Divergent AML/CFT Rules and Cross-border Payment Challenges – What FATF Has to Say?

While addressing AML/CFT requirements for cross-border payments, the global financial watchdog, FATF revealed the Cross-border Payment Survey Results. The survey was conducted between December 2020 and March 2021 and results were concluded in October 2021 on the divergence of AML/CFT regulation while making cross-border payments.

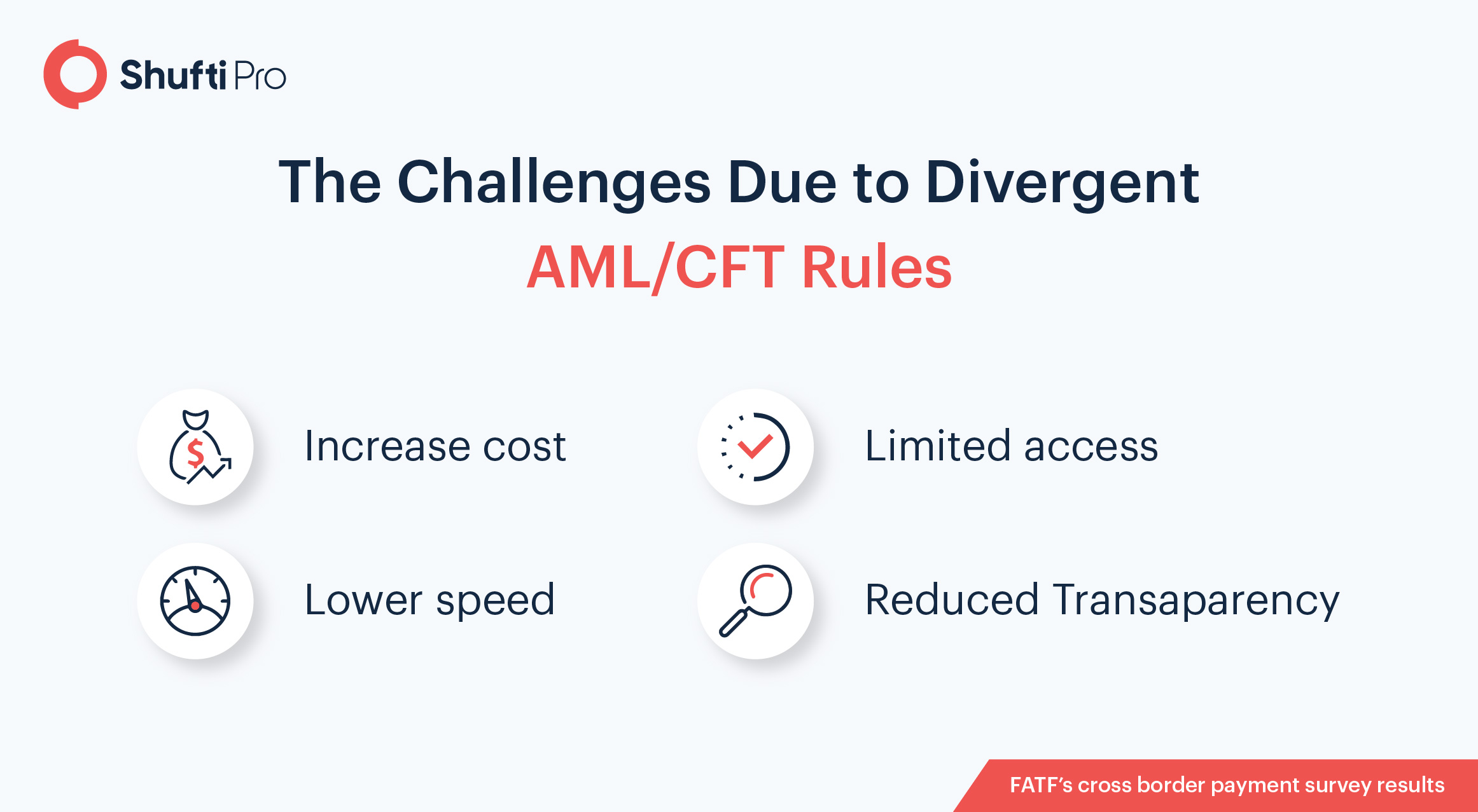

Even though government regulations are directed to enhance cross-border payments and mitigate the challenges associated with them, there is an increase in cost and speed, increased need for transparency, and limited access. The 3-month survey identified key areas of divergence in AML/CFT implementation across different states, leading to friction in cross-border payments. After consulting with the Basel Committee on Banking Supervision (BCBS) and Central Bank Governor of G20, the survey was conducted and participants included banks, Fintechs, and other stakeholders.

