KYC | How to perform KYC verification in three simple steps

Know Your Customer (KYC) is an identity verification process that plays a critical role in the prevention of financial crime within the world economy. As digital transactions continue to outpace traditional ones, financial institutions, fintechs, and digital businesses are under growing pressure to verify those that want to utilize their services.

KYC spans a wide range of customer legitimacy checks, including face verification, document verification, address verification, two factor authentication, facial biometric authentication, and video KYC. All of these enable businesses to properly verify customers during onboarding, helping to reduce the risk of fraud, ensure global and local compliance, and build trust in the digital space.

So, what does the KYC process actually look like?

At its core, the KYC process involves collecting and validating personally identifiable information (PII) and screening it against watchlists and sanctions databases. Let’s break it down using Shufti’s digital KYC process as an example:

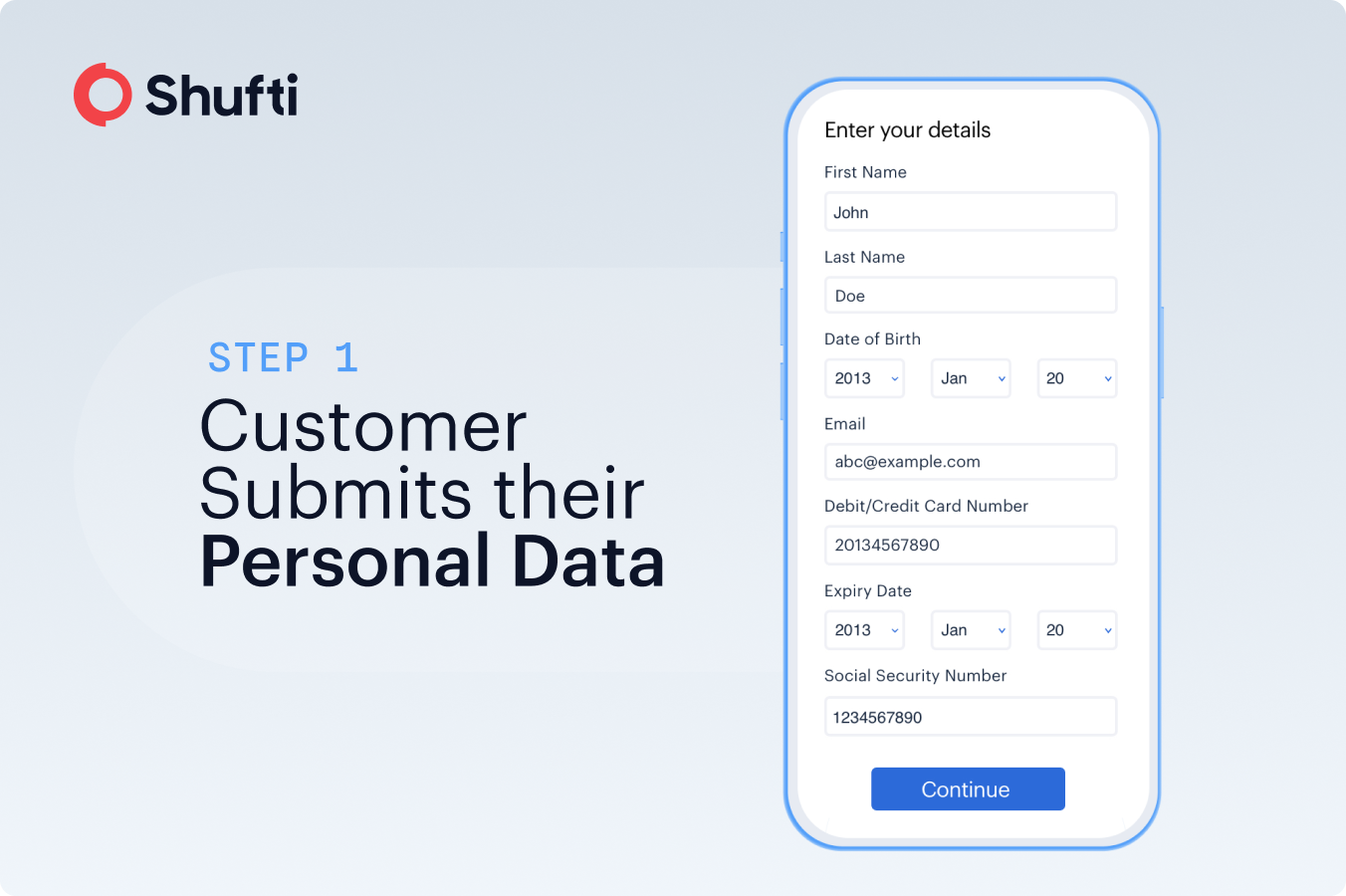

Step 1: Customer Submits Personal Data

The KYC process starts when a customer enters their personal information during registration, including:

- Full name

- Date of birth

- Nationality

- Email address

- Passport or national ID number

- Financial identifiers (e.g., bank account or card numbers)

This step lays the groundwork for identity validation and risk assessment.

