The easiest way to verify real users, without drop-offs

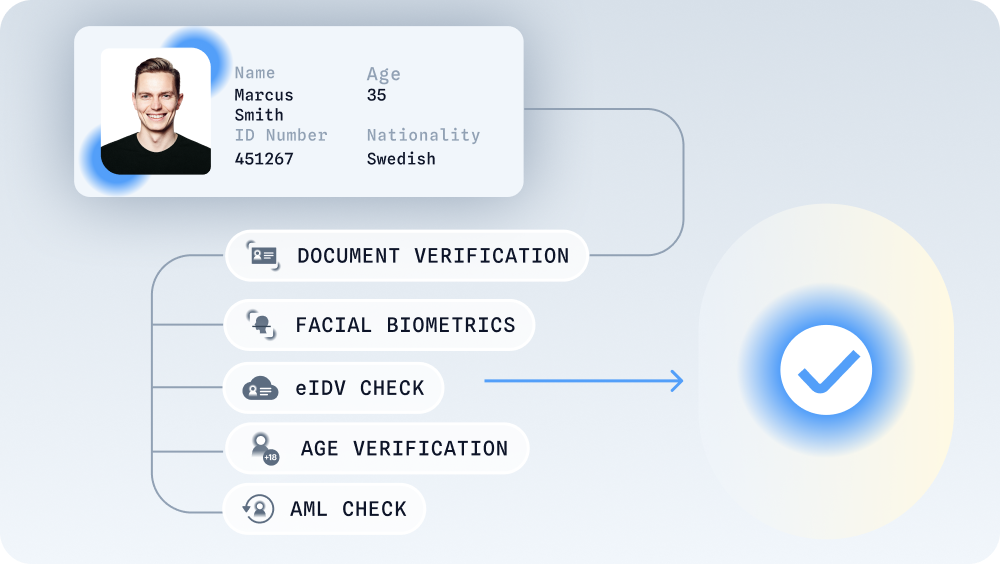

From verifying names and addresses to confirming age and detecting synthetic IDs, Shufti’s eIDV solution automatically checks what matters, without adding complex steps for your users.

