Crypto KYC: A Growing Need for Industry Regulation

The recent development of cryptocurrencies has resulted in a new era of financial transactions that operate outside of the established banking system. The decentralised nature of digital currencies, however, has made them appealing to cybercriminals and other bad actors. Adopting Know Your Customer (KYC) procedures has become increasingly necessary in the crypto business to overcome this issue. The trading of digital assets is becoming extremely mainstream. According to a report, the volume of cryptocurreny trading reached $15.8 trillion in 2021 an increase of 567% from 2020.

KYC is a method that institutions employ to verify their customers’ identities. sensitive data such as name, place of residence, date of birth, and government-issued identity proof are routinely collected and verified. KYC is intended to prevent terrorist financing, money laundering, financial crimes, and other illegal actions.

What is Know Your Customer (KYC)?

KYC refers to a collection of procedures essential for assessing customer risk and is mandated by law to ensure compliance with Anti-Money Laundering (AML) legislation. KYC entails learning about a customer’s identity, financial transactions, and risk.

What is Crypto KYC?

Crypto KYC refers to digital currency exchanges’ actions throughout onboarding to confirm customer identity and do due diligence concerning their financial activity, threats, and risk. These procedures are legally required and, if carried out correctly, are relatively time-money-saving and secure. The cryptocurrency firm collects personally identifiable details such as:

- Name

- Date of Birth

- Residency

- National ID number (SSN number)

Each country has its own set of KYC standards. Each identifiers requires different documents for verification. Others ask customers to fill out a web-based application to open an account. To confirm the identity is real, the crypto corporation uses an identity verification solution behind the scenes. These identification methods aid in the protection of the exchange and financial sector against money laundering, fraud, and other illicit activities. Crypto exchanges are frequently required by law to protect sensitive data with modern security technology. Applying for KYC for a cryptocurrency account is a regular and secure procedure.

What are KYC-Crypto Regulations?

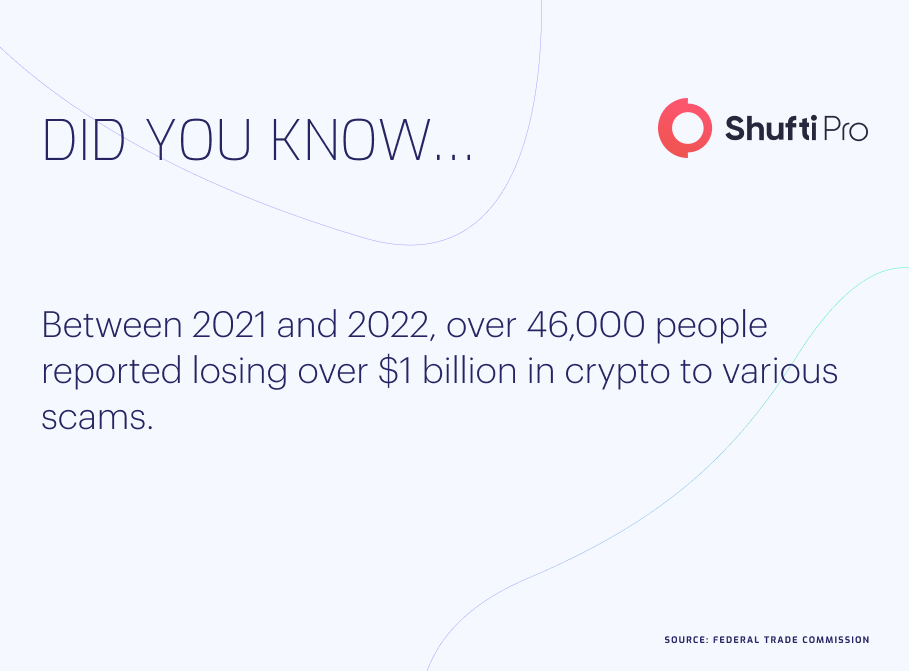

KYC refers to the activities Virtual Asset Service Providers (VASPs) take during onboarding or irregular transactions to verify customer identities as an essential part of due diligence and regulatory crypto compliance. Several nations require crypto firms to follow KYC-AML standards. This entails implementing Customer Due Diligence (CDD) processes involving Know Your Customer KYC checks. According to a report, cryptocurrency-based crime reached $20.6 billion in 2022.

As crypto legislation differs significantly by country, clients may be required to disclose additional personal information (such as birthplace, nationality, tax code, and so on). For example, the UK Joint Money-Laundering Steering Group says in the Guidance for the UK Financial Sector that data obtained as part of the KYC processes may also contain electronic wallet addresses and transactional hashes.

Is KYC-Crypto Mandatory?

Yes, in most states and territories, KYC crypto checks are mandatory. However, crypto companies’ KYC duties are determined by existing AML regulations and how countries apply them.

In recent years, AML legislation has made crypto KYC checks essential for a broader range of businesses. For example, the European Union included crypto-fiat exchanges and wallet sellers in the scope of its 5th AML standards directive (AMLD5) in 2018, which means they must follow the same regulations as financial companies.

