How to Mitigate Bias in KYC and AML: A Compliance Leader’s Guide

In 2025, financial crime is estimated to cost the global economy up to $2 trillion. To fight back, organizations are projected to spend $2.9 billion on AML and KYC data and services in 2025 alone.

The landscape is evolving fast: a recent study by Juniper Research found that more than 70% of KYC onboarding is now automated, and the global identity verification market is valued at nearly $14.82 billion.

Manual reviews remain a critical part of compliance, but they also introduce new challenges — especially when it comes to bias. Despite significant investment in AI tools, over 40% of firms still rely on human intervention for more than half of their onboarding cases. This reliance on manual processes can unintentionally shape outcomes in ways that are neither consistent nor fair.

When compliance teams review onboarding cases, their decisions are influenced by a range of subjective factors. Unconscious bias can affect how documents are scrutinized, how names are interpreted, and how cultural differences are perceived.

For example, a reviewer might — without realizing it—pay closer attention to identity documents based on a customer’s appearance or name, or request additional information from individuals whose backgrounds seem unfamiliar. These subtle biases can result in some customers facing more friction, longer wait times, or even being unfairly flagged as high risk, while others move through the process with less scrutiny.

Such inconsistencies not only undermine the customer experience but also expose organizations to regulatory and reputational risks. Recognizing how and where bias can enter the manual review process is essential for building fairer, more reliable compliance programs.

If you’re leading compliance, you know that unchecked bias in KYC and risk assessment doesn’t just threaten regulatory standing — it can erode customer trust.

Understanding the Roots of Bias in Compliance

Bias can creep in at any stage of the compliance process. Whether it’s outdated data, non-representative training sets for AI, or even human assumptions, the result is the same: some customers face unnecessary friction, while others easily slide through the process.

KYC and AML systems rely on identity verification and risk assessment to protect your business and your customers. But if these systems are built on biased foundations, you’re not just risking compliance — you’re risking trust.

Regulatory bodies like the Financial Action Task Force (FATF) have made it clear: effective compliance means fair, unbiased processes for all customers.

Where Bias Hides in KYC and AML

You might think your compliance program is rock-solid, but bias can be subtle. Here’s where it often lurks:

- Data selection: If your identity verification data doesn’t reflect your real customer base, risk assessment models can become skewed.

- Algorithmic decisions: Automated systems can amplify historical biases, especially if they’re not regularly audited.

- Manual reviews: Even well-trained compliance teams can bring unconscious bias to identity verification and customer due diligence.

The result? Some customers may be unfairly flagged as high risk, while others are overlooked. This isn’t just a customer experience issue — it’s a compliance risk that can draw regulatory scrutiny.

Practical Steps to Mitigate Bias

If you’re in compliance, you’re facing more pressure than ever. With 86 billion digital ID verification checks expected in 2025 and customer drop-offs rising due to complex KYC processes, the stakes are high.

The good news? You have real, actionable ways to reduce bias and strengthen both your compliance and customer experience.

1. Use representative data sets

Your identity verification and risk assessment systems are only as strong as the data behind them. As synthetic identity fraud jumped 18% year-over-year in 2024, regularly reviewing and updating your data sets is critical to ensure your KYC and AML processes remain both relevant and fair.

