AMLD5 Amendments in Prepaid Cards Transaction Threshold

In July 2018, the European Commission came into effect the 5th Anti-Money Laundering Directive (AMLD5). In the past couple of years, a series of money laundering cases and tremendous terrorist financing attacks were noticed. Not only this, a string of involvement of Politically Exposed Persons (PEPs) and high-profile individuals induce pressure on the Commission for policy reforms. 5th latest money laundering directive focuses primarily on centralized agencies and beneficial owners, legitimate online businesses connected directly or indirectly with the local regime.

Typically, money laundering involves unauthorized shell companies that have no evidence instead of a piece of paper, which is used to transform the embezzle funds into ostensibly legal ones. The directive ensures the credibility of papers that are misappropriated and hidden from public scrutiny. The data on these papers should be examined and verified keeping AMLD in place. According to the Head of Compliance Christopher Baines:

“The directive is definitely a step in the right decision, it reduces the number of options of criminals.”

Major Amendments in EU’s Fifth Anti-Money Laundering Directive:

In the Official Journal of the European Union, Fifth AML Directive depicts the guidelines to reduce the ventures of money laundering activities. It is in the response of terrorist financing and offshores leaks in Panama Papers that are imposing stringent checks and compliance adoption. In the recent AML regime, below are the 4 key amendments:

- It is mandatory for the member states to make sure that registers of beneficial owners of legal companies and entities are accessible to the public. These registers do not include the owners of trust as it needs an extra illustration of legitimate interests. The lists should be up-to-date indicating the comprehensive functions for identification purposes of natural or legal persons

- AML Directive (AMLD5) is extended to electronic wallet providers, art dealers, virtual currency exchanges, etc. Also, further specifications are demonstrated for tax advisors and real estate agents

- The threshold for prepaid cards holders is lowered to €150

- Member States are supposed to implement serious measures that fulfill the demand for enhanced due diligence to monitor the high-risk suspicious transactions. Electronic identification should be done to regulate and recognize the entities efficiently

After the Fifth AML Directive on 9 July 2018, EU Member States got the deadline of 10 January 2020 (about 18 months) to make sure its implementation into national law.

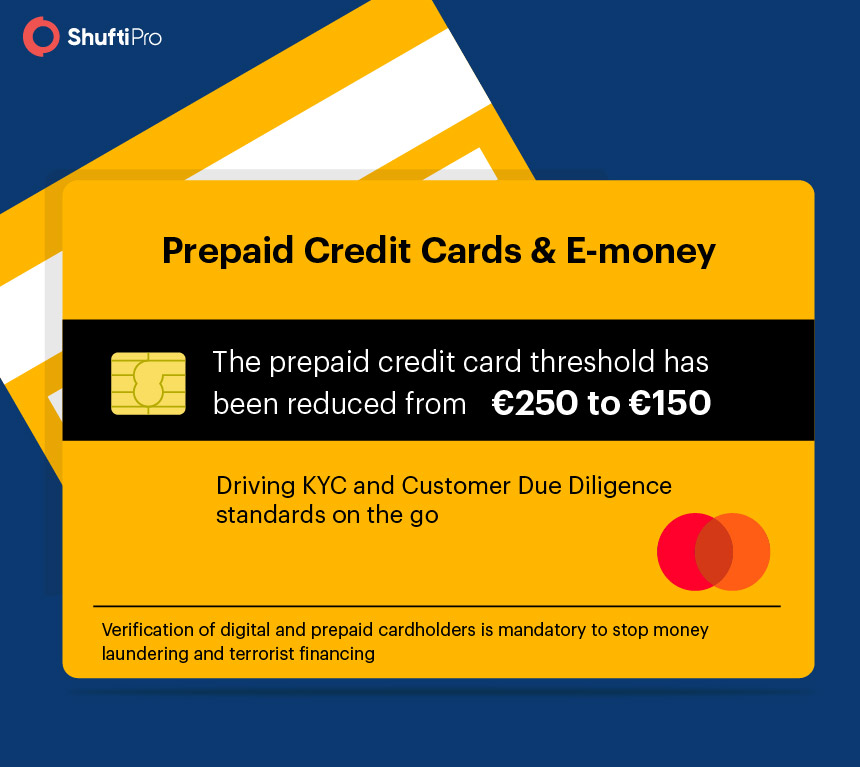

Lowered Threshold of Prepaid Credit Cards & E-money

The purpose of the Fifth AML Directive is to reduce the transactions from anonymous prepaid cards. The threshold for identifying prepaid cardholders is reduced to EUR 150 from EUR 250. This requirement neither applies to the redemption or withdrawal of cash nor applies to remote payment transactions where the amount exceeds €50 per transaction. The prepaid cards that are issued in third countries will be acceptable only if the insurance requirements meet the guidelines of the EU AML regime.

This new directive focuses on digital currencies and prepaid cards. The maximum amount that can be placed in prepaid cards has drastically reduced. The banks and financial institutions are supposed to conduct an investigation against the prepaid cardholder if a value of over EUR 150 is placed. Also, the amount of EUR 150 is for both the amount to keep in prepaid card and the transaction amount on a monthly basis. Electronic identification needs to be performed to verify the prepaid card credit. Prepaid cards that are issued outside the territory of the EU will be prohibited unless it lies under the regimes equivalent to AMLD5.

Similarly, cryptocurrencies and digital wallets are under the hood of the AML regime that ensures standards contributing to curb money laundering, the money trail, and terrorist financing. AMLD5 is going to deploy at the start of 2020, enforcing legal beneficial owners to take identification measures for authentication of prepaid cards threshold to make sure that any cardholder identity does not place credit more than the amount specified by the directive.

Explore Now

Explore Now