Bitcoin ATMs – how it works and KYC compliance

Bitcoin ATMs are everything an ATM is and isn’t.

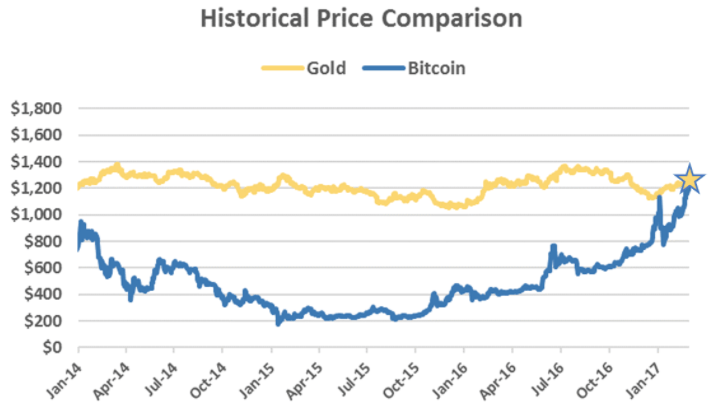

The world of finance and banking has changed drastically in the past year. The surge in ICOs, cryptocurrency; Bitcoin, and more is talk of the town. Every entrepreneur and investor is talking about it. While it emerged as a risky investment, it’s currently the most sought after online currency. The concept of Bitcoin has readdressed the standards involved in Fintech. As more and more officials are putting their faith in employing Bitcoin in daily exchanges and transactions, won’t be long till governments have to accept it as a valid currency. Crypto has opened up possibilities of revenue generating and capital market. Seeing the ambiguous state of world economy, coin based ventures are gaining more sure footing. The world’s first Bitcoin ATM can be tracked to Vancouver, Canada. Read: World’s First Bitcoin ATM

Bitcoin is gaining immense popularity, Baidu, China’s Google, was the first high profile case of Bitcoin acceptance as money. More and more corporate giants are turning to it.

As Richard Brown, IBM, has said, “…I believe they are going to change the world”. You know what? He’s right!

How it works:

Bitcoin ATMs are like regular ATMs but with a slight difference – instead of giving out money, they accept it. As bitcoin is a virtual currency, you can’t really withdraw it. The ATM itself only accepts cash and adds your bitcoin to a digital wallet (supervised under your credentials). The interface presents you with different payment scales on which you want to buy the coins. Once you have selected a desired number, the ATM asks for user identity verification. This is normally done through presenting an ID card in front of the camera. Now, this is the tricky part and we will discuss it further in the article.

Coming back to the transaction process, once your verification completes, the ATM asks you where you’d like to store the coins. Its either done by scanning your digital wallet or manually typing the address. Once this is done, the machine asks you to deposit the money manually through a slot underneath. With an average time of ten minutes, the transaction is processed and coins appear in your wallet. Makes sense? While the process looks swift and efficient. There’s one element that defines its efficiency. And that is the verification process. It can be as detailed as possible or done in a second.

Coming back to the transaction process, once your verification completes, the ATM asks you where you’d like to store the coins. Its either done by scanning your digital wallet or manually typing the address. Once this is done, the machine asks you to deposit the money manually through a slot underneath. With an average time of ten minutes, the transaction is processed and coins appear in your wallet. Makes sense? While the process looks swift and efficient. There’s one element that defines its efficiency. And that is the verification process. It can be as detailed as possible or done in a second.

An efficient identity verification interface that performs KYC and ensures reliability of end users is the key here.

Bitcoin ATMs and KYC compliance

Bitcoin ATMs have been recognized as legal money transmitters in major parts of world. While they were off radar for along time, the government agencies and corporations have finally turned their attention towards them. The Financial Crimes Enforcement Network (FinCEN) is a body established within the United States treasury. It has published a guide which outline the standards and regulations involved in running of virtual currencies. Under these guidelines the virtual currencies are to integrate Anti Money Laundering (AML) and Know Your Customer (KYC) verification features with the interface. This standard was developed seeing the rising cases of scams and fraudulent activities in Bitcoin businesses.

Here’s how you avoid the problems but reap the benefits:

As is evident from the text above, the beneficial quality of Bitcoin ATMs relies on the accuracy of their verification process. The more detailed and secure yet speedy it is, the better the results will be. Shufti is a SaaS that serves this very purpose.

