Top Five FinTech Industry Trends to Look For in 2021

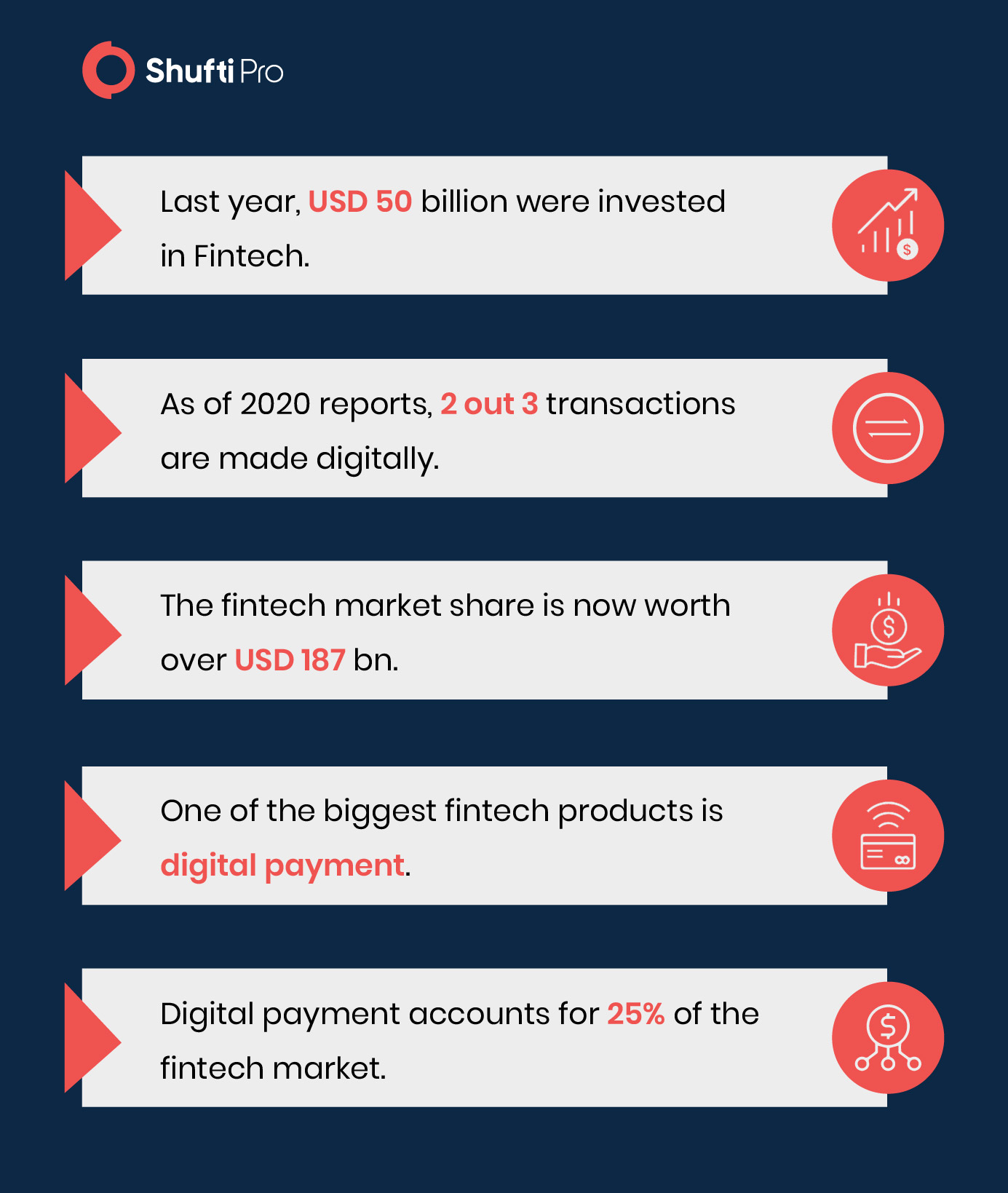

Continuous advancements in technology have shifted the world toward digital means of communication. Among all other sectors, the finance sector has been greatly impacted by the advent of technology. New methods for streamlining financial processes have revolutionised this sector. Now, the fintech sector is in full swing to bring better ideas in the world. According to Goldman Sachs, Fintech’s worth is approximately USD 4.7 trillion and there are around 12,000 fintech startups worldwide.

The global fintech market is continuously growing and reports from Industry Arc reveal that the fintech Compound Annual Growth Rate (CAGR) is expected to be 25 to 30 per cent between 2019 and 2025.

Given the shift in business operations due to the pandemic, the fintech sector can expect various turnarounds in the year ahead. It is growing at a faster than ever pace and we can expect many new financial technology solutions in the years ahead.

