FATF’s Stance on Digitizing FIUs and Adopting A Risk-Based Approach for VAs

The Financial Action Task Force (FATF) is tirelessly working to guide Financial Intelligence Units (FIUs) about the benefits, opportunities, and strategic considerations of adopting digital tools for effective AML/CFT compliance. In addition to these insights, FATF has amended its Recommendation 15 on Virtual Assets (VAs) and Virtual Asset Service Providers (VASPs).

The Risk-based Approach and digitization of FIUs was released in October 2021 and has changed the way how AML/CFT is perceived, handled, and addressed.

Why has FATF provided its stance on the digital transformation of FIUs and RBA to VAs?

FATF aim’s to enhance the efficiency of AML/CFT efforts and workflows. Monitoring emerging risks is one step forward to overcoming and mitigating AML/CFT risks. Hence, FATF is actively addressing rising challenges associated with the adoption of technology and virtual assets.

Digital Transformation & Financial Intelligence Units (FIUs)

All around the world, FIUs, law enforcement bodies, and businesses are widely adopting digital tools to streamline their day-to-day tasks of detecting and overcoming illegal financial activities.

Consequently, in collaboration with the Egmont Group of Financial Intelligence Units, FATF explored ways on how FIUs can utilize technological advancements to strengthen their operations. The report focuses on:

- How to find the right tools

- When to use those tools for effective AML/CFT compliance

- How to overcome the challenges, whether practical or operational

Why Digital Transformation?

Digital transformation is acquiring digital tools by an organization to streamline its workflow. Therefore, it is essential to:

- Increase the speed of the processes being performed for effective and robust detection of money laundering and terrorist financing (ML/TF) activities.

- Handle massive and multiple unstructured data (data that does not have a pre-defined model and manner) from multiple reporting institutions with numerous formats.

The key findings have also suggested strategic considerations to introduce digital initiatives for effective AML/CFT compliance for Financial Intelligence Units (FIUs).

These considerations included SIX steps guidance which are:

- To address short and long term goals that comply with set standards within and outside the firm

- To review existing loopholes in terms of information, resources, capability, and capacity

- To identify the crucial steps that benefit the FIUs the most and overcome the significant problems

- To build a sustainable environment for all individuals inside the firm so that they can easily comply with AML/CFT regulations

- Keeping track of the progress by taking regular feedbacks after transforming work to digital platforms

- To take feedback from internal and external stakeholders, and learn improvement strategies

Strategic Layout and Benefits of Digital Initiatives

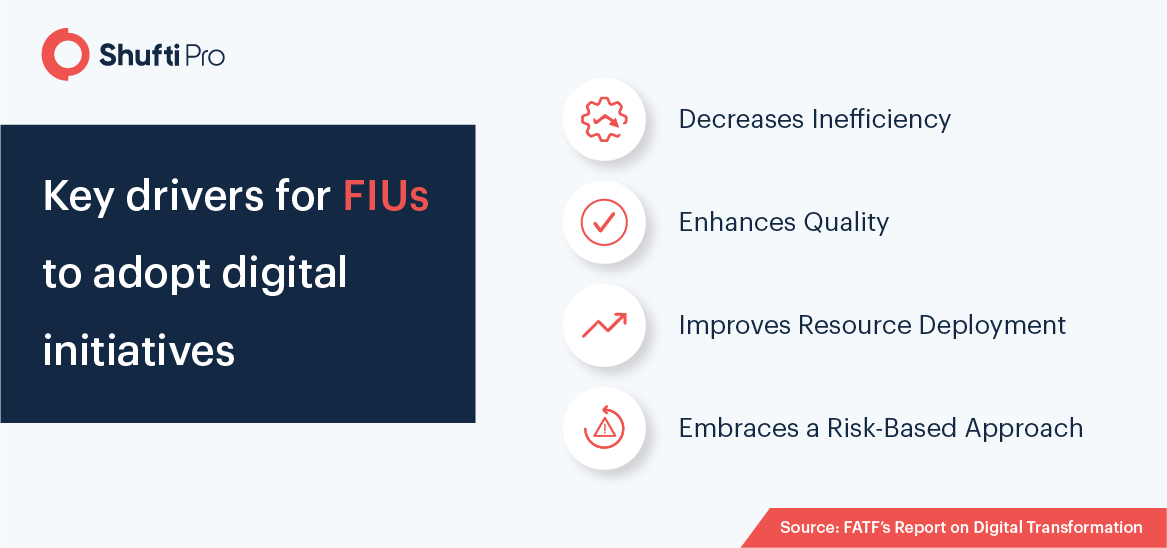

The FATF has also guided on the opportunities and benefits for FIUs when they opt for digital transformations.

Opportunities and benefits of adopting digital AML/CFT verification services:

- Presents better opportunities for FIU analysts for a comprehensive analysis

- Offers better handling of emerging risks and improved STR management

- Will provide meaningful results for data analysts and minimizes the time required for manual entry of STRs

- Helps FIUs avoid repetitive tasks, have data accuracy, and prioritize tasks and handle a large volume of suspicious transactions

- Gives more comprehensive, updated, and robust access to AML/CFT database

- Strengthens analytical capacity such as increased report handling with little staffing

- Enhances management of money laundering and terrorist financing risks with the use of AI and ML

- Contributes towards efficient and secure communication between competent authorities

Furthermore, in June 2022, FATF plans to release another update on how advanced analytical tools and technology support money laundering and terrorist financing investigations and the exchange of information.