Step 2: Customer Uploads Their ID Documents

Next, customers are prompted to upload images or scanned copies of their identity documents. These could include:

- Government-issued ID (passport, national ID card, or driver’s license)

- Proof of address (utility bill, rental contract, bank statement)

- Supporting documents like tax returns or employment letters

At Shufti, we support over 10,000 document types from 240+ countries and territories in 150+ languages, with advanced OCR technology that extracts data from uploaded documents in real time.

Step 3: Verification of the Customer’s Identity

Once the documents are uploaded and the OCR data is extracted, the system:

- Matches extracted data with the manually entered details

- Checks databases of document templates from around the world for signs of forgery or tampering

- Uses AI-powered fraud detection to spot anomalies in image quality, text consistency, or metadata

Shufti’s solution combines these with biometric verification, such as face matching and liveness detection, to ensure the person presenting the document is who they claim to be.

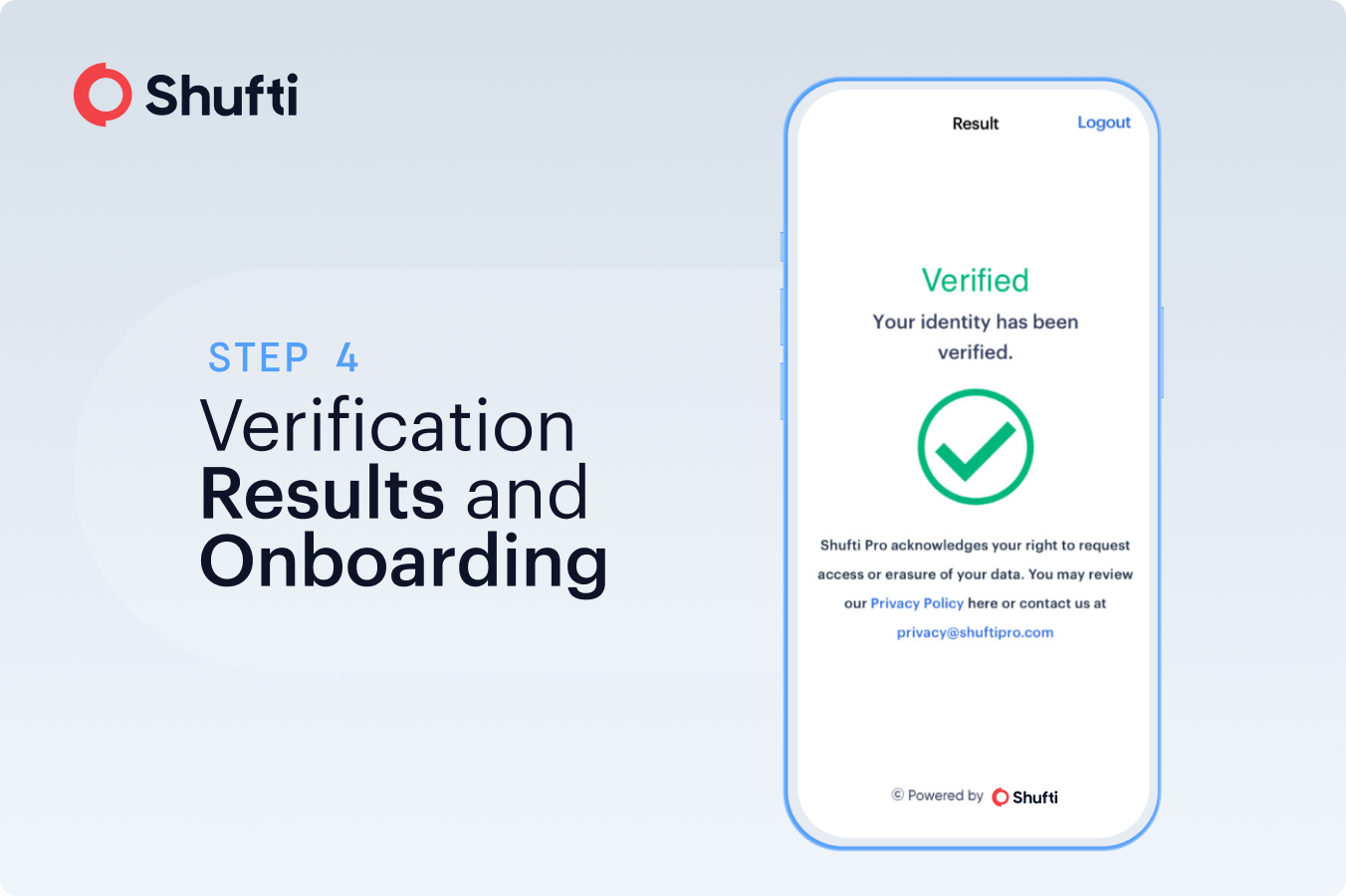

Step 4: Verification Results and Onboarding

If the verification checks are successful, results are delivered in as fast as 6 seconds and the user is granted access. The full audit trail is securely stored and made available in the back-office dashboard if needed for compliance review.

What Is KYC Compliance?

KYC compliance is a critical component of the verification framework; it defines the required guidelines and obligations businesses must implement. The policies vary across industries and jurisdictions, and are exceptionally important to those operating in finance, banking, and online payment systems. Some of the most important frameworks include:

- FATF (Financial Action Task Force) Recommendations

- EU’s AMLD6 (Sixth Anti-Money Laundering Directive)

- The U.S. Bank Secrecy Act and FinCEN guidance

- Local data protection laws like GDPR (Europe), LGPD (Brazil), and PDPA (Singapore)

KYC compliance is a legal requirement and organizations can incur hefty legal and financial consequences if they fail to comply. The regulatory landscape is tumultuous and ever-changing in order to keep up with growing threats so be sure to stay up-to-date.

For more information or assistance on KYC regulations and compliance, talk to one of our compliance specialists now.

Types of KYC Methods Used Today

Modern identity verification providers like Shufti offer a mix of automated an AI-powered KYC methods:

- Document Verification: Checking ID documents for validity and integrity.

- Biometric Verification: Face matching, liveness detection, and facial recognition for an additional layer of security.