What is Fintech Industry?

FinTech or financial technology industry provides digital solutions to make financial processes easier for different sectors. It is used to streamline the financial processes in companies. One of the ideal examples of fintech is mobile payment and cryptocurrency that brought convenience to everyone’s life.

Recommended: Disruptive Fintech Trends in 2020

Top Five Fintech Trends in 2021

Given the rise in digital modes of business operations, the fintech industry entails a lot more for us in 2021 than a few online banking methods. Let’s take a look at what you can expect from the finch section in 2021.

Digital-Only Banking

Spending hours in the queue for a bank account is not an option anymore. People love convenience and the digital world has offered a lot of solutions to ease processes. Digital banking, e-wallets, and budgeting applications are few of the fintech solutions to name.

Digital-only banks are extremely beneficial – nobody needs to spend a moment visiting any bank physically, no paperwork to handle, and no queues for testing customers’ patience. This is why they are developing in revenues and numbers globally.

Visits to banks are going to drop 36% from 2017 to 2022 due to the rise of digital-only banks. Some other benefits include convenient cost management, faster bill payments, reset pins from home, real-time analytics, and fast balance review.

Enhanced Security with Biometrics

Mobile banking and other digital financial services have become popular as they are at one’s fingertip. This is not just a great achievement but also raises many security-related challenges as cybercrime is increasing day by day. Hence, every FinTech company should take all necessary security measures to provide secure financial services. Account related frauds are the hardest challenge for fintech firms and the biometric customer authentication is the reliable solution to this. It not only provides security but maintains better customer experience.

Biometric sensors that include physical contact are predicted to be less used in the future. Despite the entire development in the use of biometric technology for verifying identities, contactless solutions will take over the market of the touch-based fingerprint readers.

Read more: Banking on Biometrics: The Future of Customer Authentication

Global Fintech Transformation with Blockchain

According to the report by Business Insider Intelligence, 48% of banking representatives believe that new technologies like Blockchain are going to have the biggest effect on banking through 2020 and beyond.

Blockchain is predicted to bring about a worldwide transformation in financial systems. It does not just provide new technology but also a new philosophy of decentralized finance that concentrates on reducing centralized procedure.

By now, Blockchain technology has inspired the development of different online peer-to-peer financial platforms that allow monetary interactions for taking place more decentralized manner. It’s a distributed ledger technology that can improve current procedures and systems. Banks are already using blockchain technology with the hope of reducing expenses and enhancing internal procedures.

Payroll Fintech to Gain Popularity

Payroll issues have increased over time. With digitisation being the mode of communications and the rise of digital payment systems, payroll fintech is expected to gain popularity in 2021. According to WhiteSight, there are four categories of fintech space; salary on-demand, salary advance, early direct deposit, and crypto payroll. In 2021, all four categories will face automation. Fintech solution providers will partner with HR to bring flexibility in the access to income earned.

Short-term credit to employees on the basis of their salary will be provided by fintech in the salary advance category. The latest and exhilarating category is the crypto payroll that will enable companies to make salary payment through cryptocurrencies.

More Stringent Laws from Regulatory Authorities

FATF, FinCEN, FINMA, and other regulatory authorities are in action to combat fraud in the fintech sector. The authorities are extending the scope of traditional KYC and AML regulations to this rapidly growing industry. Criminal activities in the fintech sector increased unusually that is encouraging the regulatory authorities to impose more stringent rules and regulations to combat crimes. Money laundering, account takeover, and identity theft are just a few crimes to name.

In 2021, more laws are predicted for the fintech industry. Compliance with the laws will become a challenge and non-compliance will result in hefty fines. Recently, the sixth anti-money laundering directive was imposed. According to the directive, non-compliance fines will be increased for fintech companies.

Recently the USA regulatory authority FinCEN proposed to implement KYC and AML regulations on crypto firms similar to the banking regulations.

Read more: US Crypto Firms Reluctant Towards New KYC/AML Proposal by FinCEN

Wrapping It Up

The fintech industry has brought many conveniences for different sectors. Financial processes have become a lot easier than what one could have expected a few years back. The rapid shift toward digitisation has opened gates to several opportunities for the sector. Next year, we can expect an increase in the automation of financial processes. Criminal activities are on the rise and the identity verification regulations from FATF and other regulatory authorities will become more stringent in 2021. Moreover, payrolls have not seen significant automation in a while. There is a prediction that the coming year will bring more automation in the payroll systems.

Get in touch with our experts and learn more about the upcoming threats and a solution to combat them.

Explore Now

Explore Now