Robust IDV with cross-data matching

Seamless address verification with a doc-free process

Quick ID validation via national database checks

Frictionless age verification without identity document upload

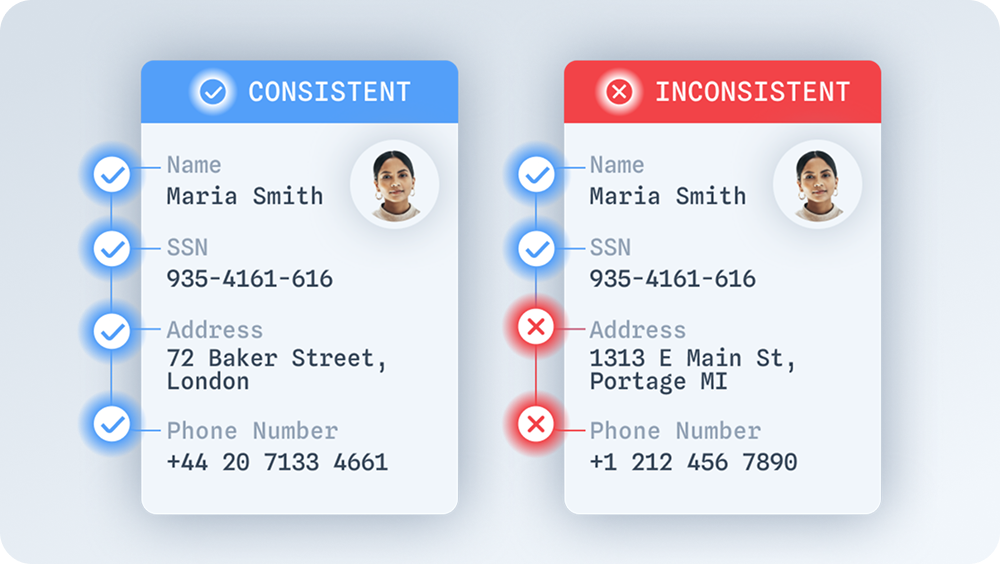

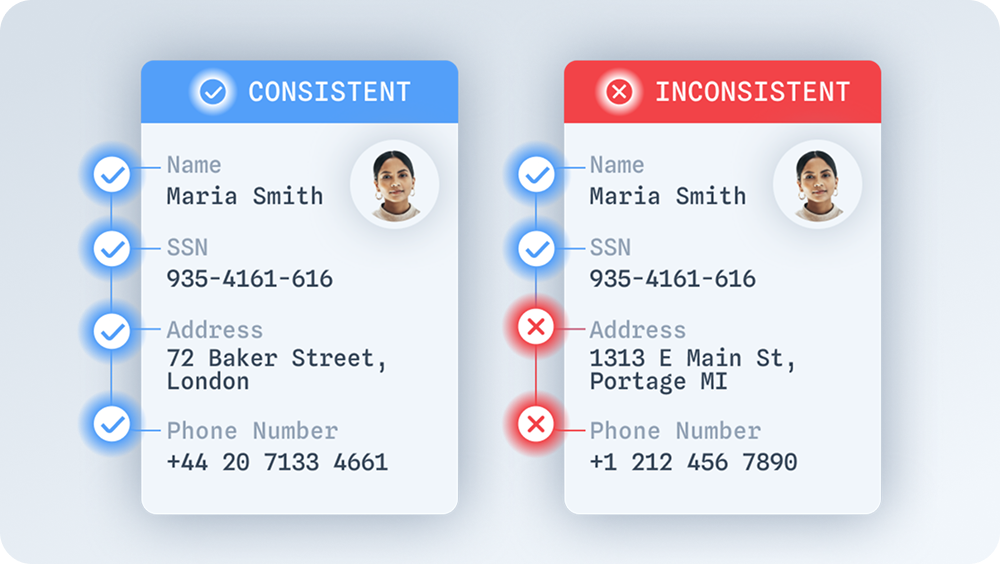

One source alone can't verify real identity.

- Cross-checks name, ID, phone number, and addresses in multiple databases

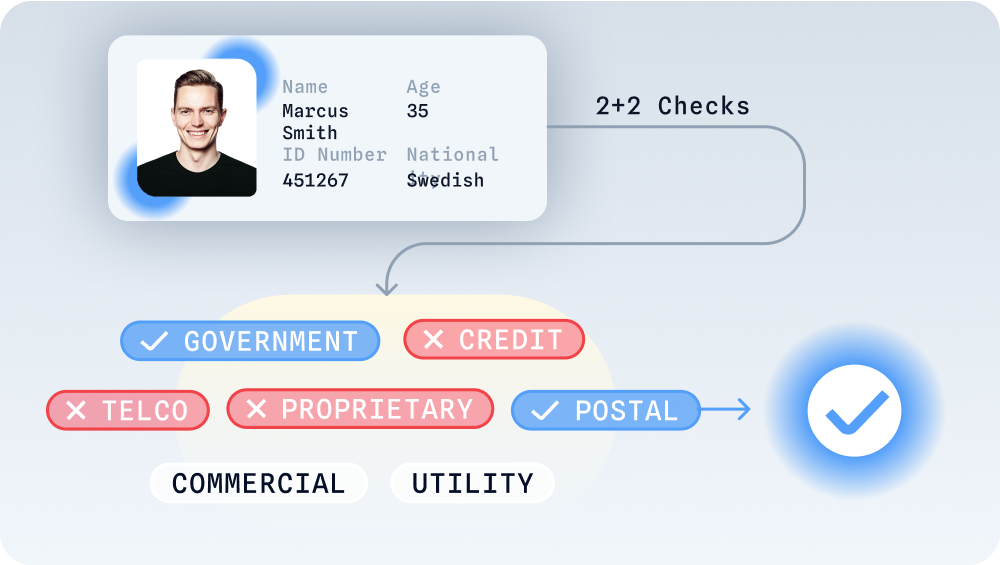

- Take a risk-based approach through Uses layered 1+1 or 2+2 verification logic

- Flags mismatches instantly to reduce false positives and manual reviews

One source alone can't verify real identity.

- Cross-checks name, ID, phone number, and addresses in multiple databases

- Take a risk-based approach through Uses layered 1+1 or 2+2 verification logic

- Flags mismatches instantly to reduce false positives and manual reviews

Seamless onboarding, without hunting down address documents.

