KYC in banking: How American banks can fight identity thieves?

In the present globalized, fast-evolving sphere, revolutionizing KYC (Know Your Customer) is crucial than ever for banks. These days, your customers may be any individual, anywhere in the world. Beyond being an authorized entity, authenticating the identity of these new clients, ensuring that they are who they claim to be, and evaluating whether they are a worthy match for your corporate are vital to your business’s well-being and virtuous prosperity.

Determining where the money is coming from is also necessary since it is equally important to eliminate money laundering and terrorism. The precision and safety of such policies has lately become a problem and is particularly appropriate now when the world just unexpectedly went online due to the COVID-19 pandemic.

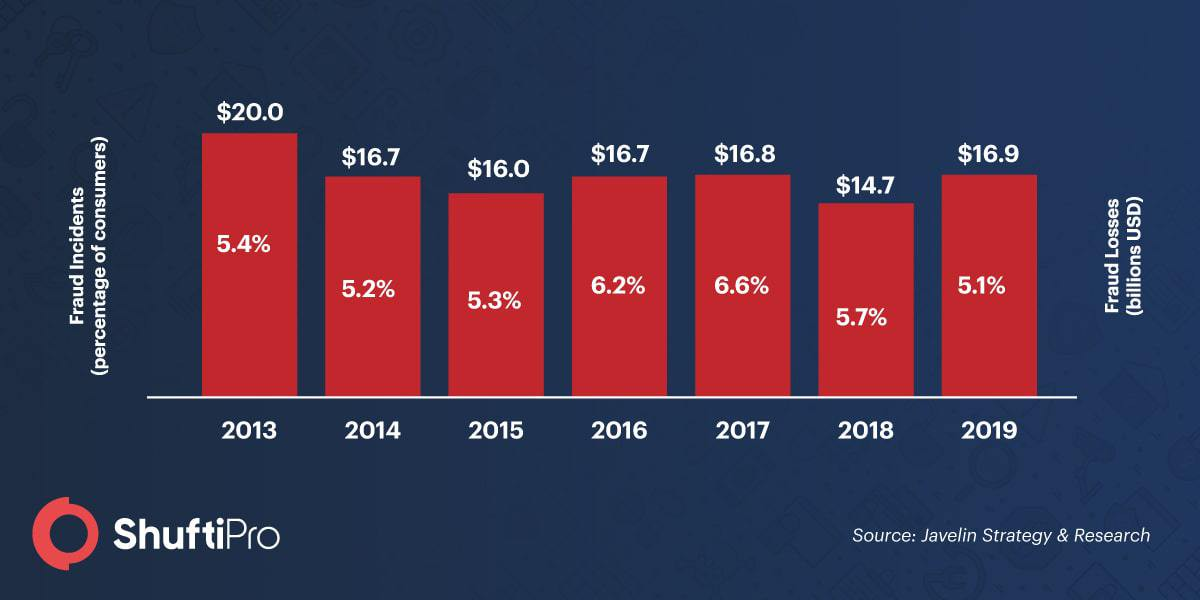

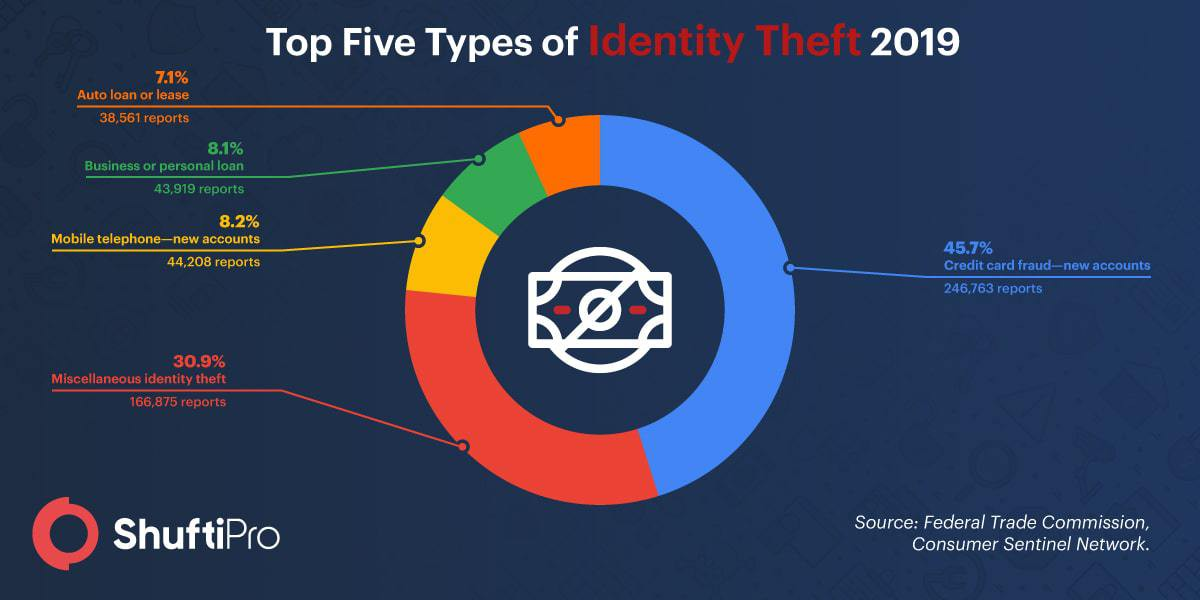

Only online identity verification services based on the KYC verification process have the latent to protect against these frauds. Credit card accounts are also in excessive jeopardy of being exposed to digital crooks. The eruption of technology and the rise of online banking services has developed an increased ratio of digital frauds and malicious transactions. Due to a lack of verification services and dependence on conventional authentication methods, fraudsters are getting an upper hand in accessing user identities and making fraudulent transactions which leads to chargebacks, non-compliance fines, and lost market value.

The importance of KYC compliance

Know Your Customer (KYC) is the procedure by which banks validate that prospective clients are authentic both before opening an account and directing transactions as well as preserving an account. It involves making sensible efforts to define the accurate identity and beneficial proprietorship of accounts, source of funds, and the nature of the client’s business which in turn helps the banks to address their hazards sensibly.

The initial know your customer law in the United States was passed in 2001 as the Patriot Act to reduce the risk of terrorist financing. The Patriot Act established additions to the bank secrecy act of 1970 which was a key source of legislative guidelines for the banking sector. The 9/11 attacks increased government attention in passing regulations for banks, making KYC an obligatory part of banks’ undertakings since then.

The banking sector requires evidence of the provided data in the form of documents and photocopies of ID documents.

How KYC works in banks & financial institutions

In order to shorten and strengthen CDD requirements and come across KYC in the financial sector, the FinCEN defined four basic essentials for a customer identification program. They include:

- Recognizing and authenticating the identity of clients.

- Recognizing and authenticating the identity of beneficial owners of authorized entities (i.e., the regular persons who possess or control legitimate entities).

- Accepting the nature and purpose of client associations to develop a customer risk profile.

- Conducting ongoing monitoring for doubtful dealings and, on a risk basis, sustaining and updating client information.

Main drivers of KYC programs:

The banking sector has to execute a robust investigation and identity verification before client onboarding to reduce risk related to money laundering. They ensure it with different stages of the CDD process and CIP dependent on the risk profile of a potential client:

1. Customer identification program (CIP)

