5 Ways Facial Biometric Technology Elevates Customer Retention

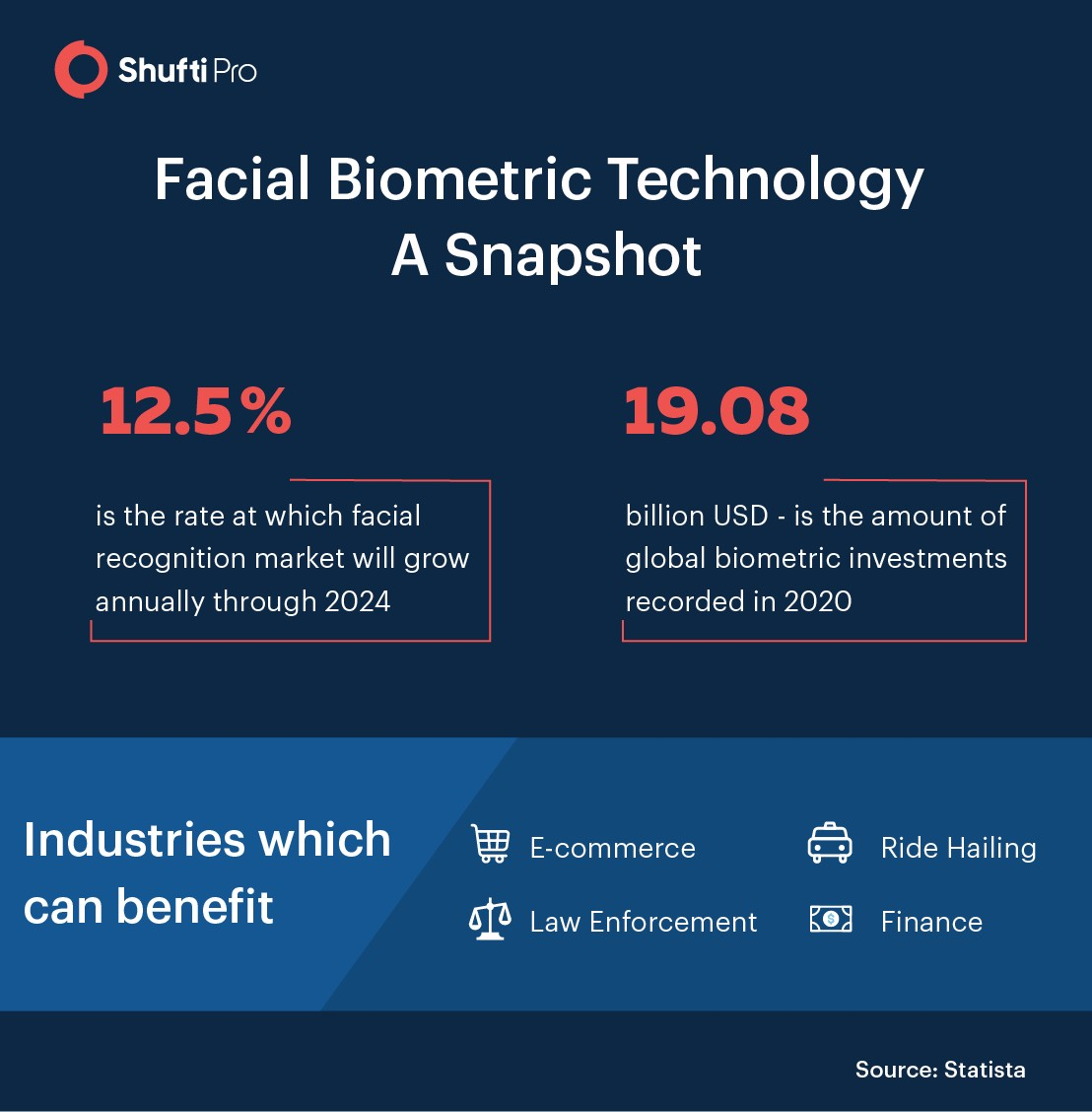

Today, biometric technology is known for its ease of use and reliability. Facial biometrics have become an active expansion in many industries, generating $4.84 billion in 2020. With advances in technology over the past few years, facial recognition systems have become intelligent as they contribute their fair share in assisting online businesses for onboarding customers and law enforcement agencies to prevent crime.

Customer retention is of utmost importance when it comes to enterprises or startups. Delivering a good experience to the customer builds that all-important trust and brand loyalty which help businesses in the long run. Facial biometric solutions provide users with an effortless method to carry out their tasks, and with confidence.

