Corporate Transparency Act – The Road to Better AML Compliance

According to the latest reports, the United States ranked number 1 for not complying with the anti-money laundering regulations. Around 12 penalties were imposed on the US banks and Goldman Sachs had the highest fine of €3.30 billion (USD 3.90 billion). Given the rise in money laundering activities in the US, the Corporate Transparency Act was structured. Recently, the Senate has passed the act. Financial institutions of the United States have until January, 2022 to report to FinCEN according to the updated laws. Once the Act is in action, the US companies have to report their Ultimate Beneficial Owners (UBOs) to the Financial Crimes Enforcement Network (FinCEN). In 2022, new Limited Liability Corporations (LLCs) have to report their UBOs and any changes in the beneficial owners will be reported as well. However, any corporations formed before the effective date will have two years for reporting to FinCEN. Let’s dive deeper into the corporate transparency act and how can companies efficiently comply with it.

Read more: Record-Breaking Fines on Banks for KYC/AML Non-Compliance

What is the Corporate Transparency Act?

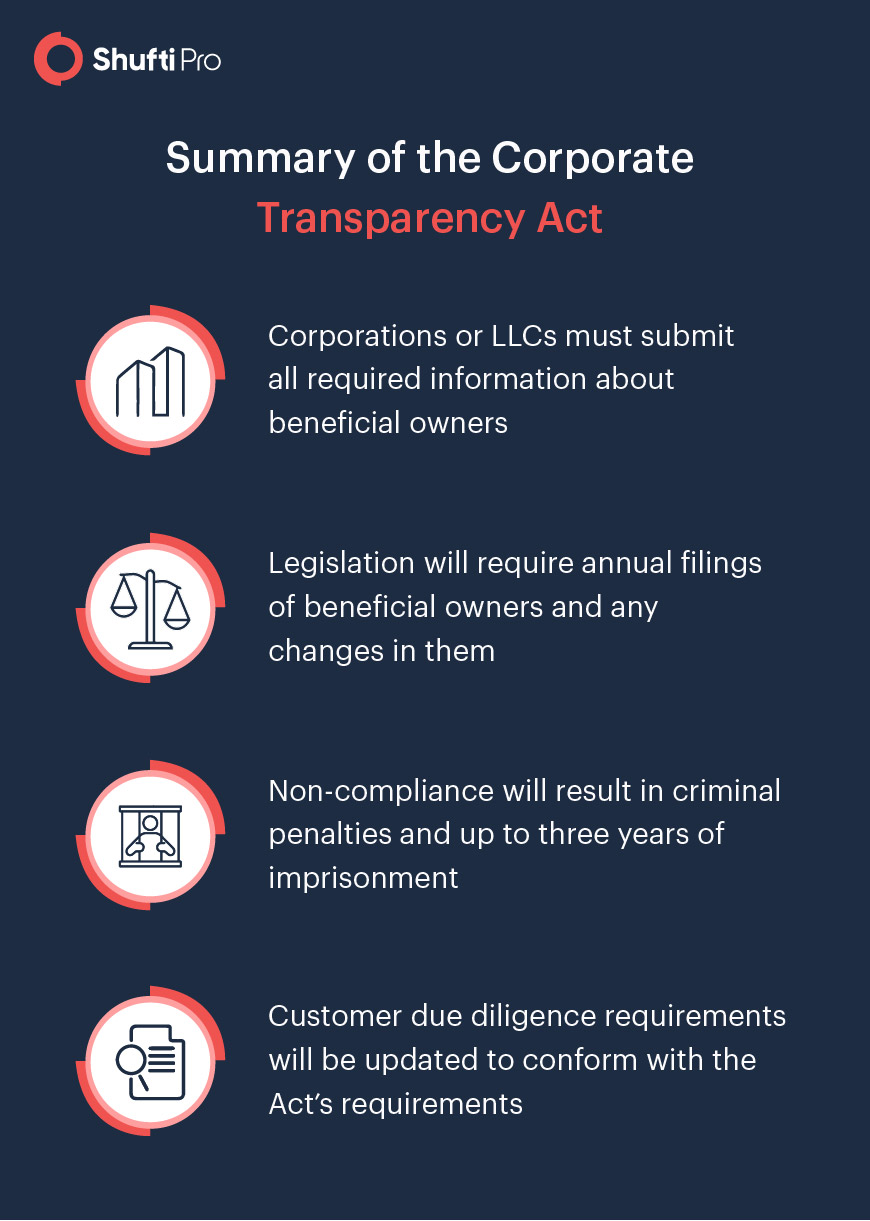

The Corporate Transparency Act (CTA) directs the FinCEN to maintain a national record of all the ultimate beneficial owners (UBOs) of companies within the US. Any changes in the UBOs must be reported too. The Act focuses on eliminating the shell companies that facilitate money laundering and terrorist financing.