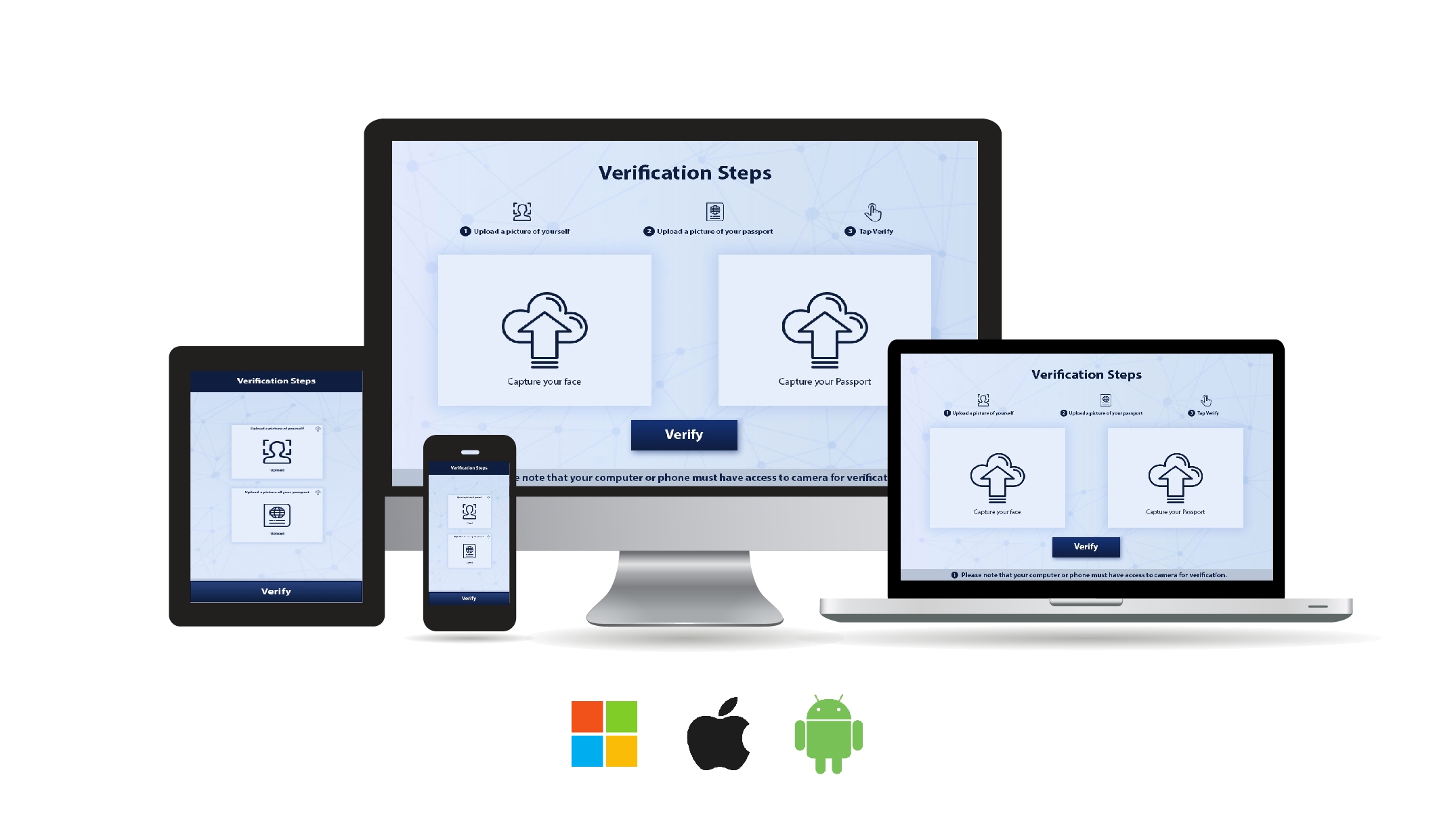

Before you get confused, simply put: it is an online service that provides digital ID Checks and documents verification. ICOs and banks integrate it with their systems. Before any transaction can be attempted, the user has to complete a verification process. It involves presenting your face for image capture via Still Verification (uploading a picture), live image via webcam or a video recording of facial identity. All this depends on the requirements of the ICOs, banks or users. The Shufti system uses AI and HI to determine the authenticity of images or documents. Results are stored in a back-office to which clients are given access beforehand so they may have a record of their users.

still verification

Currently, a number of global entities are enjoying this service.

CEO Goldmint ICO has said, “Cooperation with Shufti will allow GoldMint to adhere to its main principle: to comply with the legislation of the country in which the company operates. We opened an office in Estonia (EU) to work with the demand for GOLD tokens in the euro area. Local legislation involves the verification of users (KYC) with a turnover of more than 1000 euros per month. Shufti will provide such verification for GoldMint. This is important for our company as we are confident that the GOLD will generate considerable interest among many large buyers. At the same time, user verification is another proof that blockchain technology can be used in legal and large businesses. We are sure that cooperation of GoldMint and Shufti will contribute to the process of adaptation of new technology by traditional companies.”

As we are moving away from traditional currency and payment methods, the requirements and standards of financial technology are changing as well. It only makes sense to accommodate them. The cryptocurrency revolution is in it thriving phase. Using mediums such as Shufti to enhance this experience is just good business.

Explore Now

Explore Now