Age Verification: Use Cases, Significance and Regulations

This pillar post talks about the significance of digital age verification, how it works, what are different rules and regulations regarding minor protection in different parts of the world, and its use cases in various industries.

Easy to access digital services and products is commonplace these days. According to a survey in 2015, almost 1.46 billion consumers bought goods over the internet, and the number is expected to rise by 46% by the end of 2021. In the current setting of the COVID-19 pandemic, people are moving towards cashless payments and prefer to shop more online to practice social distancing. Where the influx of numerous customers creates better opportunities for online businesses, it also creates a number of challenges.

Today, in the digital space, minors have easy access to age-restricted content over the internet. In the offline world, where minors are not allowed to enter an alcohol or tobacco shop, buying goods online is a completely different story. According to Javelin Research Group, more than one million minors in 2017 fell prey to online identity theft resulting in a $2.6 billion loss with almost $540 paid by the families.

In 2017, almost a million children were a victim of identity theft, says Business Insider. Since children are vulnerable to violent and adult-exclusive services, and due to the rise in their demand, verifying age becomes increasingly important.

- What is Online Age Verification?

- Digital Age Verification vs Manual Age Checks

- How Digital Age Verification Works

- Global Age Verification Regulations

- Age Verification in the UK

- Age Verification in Europe

- Age Verification in the USA

- Age Verification in Australia

- Industry Use Cases of Age Verification

- Risks of Lacking Age Verification Checks

- Conclusion

What is Online Age Verification?

Online Age Verification is a mechanism to protect individuals and audiences from consuming digital content and services not appropriate for their age. Merchants of age-restricted products have the responsibility to sell their services only to people above the legal age. For online businesses, it is important to know the age of their users, and digital age verification provides a feasible solution. It provides a safe and secure channel for minors to perform online activities, and keep the regulatory compliance intact.

Age verification solutions not only help to deliver the right content to consumers but are also a good bet when it comes to business entities. Age verifiers help limit underage access to non-consenting transactions which result in chargebacks from parents. The presence of a digital age verification system prevents this from happening since it encourages adults to use services catered for them and limits children.

Digital Age Verification vs Manual Age Checks

Since the advent of adult-oriented services, verifying age has become a common practice. Tobacco and alcohol stores do not allow minors to enter since it is illegal for them to buy and consume these products. According to regulations by the Food and Drug Administration (FDA), the minimum age for buying and selling of tobacco products is 18. The restrictions on these products make it illegal to sell them to underage minors. These laws can perfectly work in an offline store where the physical presence of a person makes it easy to assess their identity and age. When it comes to online stores, the problem becomes more challenging.

Without a doubt, the same minor protection rules are applicable to digital businesses as that on a physical store. The situation becomes alarming when it comes to the digital space because most vendors just ask for a username and password to provide access to their services. There is an immense need to protect minors from engaging in these platforms since consuming these products can have a bad influence on them. On the brighter side, online age verification methods have seen a constant evolution with the advent of intelligent solutions.

Today, knowing the proper age of a customer has become relatively easier with the development of biometric technology and intelligent solutions for identity verification. Today, secure age verification solutions are backed with AI and machine learning to smartly identify if a person behind an account is a grown-up or a minor.

How Digital Age Verification Works

Age Verification solution by Shufti helps businesses onboard legitimate customers for login and transaction authentication while saving them from fraudsters and preventing children from being a victim of identity theft. Shufti’s online age verification process consists of four steps which are listed below:

Submit Date of Birth

The end-user submits details including name, and date of birth through an online form provided by the system.

Upload Document

The user uploads a photo of an identity document such as a government-issued ID card, driving licence or a passport and submits it for verification.

Extracting Identity Credentials

The age verification solution extracts relevant details like the date of birth and name using OCR and performs document authenticity checks.

Verification and Dispatching Results

Upon successful verification of the details and document originality, the secure age verification procedure is complete and the end-user is verified or declined on the basis of the provided age verification threshold.

Shufti’s age verification solution is driven by artificial intelligence and cross-checked by human experts. Our services also help online businesses comply with global age verification laws such as the GDPR, FFDCA, NVP, COPPA and the Gambling Act of UK.

Shufti age verification service is approved by the German regulator KJM by cross-checking against legal and technical requirements. This shows that the solution provided by Shufti is reliable for media distributors in Germany to perform age verification.