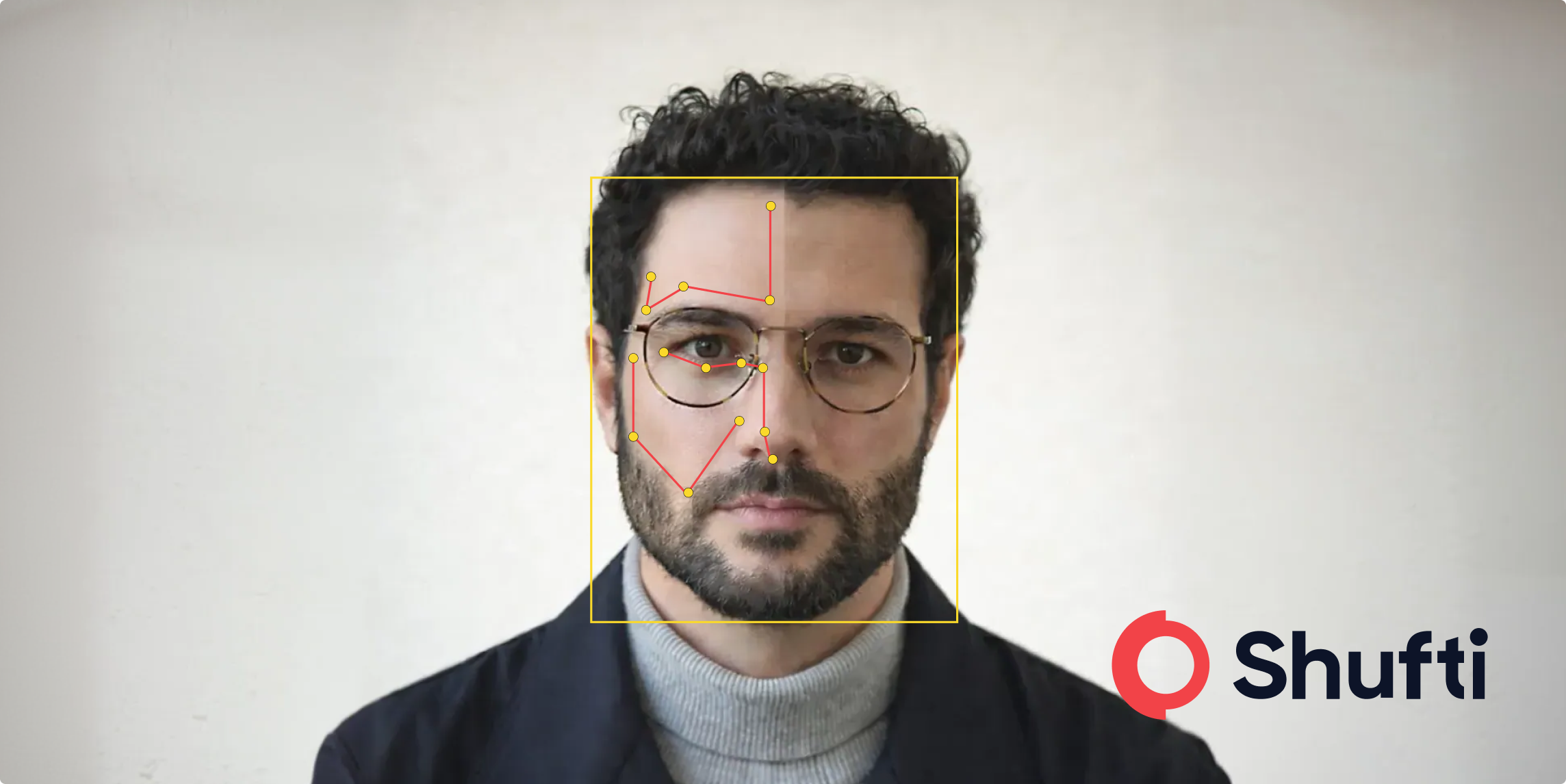

2. Combine human and AI review

Technology alone can’t catch every nuance. While AI can speed up identity verification and risk assessment, it’s human judgment that often catches the subtle signals of bias. A hybrid approach — where AI handles routine checks and humans review the edge cases — helps you flag potential issues before they become compliance headaches. Shufti’s Fast ID is built to deliver this kind of balance, so you gain both efficiency and oversight.

3. Audit and monitor regularly

Bias isn’t static — it can evolve as your systems and customer base change. That’s why ongoing audits are essential. Schedule regular reviews of your identity verification and risk assessment processes, looking for patterns that might signal bias. And document your findings and remediation steps — regulators expect transparency, and it’s also a best practice for continuous improvement.

4. Train your teams

Even the best technology can’t replace an informed, vigilant compliance team. Make bias awareness part of your regular training. Help your team understand how bias can affect identity verification and customer due diligence, and give them the tools to intervene when needed. This not only strengthens your compliance efforts but also builds a culture of fairness and accountability.

5. Adopt risk-based approaches

Not every customer or transaction carries the same risk. By using a dynamic risk assessment framework, you can focus your compliance resources where they’re needed most — and avoid unnecessary friction for low-risk customers. This approach not only improves efficiency but also demonstrates to regulators that your compliance program is both thoughtful and adaptive.

How Shufti Helps Compliance Teams Stay Ahead

At Shufti, we know that compliance leaders need more than just tools — you need confidence that your KYC and AML processes are both effective and fair.

Our compliance solutions are built with bias mitigation in mind, combining advanced AI with human oversight.

- Regulatory KYC keeps you aligned with evolving standards.

- AML Screening adapts to new threats and changing risk profiles.

- Fast ID delivers rapid, reliable identity verification without sacrificing accuracy or fairness.

Fair Compliance and Better Outcomes for All

Mitigating bias in KYC and AML isn’t just a regulatory checkbox — it’s about building trust and protecting your business. By focusing on representative data, hybrid review models, and ongoing risk assessment, you can make your compliance program a source of strength, not stress.

Ready to see how bias-free identity verification and risk assessment can transform your compliance workflow?

Request a demo to see Shufti’s solutions in action.

Explore Now

Explore Now