Affiliate Fraud Detection | How to Prevent it in 2024

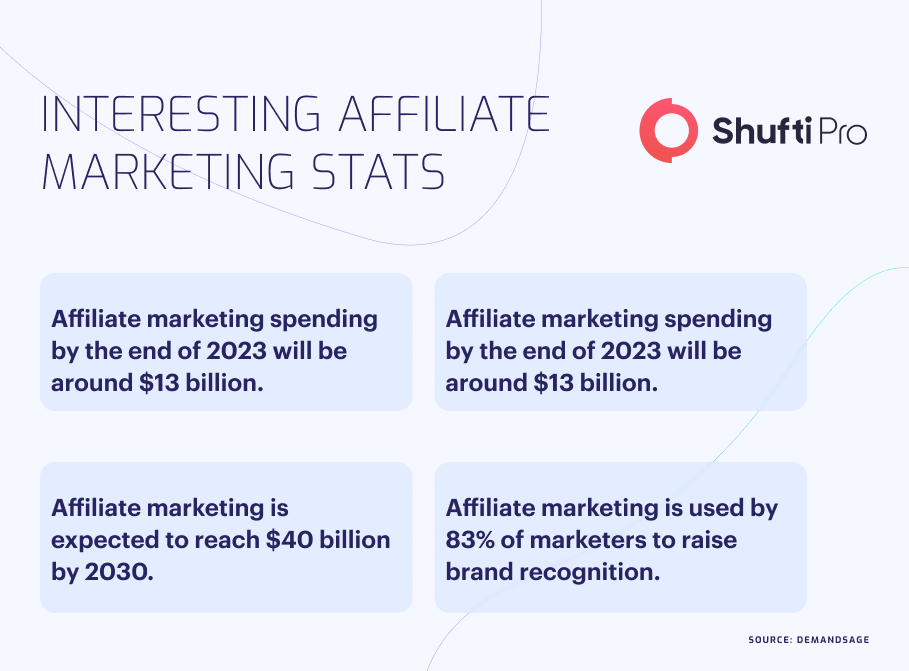

Affiliate marketing is growing at an exceptional rate, worth $17 billion by the end of 2023, and brands are using it as a tool to increase the return on investment. Nonetheless, with the opportunity of earning high and partnering up with companies to earn a commission, affiliate programmes make brands or businesses vulnerable to fraudsters and scammers. It is reported that in 2020, 10% of affiliate traffic was fake, either from bots or fraudsters. After two years, in 2020, fraudulent clicks accounted for 17% of affiliate traffic and resulted in an estimated $3.4 billion loss.

The need for affiliate fraud detection is increasing with each day passing. The dishonest practice has spread more widely and is still causing significant financial losses for companies all around the world. Fortunately, organisations can identify affiliate fraud in real-time with the aid of advanced tools. Recognise affiliate fraud and efficient techniques for detecting it.

What is Affiliate Marketing?

Affiliate marketing is a form of performance-based marketing where a company pays one or more affiliates for every new customer or visitor they bring to their site. The pay-per-performance aspect of affiliate marketing is what excites me. It guarantees that companies don’t waste money needlessly and only pay for genuine results. These can take many different forms, such as cost per install (CPI), cost per lead (CPL), cost per action (CPA), cost per click (CPC), and other comparable metrics.

Affiliate marketing fraud is a serious issue that affects all types of industries. Fraudulent activities can include fake impressions, fake clicks, to sophisticated tactics like ad injection or cookie stuffing. These malicious activities result in wasted ad spending, inaccurate or misleading data, unnecessary friction, delay, and lower conversion rates. For instance, fraudulent clicks might manipulate the number of conversions, making it challenging for companies to assess the effectiveness of their campaigns. Similar to this, ad injection can cause inappropriate and unapproved advertisements to appear on websites, undermining the legitimacy of the brand. To reduce the risks connected with affiliate marketing fraud, it is crucial for organisations to put strict fraud detection and fraud prevention systems in place.

The Menace of Affiliate Fraud

Affiliate fraud is an illegal act aiming to earn commission unethically. Fraudsters employ a variety of dishonest tactics, such as obtaining wrong leads and delivering bad traffic that ultimately leads to spam clicks or unjustified sales credit. In addition to unfair rewards for scammers, this will cost real affiliates and companies money, harm their brand’s reputation, reduce their return on investment, and force them to permanently leave the marketing and business sectors.

