How to Create a Wow! Fraud Prevention System with Shufti

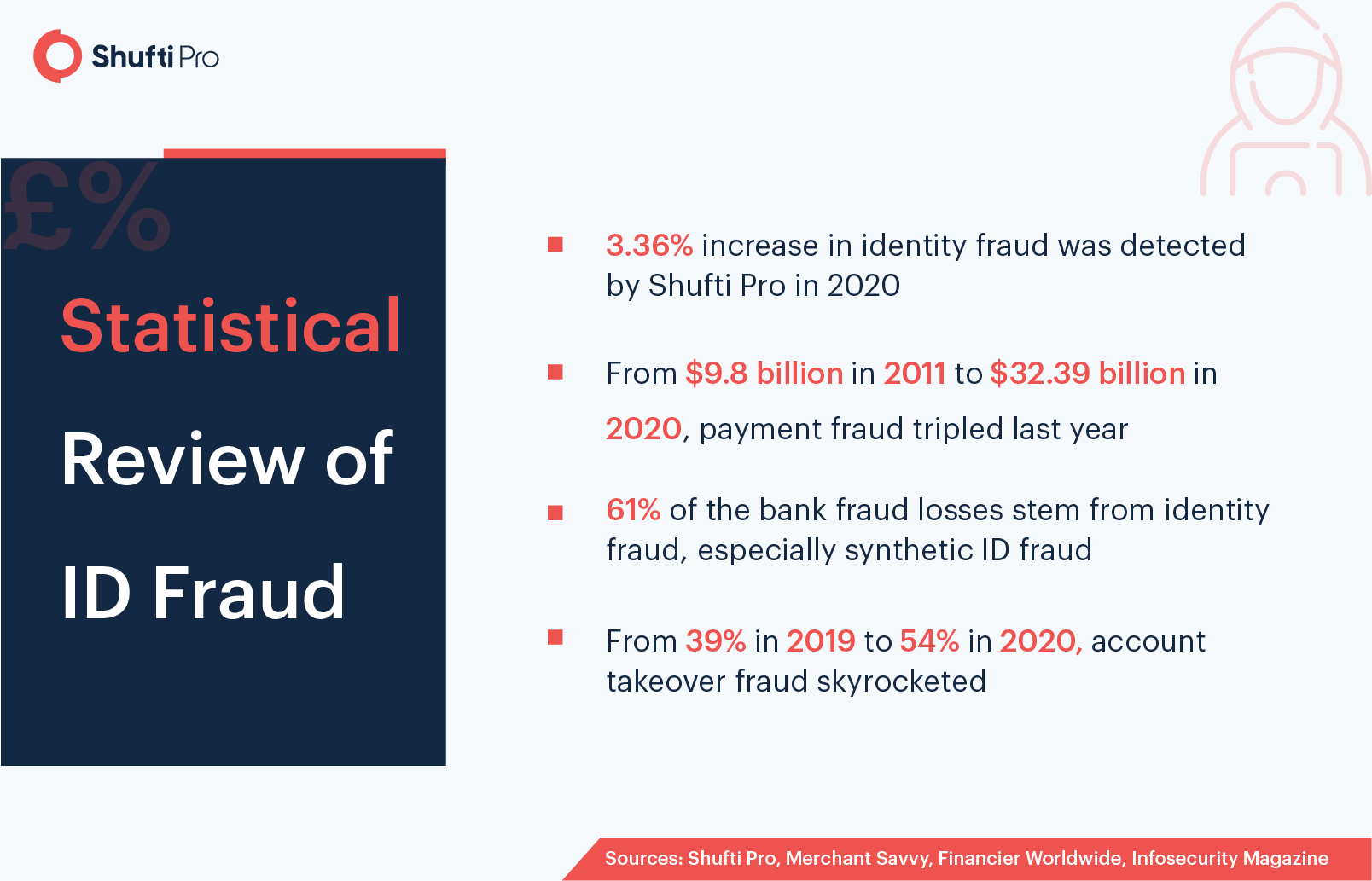

The ever increasing threat of identity fraud skyrocketed when the coronavirus pandemic struck the world. While everybody was figuring out ways to stay safe, fraudsters were planning their next move for achieving illicit goals. Shufti’s Global ID Fraud Report 2020 revealed that the identity fraud rate increased by a whopping 3.36% in 2020. The staggering numbers are not going to reduce or stabilize anytime soon according to our experts. Banks, non-banking financial institutions, FinTech companies, gaming platforms, crypto exchanges and various other sectors are at risk of identity theft, synthetic identity fraud, account takeover (ATO) fraud and more. What can be possibly done to stop this surge of digital crime? The simple answer is a robust fraud prevention system that can protect businesses against multi-faceted fraud.