What is Facial Biometric Technology?

Facial biometric technology has the ability to map a person’s facial features into digital form. It not only identifies the face attributes but also provides a mechanism to authenticate them. By using algorithms based on artificial intelligence, facial recognition solutions provide an in-depth analysis of a user’s identity.

Customer Retention for Enterprises

For businesses, a strong customer base is what drives the revenue and sales of a product or service. Understanding the needs and creating easy and effective solutions for your target market is the key innovator for success. One thing which early startups and enterprises should consider is that retaining previous customers is as important as acquiring new ones, since it takes up to 5 times as much effort in the previous case.

The good thing about existing customers is that they are already familiar with a company’s products and have a certain inclination towards the services it offers. Investing in customer retention can provide better opportunities to understand their needs and provide tailored solutions, giving them lesser reasons to abandon the service.

5 Reasons why Facial Biometric Technology is Essential

Automated and Efficient Solutions

Manual verification of customers is a thing of the past. The process acquired ID information from the customer using cumbersome and tedious methods that took long waiting hours. Apart from that, human error was another rock in the path when it came to efficiency. Keeping a track of the verifications and managing them on time was another hassle.

Now with intelligent solutions in place, companies don’t need to worry about delayed operations. Facial biometric technology automates the process of identifying users with the minimum possibility of error. It allows customers to interact with a business better and save valuable time, offering convenience as compared to earlier procedures. It also saves enterprise the cost and effort of investing in employees and experts for customer identification.

Turning the Tables on Bad Actors

Identity thieves don’t miss an opportunity, do they? By stealing the facial identity of legitimate users on the internet, they use it for their malicious purposes. Between 2019 and 2020, online identity theft was reported at almost 5.1%, which is still an alarming number for both businesses and customers alike. Fraudsters employ a lot of different ways to trick recognition systems into believing they are the right user. This makes it increasingly important for companies to eliminate fake identities using a robust defence mechanism.

Even though criminals have become sophisticated by using deepfakes, photoshopped images, and replay attacks, artificial intelligence has helped facial biometrics to get even better. Intelligent solutions for face verification analyse fine details on a person’s face and then create a faceprint against it. The mapped image is then matched against a database of suspicious identities which helps in taking down facial spoof attacks. Online businesses can use a robust facial recognition solution to keep false identities off their platforms and develop a good market reputation, eventually retaining their customers.

Easy Integration and Security

These days, users prefer businesses which offer them convenient solutions under a safe haven. Facial biometric technology aligns best with the idea of customer security, which is directly linked with retention. Most companies simply integrate a facial recognition software with their existing security systems and don’t have to worry about it again. But how does it help the business? The company does not need to develop its own solution for facial biometric verification and save on those expenses. This way, enterprises can both offer a sense of security to their customers and cut on administrative costs.

Contactless and Quick Onboarding

Today, when social distancing is a common practice, contactless solutions have become a necessity. Online businesses can use facial biometric technology to streamline their Know Your Customer (KYC) process to quickly onboard their customers. Facial recognition solutions verify a user in seconds without the need for a physical verification. These days, the job is done through smartphone cameras which are a good source of contactless facial verification. Apart from this, users need not worry about potential loopholes in fingerprint identification like dirty hands, etc.

Read more: Speed Up Customer Onboarding with Online Facial Recognition

Accurate Verification of Identity

The success of a facial biometric solution greatly depends on the level of accuracy it provides. Thanks to advances like 3D facial recognition, customer identity can now be accurately verified in real-time. With new and improved solutions for facial recognition, online businesses can ensure that the person behind the camera is not holding a paper image of a face or performing a replay attack. With facial biometric technology, enterprises can onboard real and legitimate customers in a secure and trusted environment.

Shufti Face Verification

Today, online businesses face a constant threat of identity theft which directly affects the customer experience. Face verification by Shufti offers enterprises an active defence against a wide array of facial spoof attacks including 3D masks, hyperfaces, eye-cut and paper-based photos. The solution takes into account mapping algorithms based on artificial intelligence to quickly verify a person’s identity.

Shufti Face Verification comes with liveness detection and 3D depth sensing which analyses micro-expressions and skin texture to deliver accurate results. Face verification solution makes the onboarding process effortless and reliable, and helps online businesses retain their loyal customers by keeping fraudsters at bay.

Explore Now

Explore Now