Affiliate Fraud Detection Techniques

Affiliate fraud is not a single thing; it takes many different forms, which makes it difficult for companies to identify and stop. Fraudsters frequently take advantage of the affiliate marketing system in the following ways:

Click Fraud: Fraudsters use proxies or VPNs to create a huge number of click events by deploying automated bots that mimic human behavior. This can lead to high conversion rates being pushed down or CPC budgets being completely depleted by bad-quality leads. More sophisticated anonymous IP addresses are being used by bad actors to create false conversions.

Cookie Stuffing: When a user visits a fraudulent website, cookies are immediately dropped onto their browser. When the customer purchases something from the advertising, the fraudster gets paid a commission. Since the majority of affiliate programmes have included cookie-stuffing protection, fraudsters have had more difficulty executing this tactic.

Content Duplication: Scammers frequently copy the content of a successful, real affiliate and then trick search engine optimisation into driving traffic to their copied website.

Data Theft: To create bad leads, fraudsters utilise lead forms or malware to obtain user data from online breaches, including credit card and billing information, as well as other forms of personal data. By using a dark web API, advertisers may determine whether their leads have been combined with stolen data.

Click Spoofing: It is the practice of fraudulently causing invalid click events even in the absence of user interaction, which results in unjustified commissions when the user subsequently completes a transaction.

How Common is Fraud Using Affiliates?

Affiliate fraud is thought to cost companies more than $1 billion annually. Whilst that is a sizable amount, it is insignificant in comparison to the annual tab for ad fraud, which exceeds $120 billion. A closer look at the affiliate marketing data does help to clarify matters.

For 40% of the US retailers and many more globally, affiliate marketing is their preferred method of acquiring new customers. Considering that the US e-commerce business is currently valued at over $800 billion, the affiliate marketing industry appears to be in a positive light. Not that affiliate fraud isn’t a problem, although it is an overwhelming one. The most crucial thing is that companies make sure their software is safeguarding them against affiliate fraud and take it seriously.

Detecting Affiliate Marketing Fraud

Monitoring Traffic and Conversions

An essential component of combating affiliate marketing fraud is tracking traffic and conversions. Marketers are able to detect suspicious activity or anomalies by closely monitoring the origins and patterns of incoming traffic. For example, if there is an unexpected spike in traffic, it may be a sign of fraudulent activity like click farms or bot traffic.

Furthermore, by keeping an eye on conversions, one can identify any disparities between the number of clicks and the actual conversions, which may indicate instances of fraudulent transactions. Marketers can protect their campaigns from affiliate marketing fraud and improve the performance of their tactics by closely observing traffic and conversions.

Analysing Affiliate Behavior

Fighting affiliate marketing fraud requires a thorough analysis of affiliate behaviour. Businesses can spot clues of possible fraudulent activity by regularly monitoring affiliate behaviour.

One indicator to look out for is a sudden spike in affiliate registrations from a specific area or IP address. Affiliates who have an exceptionally high conversion rate or persistently low return rates could also be involved in fraudulent activities. Businesses can take proactive steps to reduce the risks connected with affiliate marketing fraud by analysing patterns and anomalies in affiliate behaviour.

Leveraging Device Fingerprinting

Device fingerprinting is the process of generating unique IDs for each visitor’s hardware and software combinations in order to identify any suspicious activity. For example, if a configuration is consistently found on your website, it may be a sign of an effort at multi-accounting, which is a popular fraud tactic. Risky behaviour such as virtual devices, emulators, GPS spoofing, and device resetting can also be detected by device scoring.

Monitoring Traffic Quality

One of the most important steps in identifying affiliate fraud is monitoring the quality of the traffic. An accurate picture of the users an affiliate brings in and the proportion of visitors who successfully complete the conversion stage—such as registering, submitting a form, or making a purchase—can be obtained by analysing the traffic source and recording affiliate IDs.

Since most fraudulent clicks are produced using an anonymous IP, avoiding high-risk clicks requires the use of a proxy detection tool. VPN detection is comparable to screen traffic in that it can detect techniques used to disguise one’s location.

Secure Affiliate Marketing with Shufti

Tools for detecting fraud are essential for protecting affiliate marketing initiatives against possible fraud. Detecting and preventing fraudulent transactions is made easier by these solutions by offering insightful information and analysis.

Shufti‘s affiliate fraud detection ensures data accuracy and efficiency in real-time. Whilst upholding compliance, we provide affiliate fraud detection and standardisation. Our solution for detecting affiliate fraud keeps accuracy and compliance at 99.97%.

Confused about how to verify affiliate marketing and maintain stringent jurisdiction compliance in 2024?

Explore Now

Explore Now