All You Need To Know About KYC Compliance

With evolving global KYC regulations, the biggest concern of businesses is to streamline their compliance processes with customer onboarding. Online KYC screening solutions address multiple concerns of executives planning to implement KYC compliance in their organization.

Becoming KYC compliant requires extensive research. Below is a detailed guide on KYC for businesses around the world.

What is KYC?

The scope of KYC is not limited to the verification of the clients only. Businesses around the globe practice it to verify their merchants, agents, partners, employees, etc. with the change in purpose, it also changes the name of this process and it becomes, Know your Merchant (KYM), Know Your Business (KYB), or Know Your Employee (KYE). But KYC is the most common, and one compact process can be designed to verify the customers, employees, merchants, etc of a business.

History of KYC

Businesses, especially the financial sector have adopted KYC way before other sectors due to high financial risk associated with their operations. In the past, KYC regulations were only imposed on the financial sector but with the evolution of the financial sector and the advent of FinTech expanded the scope of KYC regulations.

BSA and Advent of KYC in Financial Sector

KYC started when the U.S. introduced the Banking Secrecy Act (BSA) in 1970. This act was developed to control drug trafficking by keeping an eye on black money transactions. Subsequent AML regulations were developed on the basis of BSA in 2001 in the form of the USA Patriot Act which was implemented in 2003.

After that many other regulatory authorities introduced KYC and AML Regulations on regional and international levels.

Evolution of KYC

With an increase in money laundering and terrorist financing, the regulatory authorities are always in a bid to enhance the regulatory framework. The KYC regulations of BSA were globally acclaimed and many states implemented those regulations or developed their own regulations accordingly.

With the break of Panama Papers, the global regulatory authorities amended the KYC regulations to curb money laundering. For instance, FinCEN (U.S regulatory authority) amended the KYC regulations and expanded the scope of customer verification in 2016. Because there were loopholes in the KYC protocols of financial institutions. Shell companies were used by the criminals to wash their black money by manipulating the business proceeds of those businesses.

Since 2016, KYC is also addressed as KYB (Know Your Business). Global regulatory authorities now demand the financial institutions to verify the Ultimate Beneficial Owners (OBO) of the businesses that they serve as clients.

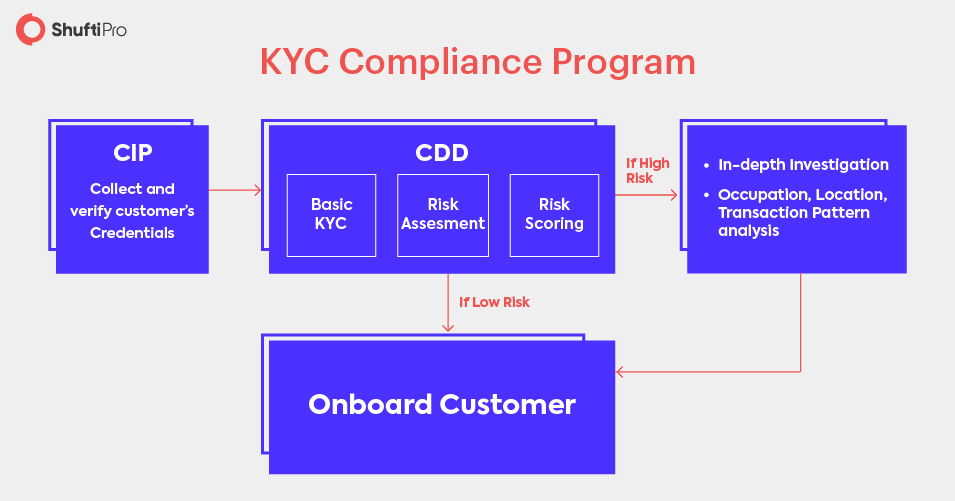

KYC Compliance Program

KYC compliance is not just a one-time practice. It is a thorough verification process that starts with developing a Customer Identification Program (CIP). Then it comes to accessing the risk associated with each client. In the case of a low-risk client, basic KYC is enough but if the customer has a high-risk profile then Enhanced KYC is applied to that customer.

Customer Identification Programs (CIP)

Customer Identification Program is the first step in KYC compliance. It consists of the requirements of regulatory authorities that apply to your business model or industry. CIP protocols are the same in most of the regions in the world. For instance, in the USA the CIP requires that every financial transaction must be verified through an in-depth identity verification of the person making the transaction.

