Video-KYC – The ‘New Normal’ for Digital Customer Verification

The KYC requirements all over the world are getting stringent. ID document verification is a norm for major business entities when it comes to onboard a secure clientele base. Remote verification of customers has various forms. It can either be done through digital document verification or biometric authentication in combination with other attributes such as remote anti-money laundering (AML) screening and address verification. However, another method of customer verification is becoming “the new normal” in the identity verification market. Video KYC is now grooving in the digital space for remote verification of customers.

Multiple industries, dominating the banking sector intersecting with the Fintech use-cases are in need of digital customer identity verification. Video KYC thus is among the most suitable methods in which with the assistance of KYC experts and technology, identity is verified remotely.

What is Video KYC?

Video KYC procedure is a video-based identification interview with a KYC expert through a live video call. It integrates human and artificial intelligence to provide a higher accuracy rate.

Role of KYC expert

The online user first fills the registration form and the KYC expert connects the user for remote verification. The expert guides the user to verify the identity throughout the identification process and takes consent at first when it comes to collect the data from the customers. The user will be asked to show the documents asked by the expert in the camera for verification purposes. The document could be an ID card, driving license, and passport. The expert asks the user to tilt the document to check holograms in them. They are trained not only to identify the spoofing elements in the documents but also for behavioral and body language analysis.

Role of technology

During the verification process, AI-powered facial recognition of customers is also performed. The liveness detection feature in this biometric technology ensures the physical presence of a customer at the time of verification. The checks employed in the technology lookout for spoofing elements in the document as well. When both face and document is verified, the results are sent to the back-office.

Video KYC and Indian regulatory framework

The Indian regulatory infrastructure has revamped the customer identification process for the banks, NBFCs, Fintechs, and other financial institutes. The latest regulations allow the replacement of paper-based processes with the video call verification mechanisms as per the recent amendments in KYC guidelines in the country. The Reserve Bank of India (RBI) is the country’s banking regulatory authority which declared some amendments in the existing guidelines.

Under the Prevention of money laundering (Maintenance of Records) Rules, 2005, KYC is a vital part when it comes to onboard the customers. The regulations make video verification vital for the digitization and automation of the current KYC norms. For the same, in February 2016, master guidelines were released.

The following are some of the amendments in RBI:

- To build an account-based relation with the customers, a live Video-based Customer Identification Process (V-CIP) should be carried out by the official of the Reporting Entity (RE).

- A clear picture of the Permanent Account Number (PAN) card shall be captured that would be displayed by the customer during the verification process.

- A live location of the customer should be captured to ensure the physical presence of the customer in India during the verification process.

- It is the responsibility of REs to ensure secure video storage that stores the time stamp and date as well.

- All the activity logs which also contain the official credentials while performing the V-CIP, should be protected.

- REs are encouraged to employ the latest available technology which includes Artificial Intelligence (AI) and facial recognition (face matching) technologies to ensure honest verification and keep intact the process integrity.

- The BCs can facilitate the customer identification process at the customer end only whereas the official one would be at the other end of V-CIP interaction which should be necessarily a bank official.

- All the details of BCs who are assisting the customer should be maintained by banks. The responsibility of CDD will ultimately be with the bank.

Relief for financial firms – In COVID 19

Among all the hype of COVID-19, major business transformations can be seen. The banking industry has to revamp the digital banking services to establish a secure and running program for the customers. The increasing digital frauds and financial crimes call out for the stringent identity verification methods. The financial firms have got relief with the latest convenient method of customer verification in the form of video KYC that could help them cope up with the situation smoothly from all aspects.

