5 ways, one trusted identity verification solution for diverse business needs

Gone are the days when user identity verification was only done through document or ID verification. Shufti offers multiple ways to verify and authenticate global users with the least amount of friction and highest accuracy.

Facial verification

Accurate, secure facial verification that makes access simple and fraud-free.

- Capture biometric data with 3D liveness detection.

- 100 + face vector mapping to detect deepfakes.

- Prevent spoofing with advanced anti-fraud tools.

FastID

One-time verification combining user and business’s consent for frictionless, quick verification.

- Reduce repetition with reusable identities.

- Enable frictionless transitions between services.

- Maintain higher pass rates by leveraging benefits of being a partner of a closed-loop ecosystems.

Document Verification

AI-powered document checks that go beyond compliance to secure every transaction.

- Streamline text extraction with advanced recursive OCR.

- Detect tampering or deepfake documents with fraud-proof algorithms.

- Customize verification to meet complex enterprise needs.

Electronic identity verification (eIDV)

Seamless, paperless verification through centralized electronic IDs.

- Verify instantly against government databases

- Minimize errors with automated validation

- Cross-reference data with dual-source checks

NFC verification

Efficient, quick and zero-error user verification method that goes hand in hand with traditional IDV methods.

- Capture data through an NFC chip stored in document.

- Available for all countries that offer NFC chips

- Prevent fraud with advanced data extraction

When industry requirements vary, Shufti adapts accordingly to provide tailored ID verification

From fintech, banking and crypto that requires a higher level of authentic assurance of their users to e-commerce and igaming industry that want to ensure least friction and fastest onboarding for their global users, Shufti offers customizable and business-centric options for digital identity verification.

Auto-only mode verification

- 100% AI led decisions

- For businesses prioritizing speed

- Enables rapid onboarding

Standard Hybrid Mode

- AI automation plus human review

- Ensures 98% accuracy

- 60 second max processing time

AI-first verification mode

- Instant AI verification in 15 seconds

- Complex cases sent for manual review

- Real-time decisions in minutes

With Shufti’s identity verification software , you don’t have to accept any tradeoffs

Shufti has always trailblazed the IDV ecosystem. The trends we have shaped, the terms we have coined, and the innovation boundaries we have pushed to build an identity solution with convenience, coverage, and compliance at its core. While most solutions optimize a ‘single’ metric at the expense of other building blocks, Shufti has taken this challenge head-on to optimize the entire spectrum of KYC compliance value chain.

Pass Rates

at the expense

of accuracy

Accuracy

at the expense

of true pass rate

Coverage

at the expense of

weak OCR extraction

Response Time

at the expense of

three blocks

Stop juggling trade-offs. Build the complete KYC fortress with Shufti.