Additionally, the survey adheres to the FATF’s leading “Roadmap for Enhancing Cross-border Payments” adopted in October 2020.

A more inclusive cross-border payment system is robust, economic and transparent.

What are Cross Border Payments?

Monetary transactions processed via online cross-border channels at multiple locations are known as cross-border payments. The online monetary transactions are peer-to-peer, between financial institutions or between individual or banking facilities. Therefore, these transactions involve variance in taxes, transaction fees and navigating currencies.

Barriers to AML/CFT Implementation

Responses indicate that divergent AML/CFT rules across the states significantly contribute to cross-border payment issues. The study suggests considerations that must be given to anti-money laundering and counter-terrorist financing (AML/CFT) at a national level according to criteria set by the FATF.

1. Verifying Customers and Beneficial Ownership Information

As the speed and reach of global communication and trade progresses, the demand for seamless cross-border payments is increasing. One of the major challenges due to divergence in AML/CFT implementation in cross-border payments is the identification and verification of UBOs (Ultimate Beneficial Owners) and customers. Information sharing remains a significant barrier for financial institutions and jurisdictions alike. This directly impacts risk management, transaction processing, and sanction screening.

Listed below are key challenges faced by businesses in verifying UBOs..

- Extensive manual documentation

- Differences in approach

- Variance in the implementation of data protection and privacy regulation

- Improper information regarding the beneficial owner

- Difference in opinion in AML and data protection requirements

- Unnecessary CDD requirements due to lack of risk assessment rules and recommendations

1. Targeted Financial Sanction Screening

According to the survey results, manual transaction screening, multiple sanctions across jurisdictions, conflict of laws and inconsistent requirements across jurisdictions, different supervisory approaches, and challenges associated with data transparency are the key factors that increase challenges for cross-border payments.

Manual Transaction Screening

FATF states that the manual transaction screening process is vulnerable for all financial institutions as it:

- Increases cost

- Is difficult to digitize

- Creates unavoidable delays

- Does not lessen sanction evasion risk

- Negatively affects the customer experience

Conflicts of Law and Inconsistent Requirements across Jurisdiction

Even after organizations apply regional sanctions, they have to adhere to additional autonomous foreign or national policies, which is a key challenge to proper AML/CFT implementation. Multiple screening requirements and incomplete sanction lists increase the chances of false positives, resulting in unnecessary delays.

Different Approaches of Supervisors

Supervisors are required to develop an intelligence function within their firms to identify screening parties within the firm. These procedures create havoc, unnecessarily consume time, and waste valuable resources.

Challenges associated with Data Transparency

Inconsistencies in certain data elements and swift formats while making cross-border payments lead to hurdles in AML/CFT implementation. Data privacy laws that create barriers to access information are another challenge for transaction screening. Data transparency issues further create problems when sending and receiving customer transaction information.

3. Establishing and Maintaining Correspondent Banking Relationships

The formulation of influential and reliable cross-border payments is vital to regulate worldwide payments, expand and optimize commerce, and develop and sustain links across the globe. Moreover, facilitating economic growth changes consumer and business behavior, and hence, the incorporation of digital payment technologies enhances international trade and assures sustainable global development.

According to FATF, when establishing banking relationships, the key challenges associated with cross border payments are:

- De-risking (restricting financial dealings with a high risk client)

- Multiple approaches of nesting

- Problems with Know Your Customer’s Customers (KYCC)

- Varying EDD national requirements

- Lack of clarity on bundled payments

Suggested Read: High-Risk Transactions – How Can Enhanced Due Diligence (EDD) Help?

Furthermore, the responses to these issues go outside the scope of AML/CFT, which include rule-based filings, urgent necessity to record all cross-border transactions, and an increased usage of innovative services and technologies.

How Shufti Addresses the Barriers of Cross Border Payments

Keeping in view the FATF’s survey results, financial organizations must devise a robust AML/CFT framework during customer onboarding. These obligations ease the process of identifying the UBOs and individuals that perform transactions on behalf of the retail and corporate customers. Additionally, the FATF also suggests document verification of customers to be conducted based on the level of risk associated with them rather than pre-set document guidelines designed for all clients. Hence, a risk-based approach must be adopted for effective compliance to AML/CFT regulations.

Apart from these approaches, financial institutions must employ Shufti’s AI-backed identity verification and Anti-Money Laundering (AML) screening solutions. The globally acclaimed company offers services in 230+ countries and territories that ultimately overcomes the data transparency issues identified by FATF. In less than a second, financial organizations can get 98.67% accurate identity verification results.

To learn more about Shufti’s KYC and AML services, get in touch with us.

Explore Now

Explore Now