How Will Simplified Due Diligence SDD Help Industries in 2024?

- 01 What is Simplified Due Diligence (SDD)?

- 02 When is Simplified Due Diligence Used?

- 03 SDD VS CDD VS EDD

- 04 Simplified Due Diligence Requirements

- 05 SDD Eligibility

- 06 What are the Steps involved in the SDD?

- 07 Benefits of SDD

- 08 How will SDD Help Industries in 2024?

- 09 SDD Checklist

- 10 How Can Shufti Help?

For businesses, the due diligence process is an integral part of the Know Your Customer programme. Through the due diligence process, the customer risk is evaluated before opening a bank account or availing a service or product. Without this, the bad actors can surpass the system. They can steal the financial or other sensitive information available, costing businesses legal penalties, sanctions, and even permanent exit from the corporate world.

Depending on the situation, due diligence is implemented. Some situations represent minimal or low risk where complete due diligence processes are not needed. In that situation, the simplest version of checks, called simplified due diligence, can be leveraged to account for the lower-risk customers. FATF, out of its 40 Recommendations, requires Recommendation 10 for businesses to perform customer due diligence CDD.

Understand what the simplified due diligence process is, why it is important for businesses, how it is used, criteria and implementation, along with the difference between customer due diligence and the other processes, as well as how it can help industries in 2024.

What is Simplified Due Diligence (SDD)?

Simplified Due Diligence is, as its name suggests, a simple version of customer checking. It is the lowest level of the customer due diligence cdd process that financial institutions and other organisations implement. The simple version of the due diligence process is implemented to mitigate fraud and risks associated with money laundering and terrorist financing.

It is a simple customer verification process that can be applied to customers when the presented risk is low. It is implemented in low and medium-risk customers. The simplified version of due diligence makes other check processes simple since it doesn’t skip the other processes, making the CDD process quicker compared to the long, stringent processes.

When is Simplified Due Diligence Used?

Simplified due diligence can be used when a customer makes a lower amount of transactions, for instance, transactions under $100 to $500. If the customer exceeds the limit, they may have to go through the CDD process. Nonetheless, SDD may not be suitable for all industries, jurisdictions, products, and services. However, the below-given type of customers goes through the SDD checks initially:

- Financial institutions such as banks, investment firms, etc., that are subject to money laundering and terrorist financing, such as the European Union Anti-Money Laundering Directives (EU-AMLDs).

- Businesses that are accountable to community institutions are subject to balance checks and appropriate procedures.

- Authorised public authorities whose data is publicly available.

- Customers offering certain insurance policies, electronic money products, pensions, etc.

SDD VS CDD VS EDD

There are three types of due diligence processes depending on the risk associated; these are as follows:

SDD: Simplified Due Diligence, as the name implies, is the simplest and primary form of verification. In SDD, low-risk entities that provide low-risk products or services that are subject to money laundering are the customers. For SDD, fewer documents are provided, and individuals or entities are screened for risk and monitored afterward.

CDD: Customer Due Diligence is the moderate form of verification when an individual presents medium-level risk or conducts moderate transactions they are subjected to the CDD processes. Performing CDD is one of the recommendations of FATF, and every financial institution or business in EU-AMLD is advised to implement it into practice. To complete the CDD requirement, additional documents are required for verification. The documents provided are then screened against databases and continuously monitored for further changes.

EDD: Enhanced Due Diligence is the comprehensive form of verification. EDD is performed either for high-risk customers or individuals who have high investments or conduct larger transactions in general. It requires additional information and documents for accurate results. Additionally, the high-risk customers are screened against Politically Exposed Persons (PEPs), AML, and sanction lists along with the relatives and close ones verification. They are also screened against adverse media screening, and if any information is presented there, it may affect their risk score. Once the verification is done, the individual or entity is continuously monitored to detect if any changes may occur.

Simplified Due Diligence Requirements

Every customer goes through the customer verification checks or process before onboarding or opening an account, but not all customers qualify for the SDD checks. FATF, under recommendation 10, requires businesses to perform CDD, which includes simplified due diligence. Based on the FATF Recommendation, the due diligence processes should be implemented when:

- Forming a new business relationship

- Risk of money laundering or terrorist financing

- Financial institution questions about the customer identification data

- Carrying out the transaction above $15,000

When identifying lower-risk situations suitable for SDD, compliance staff should ensure the scenarios are consistent with the assessment of overall ML/TF risks identified on a country and company-wide level.

SDD Eligibility

Not every individual is subject to the simplified due diligence processes. The SDD eligibility varies from jurisdiction to the industry working in. It is performed specifically on individuals or entities who represent a lower risk of terrorist financing, corruption, money laundering, or any other crime whilst forming a business relationship or engaging with them. To be qualified for the SDD, the customer must have a record of infrequent small transactions, and their funding source must be transparent. The FATF has also presented a non-prescriptive list of instances when SDD may be required:

- A financial activity is performed by a legal person on an occasional or limited basis.

- Inappropriately defined financial products and services.

- Households have an average monthly income of less than a predetermined amount.

Whilst identifying the SDD, the compliance officer may ensure the regional and global regulations and perform the due diligence process accordingly. The officer must also ensure the scenarios are consistent with the AML/CTF/CPF assessment and overall risk identified on a national or global level.