Requirements for Corporate Transparency Act

As per this Act, the term beneficial owner refers to anyone who owns 25% or more equity share, has some substantial control over the company, or receives benefits from the company’s assets. Therefore, verifying these stakeholders is essential for the company.

FATF’s recommendations for best practices on beneficial ownership for legal persons have been best categorised in the Corporate Transparency Act of 2019. According to this Act, companies have to provide the following information about the ultimate beneficial owners to FinCEN.

- Complete legal name of the owner

- Owner’s date of birth

- Current residential or business address

- Unique identification number as on the passport, driving license, or the ID card

The company has to submit an annual report of the current UBOs and any changes in the previous year’s owners to FinCEN.

Current Scenario of the CTA

According to the current situation, some sections of the Act need more clarification and specifications to address minor details. The Corporate Transparency Act has not clearly defined beneficial owners as direct or indirect substantial controlling authorities. Any failings in the Act can lead to more challenges for businesses and violations of the Act will lead to heftier penalties.

Anyone who assists in the creation of legal entities like attorneys will be monitored. Previous iterations in the Corporate Transparency Act categorised formation agents as financial entities and made them subject to the AML and reporting obligations of the Bank Secrecy Act. In the current version of the Act, references to formation agents have been removed. However, the rulemaking authority given to the Department of Treasury can expand requirements for business. This will ultimately broaden the scope of potential criminal liability.

Next Steps for the Financial Institutions

Until long-term actions have been decided, here are some short-term actions that must be considered by form corporation and entities:

- Assess if your company has reported the beneficial ownership requirements according to the Corporate Transparency Act or not.

- Create a checklist of the reporting requirements

- Under the Act, every beneficial owner must be identified

- Endorse all identity verification documents of every individual that is considered as a beneficial owner

- Plan renewal in case of expiration of the documents of UBOs

- There must be a risk ranking system that account for variables like country of origin, service provided, and categorize the levels of risk within relationships

- A “trust-but-verify” approach must be leveraged if any of the information raises red flags suggested by FATF

- There must be a sound process for keeping the reporting mandates in touch. This includes the people responsible for collecting information of beneficial owners and filing with FinCEN

- Annual monitoring for tracking compliance is important

- Sufficient resources must be allocated for better compliance with the new filing obligation

Penalties for Non-Compliance with Corporate Transparency Act

The CTA has announced hefty penalties for any company that does not comply with the regulations. According to the Act, USD 10,000 must be paid as civil penalties. Furthermore, criminal fines and up to three years of imprisonment have also been announced. In order to comply with these regulations and avoid any fines or penalties, it is better that the US-based companies employ Anti-Money Laundering (AML) screening.

With the help of AML screening, organisations verify all the stakeholders and any high-risk customers can be identified before they become the company’s problem. This screening cross-checks the identity of the person with numerous sanction lists. Lastly, enhanced due diligence checks are also an option that can help your company comply with the regulations.

Summing It Up

The rise in criminal activities has led to amendments in Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. The new laws are designed to make customer due diligence and identity verification measures as rigid as possible. Criminals should not be allowed to surpass these checks at any cost, and better laws can help companies in this regard. The Corporate Transparency Act (CTA) will be active in January 2022 and businesses have until then to report FinCEN about their Ultimate Beneficial Owners. USD 10,000 civil penalties, criminal penalties, and up to three years of imprisonment is the punishment if any organisation fails to comply with CTA.

The purpose of Corporate Transparency Act is to combat money laundering and terrorist financing. With the help of Anti-Money Laundering screening, companies can ensure enhanced due diligence of all the customers. It will not only help onboard the right customers, but it will also assist your company in better compliance with CTA.

Multi-layered identity verification and background screening of beneficial owners is now inevitable for the US finance sector. All risky entities will be highlighted and reported timely, reducing the risk of money laundering and terrorist financing in the USA.

Want to know more about automated AML screening? Talk to our experts.

Explore Now

Explore Now