Building a strong fraud prevention system may not be as easy as it sounds but Shufti is there to help. We can help you in structuring a suitable system that can secure your company from the terrifying identity fraud predictions of the year.

What is an ID Fraud?

ID fraud or identity fraud refers to the illegal use of one’s identity. Fraudsters use multiple means of stealing personally identifiable information (PII). They can use the details for opening fake bank accounts for criminal activities. Imposters also use pieces of stolen identity and combine them with fake details to develop synthetic identities which are difficult to capture due to fragments of true information in them.

How ID Fraud Threatens Businesses

Identity fraud may not sound like a big deal but every year, fraudsters take away a lot from businesses. Financial loss is just one to name here. Unfortunately, one of the ways to commit ID fraud is data breach, so companies are at constant risk of losing sensitive data. On the other hand, business email compromise (BEC fraud) is another threat to businesses. All these frauds lead to the following major problems for the corporate sector:

- Lawsuits may be filed by customers upon losing information

- Brand reputation is severely damaged

- Recovering from such losses gets nearly impossible

- Customers lose trust and the firm is likely to see a drop in revenue

Recommended: On-Premises Identity Verification – A Solution to Prevent Data Breaches

Fraud Prevention System with Shufti

In the fight against identity fraud, you have to gear up with the perfect system that can identify, assess and mitigate the risk of fraud in the blink of an eye. Let’s take a look at how you can equip yourself with a robust fraud prevention system with Shufti.

KYC – Identity Verification During Onboarding

Know Your Customer or KYC verification has marked its vitality over time. According to a report from the Association of Certified Fraud Examiners, businesses lose approximately $3.5 trillion every year to fraudsters. The major chunk of this amount comes from ID frauds. Thanks to KYC identity verification protocols, companies can now identify imposters right at the time of onboarding. After registration, digital identity verification helps in validating the government-issued ID documents along with some liveness detection checks.

Do you know Shufti KYC ensures 98.67% accuracy of verification results?

Ongoing KYC = Ongoing Fraud Prevention

Also known as the perpetual KYC, the ongoing identity verification solution gives you a chance to regularly monitor all your customers. What if you onboarded a legitimate customer but they become your worst nightmare afterwards? As scary as it sounds, the ongoing KYC system will update every end-user profile at regular intervals or after a trigger event. These are a few reasons why ongoing KYC is the need of the hour:

- Your customer has switched to a high-risk jurisdiction

- The company’s beneficial owner has changed

- You onboarded a low-risk customer who is now on a global watchlist

Suggested: Multi-Tier Security – Another Line of Defense Against Bank Account Scammers

Facial Biometric Authentication for Secure Logins

Secure all the logins with biometric authentication. It takes a few seconds to log in an account with a selfie. Not only will your end-users enjoy logging in for verification but you can also make sure the right customers are accessing the system. Make unauthorised access impossible and keep every ID fraud at bay.

Searching for More Robustness? How About NFC Verification

In the digital world we live in, criminals also have access to advanced technology. They can crack codes, decipher the most secure passwords after a little struggle and gradually, they are targeting the corporate sector with astonishing methods. Why should businesses stay behind in the continuously evolving world. To increase the robustness of the ID verification system, what could be better than using NFC-based identity verification? More than 20% of smartphone users have access to near field communication. With time, the number is going to increase. So, NFC verification will come in handy.

Verifying identities is just a tap away along with the highest possible accuracy of the process. Here’s the process of NFC verification:

- The end-user shows the chip-based ID document to the camera and our system captures all the data

- Now, the customer taps the ID document on the phone (NFC-enabled)

- Data extracted from the chip is cross-matched with the information on the document and voila! You have onboarded a legitimate customer

Are You Ready to Prevent ID Fraud with Shufti?

So you see how easy it is to structure a fraud prevention system with Shufti. Gone are the days when manual ID checks and screening against domestic watchlists was the only means of fraud prevention. With artificial intelligence and machine learning, there are several ways for businesses to steer clear of identity thieves.

In a nutshell, criminal activities are not going to end but you can protect your firm from them with a top-notch fraud prevention system. Perpetual (ongoing) KYC, biometric authentication and NFC verification are just a few methods or layers of security. Our experts can guide you with a couple of more solutions so your organisation can combat fraudsters effortlessly.