FATF’s June 2021 Plenary – Strategic and Country-specific Initiatives

The fourth plenary meeting of the Financial Action Task Force (FATF) took place from June 20-25 this year. German President, Dr. Marcus Pleyer, headed the virtual meeting comprising 205 members from the FATF Global Network and other watchdogs including the World Bank, United Nations, and the IMF. The sole agenda of this meeting was to take into account the increasing money laundering risks amid the COVID-19 health crisis and develop an action plan to address them through digital transformation.

FATF is an independent financial watchdog headquartered in Paris that aims at utilising effective regulatory standards to mitigate global money laundering. The recent meeting of delegates states important concerns regarding risk-based FATF standards and their implementation to take down terrorists from exploiting loopholes in the legal financial system. The blog highlights key points of the plenary which are essential for proper AML/CFT compliance.

What are Key Features of the June 2021 Plenary?

- Digital transformation opportunities for AML/CFT compliance

- New guidance on preventing financing of weapons of destruction

- Consultation update on ultimate beneficial ownership (UBO)

- 12-month review implementation for virtual assets service providers

- Money laundering associated with environmental crime

- Terrorism activities based on race and ethnicity

Strategic Proposals for Effective AML/CFT Compliance

Employing Digital Solutions

High-end Technology

This plenary, FATF recognised the benefits of digital transformation and its role in developing cost-effective and real-time solutions for AML/CFT compliance. FATF identified that by using machine learning, data pooling and advanced analytics, organisations can develop AML compliance programs that could better identify suspicious behaviour and usual transactional patterns. The report presented in the meeting lists necessary policies, procedures and technologies to improve AML/CFT effectiveness.

Data pooling and information sharing

Without a doubt, the increased adoption of data analysis tools has made it possible for financial institutions to process large amounts of data effectively. This is when collaborative analytics and data pooling can help banks and monetary institutions assess, identify and take down money laundering, as highlighted in the plenary. The report published on July 1 also emphasises the need for data privacy and protection while enterprises and governments carry out their AML procedures using high-end privacy-centric technologies.

Read More: Global Economies are joining forces with FATF against money laundering

12-month Review Implementation

The plenary compiled a second 12-month review for introducing new changes to FATF’s standards for Virtual Asset Service Providers (VASPs). The report on revised guidelines describes 128 reporting jurisdictions out of which 58 have now implemented the new recommendations. 52 of these have regulated the operations of VASPs while 6 of them prohibited crypto providers from carrying out business activities. The majority of these countries have not yet obliged with the FATF Travel Rule and other essential requirements which call for better global efforts.

The report presented in the meeting urged the importance of regulating cryptocurrency exchanges so that virtual assets cannot be used in criminal activities. The plenary agreed on finalising the revised guidance till October 2021 including measures for preventing ransomware-based virtual assets.

Challenges with Recovering Assets

When we talk about anti money laundering requirements, asset recovery is one significant aspect. This helps regulatory authorities deter criminal instances and create better opportunities for compensating victims by taking away profits on ill-obtained money. While asset recovery is an important point of the FATF’s 40 recommendations, the report by FATF shows that many countries achieved very few objectives. The document covers all key obstacles preventing governments from proper asset recovery and presents a viable solution for them.