Global Age Verification Regulations

Legal approaches towards secure age verification vary with respect to different regions of the world. But, all of them focus on parental control and minor protection guidelines. The primary purpose is to make parents aware of appropriate services for their children and obtaining their consent. This section discusses various age verification regulatory frameworks for major countries.

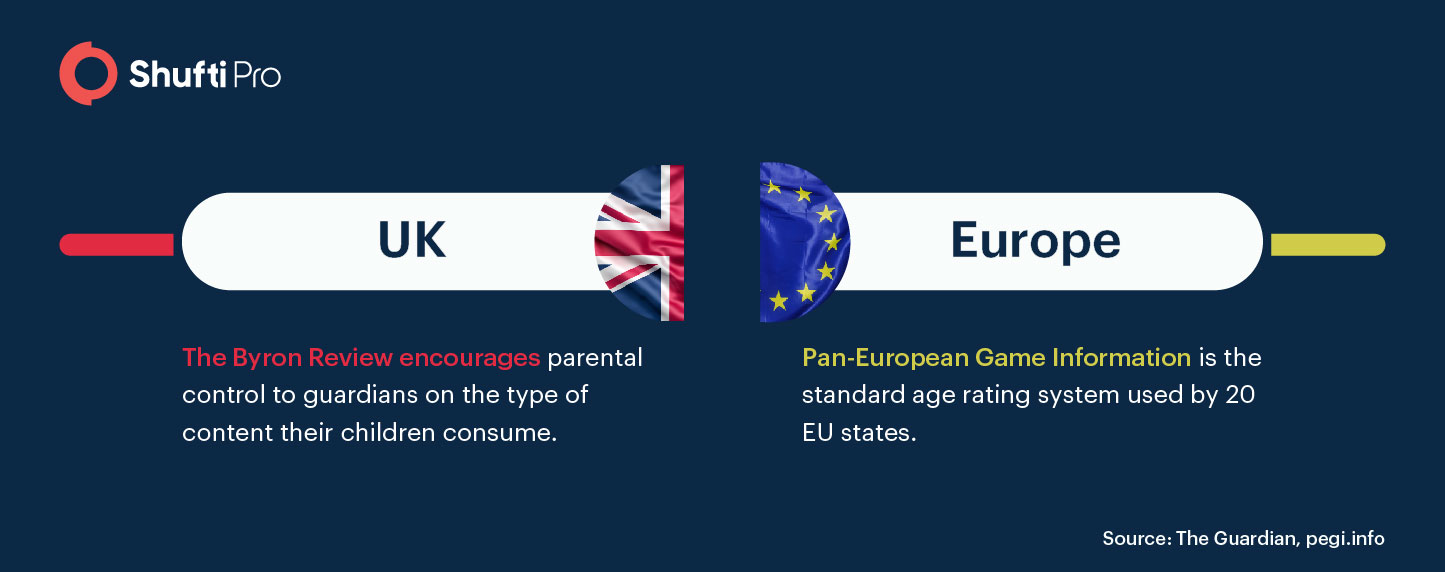

Age Verification in the UK

The UK government in 2017 made a resolution to make the country a safer place for children. In recent years, new laws came into effect to limit easy access to age-restricted products and services. Age verification in the UK became streamlined with the advent of the Digital Economy Bill. The purpose of this law was to restrict the consumption of content inappropriate for younger audiences more effectively.

A study by the British Board of Film Classification (BBFC) shows that 82% of AO-websites do not provide any type of age barrier, and 89% of them which did, allow access with just the click of a button. The Byron Review approved in 2008 focuses on restricting potentially harmful content by service providers on commercial platforms. It focuses on providing e-safety, and parents with a sense of satisfaction about their children engaging with new technology.

The online age verification provider, interactiveAgeCheck (iAC) responsible for minor protection was developed by CitizenCard which is the UK’s biggest photo-ID and age verifier organization. It takes into account the recommendations by the UK Council on Child Internet Safety (UKCCIS) which reports directly to the Prime Minister about the status of minor protection in the country.

Age Verification in Europe

The General Data Protection Regulation is issued by the European Union and applies to citizens living in the EU states. It states guidelines for the collection of personal data of consumers including biometric, health and genetic information. The GDPR’s Article 8 allows the age of consent to be set between 13 and 16 by the member states. This means that anyone in Europe over the age of 16 is legally allowed to consume age-restricted products and services.