- Confirms address via multiple sources, including national databases

- Runs passively with minimal user input

- Eliminates manual uploads, reduces friction, and ensures seamless onboarding

The easiest way to verify real users, without drop-offs

- Conduct real-time identity matches via government databases

- Avoid uploading documents or selfies

- Confirm real user presence with built-in liveness check

Smooth age checks — without unnecessary hurdles.

- Instantly check date of birth through trusted sources

- Confirms age eligibility without requesting ID

- Ensure real presence and compliance through liveness detection

Identity verification that adapts to user’s needs — everywhere

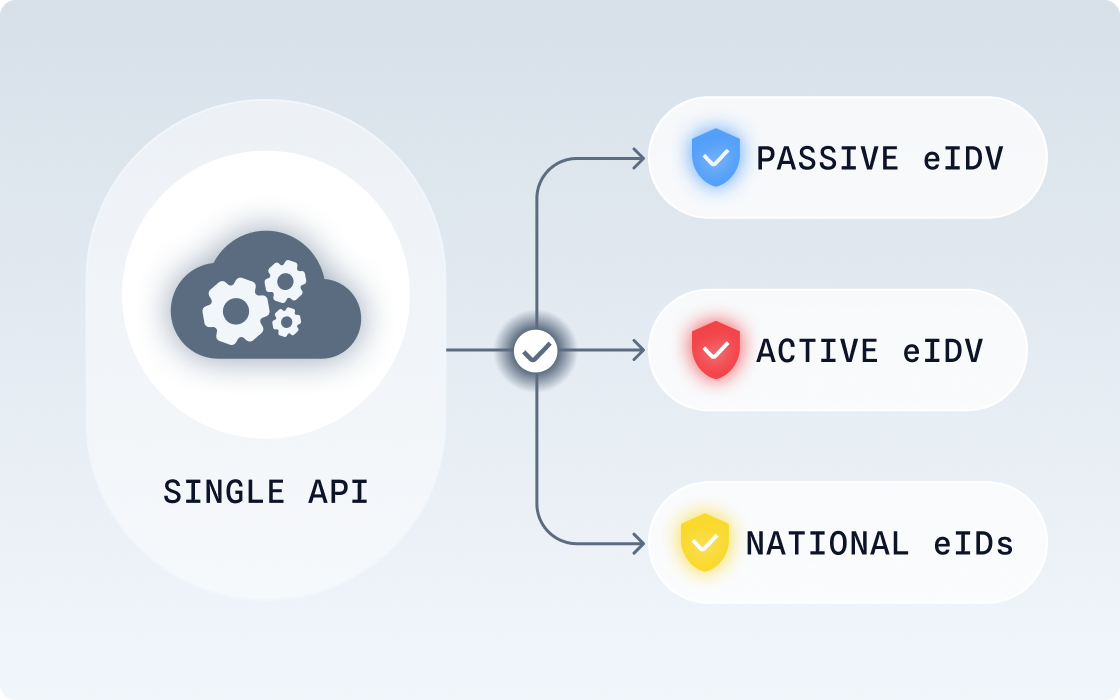

Whether it's doc-free flows or national eID logins, Shufti selects the right method per country. That means one integration, full access, and zero maintenance.

Single API integration for all eIDs

Integrate once to access every eID method across regions — without repeat integrations or ongoing upkeep.

