Top 10 FinTech Trends to Watch for in 2022

- 01 1. Emergence of Banking-as-a-Service

- 02 2. Decentralized Finance (Defi)

- 03 3. Open Banking

- 04 4. Data and the Customer Experience

- 05 5. The Rise of Cross-Border E-Commerce

- 06 6. Strengthening FinTech Regulations

- 07 7. NFC Verification Systems

- 08 8. Digital and Neo Banking

- 09 9. Innovation in WealthTech

- 10 10. Anti-Money Laundering (AML) Screening

- 11 Final thoughts

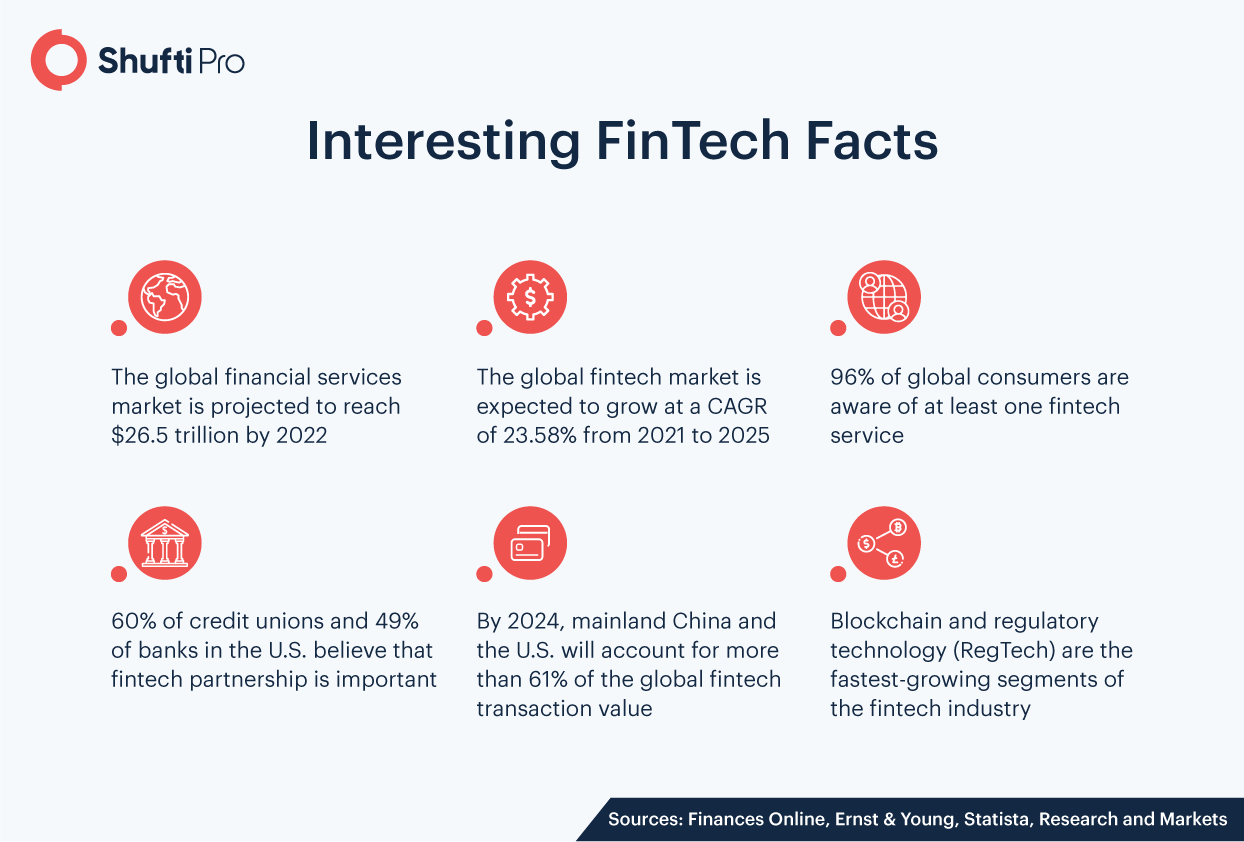

2021 was a game-changer for the FinTech sector as it has come up with innovative payment gateways and client-merchant transactions that have significantly contributed to job creation and GDP. According to Statista, the fintech sector is expected to grow at a rate of 12% in the coming years and could reach a value of €188 billion by 2024. However, 2022 will be the year for companies to prosper and swap their conventional systems with digital platforms.

This blog talks about the trends for the fintech sector, as 2022 might reshape the industry and put it on the road to ultimate success.

1. Emergence of Banking-as-a-Service

Banking-as-a-Service (BaaS) platforms have gained significance in recent years as they are a cost-effective and efficient means of offering financial services based on open banking ideas. To develop innovative digital services, monetary institutions must use a service-oriented and composable/modular architecture approach. Conventional banks and financial corporations must go for BaaS as part of their digital transformation strategy. However, traditional financial institutions are expected to collaborate with the FinTech sector to integrate BaaS services so that they can bring innovative technology in-house and improve their services. No doubt, BaaS will play a crucial part in the financial industry’s growth, as well as enabling companies to enhance consumers’ growing expectations.