The CIP includes the risk assessment of the individual and business accounts of the financial institutions. The financial institutions are required to define their risk appetite. Once it’s set, the businesses and financial institutions are required to assign a risk rating to each of their clients. It helps them define risk measures for clients falling under different risk brackets. KYC procedures are defined uniquely for complete risk prevention in all those risk brackets. This is the point where the financial institution or the business decides the procedure of Customer Due Diligence (CDD) and Enhanced Due Diligence(EDD).

CIP also includes the collection of customer information and the verification of this information. Once completed the customer is assigned a risk rating and CDD or EDD is performed on that customer based on risk rating.

Customer Due Diligence (CDD)

Customer due diligence is the process of processing the customer’s information for KYC screening. It is the second step in KYC compliance. In this step, the basic information of the customer is collected in real-time or in some cases manually.

The information collected for customer due diligence is as follows:

- Name

- Address

- Age

- Date of birth, etc.

This information is used to verify the identity of the customer. The customer is assigned a risk rating as per his credentials. The risk rating of the customer is decided on the basis of the customer’s country, financial credibility, and the AML screening of the customer. In case a customer is found to be related to someone in the PEP or sanction list than the risk is considered high and Enhanced Due diligence is practiced on such clients.

Enhanced Due Diligence (EDD)

In case of a high-risk customer, the financial institutions and businesses perform more strict KYC and AML screening, which is called Enhanced Due Diligence (EDD). Enhanced due diligence includes an in-depth investigation of customer’s identity, financial status, income, etc.

Commonly enhanced due diligence includes collecting information about:

- Customer’s business/occupation

- Transactions pattern and any unusual transaction

- Location, etc.

These EDD measures are designed by businesses as per their risk appetite. It is partially based on regulations and compliance protocols.

Who Needs KYC Compliance?

As per the regulations of global regulatory authorities. The companies around the world are required to perform in-depth identity verification on their customers to eliminate financial crime at an organizational and international level.

As per the global regimes on KYC and AML, the following are major businesses and industries that are liable for KYC and AML compliance.

- Banks and all their subsidiaries

- Insurance companies

- Brokerage houses

- Businesses in FinTech, online payment solutions, money transmitters, etc.

- Virtual currency businesses

- E-commerce

- Dealers of precious metals

- Legal Sector

- Forex exchanges

- Real estate sector

- Non-bank mortgage lenders

- Casinos and online gaming

- Real estate sector

- Non-bank mortgage lenders

Regulatory Authorities Around the Globe for KYC and AML

The major regulatory authorities that develop, recommend and implement KYC and AML compliance regimes around the globe are as follows:

FATF (Financial Action Task Force) is a global authority that collects and analyzes money laundering and terrorist financing data from the globe and gives regulatory recommendations based on its findings. It has 190 member countries.

FinCEN (Financial Crimes Enforcement Network) is a bureau of the USA treasury department that collects the financial transactions data and uses it for financial crime mitigation and international level.

FINTRAC (Financial Transactions and Report Analysis Center) is a regulatory authority in Canada, that collects and analyzes the financial crime data and works on the thorough implementation of KYC and AML rules in Canada.

FINMA is a swiss financial regulatory authority that supervises banks, insurance companies, stock exchanges, etc. The authority is responsible for the thorough implementation of Swiss KYC and AML regulations in the institutions liable for regulatory compliance.

Europol is a European Union authority that works on anti-money laundering and mitigation of financial crimes like terrorist financing.

Global KYC and AML Regulations

The regulatory authorities around the globe are different in many countries, and there are some global watch dogs as well to bring the countries on one page for counter criminal activities. Most countries have their own regulatory authorities for designing and implementing KYC and AML regulations. But all the regulations have a few things in common, which are minimum requirements of KYC/AML compliance. Global and local businesses need to comply with those regulations at minimum to prevent non-compliance penalties.

Below are major KYC and AML regulations practiced in major states in the world like the USA, UK, Canada, China, etc. These regulations are practiced in other states as well with some variations.

- The reporting entities are required to screen the identity of their clients before starting any relationship with them.

- KYC and AML screening must be performed regularly on all customers.

- Customers should be given risk rating and necessary measures of additional screening should be practiced to cater to excessive risk.

- A proper record of KYC and AML screening must be maintained.

- Transactions (local/international) above the minimum transaction threshold must be reported to the concerned authorities.

- Penalties are charged in case of non-compliance.

