AML Compliance – How to Steer Clear of Cryptocurrency Crimes

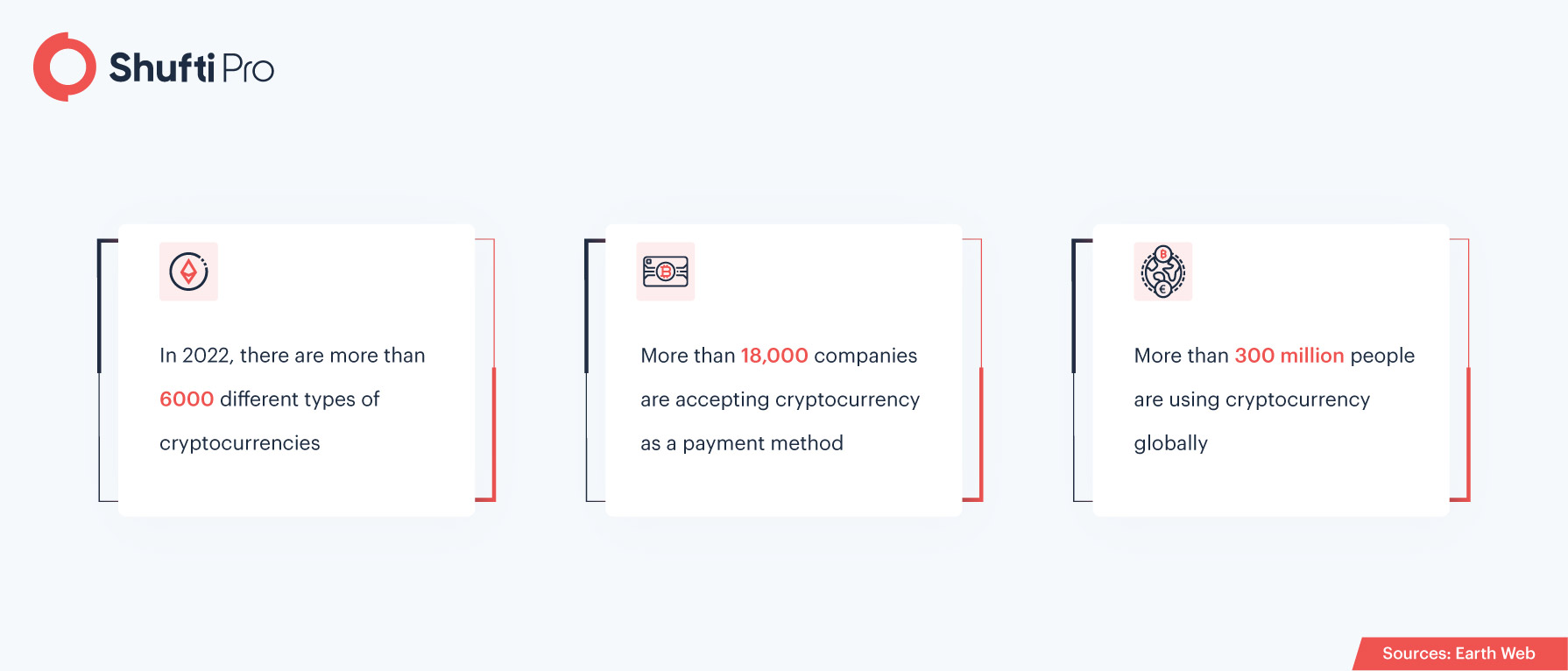

Bitcoin, Ethereum, Dogecoin, and Tether along with thousands of other cryptocurrencies are rising in terms of market value each year. Without a doubt, cryptocurrencies do provide a certain level of financial empowerment to financial institutions, the government sector, and the public sector. Since its advent in 2017, the $1.7 trillion industry has gained quite a lot of traction as companies began to adopt cryptocurrencies as a legal payment method.

While digital payments unlock opportunities like easier access to financial assets and a reduction in fraud risks, there are always criminals that find ways to use technology for their illicit purposes.

Risks Associated with Cryptocurrencies

Of the most common risks related to cryptocurrencies is the vulnerability of cybercriminals utilizing technology to create their own digital assets or gain access to someone else’s funds. Although there are no reported terrorist organizations using cryptocurrencies as of yet, there are several instances where individual terrorists use digital currencies – which indicates the risks of terrorist organizations using them in the future.