In the US, the customer identification program directs that any person involved in financial dealings need to have their identity attested. It is intended to manage money laundering, malicious attacks, terrorist financing, identity thefts, and other illegal activities

The minimum regulations to open an individual financial account are distinctly determined in the customer identification program:

- Name

- Data of birth

- Address

- Identification number

While collecting this data at the account opening process is vital, since the industry needs to verify the identity of the account holder “within an equitable time”.

Methods for identity authentication comprise of

1.Documents

2.Non-documentary methods

3.Combination of both

These methods are the center of the customer identification program as with other anti-money laundering requirements, these processes shouldn’t be checked inconsistently. They must be simplified and organized to offer continuous guidance to the workforce, managers, and for the benefit of regulators.

2. Customer due diligence

CDD is the process to initiate trust in a client and evaluate associated risk. Customer due diligence can aid banking and monetary organizations to alleviate threats presented by money laundering efforts of politically exposed persons (PEPs), terrorist administrations, or crooks.

Customer due diligence can be implemented at three stages:

- Simplified due diligence: when the risk of money laundering is low and the entire due diligence process is not compulsory.

- Basic due diligence: Basic data acquired from all customers for identity verification and evaluation of the risk related to it.

- Enhanced due diligence: High profile clients are dealt with enhanced due diligence in which additional data is collected to deliver an in-depth understanding of customer activity to diminish associated risks.

Achieving KYC in banking

Not every individual will be interested to show how much money they are producing, even if they are doing it legitimately, particularly when their profits appeal to high taxes enforced by the government. They can execute high-value transactions, which stays hidden from the government’s tax collection organizations.

These individuals can use banks or financial organizations to wash their black money with money laundering tactics. This measure results in loss of income and ultimately delayed the development of the nation. Performing know your customer ensures complying with regulatory requirements by enabling a robust and easy on-boarding process for new customers.

KYC can result in a superior level of faith, active monitoring of customer conduct as per their risk profile, and robust fraud prevention.

It all boils down to robust KYC verification

A robust know your customer solution for banks not only delivers omnichannel provision but vitally has exemplary expertise in order to quickly and accurately identify an incoming banking client. Shufti video KYC ensures secure client onboarding for financial institutions by carrying out a live identification procedure that is faster and assures high security. Its facial recognition expertise uses AI and HI to execute client verification in just 5 seconds.

Banks in search for a KYC service provider can take help from Shufti to verify the identity of a new user with the support of:

- Facial authentication

- Address Verification

- Document Verification

- AML screening

- Phone Verification / 2 Factor Authentication

It offers 7 days free trial for all its KYC and AML service providers so that enterprises can recognize high profile clients who have substantial financial risk associated with them.

Find more relevant resources: