Shufti empowers your entire KYC/AML journey from start to finish

Customize your journey to adapt to your local jurisdictions and rules. With the help of Shufti's journey builder, achieve compliance that is convenient, quick and fool-proof.

Global identity verification, with edge case resilient technology

Shufti’s advanced AI detects fraud instantly, supporting global documents from over 230+ countries and jurisdictions. Its OCR technology ensures accurate data extraction across non-Latin scripts with no extra cost.

- Detects forged, tampered, or expired documents, along with holograms, watermarks, and security features for comprehensive fraud detection.

- Enterprises can verify bulk data in under a minute, receiving instant approvals or flags through an AI-driven process.

- Supports all document types, passports, ID cards, driving licenses, and more, for seamless global identity verification.

Government database eIDV for greater accuracy and precision

Shufti strengthens identity verification by integrating with government databases and official records for real-time, error-free validation. Its systems enforce strict fraud prevention while streamlining compliance and user onboarding.

- Provides direct access to government databases for instant identity verification, reducing manual errors and boosting security.

- Verifies addresses against trusted databases and utility records to ensure authenticity and enhance fraud prevention.

- Enforces zero fraud tolerance by cross-checking user data, and verifies users' ages against official documents to ensure compliance in regulated industries like crypto and gaming.

Context-driven & custom AML screening that works

Shufti provides robust global risk screening by leveraging thousands of watchlists, media categories, and PEP profiles. Its tools enable real-time compliance and risk detection tailored to a business’s regulatory needs.

- Screens individuals and businesses against 3,500+ global watchlists (e.g., FATF, US, EU) for jurisdictional and nationality-based risk assessment.

- Tracks 215+ sanctions regimes in real time with updates on designations, delistings, and global authority changes to ensure compliance.

- Utilizes 415+ adverse media categories and a 2.6M+ PEP database to deliver precise, context-driven risk alerts and financial risk mitigation.

Your data should not be a pit stop, but that happens with third party KYC verification vendors

Time to get your business out

Contact usBusinesses can not thrive on off-the-rack-solutions, Shufti offers a way out

An e-commerce platform may allow verification based on past purchase behavior, while a bank needs strict fraud filters and document clarity. Most KYC service providers force both into the same rigid workflow, Shufti doesn’t.

- Fully customizable verification journeys by industry, region, and risk profile.

- Offers flexible, non-rigid KYC solutions that helps you decide the level of risk.

- Switch between strict or lenient matching (e.g., fuzzy logic vs. exact match).

- Keeps user and business consent as essential part of its KYC process.

Delays. Inconsistencies. Misuse: Not at our watch Shufti is built in the toughest of neighborhoods

Shufti eliminates this risk by owning the entire KYC verification stack. Our full on-premise KYC platform ensures your data stays in one secure place, with no detours.

- All technology is built in-house and end to end encrypted, enjoy no integrations and no vendor dependencies

- No lag time from third-party relays ensures faster response times, ensuring you maximize your ROI from each customer

- No requirement for aligning with limitations of external providers thus allowing fully customizable workflows to match risk-appetite of business

- Data never leaves your premises thus ensuring airtight compliance with global data protection standards (GDPR, e.t.c.)

Get KYC compliant users for every

industry

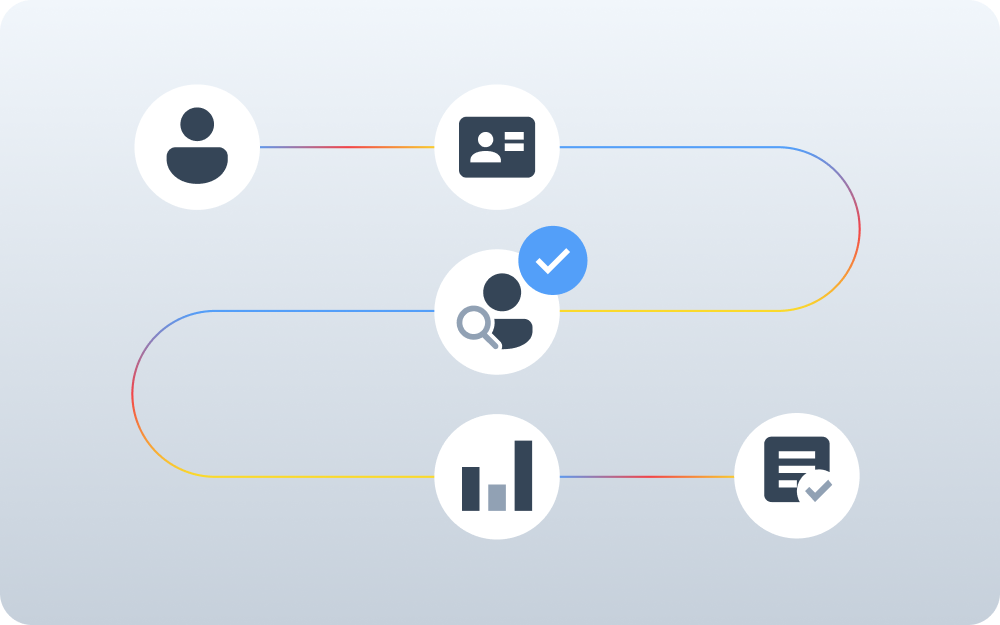

How our KYC process works

Verify users

Verify identity data

Assess risk

Screen transactions

Case management

Ongoing monitoring

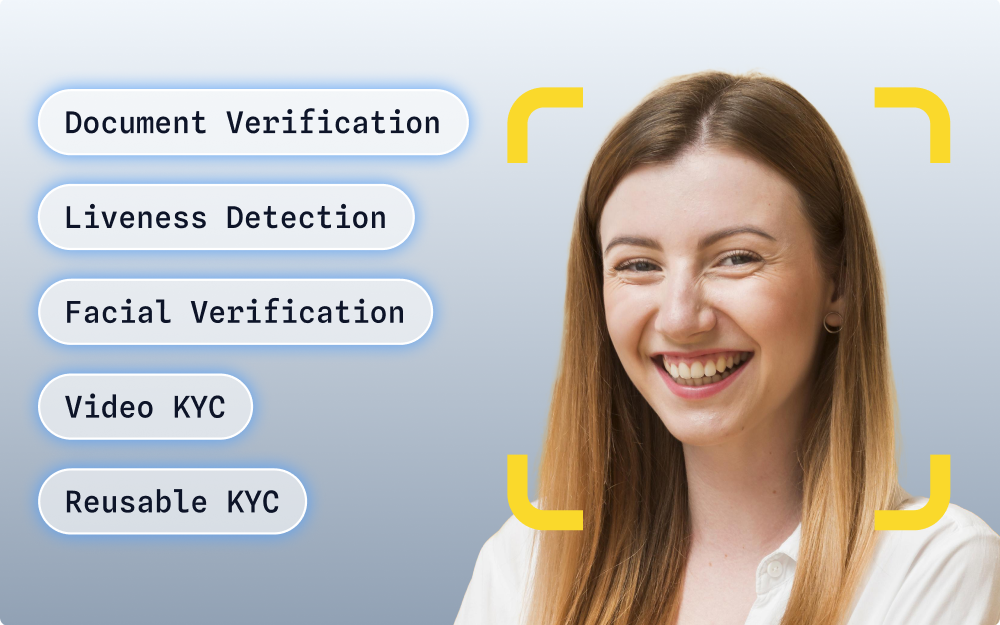

Users begin the verification process by uploading documents such as passports, driver’s licenses, and national ID cards. For countries that require a live KYC session, Shufti makes it easy to create real-time video verification.

- As part of the verification process, we make it easy to verify a user’s age to Identify minors and restrict their access to protect your business from non-compliance fines.

- Shufti also perform continuous AML screening against global lists, watchlists, PEP lists, and adverse media databases to uphold multiple regulatory standards.

Users begin the verification process by uploading documents such as passports, driver’s licenses, and national ID cards. For countries that require a live KYC session, Shufti makes it easy to create real-time video verification.

- Shufti uses liveness detection, 3D technology, and facial expression analysis to ensure the user is a real person.

- Shufti also makes it easy to reuse stored identity data with multiple verification options (including FastID).

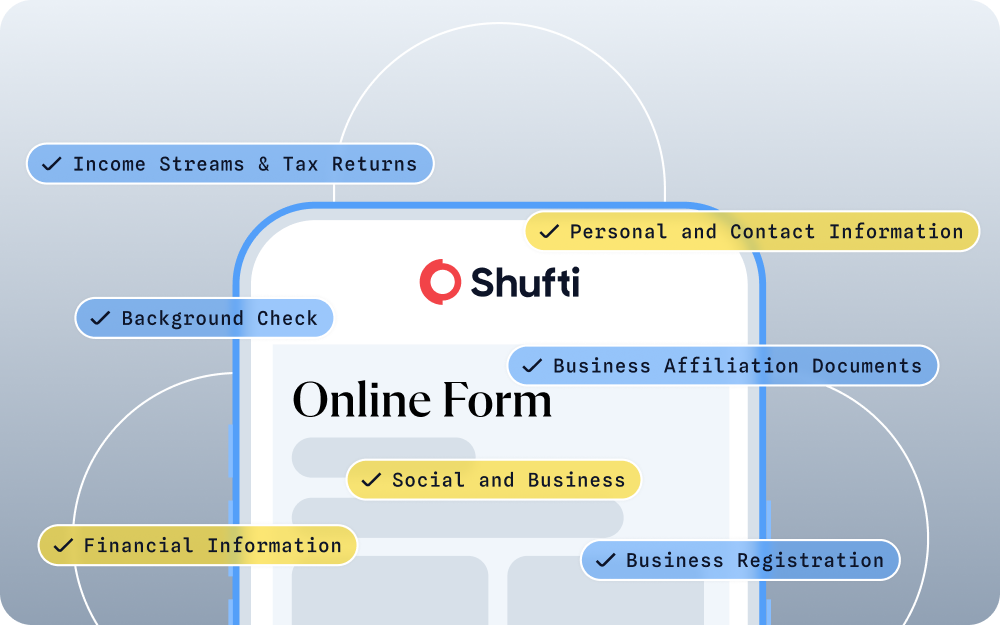

Shufti’s due diligence forms allow you to collect user data with predefined or custom industry models to ensure regulatory compliance.

- As part of the verification process, we make it easy to verify a user’s age to Identify minors and restrict their access to protect your business from non-compliance fines.

- Shufti also extracts address information from multiple documents with sophisticated OCR technology to ensure the accuracy of all provided addresses.

Shufti rapidly evaluates user identities for any associated risks using our AI-driven platform. Our reach spans over 240 countries and territories and 150+ languages.

- This ensures global verification that checks applicants against 1700+ global watchlists to mitigate fraud.

- Shufti also perform continuous AML screening against global lists, watchlists, PEP lists, and adverse media databases to uphold multiple regulatory standards.