Another age verification framework known as the Pan-European Games Information (PEGI) is the age classification system for the gaming industry in Europe. Used by 20 out of the 27 EU states, it is approved by more than 200 industry members.

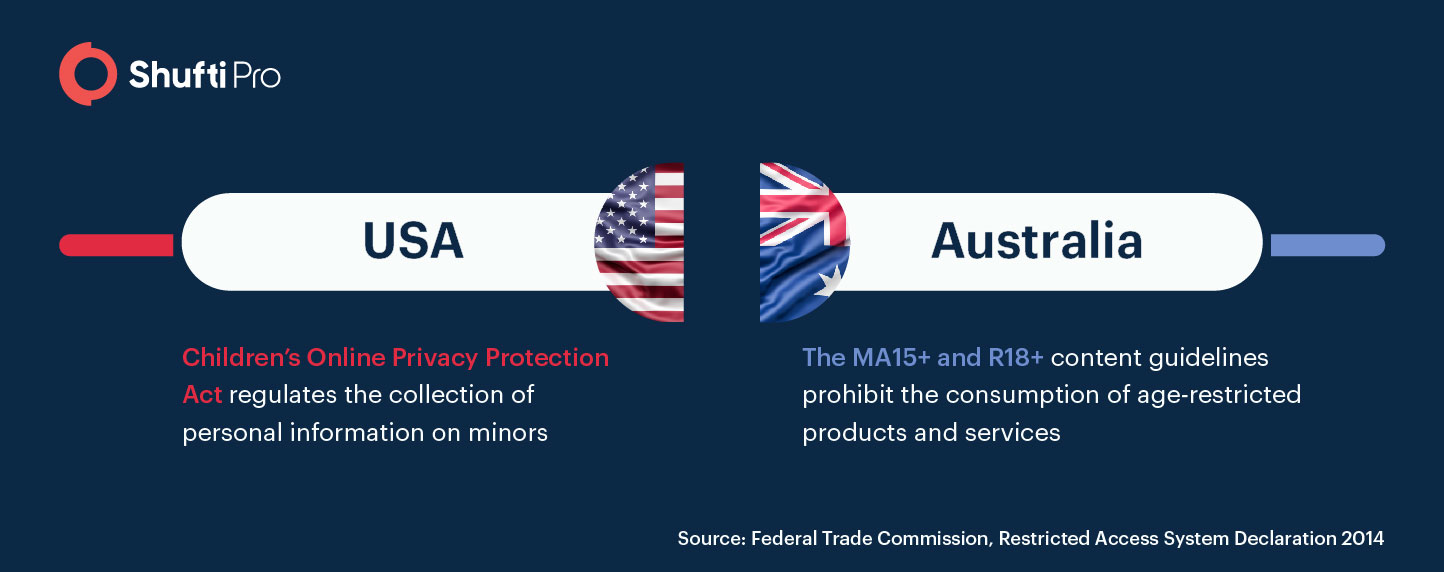

Age Verification in the USA

The Federal Trade Commission’s minor protection law, COPPA, also known as the Children’s Online Privacy Protection Act is one of the most significant laws for online child safety in the United States. It determines how companies collect and process information related to children below 13. Complying with these regulations are not only limited to displaying age-restriction warnings or integrating an age verifier which can be easily avoided by clever minors with the click of a button and lying about their age.

The Cellular Telecommunications and Internet Association issued guidelines on restricting carrier content not suitable for younger audiences. It defines different content rating standards so that parents can know what is suitable for their children and what not. According to CTIA, for each content provider in the industry, age verification mechanisms are essential in determining the type of audience for their services. By using internet access controls provided by major carriers, consumers can limit access to specific websites using filters or completely block them to protect minors from viewing inappropriate content.

The Master Settlement Agreement which came into effect in 1998 restricts marketing of tobacco products and services to the public audience which also includes underage minors. Tobacco companies, according to this law, are bound to age verify a customer before selling them products or marketing their services. The motion picture industry in the US has also developed a set of standards to regulate the viewership of violent and AO-content. Production studios like Sony, Universal and Paramount provide an age-restriction warning in the form of a red-band trailer for mature audiences.

