Video KYC in 2025: What It Is, How It Works & Why It Matters

BECKY P.

May 14, 2025

6 minute read

Introduction

Lockdowns pushed remote onboarding from nicety to necessity, turning video KYC into a mainstream compliance channel. The market, valued at US $0.29 billion in 2024, is projected to top US $1.03 billion by 2033 at a 15 % CAGR, proof that live-video identity is here to stay. Banks and fintechs love the speed: Checkout.com records 25–30 % more completed sign-ups when video replaces upload-only flows. Regulators aren’t far behind—RBI’s November 2024 V-CIP update, the EU’s forthcoming AML Regulation and a FinCEN deep-fake alert all recognise (and police) video identity.

1 · What Is Video KYC?

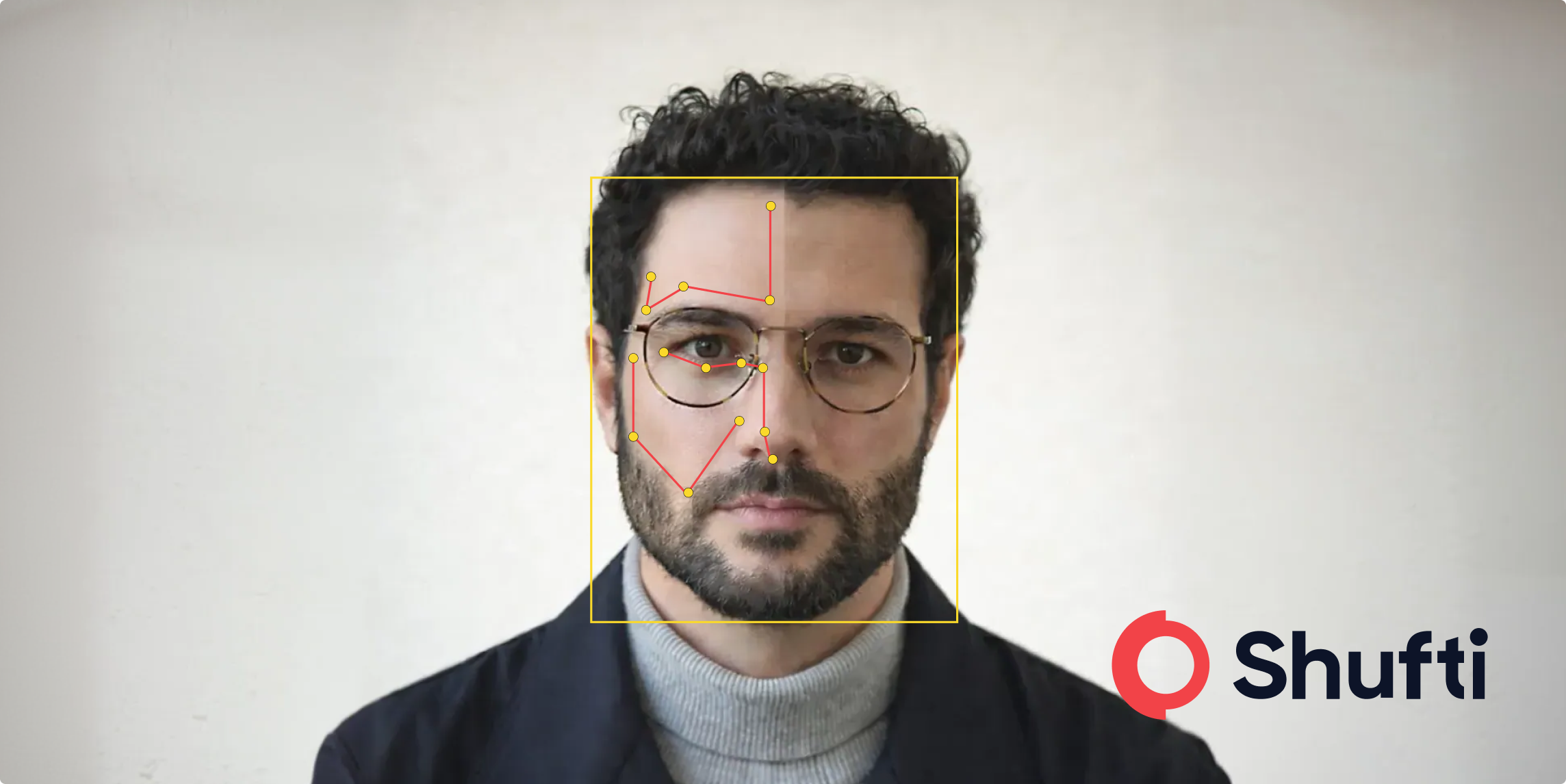

A live, agent-assisted video call—backed by AI—that verifies ID, face and liveness in real time. Successful sessions end with an encrypted recording and XML audit log retained for 5–10 years to meet FATF record-keeping rules.