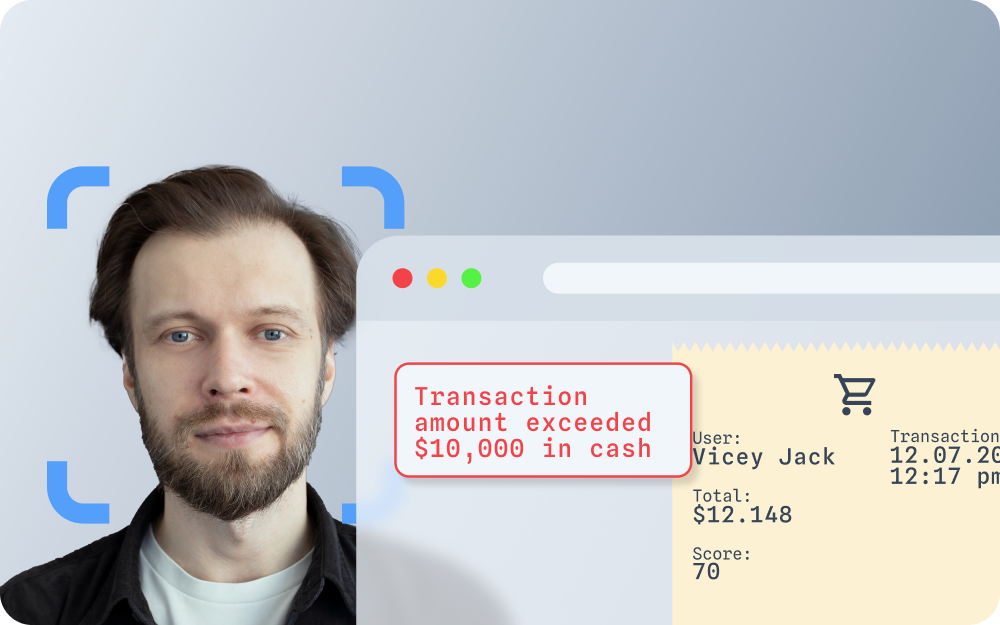

Shufti employs AI-enhanced device fingerprinting, behavior biometrics and fraud prevention technology to identify devices in real-time.

- Transaction screening ensures your users do not send money to risky senders in certain jurisdictions and localities.

- Customer accounts are also protected with an additional layer of data (such as a unique device ID) to validate the identities.

Shufti’s case management centralizes all verification data, enabling compliance teams to review, track, and resolve KYC cases seamlessly.

- Streamlines investigations with unified case histories and audit-ready records.

- Improves decision-making by flagging high-risk cases for deeper review so businesses do not have to juggle between multiple, individual processes.

Shufti’s ongoing monitoring continuously screens customers against updated watchlists, ensuring businesses stay compliant and detect risks in real time.

- Automates re-screening to catch new sanctions, PEPs, or adverse media.

- Reduces compliance gaps by alerting teams to emerging risks instantly.

Where others fall short, Shufti delivers: 4 Gaps it fills perfectly

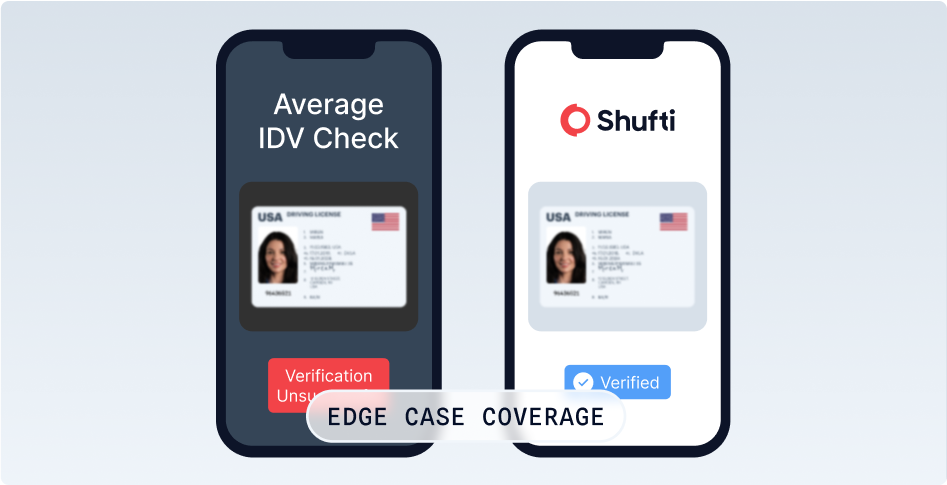

Blurry docs break their flow, not ours. Shufti excels at edge case verification

Most verification systems stall on low-quality uploads or complex edge cases. Shufti’s AI is trained to handle real-world imperfections without any delays or escalations- just smooth verification.

