Five Solutions to tackle business verification challenges

Know Your Customer (KYC) is critical for verifying the clients before doing business with them, but to authenticate businesses is as important as KYC for individuals. This is why regulators are increasingly focusing on business verification to help prevent money laundering and terrorist financing. Business verification, which includes authentication of businesses, UBO identification, and risk assessment of business entities, is been included in the new AML directive of the European Union, as well as other major regulatory authorities. Know Your Business (KYB) services market is projected to grow $11.8 billion, according to an OWI lab report.

Corporate KYC isn’t just a regulatory requirement it helps businesses in identifying the shell companies and other corporate structures involved in illicit funds transfer. The disruptive technologies like artificial intelligence, machine learning, and automation are creating opportunities for quick and real-time customer due diligence and KYC verification. However, many of these solutions focus on KYC for individual and retail customers.

Verifying businesses in the past has been a difficult and time-consuming task. Normally the KYB process for financial institutes to verify the corporates involves manual checks and physical verification, which makes it more tedious and lengthy.

Challenges associated with business verification

With the new KYC/AML regulations, business is required to verify customers, corporate clients, and other critical information. However, there are multiple challenges when verifying a business client and some of them are:

Time taking manual onboarding process

Normally, KYB verification for corporate onboarding is a tedious and manual process, requiring intensive labour. These delays lead to frustrating customer experience and customers are more likely to abandon the account creation process. Moreover, there are chances of errors and mistakes when it’s done manually.

High compliance cost

According to a report, the average KYC cost for businesses crossed $48 billion in previous years. This includes manual labour and third-party payments. All this is raising concerns about AML and KYC compliance costs becoming so high that they prevent businesses from being able to perform other daily tasks.

Complex ownership structure

Latest KYC/KYB regulatory directives such as AMLD5 and FinCEN CDD rules make it necessary to verify and identify the business entities as a mandatory regulatory requirement. Financial institutions are reliant on collecting business details from clients through a manual process by filling in forms and then verifying the information manually. There are high chances of data discrepancies to slip in.

Data inconsistencies

While companies could somehow afford all manual works but a problem that still persists is data verification sources. There are many sources where companies’ data can be found, and sometimes the information available on some file is outdated or incorrect.

Addressing the challenges

With an increase in regulatory requirements, there is a need for developing an appropriate procedure and process that facilitate financial institutes. Here are some solutions that could help businesses:

Automated KYB onboarding

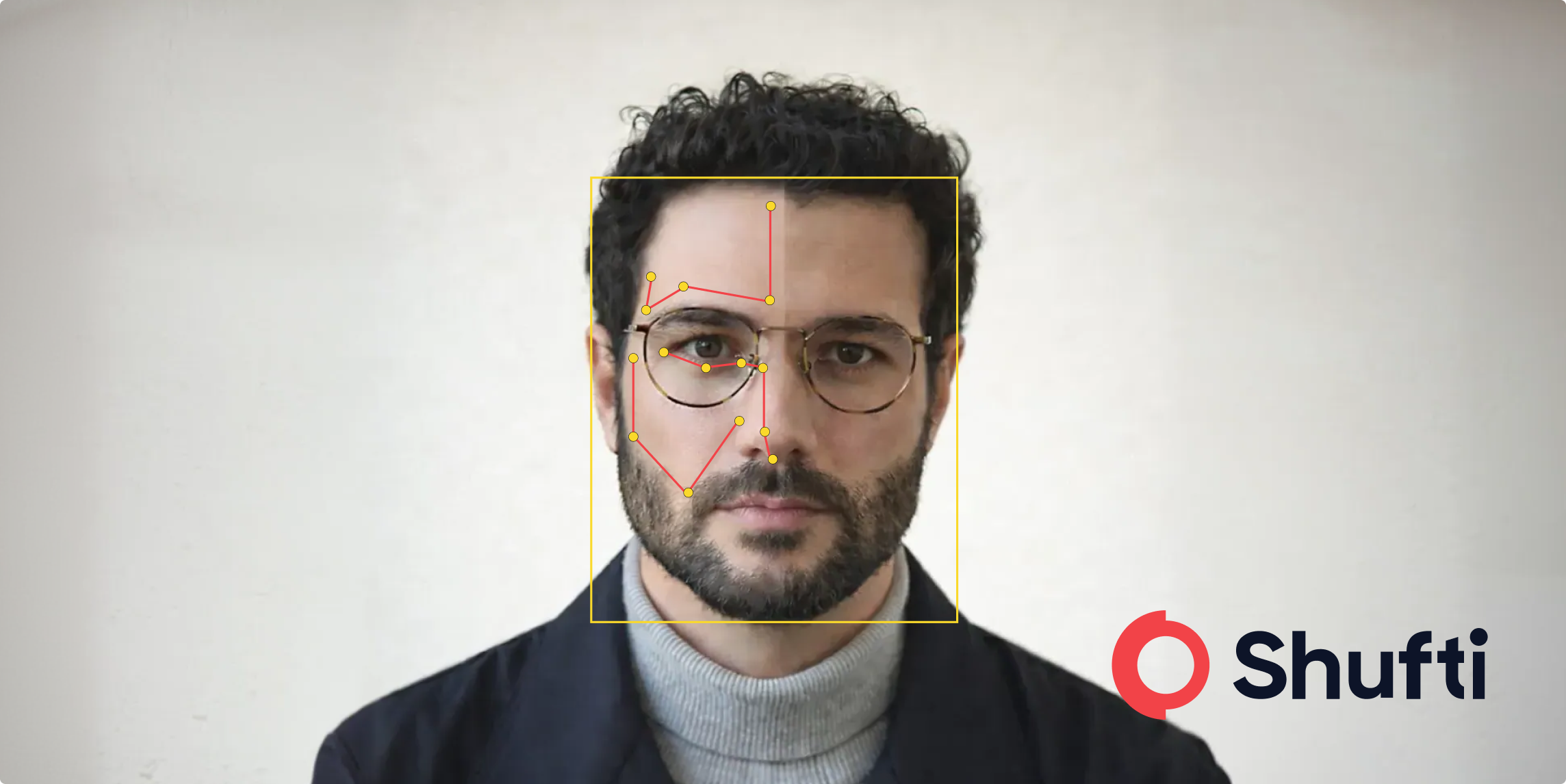

By employing the latest technologies, automated business verification solutions can solve these problems. AI-powered corporate verification solutions will provide an opportunity to enhance the efficiency of the corporate onboarding process, by reducing the cost and making it faster.

Ongoing monitoring for business verification

Businesses should monitor their corporate clients regularly to identify and monitor any changes in the company’s structure, the appointment of new executives, and changes in beneficial ownership. This practice also helps in monitoring PEPs continuously. It will assist companies in adopting a structural approach for business verification.

Access to authentic business registries

As discussed earlier, access to the correct and most updated data is a challenge in performing business verification. However, if the companies have access to the correct and most up to dated business registries is valuable and will make business compliance an easy task.

API integrated KYB solutions

Shufti API integrated solution aggregates data from various sources, so businesses only need to enter the required details such as the business registration number and the jurisdiction code where the business is operating. This centralized verification help manage the complexity involved in onboarding and monitoring corporate clients.

Virtual Identification

With an increasing compliance cost, businesses are now turning towards automated software that helps businesses to perform necessary business checks. Shufti’s KYB verification solution is specifically designed to reduce extra compliance costs and dealing with complexities involved in working with high-risk clients.

As the global business markets are growing at an increased pace, companies need to get grip on customer due diligence for both individual and corporate clients.

Explore Now

Explore Now