- Works across both passive and active eID flows

- Auto-route users by country and flow

- Cover all maintenance, updates, and protocol changes

- Avoid extra setup as new eIDs are added

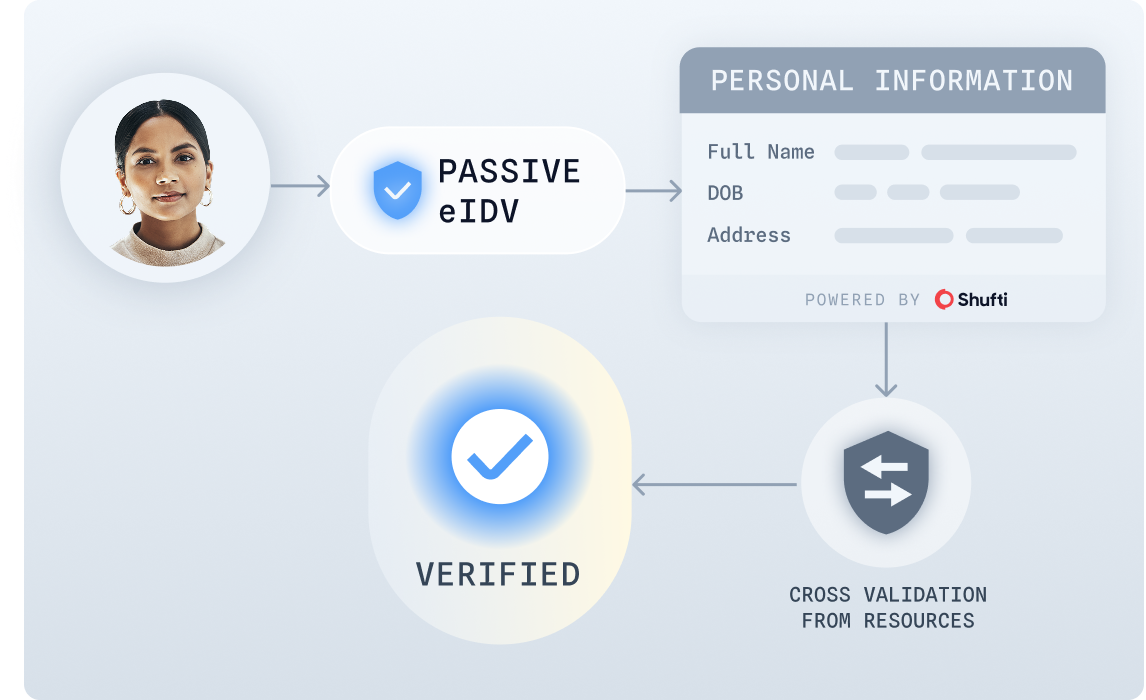

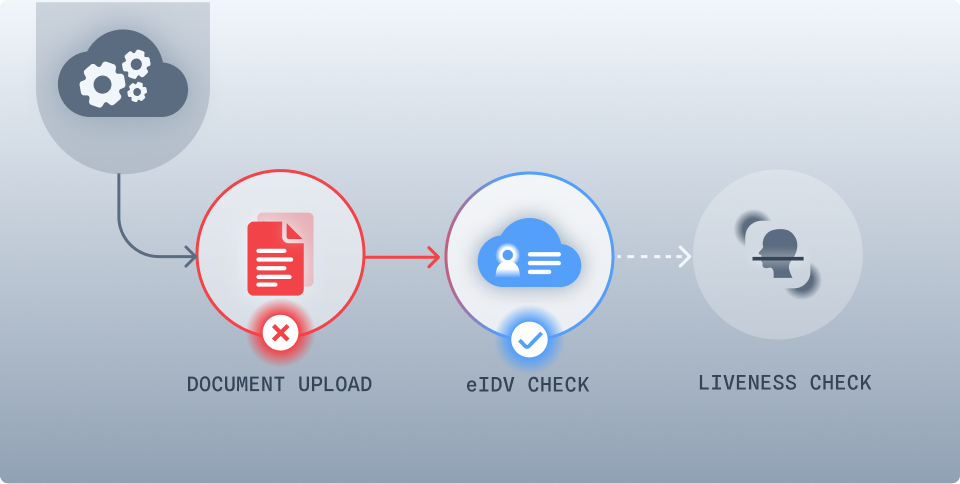

Passive eIDV

Enjoy fast, low-effort identity verification for quick customer onboarding.