2 · 2025 Regulatory Landscape at a Glance

| Region |

Authority / Rule |

Key Provisions |

| India |

RBI V-CIP update (Nov 2024) |

Allows Aadhaar offline, face recognition & geotagging; mandates dynamic scripts. |

| EU-27 |

EU AMLR draft + EBA RTS (Mar 2025) |

Formalises remote CDD; requires liveness & end-to-end encryption. |

| USA |

FinCEN Deep-fake Alert (Nov 2024) |

Urges stronger liveness & spoof detection in video processes. |

| UK |

Digital Identity & Attributes Trust Framework v1.0 (Jan 2025) |

Sets video proofing equivalent to GOV.UK Verify LOA 2. |

| Gulf |

2024 central-bank circulars (UAE, KSA) |

Permit dual-ID capture and Arabic-language video flows. |

3 · How Does Video KYC Work? (Step-by-Step)

- Session start – user taps secure link; WebRTC launches (no app).

- ID pre-screen – AI captures ID, runs OCR & fraud checks.

- Live interview + liveness – agent follows on-screen script while AI tracks depth & micro-movements.

- Geo-tag & consent – IP/GPS logged; user gives explicit consent.

- Risk score & decision – engine merges doc, face and behaviour scores.

- Audit vault – AES-256 video + XML log stored WORM-style.

Total time: ~3–4 minutes on LTE/5G.

4 · Benefits vs. Traditional Upload Flows

| Benefit |

Impact |

| Higher conversion |

+25–30 % completed sign-ups (Checkout.com) |

| Lower fraud |

Real-time agent & AI catch fake IDs before account open |

| Regulatory robustness |

Full video + script satisfies RBI, EU AMLR, BSA §326 |

| Accessibility |

No app download; any modern mobile browser |

| Fast deployment |

< 2 weeks via SDK/API |

5 · Common Pitfalls & 2025 Fixes

| Pitfall |

2025 Fix |

| Bandwidth drop-outs |

Adaptive bitrate + async photo fallback |

| Deep-fake spoofs |

Multi-angle liveness + gesture challenge + texture analysis |

| Agent-script drifts |

Dynamic on-screen prompts; XML prompt logging |

| Privacy worries |

Display retention term up-front; host only in ISO 27001/SOC 2 zones |

6 · Best-Practice Guidelines for a Compliant Call

| Guideline |

Why It Matters |

How to Implement |

| Full-session recording |

Audit trail for RBI & FATF |

AES-256 video + stills at start/mid/end |

| Scripted workflow |

Removes ad-hoc Qs |

Surface prompts; log Q/A to XML |

| Liveness every 5 s |

Blocks masks & deep-fakes |

Passive depth + active gesture |

| Tilt-ID 30° test |

Detects hologram tampering |

Capture glints on tilt |

| Synthetic-ID scan |

Synthetic IDs ↑16 % YoY |

Cross-check MRZ vs chip + bureau |

| Geo-tag & IP log |

Jurisdiction risk scoring |

HTML5 geo + IP-to-country |

| Explicit consent |

GDPR/PDPA compliance |

Verbal + checkbox confirmation |

7 · People Also Ask — Quick Answers

| Question |

Short Answer |

| What is video KYC? |

A live video call where an agent verifies your ID and face. |

| Is video KYC mandatory? |

Depends on jurisdiction; optional but popular in India, EU, GCC. |

| How safe is video KYC? |

End-to-end encrypted with AI liveness is as secure as branch visits. |

| How long does it take? |

About 3–4 minutes end-to-end. |

| Can I use mobile? |

Yes—runs in-browser via WebRTC. |

| Does it record me? |

Yes—encrypted video stored for audits. |

| How to pass first time? |

Good lighting, stable internet, docs ready. |

| What if it fails? |

Retry or switch to photo upload; persistent fails may need in-branch. |

8 · Key Takeaways

- Market momentum: 15 % CAGR to 2033; video is mainstream.

- Conversion booster: +25–30 % completions vs. upload flows.

- Regulations explicit: RBI, EU AMLR, FinCEN all cite video identity—deep-fake safeguards required.

- Execution is everything: Adaptive streaming, scripted agents and layered liveness separate success from sanctions.

Next Steps — See Video KYC in Action

Cut onboarding time by 30 %, lift approval rates and keep regulators happy. Shufti’s Video KYC delivers:

- Real-time verification in 3–4 min

- Coverage in 230+ countries & 150+ languages

- Bank-grade security (ISO 27001:2022, PCI DSS, GDPR)

- 99.3 % doc/face match precision (Aite-Novarica 2024)

Keep up to date with the Shufti newsletter

Stay ahead of the curve with fresh takes on the latest identity innovations.

Thanks For Your Submission.

Explore Now

Explore Now