The sun never sets on Shufti

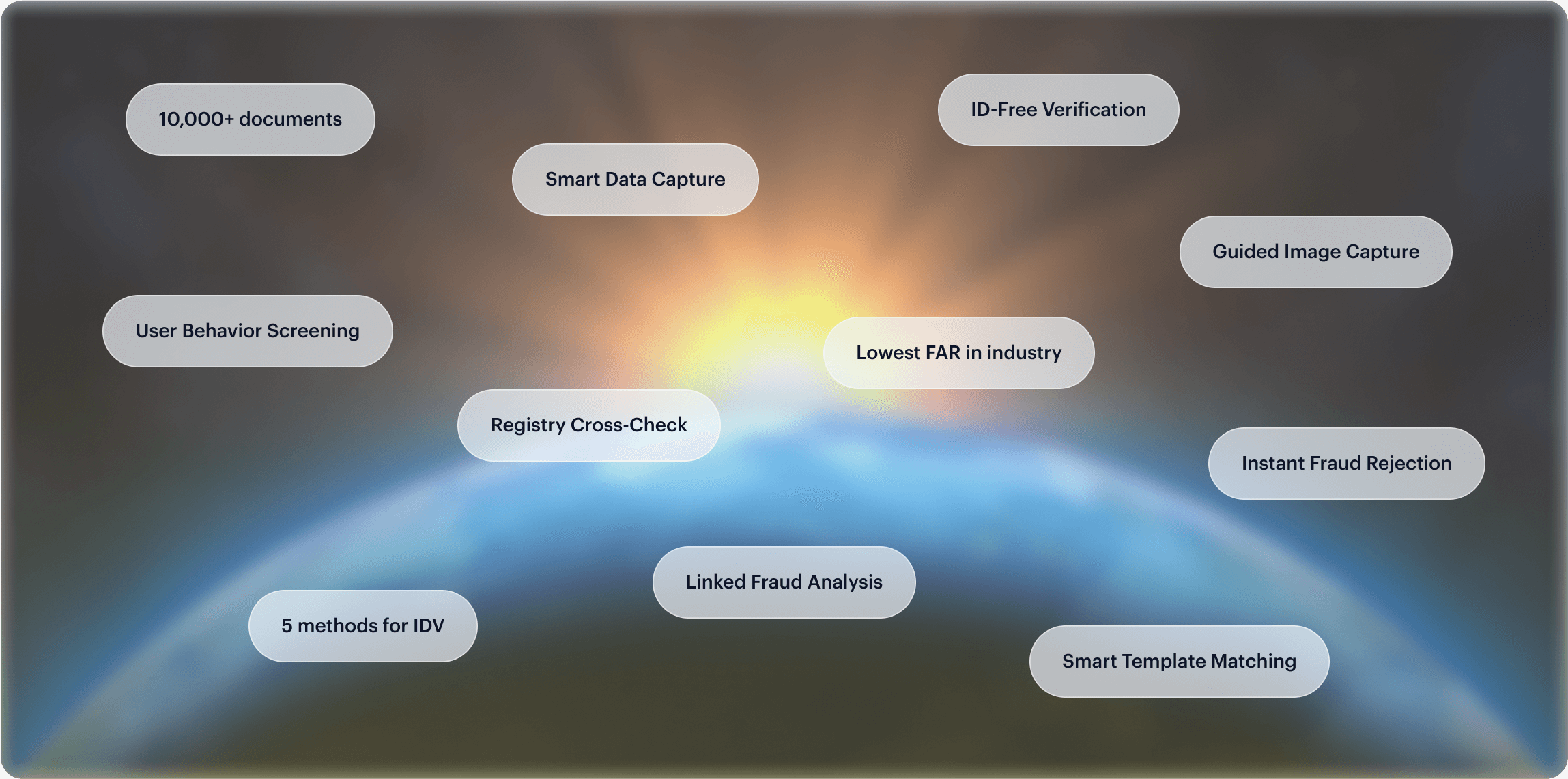

No legit ID card or document, anywhere in the world, that Shufti does not verify.

The best run KYC compliance programs run Shufti

IDV isn’t just about documents or faces; it’s about trust. Shufti’s end-to-end framework delivers a complete 360° experience to help businesses verify with confidence.

Pre- IDV

- Customizable workflows with the help of Shufti's journey builder

- Multiple integration types help smooth functions across multiple teams

- Tool layouts and colors adjusted to match your brand identity

- No extra charges for non-latin document

- Free demos and trials to help build trust, especially for non-latin countries

During IDV

- 24/7 live technical support with instant issue resolution.

- Multi-layered verification (in one flow).

- Failover systems to keep verification running in peak loads.

- Localized experience for every user.

- Transparent status tracking so partners and users know where they stand.

Post-IDV Journey

- Name parsing and weightage adjustments according to jurisdiction.

- Adaptive data retention privacy laws (like GDPR vs. PDPA).

- Spotting unusual patterns across past verifications (e.g., same IP linked to multiple identities).

- Prompting re-verification at set intervals.

- Dynamic risk scoring by region that adjusts risk levels.

Top Challenges of IDV, and how Shufti ID verification solution solves them

Rise of deepfakes

Shufti conducts hundreds of checks on documents and biometrics to ensure fraudsters don’t get inside your system.

Imperfect ID cards

Shufti is not built for the utopic world; it accepts 10,000 types of documents to ensure a low FRR.

Language & Script Diversity

Shufti does 100% accurate OCR extraction for latin and non-latin documents, catering for transliteration challenges.

Become a partner or resellar with Shufti to become part of it’s mission of global IDV inclusivity

Explore our partnership programWith its 100% in-house IDV technology, Shufti achieves what others only claim

Most IDV vendors rely on third party supply chains for different steps of IDV. Shufti is build in the toughest neighborhoods and has its entire technology built-in-house and from scratch-giving it room for constant innovation.