Age Verification in Australia

The Australian Communications and Media Authority (ACMA) in 2008 published new guidelines to prohibit access to age-restricted content under the MA15+ and R18+ content rating standards. These regulations are applicable to anything aired from Australian media or hosted on TV channels within the country. The Broadcasting Services Act of 1992 played a vital role in the development of this regulatory framework.

Corresponding to the Restricted Access Systems Declaration of 2007, these rules address content providers to take adequate measures for age verification. For each content rating group, these rules provide a different set of standards for consumer verification. The MA15+ guidelines require:

- A warning message that this content is MA 15+

- Safety information for parents to protect their children who are below the age of 15

The R18+ guidelines address the following concerns:

- Warn about the risk of using proof of age by another person or someone who is not eligible according to their age

- Take into account which evidence is provided and how it is presented

Industry Use Cases of Age Verification

Online age verification is widely used across many industries because of its significance in delivering age-oriented services to proper audiences. To highlight the importance of age verification solutions, its use cases in different industries are listed below:

Age Verification for E-Gaming

The eSports industry is worth 776.4 million US dollars and is estimated to top $1.6 billion with the end of 2023. According to Newzoo, there are almost 2.7 billion gamers around the globe and the number is growing exponentially. Where the gaming industry is home to millions of players, it has its fair share of challenges. Providing age restricted games to the appropriate audience is significant since they can negatively affect children.

Poker

A form of gambling, also called poker, is an online game which is played with cards. Because of its appealing nature and the ability to make instant money, e-betting and gambling are widely popular. The total revenue of the industry is around 647.9 billion US dollars and will increase at a rate of 5.6% from 2022-2027. Unfortunately, many minors also engage in these platforms to throw some cards to win a bet.

The UK Gambling Commission states that almost 400,000 youngsters in the country regularly perform e-betting activities without consent from their parents. Most individuals taking part in gambling are aged 11-16 which is even more disturbing. Poker websites need to adopt robust mechanisms to confirm the age of players before allowing access to their platforms. Age verification checks at these sites could help prevent minors from falling prey to a bad habit of gambling.

R-Rated

Video games involving adult themes, violent expressions, and hard language are categorized as R-rated. This type of rating is given to content only appropriate for a selected type of audience and minors playing these can corrupt them. A survey by Statista shows almost 41% of video games in the US are labelled as mature and teen-rated, in 2019. The ESRB and PEGI rating systems provide information about parental guidance and games which are suitable for users. Since these types of games involve strong content, age verification becomes a need of the hour.

Age Verification for Tobacco & Alcohol E-stores

The World Health Organization shows alcohol consumption kills almost 2.9 million people annually and the number is significantly on the rise. Tobacco products like cigarettes and vapes are not legal for children to consume in public. The National Minimum Drinking Age Act of 1984 declares 21 as the legal drinking age, although not all states in the US comply with this regulation. Buying an e-cigarette or a bottle of wine online is not an uphill task any more with digital services.

The global vapes market is expected to grow at a CAGR of 15% during 2019-2024 and this means more minors would be attracted towards it. Since minors can now buy alcohol/vapes using their parent’s payment cards, online age verification on these platforms has become more important than ever. This way, clever minors can no longer trick robust age verification checks.

Age Verification for Cannabis Industry

Due to legal restrictions imposed by regulatory authorities in the past, cannabis was imported through smuggling and other illicit activities. With its usefulness in the healthcare sector, the marijuana industry is legalized in most parts of the world. By the end of 2027, the cannabis industry is estimated to reach 73.6 million US dollars, states PR Newswire.

Unauthorized vendors selling over-the-counter drugs to underage minors pose the greatest threat to industry laws and regulations. Due to the rise in these activities, stringent laws came into effect from the banking industry providing its services to cannabis vendors. Age verification solutions were proposed to mitigate the unlawful import and selling of cannabis products to protect minors from getting harmed.

Age Verification for E-commerce Platforms

A staggering 2.14 billion people are expected to shop online goods and services by the end of 2021. While it has brought new innovation to the table, age-exclusive e-commerce sites also create unforeseen challenges. A few examples of these digital products include alcohol, dating apps, e-cigarettes, and subscription of adult-themed online content. Merchants of these services need to make sure they are using proper ways and means of verifying consumer age, otherwise, they have to face serious consequences and penalties.