2. Decentralized Finance (Defi)

Decentralized Finance (Defi) is a notion that is dominating most discussions about FinTech’s most fascinating concepts. While DeFi began as an alternative financing tool to support cryptocurrency, industry analysts believe that it will continue to be at the forefront of FinTech in the next few years. As of October 2021, the market value of DeFi that allows money transfers without the intervention of a central authority is set at $99 billion. DeFi has come up with self-executing smart contracts, that are all set to reshape financial operations. 2022 will be the year when most of the banks and other financial corporations will embrace DeFi.

3. Open Banking

Due to the pandemic, there has been an increase in online transactions, and ideas of self-service banking are circulating globally. Financial firms are getting digitized to meet customers’ expectations. Open banking is a technology-driven, API-enabled approach that will allow banks and other financial institutions to provide monetary services in a seamless manner using authenticated client data. Open banking principles are being incorporated into the services of fintech companies globally. In 2022, banks that feel hesitant to adopt open banking will limit their ability to provide frictionless customer service.

Suggested Read: Open Banking Trends & the Vitality of Identity Verification

4. Data and the Customer Experience

The aftermath of COVID has made digital banking a go-to option across the financial world. Fintech companies are continuously coming up with new technologies, not only to engage with the clients but also to provide them with more efficient services and products as well. Data is a significant part of digitization. Better insights of the information rendered out by using AI and machine learning concepts improve the analytics; therefore, it provides businesses with a broader understanding of customers’ requirements. Real-time analytics also improves service speed. In 2022, clients’ will expect immediate responses to their banking operations and services. In addition to this, the cybersecurity measure can also be enhanced by embedding facial biometric authentication solutions in the pre-existing systems.

5. The Rise of Cross-Border E-Commerce

Progress usually entails change, and in recent years, most significant change was as a result of Covid, making work-from-home and social distancing the norm, radically altering the concept of a “hometown business”. According to a study by Accenture, the total worldwide cross-border payment flow is expected to reach US$156 trillion by 2022, expanding at a CAGR of roughly 5% each year.

However, due to the explosion of eCommerce, global transactions provide huge growth potential for small retail businesses. However, in 2022 there will be a spike in cross-border eCommerce, while clients will expect an easy and secure payment solution from such businesses.

6. Strengthening FinTech Regulations

The increasing number of digital financial transactions, as well as shift of monetary services to the cloud, necessitates improved data security and regulations. As a result regulatory authorities are making efforts to come up with more comprehensive laws regarding finance and data management. That being said, Regulatory Technology (RegTech) has become a popular buzzword. Enterprise-level software that uses machine learning algorithms and the newest data analysis principles now handles regulatory monitoring, compliance, and suspicious activity reporting. However, in 2022, the regulatory landscape will become more rigid that will assist the FinTech companies to make onboarding and financial processes transparent.

7. NFC Verification Systems

Like other industries, Fintech is also on the hit list of criminals. Criminal activities like data breaches, money laundering, and other financial crimes are on the rise. FinTech companies need to comply with the Know Your Customer (KYC) regulations to identify the real identities of the customers before getting them on board. On another hand, combating fraudulent activities must be the top priority of this industry. However, Shufti’s robust NFC-based identity verification solution can aid the FinTech companies in determining the clients’ identities and staying put with the regulatory obligations. The data saved in NFC is encrypted, which means it’s impossible for the fraudsters to decrypt and alter information. Therefore, companies must go for NFC Verification in 2022 to secure financial services from cyberattackers.

8. Digital and Neo Banking

Banking has historically been a monopoly with substantial entry barriers. However, the insufficient set rules and standards in countries across the globe has given neobanks an opportunity to take the lead. Neo banking attracts customers’ by promising lower costs, convenient mobile banking, and an improved customer experience that eliminates the need for conventional banking needs. That’s why, the neobank sector is expected to develop at a CAGR of 47.7% over the next eight years, valuing it at $30 billion or more in 2020. As the world’s population becomes more connected, digital banking is expected to overtake traditional financial services in 2022.

9. Innovation in WealthTech

WealthTech aims to provide better monetary management software to aid entrepreneurs in successful digital business operations. Having in mind the enterprise’s needs, SaaS providers by using key concepts of AI and Big Data have emerged with automated financial management solutions. In FinTech, Robo-advisors are a hot topic for research and development. However, these AI-backed systems can help businesses to make better decisions precisely. Other than this, some of WealthTech’s solutions include online brokerage, micro-investment platforming, and various other financial solutions.

10. Anti-Money Laundering (AML) Screening

The Fintech sector is one of the primary targets of financial criminals. Online payment gateways, for instance, are widely used to launder money or fund terrorist groups. To combat the rising issue, fintech companies will be paying more attention to Anti-Money Laundering (AML) screening service during account opening.

“By 2025, the market worth of the software for curbing the laundering of money is expected to reach 2717 million USD from 879 million USD in 2017.”

Screening every identity against global watchlists will filter high-risk entities on time and necessary actions can be taken to prevent financial crimes and non-compliance penalties.

Final thoughts

Financial analyst forecasts a promising future for FinTech industry. The finance sector is swiftly changing due to which digital services are progressing, therefore fintech companies must utilize new technologies to develop innovative financial solutions. Cybersecurity will be a top priority area for monetary institutions. Anyways, 2022 trends will put the industry on the road to success.

Want to know more about KYC/AML Compliance for the FinTech Industry?

Explore Now

Explore Now