More virtual asset-related services have been controlled throughout time in order to successfully prevent money laundering. As a result, nations, including certain EU members, have begun to implement the FATF Guidance 2019 and its amended Guidance of 2021.

What are KYC Standards?

KYC standards help protect regulated organisations, such as credit unions, banking institutions, financial or digital enterprises, and cryptocurrency exchanges, against theft, corruption, money laundering, and terrorist financing. KYC methods also provide investment advisors with information about a client’s level of risk and financial situation. Simply, cryptocurrency exchanges must confirm that their users are who they say they are. KYC measures consist of several steps:

- Building customer identity

- Understanding clients’ financial activities and funding source legitimacy

- Assessing money laundering risks that customers bring

KYC-crypto can comprise online KYC verification, biometric authentication, eIDV, and document verification. KYC standards, which analyse and monitor risk as well as potential criminal activities, are critical to guaranteeing secure transactions between digital currency exchanges and their customers. If a user fails to meet the required KYC-crypto criteria, crypto exchanges may delay an engagement or refuse to open the user’s account. As cryptocurrency becomes more widespread and regulators increase fines as well as sanctions, the demand to comply with KYC rules grows.

What’s Next for KYC-Crypto?

KYC requirements are changing to protect the online transaction platform from unlawful financial activity. Such limitations are always changing as cryptocurrency evolves, innovates, and new threats emerge.

The Travel Rule

Regulators are strengthening requirements for the Travel Rule, which would set regulations regarding originator and beneficiary data for transaction monitoring in response to Financial Action Task Force (FATF) recommendations. Various industry groups have joined forces to develop coordinated solutions to comply with these regulations.

Decentralised Finance

The introduction of Decentralised Finance (DeFi) platforms is one method KYC pushes for change in the crypto economy. These platforms are built with a special focus on the significance of KYC standards to provide investors with a secure place to trade.

DeFi systems use KYC blockchain technology to deliver decentralised financial services like borrowing, crediting, and trading. These trading platforms often require users to undertake KYC procedures to ensure compliance with anti-money laundering legislation and support particular trading conditions. Decentralised Finance (DeFi) employs smart agreements to perform responsibilities previously reserved for financial organisations. The World Economic Forum has referenced DeFi proponents’ perspectives on the benefits of DeFi.

“Open-source technology, economic rewards, programmable smart contracts, and decentralised governance might offer greater efficiencies, opportunities for inclusion, rapid innovation, and entirely new financial service arrangements,” according to a document issued by the World Economic Forum. However, DeFi protocols that allow financial transactions without KYC may facilitate money laundering or other illegal financial operations.

Non-Fungible Tokens

Statistically, Non-Fungible Tokens (NFTs) can be proven unique, and their ownership is verifiable on public blockchains. NFTs are much more than dazzling digital goods. They are a technique of implementing basic business principles like copyright and contracts into constructing Web 3.0 platforms. On the other hand, money launderers can transform tainted cash into NFTs to conceal their financial holdings or cover a money flow with several transactions if KYC is not mandated.

Custodial vs. Non-Custodial Crypto Wallets

An individual’s crypto holdings are stored on a blockchain, however, how can they get access to them? In order to keep digital currency safe yet available, a crypto wallet stores a customer’s confidential keys. People can store their assets in either a custodial or non-custodial digital wallet. Most cryptocurrency wallets are custodial, which means that a third entity has access to the private keys and is primarily responsible for fund protection.

Non-custodial crypto wallet verification allows consumers full authority over their login credentials and cash by eliminating external control. Because they do not require affiliation with authorised exchanges, they also provide confidentiality. The KYC standards for anonymous crypto wallets are not established, although both the US and the EU are beginning to look into them.

Why do Crypto Companies Need KYC?

KYC in cryptocurrency is a legal requirement in most jurisdictions. As a result, most crypto service providers prohibit their customers from purchasing Bitcoin or withdrawing funds before they pass a KYC Bitcoin check. Nevertheless, some crypto firms continue to allow users to trade without completing KYC. These are typically decentralised, unregulated exchanges or trades from nations with lax anti-money laundering regulations, including Luxembourg, the British Islands, or Panama. Some exchanges allow you to set withdrawal restrictions, and KYC is only required when those limits are surpassed.

KYC-Crypto Longevity

KYC-crypto laws safeguard cryptocurrency platforms by lowering consumer risk factors, improving fraud protection, and emphasising AML compliance. A complete crypto ID verification platform aids in the security of digital transactions for both individuals and enterprises. Compliance with KYC laws can also boost client confidence in cryptocurrency by instilling a sense of confidence and security.

Shufti tackles all of the issues that manual KYC crypto raises. Shufti’s KYC verification solution ends the necessity for manual verification by outsiders and costly compliance teams, making the initial onboarding procedure smooth and cost-effective with an AI-powered solution. Customers are checked against 1700+ global watchlists to avoid hackers, money laundering, and other types of fraud.

Furthermore, an AI-powered KYC onboarding solution helps both the company and clients by saving resources, money, and time. Instead of individually authenticating every individual, Shufti makes it easier for clients to be verified in a matter of seconds.

Need to secure your digital assets but don’t know how?