- User enters basic information like ID number, name, or date of birth

- Shufti performs a quick liveness check

- Identity is verified instantly — no uploads, redirects, or logins

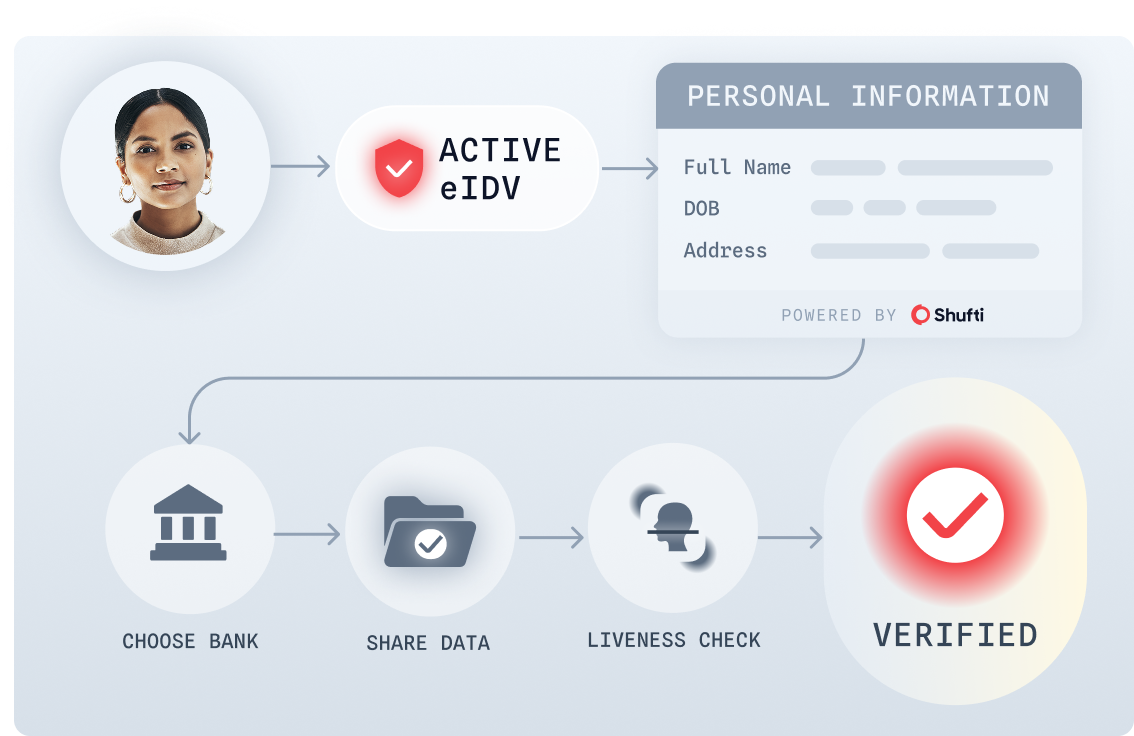

Active eIDV

Experience hassle-free, step-by-step verification through national digital identities.

- User enters name, date of birth, and address

- User is redirected to choose and log in to a provider, such as a bank or national eID portal

- Grants permission to share verified data and completes liveness check

- Shufti pulls real-time official data to complete the verification

Adaptive Electronic ID verification that never hits a dead end

Shufti intelligently selects and switches verification methods to ensure every user gets through, no matter where they are.

Optimized by region

Shufti learns what works best in each country - so your users never hit dead ends.

- Chooses the highest-success-rate method automatically

- Adjusts to regional rules and network conditions

- Avoids retry loops and wasted steps

Seamless failover handling

If a method doesn’t work, Shufti shifts - your users don’t even notice.

- Tries the next method without delay or setup

- Keeps verification moving in the background

- Prevents drop-off, confusion, or manual fallback

KYC compliance for all types of industries

Shufti’s eIDV makes staying KYC compliant simple, secure, and seamless. With real-time checks and global coverage, you can verify identities with confidence while keeping fraud out.

Regulated Industries

Non-Regulated Industries

Banking & Fintech

Mandatory under AML/KYC regulations (e.g., FATF, FinCEN, EU AMLD, RBI, MAS). Required for account opening, transactions, and fraud prevention.

BNPL & E-commerce

If providing credit/loans (BNPL), they fall under KYC/AML. Pure retail e-commerce is usually not legally required, but may still verify for fraud/chargebacks.

Gambling & iGaming

Strictly regulated; operators must prove identity, age, and source of funds under gambling licensing laws (UKGC, MGA, etc.).