- For AML screening, the clients must be screened against international sanction lists, terrorist lists, PEPs lists, etc.

- Some countries require the reporting entities to maintain an AML department and to hire AML officers as well for thorough compliance.

- Due to global risk, businesses are required to develop some sort of global risk cover. Like KYC/AML screening software that could verify people from every corner of the world.

Major updates in Global KYC/AML Laws

Amendments in Canada’s PCMLTFA rules

Canada also changed its KYC and AML regimes to collaborate with the global regulations of FATF. It amended its PCMLTFA rules. FinTRAC, the independent regulatory body in Canada, will be responsible for the thorough implementation of these rules. Digital KYC will be possible as scanned copies of documents can be used for KYC verification of the customers. Money service businesses and virtual currency businesses will be added to reporting entities and they will have to follow KYC and AML regulations just like the typical fiat currency businesses.

The USA expanding its Counter-Terrorism Powers

The USA also changed its KYC rules to cater to increasing money laundering and terrorist financing. It expanded its counter-terrorism powers and now targets the international financial institutions around the world that aid the terrorist groups working in the U.S. Also it added three Korean groups, namely, Bluenoroff, Lazarus Group, and Andriel into sanctions lists. These groups were involved in the global cyber attacks on financial institutions.

UK MLA Amendments

The UK also amended its KYC and AML regulations and expanded the scope to an international level. The Money laundering Act (MLA-2017) of the UK was amended. The UK-based businesses will practice the MLA rules in their international affiliates operating in non-EEA states.

The EU 5AMLD and 6AMLD

The EU implemented its Fifth Anti Money Laundering Directive (5AMLD) in 2018-19. 5AMLD reduced the transaction and deposit limit on the prepaid cards. If the card holder will deposit or make a transaction of above EUR 150 the prepaid card provider will have to run KYC and AML on its customers. This limit is EUR 50 for online transactions.

6AMLD is an extended effort to harmonize AML/CFT regulations in the EU region. 22 predicate offences are provided in the official journal of 6AMLD and the new regulations are pushing reporting entities to go the extra mile in their effort to prevent financial crime in their authority area.

FINMA gave banking certificates to Crypto Banks

FINMA and Swiss regulatory authority issued banking certificates to pure-play cryptocurrency banks. Tight KYC and AML regulations are imposed on these banks.

FATF recommendations for Crypto, legal and precious metal dealers

FATF also gave some recommendations in June 2019. As per the recommendations, the member states are required to implement KYC and AML regulations on virtual currency and legal sector. These businesses will be required to follow the same regulations as financial institutions.

The above discussion shows that fraud and financial crime is a global threat that affects not only the businesses but also the economies. The rise of internet and FinTech created loopholes in the previously prevailing KYC and AML laws. Even if a business is a victim of a phishing scam it will have to bear some sort of financial loss in the form of penalties, profit loss, recovery expenses, etc.

Hence the reason why regulatory authorities around the globe are joining forces against money launderers, terrorist financiers, cybercriminals and identity thieves.

So, the businesses are obliged to exercise KYC and AML compliance for several reasons. KYC and AML compliance help businesses in multiple ways.