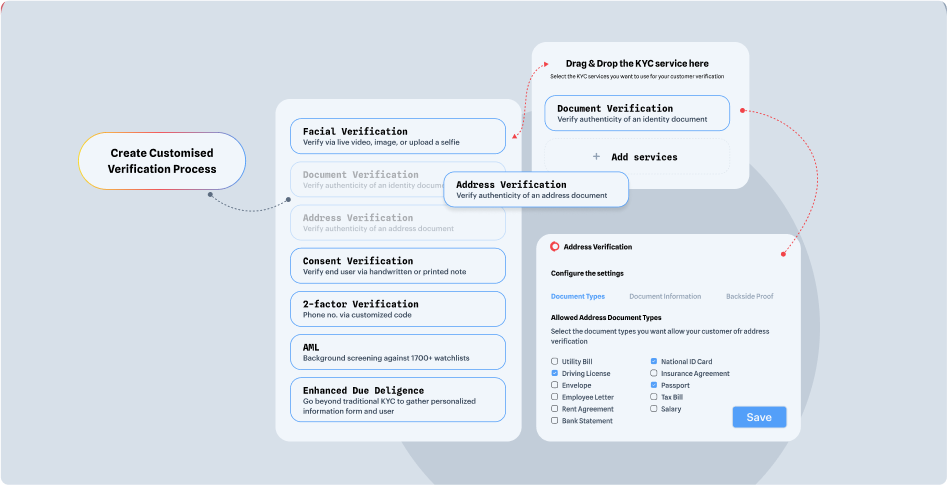

No-code journey builder for custom user journeys

IDV systems are not a one-size-fits all. Shufti offers its clients the freedom to design and deploy custom verification flows effortlessly with a simple drag-and-drop, no code, interface thus ensuring that no integration is required.

Lowering FAR while maintaining low FRR

Every vendor struggles when it comes to balancing FRR with FAR. When systems are designed to reduce FAR, they automatically increase FRR. However, Shufti keeps FAR to 0% while keeping FRR 2.5% thus ensuring 98.72% total accuracy.

Bulk Blacklist protection for proactive risk mitigation

Shufti allows businesses to block users based on IP addresses, email addresses, device fingerprints and facial scans. Additionally, with its real-time verification blocking allows company to reject verification according to multiple identifiers.