- Advanced and purpose-built OCR that allows for holistic analysis of data from IDV documents

- Auto-enhancement of low-quality images for accurate extraction of data from blurred, aged or cropped documents.

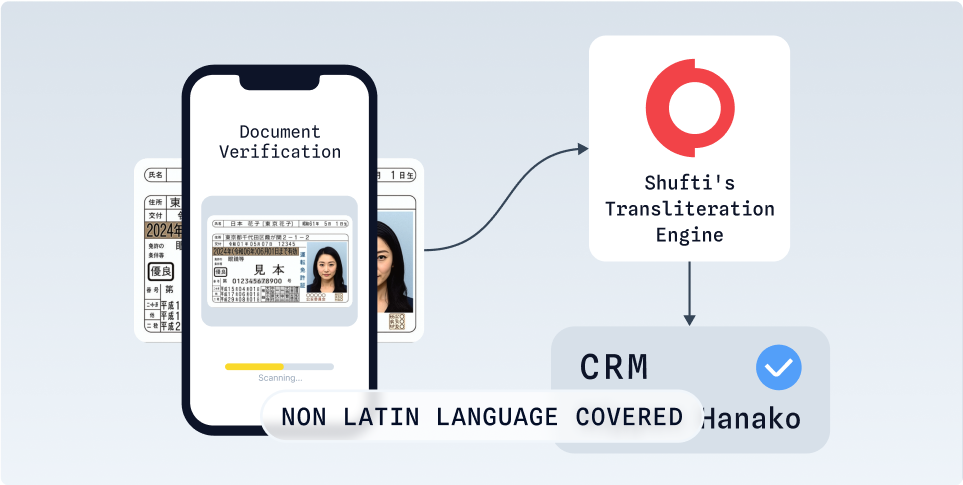

Non-Latin scripts confuse them, Shufti’s built for it

Most verification systems are built with a Latin-first bias, failing to accurately process scripts like Arabic, Hindi, Cyrillic, Chinese, and more. Shufti supports 150+ languages and regional formats with native precision

- Uses advanced script-recognition tool to identify characters across diverse languages thus ensuring worldwide document coverage.

- Culturally aware verification logic and AI trained on localized documents helps reduce false negatives.

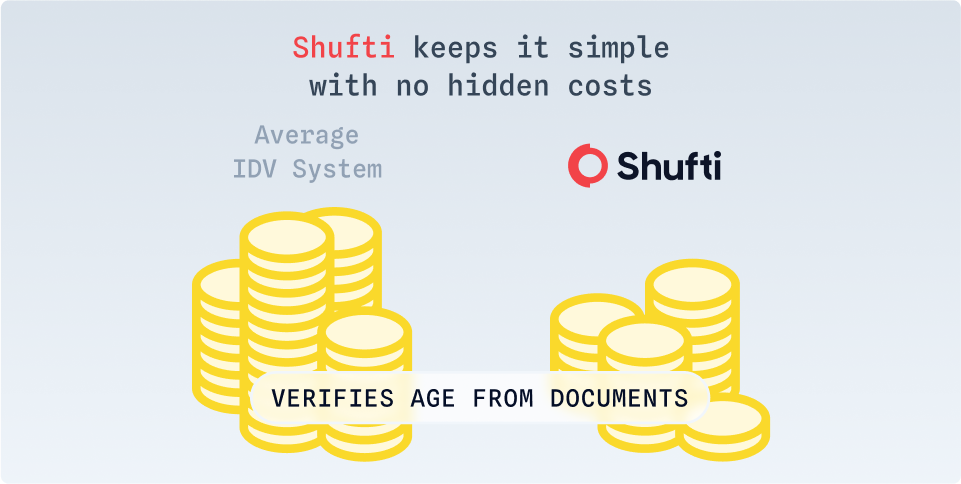

Hidden fees turn compliance into a pricing trap, but Shufti keeps it simple with no hidden costs

Many vendors hike prices for non-Latin language support, high-risk jurisdictions, or advanced features, turning compliance into a difficult tradeoffs for business. Shufti keeps it simple with flat, transparent pricing across all use cases.