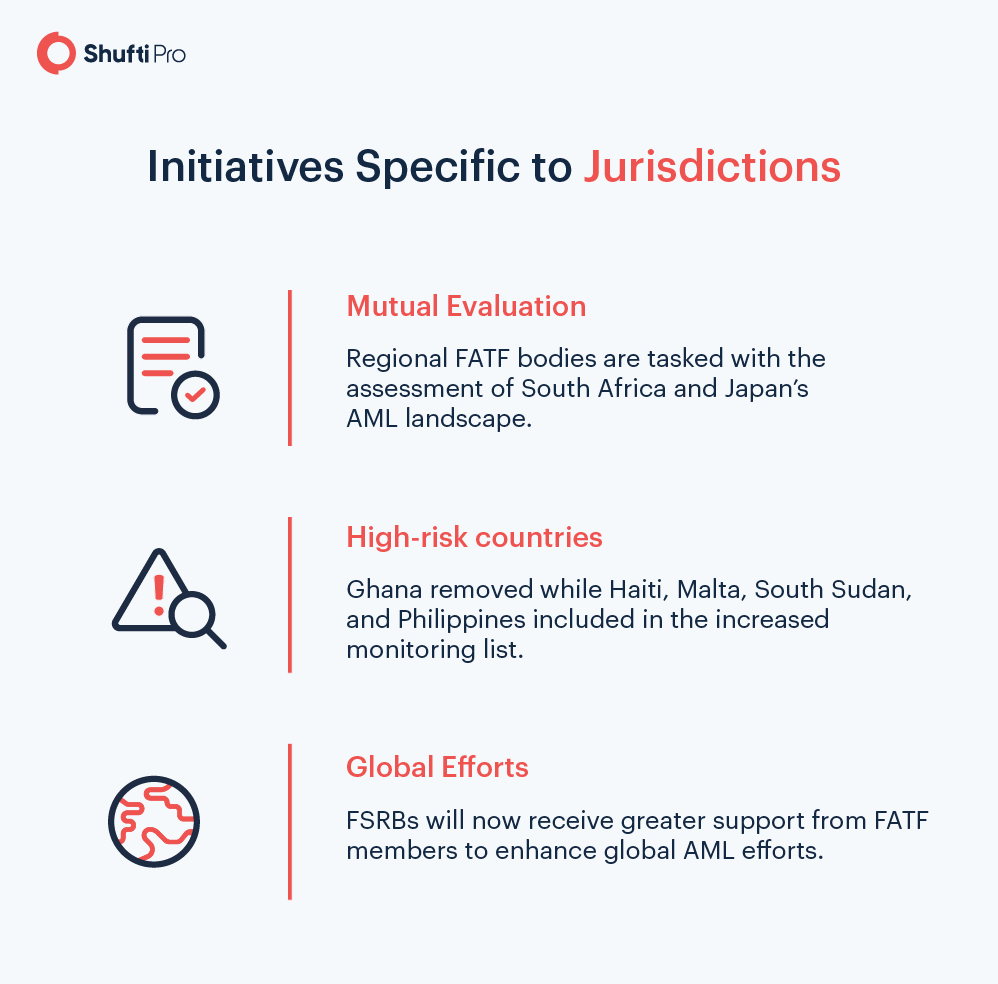

Jurisdiction-based Updates

Evaluating ML/TF regulations in RSA and Japan

FATF’s plenary discussed the state of financial crime in both Republic of South Africa (RSA) and Japan considering their AML efforts and compliance with action plans. In this regard, the joint association of FATF and the Eastern and South Africa Anti-Money Laundering Group (ESAAMLG) carried out an assessment which was evaluated by FATF representatives.

The meeting decided that even though South Africa had a robust AML infrastructure, it needed to address money laundering concerns as per its risk profile. Regulatory authorities need to develop better channels for sharing financial intelligence and improve the application of risk-based frameworks.

Moreover, the assessment carried out under the joint FATF Asia/Pacific Group on Money Laundering (AGP) was also examined which concluded that Japan has made significant progress in meeting its action plan requirements. Despite the fact that Japan showed promising results in mitigating terrorist financing risks and money laundering, it needs to better supervise preventive measures for financial organizations and non-financial businesses or professions (NFBPs).

Updates to the Increased Monitoring List

The financial observer regularly updates its Jurisdictions Under Increased Monitoring list in its official meeting that is carried out three times in February, June and October each year. These countries work closely with FATF to reduce strategic deficiencies and terrorism/proliferation financing. As of June 25, 2021, the FATF after an on-site inspection decided to remove Ghana from the list of high-risk countries. On the other hand, the watchdog after a detailed review added new restrictions to the increased monitoring list including the Philippines, South Sudan, Haiti, and Malta.

Strengthening Global AML Efforts

Given the increased demand for financial crime prevention, the plenary acknowledged the role of FATF-styled Regional Bodies (FSRBs) in combating money laundering on a global level. These independently operating units make sure that FATF-set standards are effectively implemented by member countries. To better assist FSRBs in timely delivering their Mutual Evaluation (ME) reports, despite the COVID-19 context, FATF is now providing high-priority support and additional resources.

Need more information on AML/CFT compliance? Get in touch with our experts.