Payment Cards

Today, children can easily bypass self-check and payment card authentication procedures required to buy online products. Since minors themselves aren’t eligible to purchase and consume these items, they use their parent’s credit cards to authenticate payments, and that too without their consent. Since children are not mature enough to know about an authentic platform, they often end up handing their details to a potential fraudster through an imposter website, which leads to a credit card or card-not-found fraud.

Chargeback Fraud

In the world of digital transactions, credits cards are common these days. Online scammers use them as a source to carry out chargeback fraud which results in a hefty loss to digital businesses. In this type of crime, the fraudster buys online products, uses them for some time and then claims a refund against them. The bank then requests the relevant service provider to issue a refund to the customer.

A similar type of chargeback happens when parents claim their child did an online purchase without their consent. Not to be confused with a false claim fraud, this is a genuine reversal request, but it equally affects the business in terms of loss. Proper age verification checks at e-commerce platforms can prevent minors from buying age-exclusive products, and eventually reduce chargebacks for an enterprise.

Account Takeover

These days, you won’t find an e-commerce platform where you enter payment information every time. Online shopping websites provide their customer with the utility of saving their profile information, payment card details and purchase history. Comparitech in a study states that during the past year account takeover fraud on e-commerce platforms grew 282%, which is a big blow to the industry in terms of fraudulent attacks. These payment details often misplaced by minors on fake websites and malicious mobile apps make the situation worse.

An age verification solution for the e-commerce industry can significantly help in identifying the age of the consumer to prevent multiple chargebacks, account takeover fraud and minors from misusing their parent’s credit cards to perform unauthorized transactions.

Risks of Lacking Age Verification Checks

The absence of an age authentication mechanism could result in non-compliance penalties and a drop in market reputation for offline and online businesses alike. Generally, the perceived level of risk involved determines the level of control and application of the regulatory framework. For instance,

State departments and regulatory authorities enforce age verification guidelines for minor protection and content distribution. Lack of Age verification checks leads to consumption of adult-exclusive products and services by the underage population. Some risks of not having proper age verification mechanisms are listed below:

Compromised Market Reputation

Good business practices are all about providing customers with the best possible experience. A Customer Thermometer survey indicates 13% of consumers are willing to pay 31-50% more if they are provided with a good onboarding experience. User satisfaction plays an important role in building loyalty of the customer and a good reputation for your brand. Not investing in an age verification software could hurt your business in terms of both negative brand image and non-compliance costs. Since the absence of age verification checks directly corresponds to easy access to age-restricted content and services, they put minors at the risk of being exposed to inappropriate material.

Non-Compliance Costs

The GDPR applies to all kinds of vendors and organizations regardless of the type of products and services they offer. The purpose of this regulation is to ensure privacy and secure record-keeping of personal data of users. This framework is equally important when verifying the age of users during customer onboarding procedures. GDPR being rigorous in nature imposes hefty fines ranging from $22.5 million US dollars to a maximum of four per cent of the annual global income of the company.

Till June 2016, the minimum penalty for not complying with COPPA was 160,000 US dollars, which was increased up to 43,280 US dollars per violation. With this change, minor protection incentives were reinforced to provide better compensation to the victim and deliver a strong message to the defiant party.

Financial Loss

Online businesses can reduce friendly fraud resulting in chargebacks by parents against the non-consenting transactions performed by their children. An age verifier integrated into a platform or an application can check for age and other identity information of a person which regulates the use of age-restricted products and services, ultimately preventing chargeback costs for the business. Online age verification provides an all-in-one solution which is far better than self-verification, manual age checks by humans, and checkboxes to confirm age on websites, saving business a great deal of money.

Conclusion

To wrap up, age verification is the need of the hour to protect the young generation from the adverse effects of age-restricted goods and services. Merchants have the corporate social responsibility to secure minors and to restrict their access. Online age verification is one of the most seamless and cost-effective methods to practice age verification protocols.

Shufti’s age verification services allow easy onboarding of customers in a wide range of industries including online gaming, e-commerce, tobacco, alcohol and cannabis. By ensuring minor protection in light of global regulations, we offer merchants of age-exclusive products to use our services with a single API integration.

At Shufti Pro, we also provide a 7-day free age verification trial of our services for the prospects, to get a first-hand experience of the services we offer, including document verification, biometric authentication, and face verification.

Want a walkthrough of our age verification services?

Explore Now

Explore Now