The other risk associated with cryptocurrency is the lack of security provided in its trade and online exchange. In simple terms, the security of digital assets is basically dependent solely on the quality of service. In the best cases, crypto investments are not considered a safe option. Online crypto trading platforms are always prone to hacking and theft. This is proved by a report that claims a total of $11 billion in cryptocurrency was lost to hacking during the time frame of 2011 to 2020. Taking into consideration the sum of money stolen in the last decade, it cannot be said that currency exchanges are safe in general.

Crypto-based Crimes

Crypto-based crimes surged to an all-time high in 2021 with more than $14 billion being transferred to illicit locations throughout the year, as compared to $7.8 billion in 2020. According to Chainalysis, the total cryptocurrency transaction volume in 2021 was $15.8 trillion. Considering these numbers, the crypto industry is clearly growing at a fast pace. With the large-scale adoption of cryptocurrencies in the financial sector, it was inevitable that cybercriminals would step in for their share.

A total of $14 billion in cryptocurrency was used in illegal activities during the last year, indicating the lack of proper regulations in the crypto industry. This negative use of cryptocurrency not only creates problems for the companies adopting it as legal payment but also increases the chances of more cryptocurrency restrictions by different governments.

DeFi as a Source of Crypto-based Crimes

DeFi proves to be one of the major reasons for crypto-based crimes as it gives way to theft and scams involving digital currencies. By November 2021, fraud and theft at DeFi platforms summed up to $10.5 billion. This is because decentralized finance sites give permission to crypto users for dealing with cryptocurrencies while staying clear of traditional checks that apply to the usual financial transactions. DeFi platforms attract companies and individuals by promising high returns on saving as compared to the low-interest rates provided by traditional banks. With low-cost and optimized financial services, DeFi seems to be the ideal place for investors as well as criminals.

In 2021, $7.8 billion in cryptocurrency was stolen from DeFi platforms. More than $2.8 billion of this sum was lost to a new type of scam called rug pull. Cybercriminals use this new trick to develop seemingly legitimate crypto projects, which is much more than just setting up fake wallets to gain cryptocurrency. Rug pulls are a relatively common scam in DeFi primarily because of the hype in DeFi. Secondly, DeFi transaction volume shot up by a shocking 912% in 2021. It’s considerably easy for criminals with the relevant technical skills to develop DeFi tokens and get enlisted in exchanges while bypassing any kind of audits.

For instance, a code audit is a procedure in DeFi that confirms a new token or contract’s governance rules. When code audits are managed correctly, crypto investors are less likely to lose their digital assets to rug pulls.

Wash Trading

Wash trading is a type of NFT-related crime where the seller gets involved in both sides of the trade in order to exploit the value and liquidity of the digital asset. Wash trading is more commonly seen in crypto trading platforms that try to elevate their trading volumes. Speaking of NFTs, wash trading involves investors selling tokens for higher prices to another wallet that they own. This easy process does not involve any checks or disclosure of the investor’s identity.

According to Chainalysis, while the majority of NFT wash traders have been rather unsuccessful in making any significant profits, the ones that were successful earned quite a lot. 41% of the 262 total wash traders that were identified made nearly $8.9 million. On the other hand, the remaining lost almost half a million.

Money Laundering

One of the widely known financial crimes that troubles the financial paradigm is money laundering. Much to the concern of financial watchdogs, money laundering is also prevalent in the cryptocurrency sector and NFT market. In 2021, more than $3 million were invested in NFTs by investors located in illicit jurisdictions. This is a sharp increase when compared to the $500,000 invested in 2020.

Money coming from high-risk jurisdictions was seen to be invested in cryptocurrencies in the second half of 2021, with Chatex transferring around $284,000 worth of crypto. The virtual crypto trading platform is on a Specially Designated Nationals List of the US government, which enlists individuals that are suspected of money laundering, terrorist financing, drug trafficking, and other such heinous crimes.

The crypto industry will continue to grow regardless of any external factors as it’s backed by a decentralized structure. However, businesses and financial institutions that deal in cryptocurrency should keep an eye out to ensure that their investment does not end up costing them a fortune.

How Shufti Can Help

It is becoming increasingly significant for investors to consider that the crypto industry relies on speculation, is susceptible to hackers, and is often used for illicit crimes. With financial regulations becoming more important for the cryptocurrency sector, businesses must incorporate AML solutions in order to combat financial crimes. Shufti’s robust AML Screening enables crypto trading platforms to screen investors against 1700+ global watchlists, making the digital currency system crime-free.

Want to learn more about AML Screening for your financial institution?

Explore Now

Explore Now