Implementing Robust Anti-Money Laundering Checks for the Insurance Sector

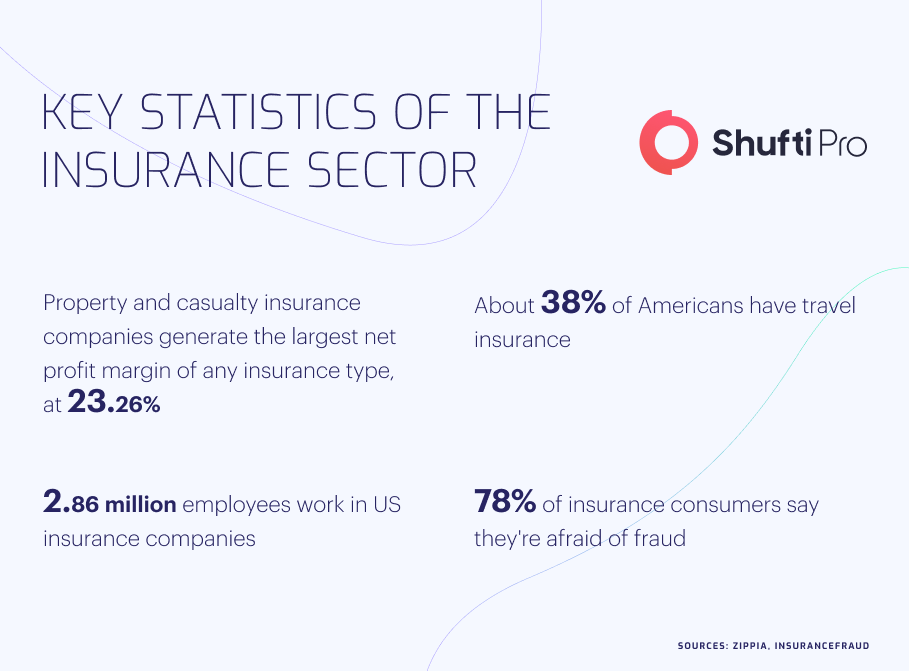

Insurance companies play a decisive role in the considerable growth of an economy. It turns accumulative capital into fertile investment. It also alleviates losses and promotes financial stability, resulting in substantial growth and development. Along with its benefits, insurance sectors have surged with financial thefts like money laundering and terrorist financing. According to International Monetary Funds, money laundering in insurance companies has been estimated to be 5% of the world’s GDP. Since insurance companies are involved in an outflow of money, it becomes hard to keep track of large sums, hence, the chances of money criminal activity increase.

Two-thirds of insurance firms have encountered monetary crimes in 2021. As a consequence of this accelerated criminal activity within the insurance sector, global authorities and governments have collaboratively incorporated a series of anti-money laundering regulations as a part of their legal obligation. In case of non-compliance with regulations, insurance companies should be obligated to heavy fines and in some cases prison to minimize the risks of money laundering.

Vulnerability of Insurance Sectors to Money Laundering Risks

Insurance sectors are equally vulnerable to money laundering risks like other financial institutions. With advancing technology, criminals are in a constant struggle to sneak into the insurance sector to launder money. Therefore, insurance companies should take strict measures to identify and defend against money laundering and terrorist financing by adopting customer due diligence, as part of a risk-based approach.

Mostly, money laundering occurs when unscrupulous businessmen invest their dirty money in buying lavish items which they later claim through insurance firms. As per law, the insurance sector must pay the funds back in case of cancellation within a particular time period. Along with that, insurance sectors do not take necessary actions against customer negligence as other conventional institutions. As a result, insurance firms become more vulnerable to money laundering in the absence of suitable AML compliance.

By summarizing the current circumstances, to reduce overall vulnerability, extra attention should be paid to employee training in the insurance sector and public consciousness to reduce the risks of money laundering and build extra pressure on the insurance sector.

Prevailing Frauds in Insurance Companies

The Insurance Information Institute (III), interprets insurance fraud as a calculated risk perpetrated against or by an insurance company for the motive of monetary gains. Fraud in the insurance sector may be committed by the applicant, policyholders, or service providers. Inflating claims, misreporting of the insurance policy facts, and reporting losses that never occurred are the most commonly encountered frauds in insurance companies. The annual cost the insurance companies cause to US consumers is at least $80 billion.

Auto Insurance Fraud

This no-fault auto insurance permits the policyholder to restore monetary losses from their own insurance organizations claiming damage to their personal vehicle. The trickster may also provide fake documentation to support the claim. Auto insurance loses at least $29 billion per year.

Healthcare Fraud

Healthcare fraud influences almost all types of property insurance coverage including medical payments for car accidents or people injured in a workplace. In health care sectors, doctors, nurses, and other worker-related to the facility could be involved in frauding the system. Financial losses due to healthcare fraud are estimated to be $68 billion.

Employer Compensation Fraud

Some workers apply for fake loss recovery under fake identities to avoid the detection of their unrecognizable records. It most commonly involves billing for procedures that were never executed such as work-related injury. An employer can also commit a scam by lying about the job’s safety. The annual estimated value of worker compensation fraud is $7 billion.

Global Regulations to Combat Money Laundering in Insurance Companies

In the UK, many insurance companies are not compelled to comply with AML regulations, but they are obliged to report doubtful ventures. Therefore, all the financial businesses inciting insurance sectors that do not follow AML sanctions are highly prone to monetary crimes and terrorist financing.

In accordance with FATF, global regulatory authorities have made attempts to put a stop to financial crimes in insurance companies. FCA in the UK is the key regulatory authority in charge of monitoring AML regulations. The European Anti-Fraud Office is the institution supervising the exemption of money laundering in the EU. The European Union follows the most recent 6AMLD along with the previous one 5th AML derivative.

However, US insurance firms are regulated by FinCen (Financial Crime Enforcement Network) and all financial firms must comply with the Bank Secrecy Act. All the countries must have institutions focused mainly on AML regulations accompanied by FATF operating on an international level. The Financial Action Task Force administers global AML policies and counts 39 country members worldwide.

Need for AML screening in Insurance Companies

The magnitude of transactions in insurance sectors is quite small compared to the total number of accounts. Therefore, the insurance sector regulatory authority will need a more pliable solution for money laundering and monetary crimes at an affordable price.

Through PEPs, FATF and Interpol have accumulated much information on financial crimes (Politically Exposed Persons lists). Every insurance provider needs access to these lists so they may check their customer information against them. It can reduce money laundering and terrorist financing concerns with an effective AML system, which can also help catch criminals. In ML risk relating to insurance policies, AML risk assessment is soon to come.

In addition to implementing accurate AML regulatory measures, insurance companies should also ensure their AML/CFT programs include satisfactory CDD (Customer Due Diligence) measures to confirm the true identity of their customers. CDD is a crucial factor in the sanction screening process because it permits figuring out whether the customers are truthful about their identities. So, despite the regulatory gaps in the insurance sectors, a good KYC/AML is crucial and should summon best practices.

What Shufti Offers

To stay ahead of the sams of money launderers, insurance firms should incorporate strict AML regulations to verify customers’ identities and detect their transactions. Verifying and eliminating the probability of monetary thefts by applying a risk-based approach must be the top concern of insurance sectors.

Shufti’s Anti-Money Laundering (AML) solution allows insurance firms to stay amenable to regulatory standards and prevent financial crimes like money laundering. Backed by AI algorithms, Shufti’s AML screening also screens customers against 1700+ watchlists worldwide within a few seconds with 99% accuracy.

Want to learn more about our AML screening solution for your insurance firm?

Explore Now

Explore Now