The US Corporate Transparency Act – What’s New? [December 2022]

- 01 Who is a Beneficial Owner?

- 02 How many businesses will be impacted by CTA?

- 03 How soon do companies need to report beneficial ownership?

- 04 What are the penalties for not complying with the CTA’s Reporting Requirements?

- 05 Which companies must report?

- 06 Which companies are exempt from reporting?

- 07 What needs to be reported?

- 08 The Challenges of Implementing CTA and What The Future Holds for Companies

Generally, small to medium businesses in the US continue operating without disclosing the beneficial owners’ information to the government. All of that however, is about to change in 2023.

The US Corporate Transparency Act (CTA) is one the latest laws that passed on the 22nd October 2019, and enacted by the Congress on 1st January, 2021 by overriding a presidential veto.

The purpose of CTA is to disclose beneficial ownership for all businesses and companies formed either by US citizens or foreigners.

It will help the US Government in an ongoing fight against money laundering and financial crimes. This is in line with other countries such as Canada, the UK and the European Union.

Sharing the details of beneficial owners of companies is one additional step that the US is taking to ensure transparency of businesses operated by individuals within or outside of the country. Let’s dive deep into what this law actually is, how it implements businesses, and what information needs to be reported to the federal authorities.

Who is a Beneficial Owner?

According to the CTA’s requirements, the following criteria defines the ownership interest:

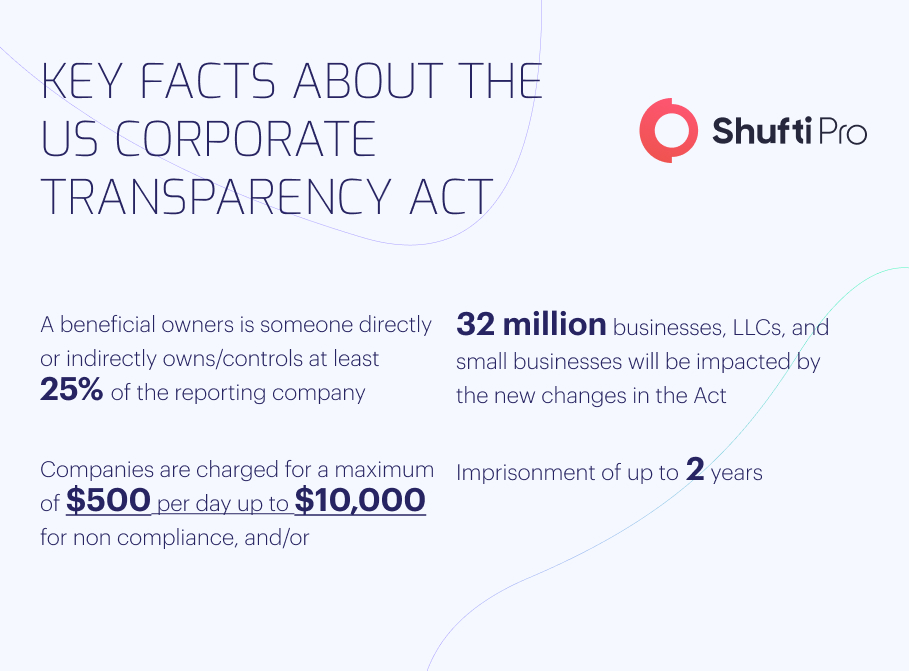

- Directly or indirectly owns/controls at least 25% of the reporting company

- Exercises substantial ownership and control of the company

And the following criteria defines substantial control of the company:

- Individuals with the power and/or authority to direct control or influence decision-making process

- Senior advisors of the company

How many businesses will be impacted by CTA?

According to an estimate, roughly 32 million business entities, LLCs and small businesses will be impacted by sweeping new changes in the regulation.

The affected businesses will now have to disclose the beneficial owners’ identities, source of income, and other documentation to ensure compliance with anti-money laundering laws.

In September 2022, a final rule implementing the CTA was issued by the Financial Crimes Enforcement Network (FinCen). The regulations will go into effect on the 1st of January, 2024, which gives business owners a year’s time, at the writing of this story.

How soon do companies need to report beneficial ownership?

All companies are obliged under law to report BOI (Beneficial Ownership Information) if formed before 1st January 2024, to FinCen by 1st January 2025. Companies formed on or after 1st January 2024 need to report BOI within 30 calendar days. Should there be any change in ownership, it also needs to be reported to FinCen within 30 calendar days.

What are the penalties for not complying with the CTA’s Reporting Requirements?

It is imperative that companies continue ensuring compliance with all types of AML regulations in their operating countries. For this specific case, failure to comply with the reporting requirements of CTA can lead to civil and criminal penalties, whereby:

- The companies are charged for a maximum of $500 per day up to $10,000 for non compliance, and/or

- Imprisonment of up to 2 years

Which companies must report?

A reporting company is defined as any corporation, LLC (Limited Liability Company), or any other business registered with SEC (Securities and Exchange Commissions) in any state, or formed in a foreign country but registered within the US. To understand better, it is imperative to understand the difference between a domestic and a foreign company.

Domestic Company

All types of limited liability partnerships, business trusts, or any small business registered by an American citizen physically within the US.

Foreign Company

Any corporation, limited liability company, or any other entity formed under a foreign country and registered in any state or tribal jurisdiction of the US.

There are no restrictions in place by the US government on the creation, ownership, and the operations of a company registered by a foreign national from outside of the country. States with the highest amount of foreign-owned businesses are Delaware and Vyoming.

Which companies are exempt from reporting?

There are 23 different types of “reporting companies” exempt from filing their BOI including:

- Large companies – Businesses employing a minimum of 20 full-time employees, earning $5 million in annual revenues with physical presence in the US.

- SEC-registered issuers

- Banks, Bank holding companies, loan holding companies, and credit unions

- Insurance firms

- Registered CEA (Commodity Exchange Act) utilities

- Investment Advisors

- Accounting firms

- Dormant or inactive companies

- Tax-exempt companies

What needs to be reported?

In report to FinCen, the company needs to provide:

- Every beneficiary’s full name

- Date of Birth

- Residential or Business address

- Passport or Driving Licence

The Challenges of Implementing CTA and What The Future Holds for Companies

The CTA and the Final Rule represents a final nail in the coffin in ongoing AML regulations. The 32 million companies that fall under the scope of the Final Rule are single-owner LLCs, foreign-owned entities and small businesses.

According to FinCen’s estimate, the total cost of compliance could amount to $21.7 billion for the first year and $5.65 billion per year thereafter.

Companies must develop SOPs to assess reporting obligations and ensure compliance. This means that companies need to make calculated decisions to avoid getting hit with penalties and severe fines.

Shufti’s AML Screening Solutions can help you remain compliant by ensuring that onboarding new clients have their identities verified across 1,700+ international criminal watchlists.

Compliance is costly, but non-compliance is even costlier. Want to learn more?

Explore Now

Explore Now