AML Screening – Securing Alternative Payment Market and Overcoming Prevailing Risk of Crimes

Escalating demand for innovative, new, and robust alternative payment options across the world is transforming the financial services landscape. However, many emerging economies are providing bank account ownership at a very low rate. Yet, a high level of smartphone engagement is becoming the viable choice to replace fiat currency and plastic cards when it comes to making transactions.

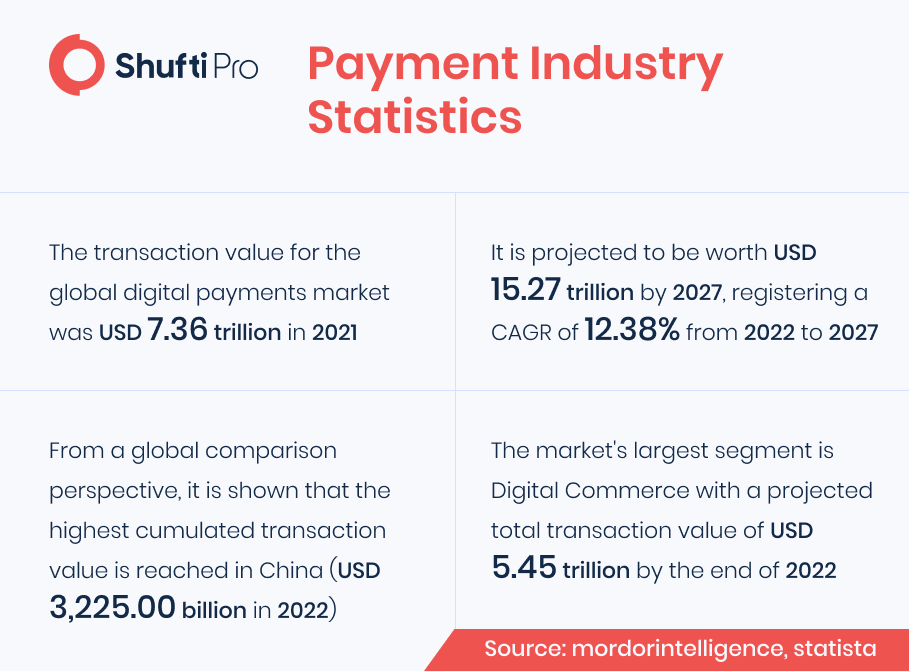

Therefore, with digitization, the payment industry is also rapidly evolving, and people can use alternative payment methods other than traditional ways to make transactions. However, there are no signs of eradicating the use of mainstream payment approaches like fiat currency, debit cards, etc, yet the alternative means are soaring in popularity. In addition to this, the involvement of financial technology companies and tech giants is also becoming the major reason for the shift to alternative payment methods. By providing users with robust, secure, and more convenient payment services, the industry has successfully gained billions of customers across the globe.

The Rise of the Alternative Payment Industry

It’s viable to attribute the rise of the alternative payment industry to coronavirus, but the truth is, new emerging technologies have been navigating the payment service providers towards convenient and reliable ways to exchange money for decades.

Covid has been accelerating the changes to customers’ needs and payment options by removing the barrier of buying essentials from the physical stores and necessitating a major shift to digital platforms. According to Worldpay Report 2020, 32% of eCommerce payments in the UK were made through digital wallets like Amazon Pay, Paypal, Apple Pay, and Google Play.

In addition to this, as the alternative payments industry is growing increasingly, financial institutions are rushing to ensure that their anti-money laundering control systems can cope. World over, the war against money laundering and terrorism financing is also becoming the top priority. Financial crimes pose a potential risk to the stability and reliability of the financial firms, increasing the volatility of capital flow, and affecting foreign investments. Various approaches are being used by the money launderers and organised crime groups are using alternative payment services including wire transfers, cryptocurrency investments, and much more.

FCA Seizes £2m From QPay Over Links to $150m US Payment Fraud Case

The UK’s regulatory body, the Financial Conduct Authority (FCA) has seized millions of pounds from the QPay believed to be the proceeds of illicit crimes. FCA has also claimed that the money was linked to the criminal proceedings in the US concerning an alleged conspiracy to commit wire fraud in a $150 payment processing scheme. Therefore, the regulatory authorities ordered QPay to pay $2 million under the Proceeds of Crime Act in the Westminster Magistrates’ Court.

“Account forfeiture orders are an important means of intervening and capturing illegal money and this action is a good example of what can be done,” said Mark Steward, the executive director of enforcement and market oversight at the FCA. “The funds will now be used to assist the FCA and other authorities fight illegal activity,” he added.

The seized money was allegedly connected to the case in the US which involved the executives of Allied Pay, a payment service provider located in Los Angeles, a company that processed transactions for high-risk entities through bogus misrepresentation of clients. Thus, the criminals are accused of obtaining $150 million in payment card processing through more than 100 illegal merchants.

Turkey to Ban Cryptocurrency Payments to Avoid Financial Crime

The central bank of Turkey banned the use of cryptocurrency payments in 2021. This action was taken as a part of the country’s efforts to regulate the digital currencies which gained uncontrollable popularity in recent months. In addition to this, the Turkish government has also been closely monitoring cryptocurrency transactions and service providers for some time and found out that criminals and terrorists were using cryptocurrencies to fund illicit activities across the country.

“Their use in payments may cause irreparable damages for the parties to the transactions, and include elements that may undermine the confidence in methods and instruments used currently in payments,” the bank said.

Regulations

PSD2 & Payment Services in the E.U.

Payment service directive 2 (PSD2) was introduced as a national law to mandate the payment industry to comply with the FCA regulations and standards. Therefore, the payment service businesses that are providing the facilities as a part of service packages or if the company receives funds from the client before passing it to other parties, such businesses are subject to the PSD2 requirements.

However, the payment service directive aims to promote innovation along with competition in the payment industry, while mandating businesses to enhance their security measures for digital payments and make efforts to secure the customers’ personally identifiable information particularly financial credentials. Furthermore, the businesses are also required to integrate robust and automated customer verification solutions, and transaction monitoring systems in order to track illicit activities and maintain effective communication standards for effective suspicious activity reporting.

Electronic Fund Transfer Act (EFTA)

Electronic Fund Transfer Act (EFTA) is legislated to secure financial services. The Act is imposed on all financial institutions and payment service providers that allow the customers to make transactions using smartphones, computers, or any other digital gadget. This regulation is particularly mandatory for banks and other financial firms, but a certain degree of provisions only apply to individual entities. EFTA also provides customer rights to a number of disclosures and error resolution procedures for unauthorised or illicit transactions.

What Shufti Offers

Shufti is a UK-based identity verification service provider which is an ideal option for the payment industry. Powered by thousands of AI models and PCI DSS compliant KYC/AML solution enables businesses to stay put with regulatory obligations along with screening customers against 1700+ global watch lists in less than a second with 98.67% accuracy. Additionally, Shufti’s state-of-the-art solution also assists payment service providers to protect the data integrity in order to ensure that the international payments remain secure from exploitation while enabling customers to experience frictionless onboarding and transaction experience.

Want to know more about our AML screening services for the payment industry?

Explore Now

Explore Now