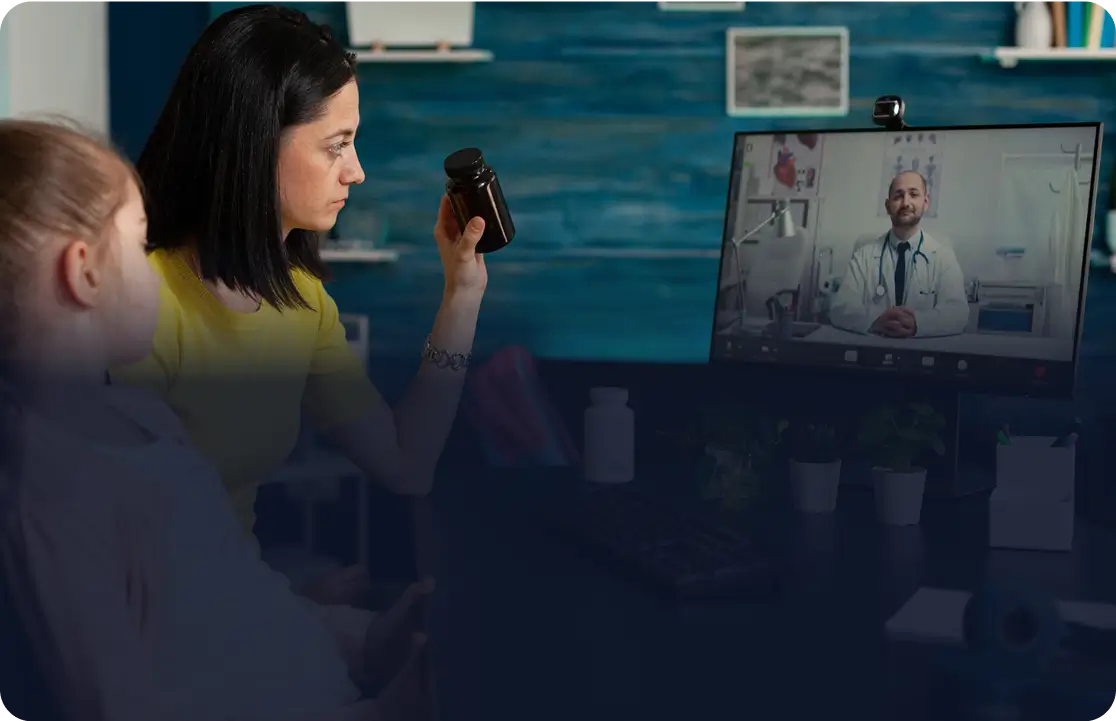

Telehealth

Depending on the region, compliance is mandatory for identity proofing of patients & providers (e.g., HIPAA in the U.S., GDPR in the EU, eIDAS for e-prescriptions)

Real Estate & Title

Regulated in many regions due to high fraud/money laundering risks (e.g., U.S. FinCEN rules, EU AML directives). KYC is legally required for real estate agents, title companies, and notaries.

Gig Economy & Marketplaces

Not mandated, but platforms like Uber, Airbnb, Fiverr use IDV to build trust and reduce risk.

Travel & Hospitality

No strict KYC mandate, but eIDV is adopted for smoother check-in, borderless travel, and fraud prevention

Age-Restricted Retail

Laws require age verification, but not always full AML/KYC. Attribute-based checks (“18+ verified”) are often enough.

Achieving Critical Compliances to Ensure Your Peace of Mind

Related Solutions

Know your Customer (KYC)

Simplify customer onboarding with efficient identity verification, reducing compliance burdens and boosting security across your operations.

Explore

Explore

Fast ID

Eliminate time-consuming document scanning, accelerate customer onboarding, and enhance authentication by using existing verified data.

Explore

Explore

Document Verification

Use advanced data extraction and AI-powered verification to process 10,000+ document types worldwide rapidly.

Explore

Explore

Our platform has you covered

Global Coverage

Break through growth limits thanks to comprehensive reach and accessibility.

Customizable orchestration

Adapt verification workflows to fit seamlessly with your business operations.

All in One SDK

Integrate effortlessly with our versatile toolkit, compatible with various platforms and devices.

Explore the Shufti Global Trust Platform

Unlock your business potential with a verification platform built for worldwide scalability and reliability.

View Platformmore RESOURCES

The 10 Most Difficult Countries for ID Verification

At Shufti, we know that identity verification is only as strong as its weakest region. This report outlines the top 10 countries where verifying government-issued IDs is most challenging - exposing the gaps fraudsters exploit and why localized strategies matter.

Download Report

Experience the power of seamless trust in your business relationships.

Contact us

Connect with our team for expert guidance on enhancing your business verification and compliance strategies.

Contact usRequest demo

Discover how our advanced identification solutions can streamline operations and build stronger relationships with your business partners and customers.

Get started

Explore Now

Explore Now