Suggested Read: 40 recommendations of FATF – Shaping the future of your business

FATF’s Recommendations to VA’s and VASPs

VAs are digital assets that are digitally transferred for multiple investment purposes, while Virtual Asset Service Providers (VASPs) are legal people who handle virtual assets businesses of other individuals. Therefore, the fast-paced and technologically zestful VAs require continuous monitoring and sky-high engagement between the public and private companies.

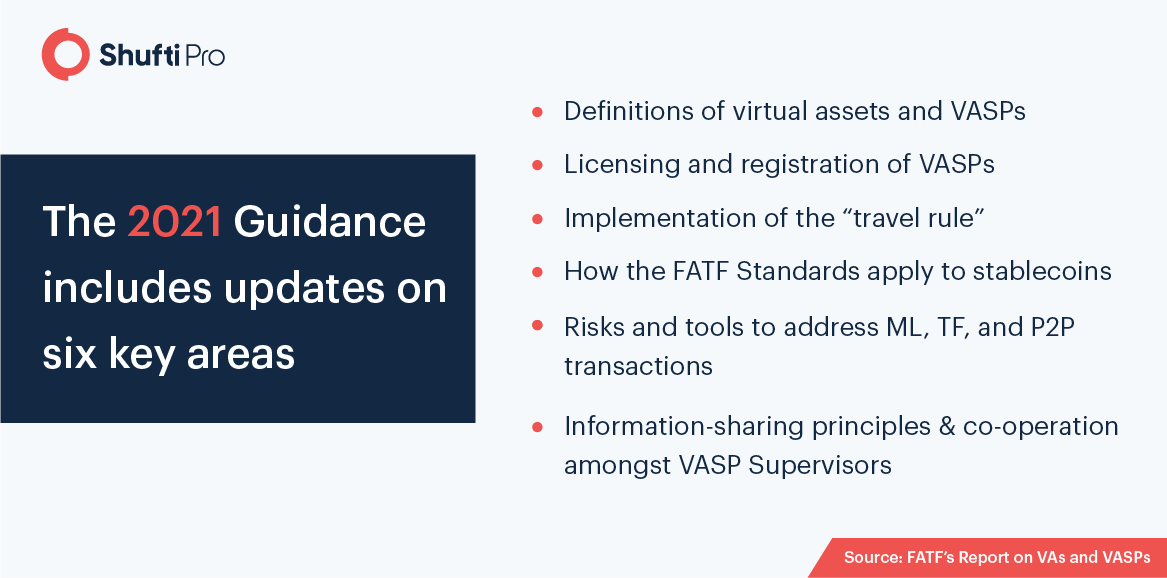

That being the case, the FATF in October 2021 issued an update to its 2019 guidance for a risk-based approach for VAs and VASPs.

The FATF has published clarifications for virtual assets and virtual assets service providers that explicitly apply to financial activities. Moreover, they have added two new definitions of VA and VASP to clarify that FATF’s Recommendation 15 aims to counter money laundering and terrorist financing. These updates aim at helping national and private sectors to understand and develop regulatory and supervisory responses to VAs.

The guidelines address the issues of ML and TF and how countries need to understand the risks associated with virtual asset activities. Additionally, the updated guidance refers to ways how public and private sectors can understand and develop regulatory and supervisory approaches to VA while they effectively comply with changing AML/CFT regulations. It further encourages techniques to address the risks and efficiently mitigate them. The FATF’s obligations are necessary for all financial institutions along with some of the selected non-financial businesses. Therefore, the guidelines are mainly for countries, competent authorities, and obliged entities engaged in virtual assets activities, including all financial institutions.

Definitions of VAs and VASPs

The guidance starts with the clarification of the definitions of VA and VASPs that define virtual assets as the “digital representation of value that can be digitally traded or transferred and can be used for payment or investment purposes.” It additionally provides multiple examples of how these definitions apply, and even if fiat currencies, securities, and financial assets are digital, they are covered by FATF elsewhere and they must not be considered virtual assets. However, the guidance clarifies that stable coins fall under the category of virtual assets and further explains that NFTs must have a context-specific approach. For instance, NFTs are only considered virtual assets if used for “payment or investment purposes.”

Peer-to-peer (P2P) Transactions

The guidance continues to address peer-to-peer transactions and possibly diminish AML/CFT risks. It indicates that countries require an understanding of the risks and how peer-to-peer transactions are handled, particularly if new VAs enter or pre-existing VAs are adopted at a massive scale. It further presents specific actions countries may need to lessen these risks.

Travel Rule

The guidance also addresses the “implementation of the travel rule” and suggests sharing specific identification details about the recipients who make cryptocurrency VASPs transfers above USD 1000. In addition, if a transfer is to/from an unhosted wallet, then the VA service provider must be aware of the risk possessed by the recipient and impose added limits if deemed necessary.

How can Shufti help?

Shufti’s identity verification and AML screening solutions provide robust biometric and document verification services to FIUs and VASPs. AI-powered AML screening solution screens identities against 1700+ global watchlists and flags any high-risk entities in seconds. As a result, VASPs and FIUs can build a transparent relationship with their clients while they effortlessly comply with FATF’s updated guidance.

To know more about AML screening and FATF’s updated guidelines, talk to our experts.

Explore Now

Explore Now