AML Verification Services: Fighting Back Financial Crimes in 2023

The Covid-19 outbreak has increased reliance on eCommerce and digital banking — cultivating a lush ground for crimes like money laundering, corruption, and tax evasion. The surge in financial fraud is costing businesses handsome money and putting a dent in their reputations.

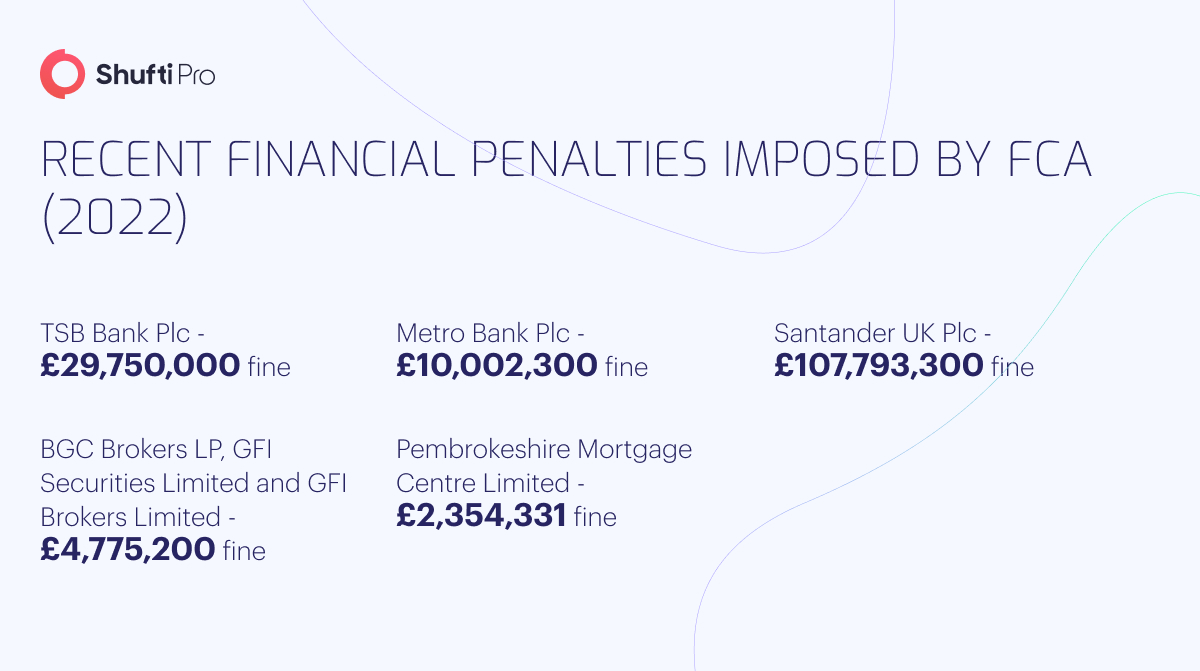

The total amount of financial penalties in 2022 was £215,834,156, with no signs of slowing down in the coming years. Thus, thwarting heinous crimes and their ramifications has become a greater imperative in the ever-changing digital era.

Financial Crimes and Global AML Regime – 2023 Outlook

Global penalties for failing to curb money laundering and other financial crimes increased by more than 50% in 2022.

Banks and other financial firms were fined $5 billion for Anti Money Laundering (AML) infractions, violating sanctions and shortcomings in their Know Your Customer (KYC) systems in 2022.

Huw McCartney, Professor at the University of Birmingham, said that “in the wake of fines, companies usually put more resources into compliance and monitoring but remediations could be quite poorly enforced and monitored both within the firm and by the regulators themselves”.

The US is the most aggressive imposter of fines, charging total penalties of more than $37 billion, followed by $11 billion in Africa, Europe, the Middle East, and more than $5.1 billion in Asia-Pacific.

According to Chief Executive of Better Markets, Dennis Kelleher: “No matter how big the fines are, they don’t punish and don’t deter, the penalties are mostly a meaningless cost of doing business. No matter how big they are, they are small compared to the revenue and profits of the banks.”

BNP Paribas, Goldman Sachs, HSBC, Standard Chartered, UBS, and JPMorgan Chase, topped the list for AML and related penalties in the post-crisis period.

Standard Chartered said that it saw “fighting financial crime as an ongoing process of improvement and will continue to invest in our people, systems and processes”. HSBC stated that it was “deeply committed to combating financial crime and protecting the integrity of the global financial system and had made significant investments to bolster its financial crime and compliance capabilities”. However, UBS, BNP, Goldman and JPMorgan refused to comment.

A Recap of the Latest AML Fines

As technology is advancing, scammers are also revising their strategies to exploit banks and other financial institutions for accomplishing their illicit goals. Scammers are laundering money in a very sophisticated way, leaving businesses in vain.

Let’s dive deep into some latest AML fines imposed on banks and financial firms.

FIAU Charges ECCM Bank €310,000 for Weak AML Controls

The Financial Intelligence Analysis Unit (FIAU) has fined ECCM €310,000 for weak AML controls. FIAU disclosed that the bank didn’t have any adequate measures to assess the risk associated with business and customers. Besides slapping ECCM with a heavy penalty, the bank was also asked to take remedial steps to support its AML controls.

FIAU Slaps Triton Capital Markets Limited with €227,000 Fine for AML/CTF Breaches

FIAU has charged Triton Capital Markets Limited with €227,000 for violating AML and Countering Terrorism Financing (CTF) regulations.

The FIAU noticed, “the investment services company had failed to take appropriate steps, proportionate to the nature and size of its business, to assess the risks of money laundering/terrorism financing arising from its operations and to adequately document such assessment”.

CFTC Fines CHS Hedging $6.5m for AML and Other Violations

The Commodity Futures Trading Commission (CFTC) has charged CHS Hedging with a civil financial penalty of $6.5m for failing to manage risk and violating AML regulations.

As per the CFTC, these infractions are mainly the result of CHS Hedging’s ineptitude towards placing a robust AML programme, especially when it came to a trading account that was under the supervision of one of its clients. Also, CHS Hedging hadn’t set risk-based limitations for that client’s trading.

Danske Bank Charged with $413m for Defrauding Investors about AML Shortcomings

The Securities and Exchange Commission (SEC) has fined a multinational financial services firm in Denmark, Danske Bank, $413m, for cheating investors about the AML compliance program in the Estonian unit. SEC announced that Danske bank was slapped with this hefty penalty as it didn’t reveal the shortcomings in its AML controls.

AML Verification – The Solution to Curb Financial Fraud

Looking back at 2022 makes it clear that even such heavy fines are not the solution to curb money laundering, terrorism financing, and other financial crimes. Despite efforts to prevent fraud in banks and the financial sector, the surge in financial penalties indicate that the root cause of the problem must be identified and regulations must be followed to get rid of such heinous crimes.

This is where the AML verification solution proves to be a great bet. But how? Well, it authenticates any customer before onboarding them, safeguarding all financial firms from fraudulent activities. Furthermore, it makes banks and other financial institutions comply with AML regulations, offers a great user experience, and builds a positive brand image.

How Shufti Fits in the Puzzle

Shufti is their go-to option for all banks and financial firms looking for a globally trusted AML service provider. Based on thousands of AI models and screening against 1700+ global watchlists, Shufti’s AML screening services promise a fraud-free world. Moreover, it has an accuracy rate of 99+% and authenticates any individual in less than a second.

Still, confused about how AML verification services keep fraudsters away?

Explore Now

Explore Now