- Video KYC: Live video interaction with an agent to validate identity in real time, now being implemented in countries like India.

- e-IDV: Matches user details against trusted databases (e.g., credit bureaus, government records).

- Address Verification: Validates residence via utility bills, tax returns, or geolocation metadata.

Shufti’s recently launched e-IDV solution offers global coverage with enhanced speed, data matching accuracy, and seamless integration.

Common questions about the digital KYC verification process

Which ID documents are considered for KYC verification?

Government-issued ID cards, passports, driver’s licenses, debit/ credit cards are required for document verification. Employee letters, insurance agreements, utility bills, bank statements, tax bills, and rent agreements may be required in case of customer address verification.

At Shufti we authenticate more than 10,000+ ID documents, so you’ve got a wide range of identity documents to choose from. For a full list of documents supported by Shufti, click here

How can my company carry out KYC verification and customer onboarding?

Companies usually work with an identity verification provider – like us. Verification software isn’t a quick or easy thing to develop, so we handle that part for you. Our solutions are easily integrated into the company’s KYC practices and website for customer onboarding and verification. We have recently launched an e-IDV solution to revolutionise the identity verification landscape globally.

What IDs can be used for KYC verification and onboarding?

This will vary depending on your IDV provider. At Shufti, we verify an expansive range of documents, 10,000+ ID documents across 240+ countries & territories, in 150+ languages – we’re dedicated to creating a safe digital world.

How long should it take to verify a customer?

Again, this will depend on your KYC verification provider, but generally across the industry it’s between 15 and 30 seconds. However, here at Shufti, we offer unmatched speed, with accurate verification in around 6 seconds.

Final Thoughts

Performing KYC verification doesn’t have to be complex. With the right technology in place, businesses can verify customers securely, meet global compliance standards, and reduce onboarding friction, all while achieving almost instantaneous results. As fraud techniques grow more sophisticated and regulations continue to evolve, having a streamlined and adaptable digital KYC process is no longer just a competitive advantage. It’s a requirement.

Whether you’re verifying identities through document checks, biometrics, or real-time video KYC, the ability to authenticate customers in seconds ensures your business stays protected and compliant in today’s digital first environment.

Explore Now

Explore Now