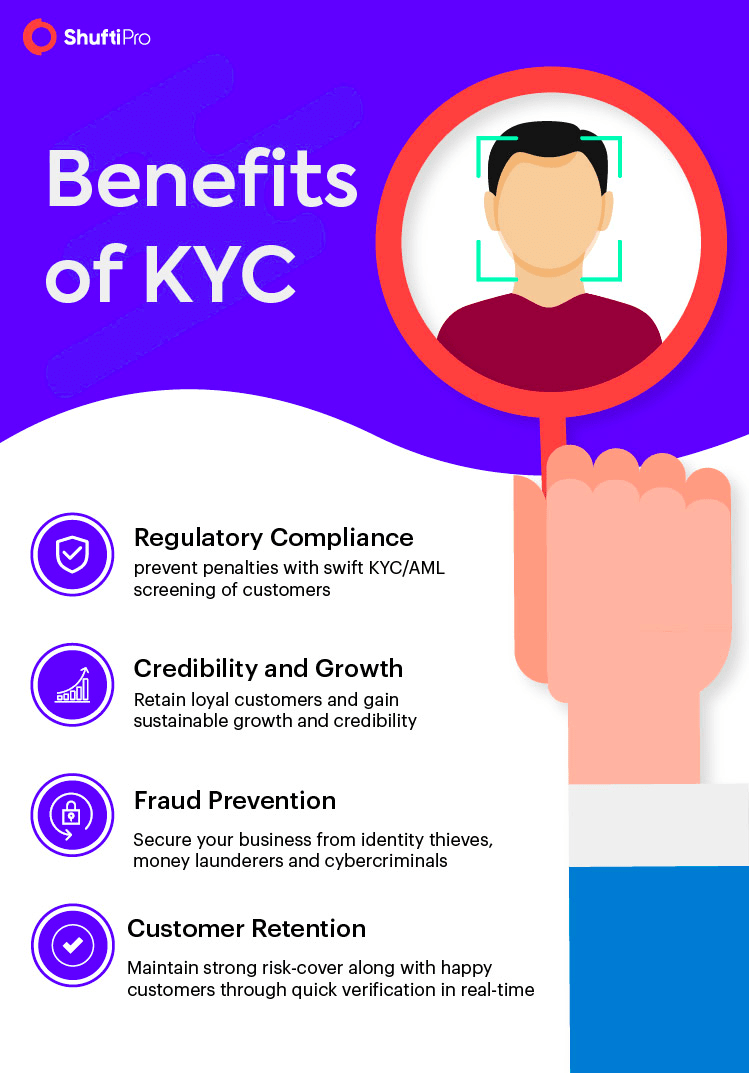

Benefits of KYC and AML Compliance

1- Fraud Prevention

One of the major reasons why businesses perform KYC screening on their customers is fraud prevention and risk prevention. Fake or stolen identities are used by fraudsters to conduct their illegal activities anonymously. Mostly the victim businesses and institutions are targeted for financial gain.

Some common frauds with businesses are account takeover fraud, money laundering, terrorist financing, phishing scams, etc.

KYC and AML compliance help businesses with effective risk management. Once the risk is identified, KYC verification helps in seamless and thorough implementation of fraud prevention measures. Because designing risk prevention strategies is the first step, KYC and AML screening helps in reaping the benefits of such strategies.

2- Regulatory Compliance

As mentioned above most of the businesses around the globe are liable for KYC and AML compliance. KYC and AML are not limited to developed and prosperous countries. Global regulatory authorities are expanding the scope of KYC and AML regulations to eliminate money laundering at a global level.

For instance, recently FATF, a global regulatory authority included new members in its member states. The newly added countries are not developed countries but are the ones with a high rate of financial crime. Other than that most of the countries have their own KYC and AML regulations and regulatory authorities for their thorough compliance. Some major authorities are mentioned above.

Regulatory authorities have the right to charge high penalties to the reporting entities in case of non-compliance. KYC and AML compliance practices help businesses in preventing any such penalties.

3- Secure Customer On-boarding and Customer Retention

Going KYC compliant helps businesses in developing a secure customer base. Screening the clients before onboarding shows its commitment towards securing the interest of all the stakeholders.

The research in 2018, found that 66% of the customers feel more secure on online platforms that use security protocols. Performing KYC and AML screening on clients gives a positive message to the customers that you have them covered against fraudsters. Showing your security concern through visible security protocols helps in retaining clients. The same research found that a lack of visible security is the major reason why clients abandon an online transaction, globally.

4- Credibility and Growth

KYC and AML compliance help organizations in gaining credibility and market value. Compliance with regulations help in gaining global acknowledgment, and market share. On the other hand, non-compliance with KYC regulations will leave loopholes for fraudsters that will be exploited by the fraudsters.

In case of non-compliance businesses not only face profit loss they also lose their credit rating in some cases. For example, one of the Swedish banks involved in a money-laundering scandal in 2019 lost its credit rating and market value.

So, KYC compliance helps in gaining retainable growth as KYC verification helps in onboarding only legitimate clients. Also, customers stay for a long time if the business offers good security protocols. So, it helps the business to retain and grow its market value and credit rating.