Video KYC – Swift and convenient solution

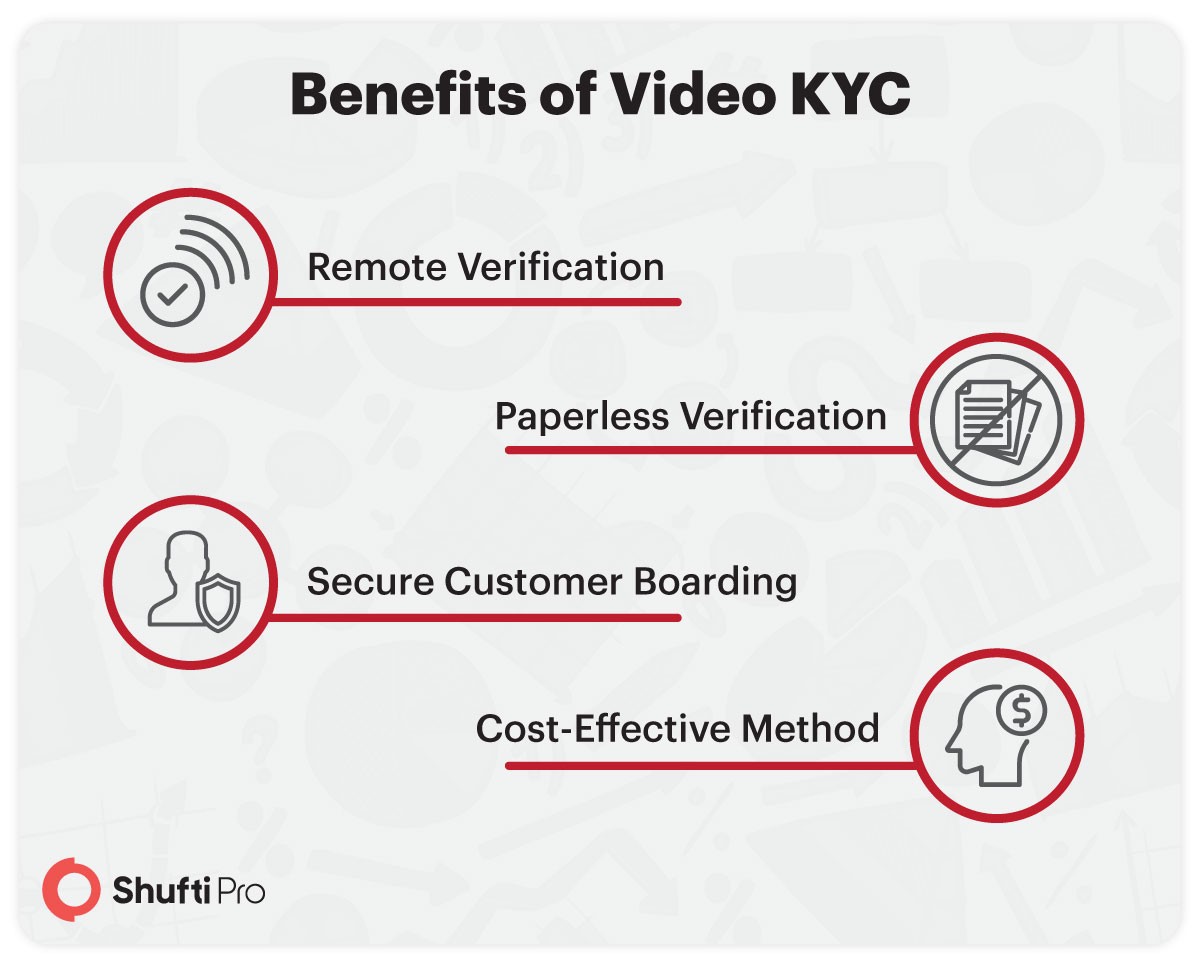

Video KYC is a quick and convenient process in which all the traditional verification methods are replaced with a video verification by a KYC expert. It is a secure method that helps the banking industry, particularly the Fintech businesses in attaining a clean customer base. Another benefit of Video KYC is that it helps businesses comply with the KYC and AML regulations with easy and secure customer acquisition.

Explore Now

Explore Now