- Full access to global language and region coverage at no extra cost. No surprise charges for complex cases or edge-risk profiles.

- All features, all industries — one clear price, no forced upgrades.

Benefits of Shufti’s Journey Builder

A revolutionary concept to streamline your compliance needs.

No code and easy setup

Drag-and-drop interface eliminates technical barriers, reducing setup time and costs.

Customizable workflows

Tailors your verification journeys based on user segments, regions and risk appetite of your business.

Seamless scalability

Modifies your workflows in real-time, adds new verification steps and expands without downtime.

Regulatory compliance

Supports more than 240 countries and jurisdictions with diverse ID verification, AML screening and fraud prevention tools.

A KYC solution to build digital trust through strong customer identification and AML risk controls

Partnership programShufti’s KYC software made for all age groups, from Gen Z to Millennials to Boomers

Shufti offering all-in-one verification & risk management tool

Remote identity verification process for enhanced security.

Electronic identity verification via government databases.

Shufti’s proprietary tech for address verification.

Accurate facial biometrics for identity confirmation.

Comprehensive AML risk assessment for compliance.

Real-time transaction monitoring for fraud prevention.

Frequently Asked Questions

What is KYC verification?

KYC verification is the process of confirming a customer’s identity to prevent fraud and meet compliance regulations. Shufti makes this seamless by verifying documents, biometrics, and assessing the risk of an individual continously. This ensures businesses know exactly who they’re working with.

Which KYC verification services do Shufti provide?

Shufti offers document verification, face verification, eIDV, address verification, AML screening, and ongoing monitoring. These services cover the full spectrum of compliance needs. Businesses can mix and match for a tailored KYC flow. Additionally, Shufti also offers FastID for instant verification across closed-loop ecosystems.

What does KYC software do?

KYC software automates identity verification, reducing manual checks and errors. With Shufti, it screens identities in real time against global databases. This helps businesses onboard customers faster while staying compliant. Additionally, through video kyc, Shufti ensures quick onboarding of your customers.

How can a business choose the right KYC provider?

The right KYC provider should offer accuracy, global coverage, easy integration, and regulatory compliance. Shufti ticks all these boxes with flexible APIs and strong fraud detection that helps detect deepfakes and spoofing. Businesses also benefit from 24/7 support, something that Shufti offers to all its customers.

What factors affect the cost of KYC compliance?

Costs vary based on volume of verifications, level of assurance needed, and compliance complexity. Shufti helps optimize costs with scalable pricing. This way, businesses only pay for what they use. However, compared to other vendors that charge extra for non-latin documents, Shufti has no hidden charges.

Can your KYC services handle complex compliance needs?

Yes. Shufti is designed for high-risk industries like banking, fintech, and iGaming where regulations are toughest. Its flexible workflows adapt to jurisdictional requirements, making compliance simpler even in complex scenarios.

What are the integration options for KYC solutions?

Shufti offers API integration, SDKs, and ready-to-use plugins for platforms like Shopify, WooCommerce, and eBay. Businesses can go live quickly without heavy development. This makes integration both fast and cost-effective.

INSIDE THE BOARDROOM

What happens when accuracy fails? The Battle inside the Boardroom

Your KYC provider should clearly answer seven critical questions because every

false acceptance invites risk, and every false rejection pushes a trusted customer away.

The boardroom isn’t debating features or policies but weighing fraud losses against customer drop-off, speed

against security, and fighting to restore balance between risk and reliability. Will they reach a decision?

Take the next steps to better security.

Contact us

Get in touch with our experts. We'll help you find the perfect solution for your compliance and security needs.

Contact us