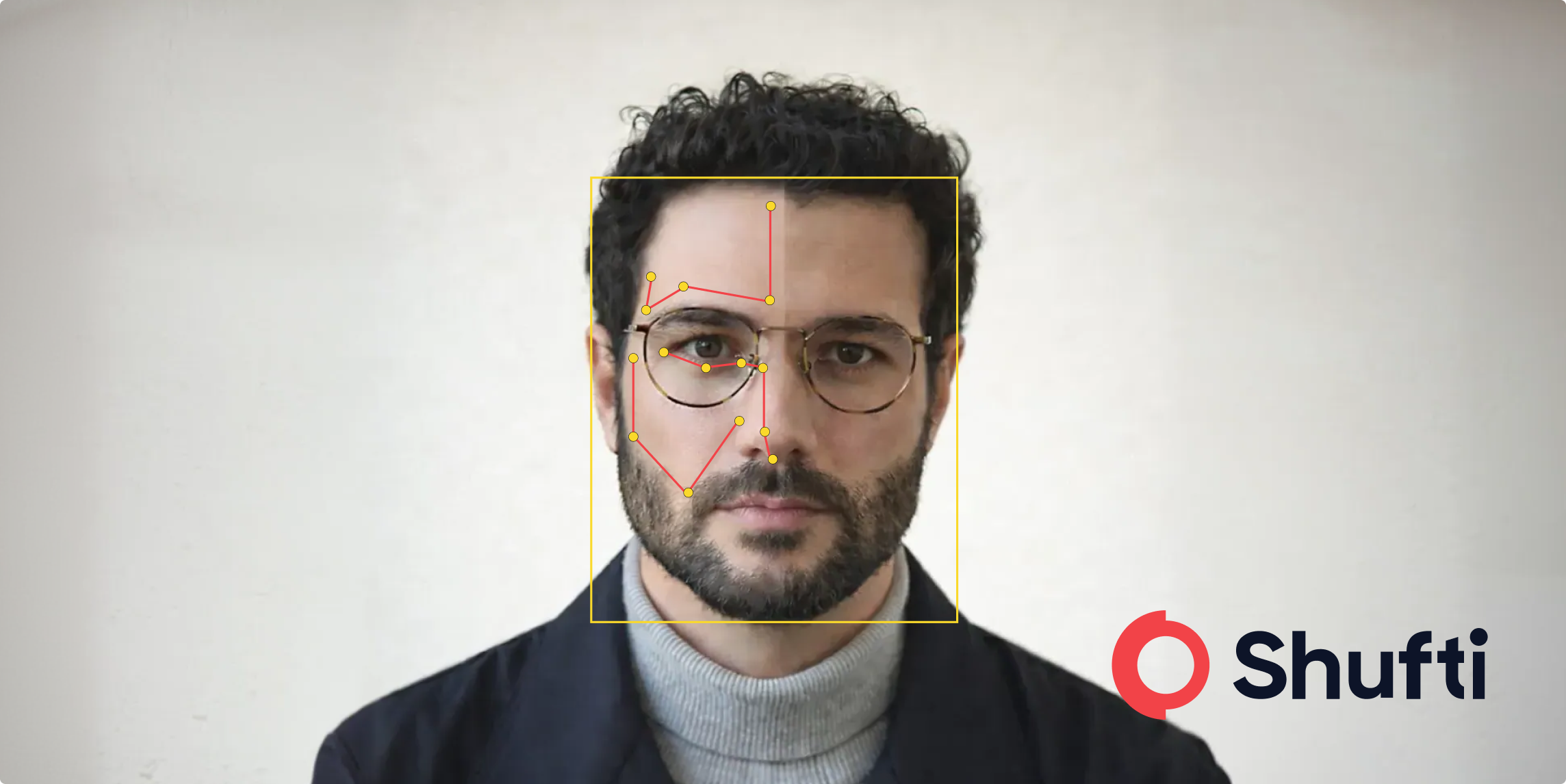

- Time‑to‑approve digital‑onboarding in mainland China fell to 7.4 seconds (‑12 % YoY) using Shufti’s hybrid OCR‑&‑biometric engine.