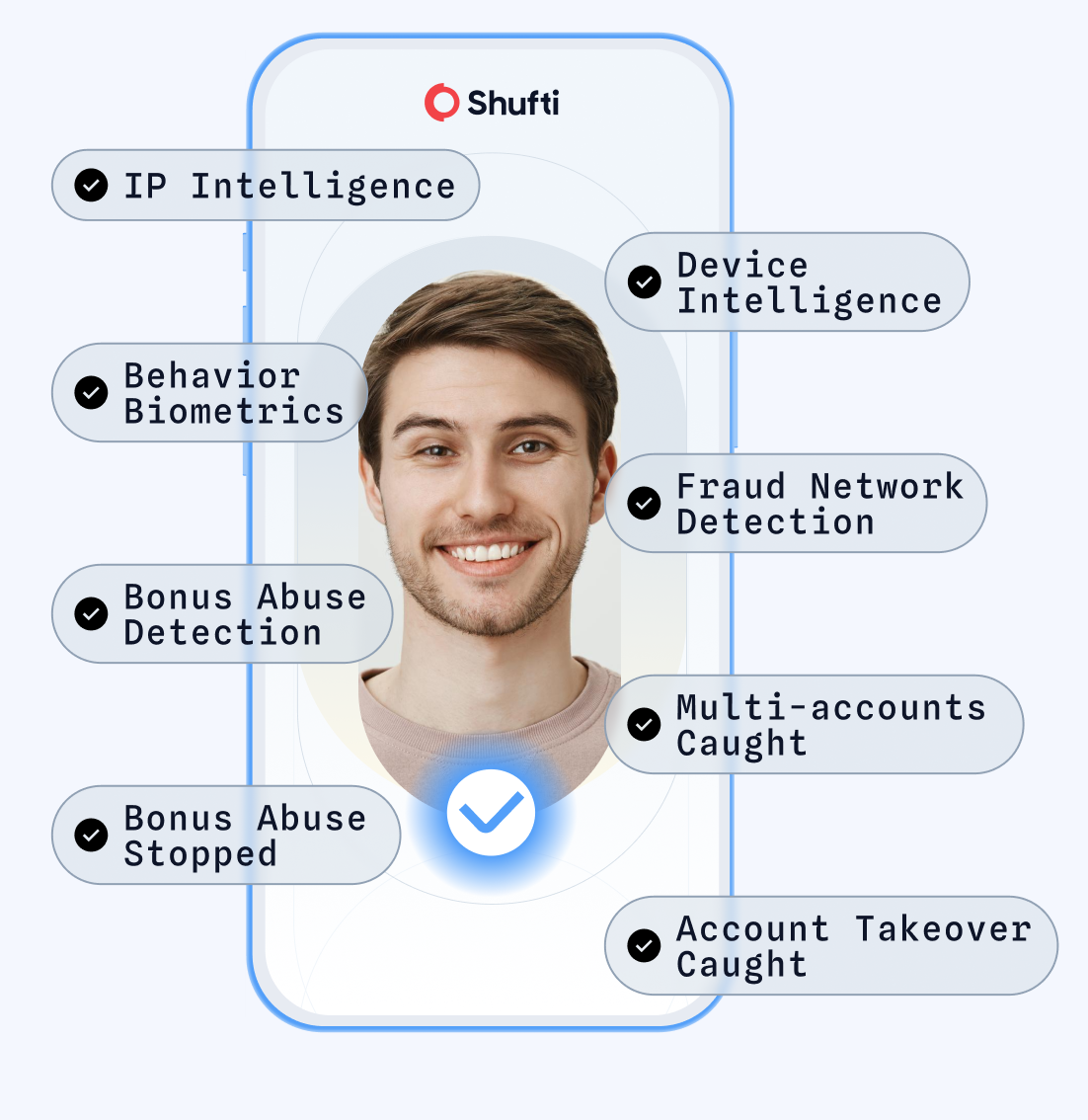

Stop multi-accounting, fraud network and account takeover fraud in its tracks

Every few days, Shufti does the unthinkable: it catches fraud networks that others miss. Just recently, Shufti was used to identify one of the biggest fraud networks in Japan. By using IP address assessment and geolocation analysis, Shufti identified instances of fraudulent activities performed at a massive scale.

- Businesses can integrate Shufti's fraud network intelligence to stop spoofs and deepfakes.

- Bulk block listing ensures that fraudulent attempts from high-risk IPs are stopped.

- Stops account takeover and bonus abuse by stopping the creation of duplicate accounts.

- Stops credential stuffing by identifying both bots and human fraudsters.

- Detects the most authentic-looking deepfakes by analyzing 100+ facial vectors.

- Sim swap detection introduced to stop account takeover by verification of phone numbers.

Shufti takes away complexity from the IDV process

Related Solutions

User AML Screening

Check applicants against 1700+ global watchlists using both search- and document-based methods.

Explore

Explore

Know Your Customer

Simplify customer onboarding with efficient identity verification, reducing compliance burdens and boosting security across your operations.

Explore

Explore

Document Verification

Use advanced data extraction and AI-powered verification to process 10,000+ document types worldwide rapidly.

Explore

Explore

Frequently Asked Questions

What is identity verification?

Identity verification is the process of confirming a person’s claimed identity through official documents, biometrics, eIDV or Shufti's FastID. Our smart IDV system streamlines this using AI-driven checks backed by human oversight, ensuring speed, accuracy, and reduced fraud risk.

Can identity verification be customized for my business?

Yes, identity verification can be fully customized to fit your industry, regional compliance needs, and risk preferences. With Shufti's journey builder, you can combine document checks, biometric verification, AML screening, or tailor workflows as needed. This flexibility allows you to balance security with customer convenience.

How long does the verification process take?

Shufti delivers results in real time, with most verifications completed in under 30 seconds. Even when manual review is required, turnaround times remain among the fastest in the industry. This ensures businesses can onboard users quickly without sacrificing accuracy or compliance.

Which documents are accepted for verification?

Shufti accepts a wide range of identity documents, including passports, ID cards, driver’s licenses, and residence permits. With support for over 10,000 document types across 230+ countries and territories, the system adapts to global and regional requirements. Coverage is continually updated to remain comprehensive.

Can identity verification be done remotely?

Yes, identity verification is entirely digital and can be performed remotely using any camera-enabled device. Shufti's solution combines document scans, selfies, and liveness detection to verify identities securely. Additionally, Shufti offers NFC verification, eIDV verification and FastID verification.

Does identity verification comply with regulations (KYC/AML/GDPR)?

Shufti is designed with compliance at its core, meeting global standards such as KYC, AML, and GDPR. It ensures that businesses not only verify customers effectively but also handle data responsibly and in line with legal requirements. This reduces regulatory risk and protects customer trust.

What happens if verification fails?

If verification fails, the user is flagged as unverified, and the session is risk-scored. Businesses can decide whether to request resubmission, escalate the case to manual review, or deny access. This process ensures suspicious profiles are contained without disrupting genuine users unnecessarily.

Why is identity verification important for businesses?

Identity verification protects businesses from fraud, identity theft, and financial crimes such as money laundering. By verifying users upfront, companies build trust with their customers and regulators. Shufti enables secure growth by balancing FAR and FRR.

INSIDE THE BOARDROOM

What happens when accuracy fails? The Battle inside the Boardroom

Your KYC provider should clearly answer seven critical questions because every

false acceptance invites risk, and every false rejection pushes a trusted customer away.

The boardroom isn’t debating features or policies but weighing fraud losses against customer drop-off, speed

against security, and fighting to restore balance between risk and reliability. Will they reach a decision?

Take the next steps to better security.

Contact us

Get in touch with our experts. We'll help you find the perfect solution for your compliance and security needs.

Contact us

Explore Now

Explore Now