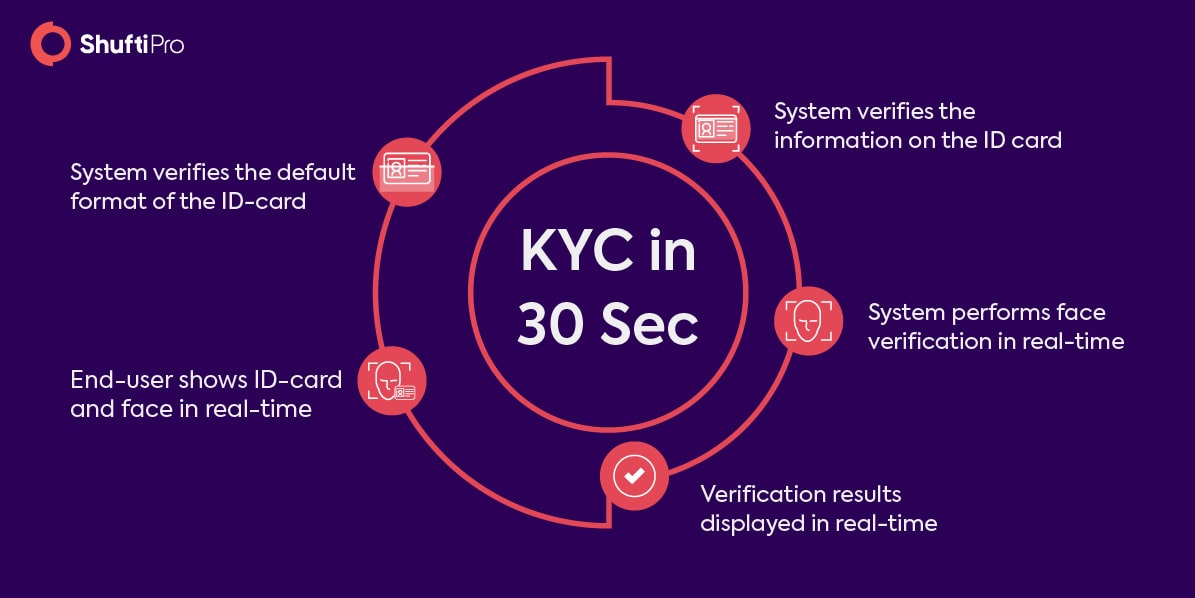

5- Real-Time KYC: An All-In-One Solution

Real-time KYC is when the customers are verified in real-time through the internet. In real-time KYC and AML screening, the customers are verified within a minute without using any physical document verification.

Identity verification is done through face verification, ID card verification, document verification, 2-factor authentication, etc. AML screening is also conducted along with KYC screening by verifying the information of the end-user with global watchlists, sanction lists, and PEPs lists, etc. So, it helps the businesses in eliminating a huge risk within a minute.

Benefits of Real-Time KYC and AML Screening

1- Cost-effective

Also, Shufti gives 7 days of free trial to help you make a better decision for your business.

Real-time identity verification and KYC/AML screening solution can be customized according to your compliance budget. On average Shufti offers a 20% low cost as compared to the market rate. Also, real-time verification is less costly as compared to manual verification. No need to hire extra employees or building new infrastructure to accommodate huge compliance department.

2- Frictionless Procedure

Real-time identity verification can be performed within 30 seconds. So it helps in attaining a frictionless KYC and AML compliance.

It helps the businesses in KYC and AML compliance as the whole process of KYC and AML screening is swift and effortless, from the API integration to the verification of the end-user. The end-users will not have to change several windows or webpages for verification.

3- Accuracy

A real-time identity verification solution provides high precision in results. Although the verification process is completed within a minute but it does not affect the verification results. Shufti delivers a 98.67% precision rate in its identity roofing results.

4- Global Coverage

KYC and AML screening done through AI-based solutions deliver global coverage in risk prevention. The software verifies the information with global databases and screens the information written in all major languages used in Identity documents.

5- Hassle-Free

KYC and AML compliance is a global phenomenon, businesses need a compact KYC and AML screening solution to comply with global regulations. Developing an in-house KYC/AML screening solution is not suitable because it is a huge investment. It requires top-notch resources and global coverage for thorough compliance. Hence the reason why most of the businesses around the globe, especially those with a global clientele are using outsourced KYC/AML compliance solutions.

API integration is very easy and swift. All major programming languages are supported and integration can be done with a website and online portal or an app. So, outsourcing proves to be feasible for businesses in all aspects.

Process of Real-Time KYC

First of all you will design your KYC/AML screening solution as per your budget and adds the services that you wish to receive as part of your KYC or AML screening solution. Then comes the integration of your business platform (website, app, online portal) with that of Shufti’s system through API integration. On completion of the integration, the verification process starts. Either the new customers are verified or the previous ones are also verified through batch screening.

For verification, the customer enters the data, and shows its ID card along with its face. So the verification is performed in real-time. After verification the results are shown on the screen and updated in the back office provided to the customer.

Explore Now

Explore Now