How the US Aims to Fight Financial Crimes and Global Corruption in 2022

- 01 Anti-Corruption Strategy of the White House

- 02 US Treasury Takes Action Against Shell Companies

- 03 FinCEN’s Regulations to Combat Money Laundering Through Real Estate

- 04 Efforts to Preventing Money Laundering in the Private Investment Sector

- 05 Cross-party Alliance to Combat Corruption

- 06 US Congress Initiates Crackdowns on Kleptocrats

- 07 What Shufti Offers

2022 is looking like the year of change in the USA when it comes to combating illicit financial crimes, kleptocracy, and global corruption. With the world drenched in the after-effects of financial crimes like money laundering and terrorist financing, the situation has clearly gone out of the hands of financial institutions. According to the US Treasury Department, the US is “the best place to hide and launder ill-gotten gains.”

Every year, trillions of dollars illegally flow through the US financial system, urging authorities to take action. This year, US authorities have initiated crackdowns against corruption and illicit crimes.

Anti-Corruption Strategy of the White House

The White House launched the US Strategy on Countering Corruption in December, which is a first-of-its-kind strategy formulated to combat financial crimes. The inevitable strategic action from the White House is considerably ambitious in scope and demonstrates some solid commitments. The illicit flow of money and rising cases of corruption will be a common target of both the authorities and the Biden White House, which aims to capitalize on the upcoming opportunities to develop a new foreign policy based on anti-kleptocracy and anti-corruption principles.

By the summer of this year, the US plans to revamp bilateral relations and engage with global entities in events such as the Summit of the Americas. That being said, the Biden Administration has the responsibility to carefully implement the strategies while considering all the elements that come into play when money moves between countries. By the end of this year, another Summit for Democracy will be held. This summit will be a significant turning point in US history if the government successfully fulfills its commitments.

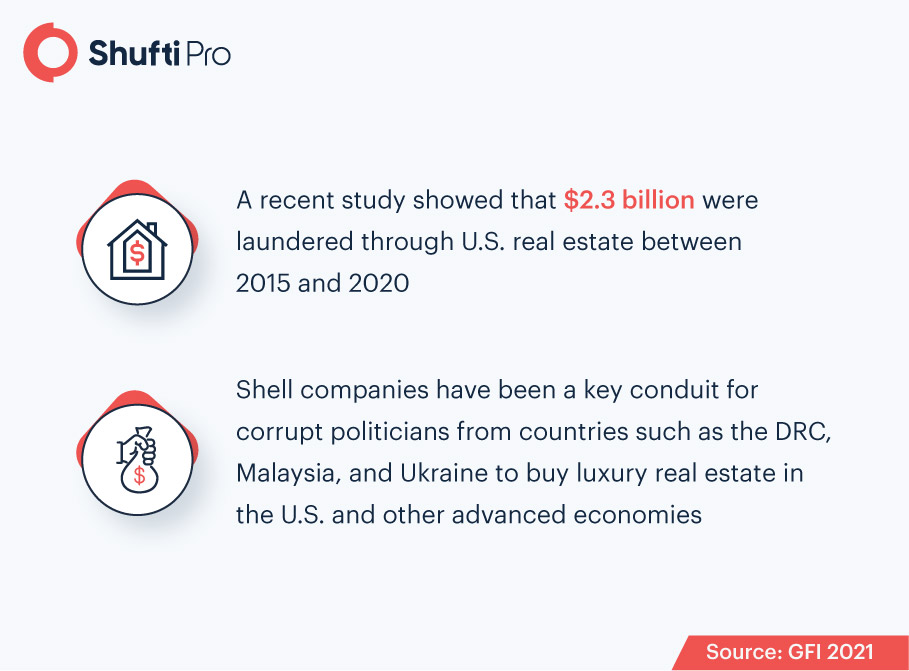

US Treasury Takes Action Against Shell Companies

The US is also taking action to implement the Corporate Transparency Act in order to prevent the establishment of shell companies. According to the Corporate Transparency Act, the true beneficial owners of any company must be disclosed to a secure directory that is overseen by the US Treasury’s

Financial Crimes Enforcement Network (FinCEN). The authorities have already issued draft regulations for the implementation of this law, and the actual law is also assumed to be implemented by the end of 2022. If things go as planned, the US will no longer be the best place to set up anonymous shell companies and use them as sources to obscure the origins of stolen/black money.

FinCEN’s Regulations to Combat Money Laundering Through Real Estate

The US real estate sector has a permanent stain for being a medium for money laundering. According to statistics from 2021, billions of dollars were laundered through US real estate. Attractive and high-value properties including mansions and luxury apartments are a favorable means for money launderers to stash their illicit funds for drug traffickers and kingpins. The Biden administration has demonstrated considerable efforts directed towards fighting the issue of financial crimes through the US real estate sector. New regulatory processes are being formulated for preventing money laundering in both residential and commercial real estate. The US FinCEN is currently asking for public comments to provide details of the regulations to be expected this year.

Efforts to Preventing Money Laundering in the Private Investment Sector

Furthermore, the White House is also putting together plans for closing down the loopholes in the private investment sector to prevent money laundering. The massive private investment sector in the US is valued at $11 trillion and is quite opaque when it comes to financial monitoring. As the private investment sector is not up to the mark in following anti-money laundering regulations, various businesses suffer by becoming victims of financial crime. Reports from Transparency International and Global Financial Integrity have indicated a number of cases where private equity and hedge funds were used for illicit crimes. According to the US anti-corruption strategy, the Treasury Department

“will re-examine the 2015 Notice of Proposed Rule Making (NPRM) that would prescribe minimum standards for anti-money laundering programs and suspicious activity reporting requirements for certain investment advisors.”

Cross-party Alliance to Combat Corruption

Alliances are being made between different parties of parliamentarians that are joining each other to fight corruption and kleptocracy. Considering the potential impact of the cooperation among lawmakers to combat money laundering and terrorist financing, this is an important move. Last year, the US launched the

Caucus Against Foreign Corruption and Kleptocracy, which has added an important bipartisan voice to policy debates. The lawmakers have joined together in an Interparliamentary Alliance Against Kleptocracy, engaging lawmakers in the European Union, U.K., and the U.S. to “disable transnational corrupt networks while deterring the movement of dirty money into democracies.” The network concluded its first meeting in January this year and has considerable potential to play a leading role in empowering governments with enforcement resources, legislative tools, and oversight.

US Congress Initiates Crackdowns on Kleptocrats

Expansion of sanction regimes against corrupt entities as well as human rights abusers has been an ongoing effort in the US since last year. Major countries like the UK, Canada, and Australia joined the development of important tools for imposing sanctions on bad actors. That being said, the list of corrupt entities and kleptocrats keeps on growing and creating opportunities for crime. The US Global Magnitsky Act is set to face a reauthorization this year, which means Congress will have to deliver the administration tools to carry out a comprehensive crackdown against corrupt entities. Corruption cases have been the cause of recent crises in many countries such as Kazakhstan, where the need for administration tools has been highlighted.

What Shufti Offers

AML compliance is made easy with the Shufti AML Screening solution. It has all the features required for a compact AML Screening solution that many businesses need today. No matter which region of the world the business is prevailing the businesses dealing in financial services are bound to follow AML Screening protocols of different frequencies. Last but not least, regulatory compliances have never betrayed a business, the investments in such compliances generate company value and provide cover against fraud and identity thieves.

Want to learn more about AML Screening for your business?

Explore Now

Explore Now