- Fraud attempt rate in Chinese cryptocurrency exchanges dropped 28 % after adopting Shufti liveness detection revealing regulators’ focus on crypto KYC.

Source: Shufti Global Identity Verification Benchmark H1 2025.

4. 2025 Compliance Checklist

Treat the checklist below as an actionable roadmap: if every box is ticked, your organisation should be comfortably aligned with the CAC’s 2025 expectations and ready to evidence that compliance on demand.

- Map data flows identify important vs core data per DSL.

- Conduct gap analysis against the April & June 2025 CAC Q&As.

- Execute Standard Contracts (or Certification) for any outbound PI.

- Localise sensitive datasets on PRC soil; use “approved nodes” for disaster recovery.

- Update privacy notices to reflect explicit‑consent requirement (May 2025).

- Test incident‑response plans report breaches within 8 hours to CAC & sector regulator.

- Leverage trusted providers like Shufti for real‑time identity & liveness checks that already align with PIPL Article 40 data‑minimisation principles.

5. Frequently Asked Questions (FAQ)

Q1: Does the 1‑million‑record threshold include employee data?

A: Yes. The April 2025 CAC Q&A confirms employee PI counts toward the cap. https://www.china-briefing.com/news/china-clarifies-cross-border-data-transfer-rules-official-qa/

Q2: Are SCCs still valid if signed before 2025?

A: Only if filing materials meet the June 2025 Guidance; otherwise, re‑submission is required. https://natlawreview.com/article/china-releases-updated-guidance-application-security-assessment-cross-border-data

Q3: Is consent always required for cross‑border transfers?

A: PIPL allows certain statutory exceptions (e.g., vital interests), but most business transfers demand explicit consent post‑May 2025.

Q4: How should SMEs approach security assessments?

A: SMEs below CAC thresholds can opt for “Certification” to streamline compliance; Shufti partners with third‑party certifiers to expedite approval.

Q5: What penalties apply for non‑compliance in 2025?

A: Fines up to ¥50 m or 5 % of annual revenue, plus possible business‑suspension orders and personal liability for DPOs.

Conclusion

China’s rapid‑fire regulatory updates underscore one theme: cross‑border data is now a privilege, not a right. Organisations that treated PIPL as a one‑off exercise in 2021 must upgrade controls to survive 2025’s stricter enforcement cycle. By embedding privacy‑by‑design, partnering with compliance‑proven vendors like Shufti, and staying alert to CAC guidance, businesses can turn regulatory friction into competitive advantage.

Need help decoding the latest CAC guidance? Reach out to Shufti’s compliance team for a personalised risk assessment.

Sources:

1- CAC, Q&A on Data Cross‑Border Security, 9 April 2025, China Briefing. https://www.china-briefing.com/news/china-clarifies-cross-border-data-transfer-rules-official-qa/

2- CAC, Guidance on Security Assessment of Cross‑Border Data Transfers, 27 June 2025, The National Law Review. https://natlawreview.com/article/china-releases-updated-guidance-application-security-assessment-cross-border-data

3- People’s Bank of China, Financial‑Data Cross‑Border Guidelines, 17 April 2025, Reuters. https://www.reuters.com/world/china/china-releases-guidelines-facilitate-cross-border-flows-financial-data-2025-04-17/

4- Standing Committee of the NPC, Revised State Secrets Law, effective 1 May 2024, Reuters. https://www.reuters.com/legal/legalindustry/chinas-revised-more-stringent-state-secrets-law-takes-effect-2024-05-07/

5- CAC Annual Enforcement Report 2025.

6- Shufti, Global Identity Verification Benchmark H1 2025.

Explore Now

Explore Now