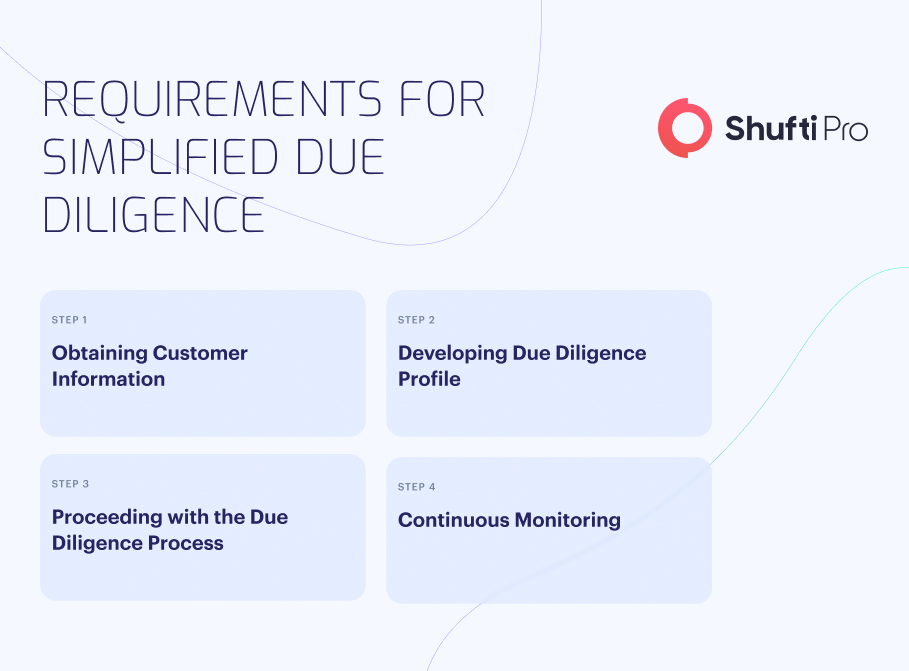

What are the Steps involved in the SDD?

The SDD is the simplest version of the due diligence process it requires a simple process that includes the following:

Obtaining Customer Information

The process begins with the Customer Identification Process (CIP), which is performed before onboarding customers. Companies perform this process before forming official ties with other businesses. Before the onboarding process, the company gathers the relative data needed for verification. The customer data needed for verification includes name, address, and date of birth; contrary, the business information may differ. The businesses must confirm that the provided information is accurate and verifiable. The document provided could be fake, or there is a chance of spoofing identities, which is eliminated during the due diligence verification.

Developing Due Diligence Profiles

Once the identity is verified, a due diligence profile against each individual is made. Based on the risk profile, the type of due diligence is decided and then proceeded. Whilst selecting the due diligence types, organisations must consider the various factors. These factors may include business ownership structure, occupation type, industry operating, compliance requirement, or the level of security needed to be built. Once the key factors are selected, the jurisdictions and other global or national requirements are considered, and the risk assessment is performed.

Proceeding with the Due Diligence Process

Upon the risk assessment, if the customer presents a low or medium risk, the simplified due diligence process is begun. It is a less detailed identity verification process where less information is required to verify the identity. This can be verified with the public registries or data available. Ultimate Beneficial Owners (UBOs) and business ownership structures may also be included in it. Nonetheless, most companies use manual methods, which are prone to error and time-consuming. To eliminate the hassle, it is important to improvise the processes and include automated solutions to the practices. The AI-powered kyc solutions in real-time verifies businesses or individuals against public or private databases and provide the necessary information.

Continuous Monitoring

The process simply doesn’t end with the one-time verification. No playbook says a customer who presents low or medium risk today won’t be a threat tomorrow for businesses. Once the company successfully verifies individuals or businesses and onboard them, they must ensure that during their stay or association with the company, no risk is presented. To validate that, continuous monitoring is essential. Ongoing assessment and continuous monitoring guarantee that the customer or business is low-risk during the time they are associated. If any suspicious activity is identified, it will automatically be flagged as a risk, and companies can decide whether to move it for further screening or ignore it.

Benefits of SDD

Simplified due diligence has many advantages, which is why many businesses incorporate it, and it is also required by the FATF. The benefits include:

Time and Cost Savings

The SDD method is intended to be a simpler method of due diligence, saving firms time and money. Businesses may undertake due diligence more quickly and efficiently by reducing the amount of data and documents required.

Enhanced Efficiency

The SDD approach can also assist organizations in increasing their overall efficiency. By using a standardised process, businesses can ensure that all due diligence is completed in a uniform and efficient manner. This can help to reduce errors and further enhance procedure precision whilst reducing friction or delay.

Increase Customer Experience

The SDD approach can also assist firms in improving their client service and relations. Businesses can assist consumers in completing transactions and developing business ties by reducing the amount of data and documents required. As a result, consumer satisfaction and trust may grow.

Flexibility and Customisation

The SDD process can be tailored to the demands of various enterprises and industries. Because of this flexibility, organisations can tailor due diligence procedures to match their specific needs whilst still conforming to AML regulations.

How will SDD Help Industries in 2024?

Simplified due diligence plays a pivotal role in many industries. Despite being a requirement by the regulatory body, it is a necessity for many industries. The dawn of 2024 is near, here is how SDD helps industries:

Digital Transformation Paving the Future

Due diligence activities are increasingly being performed online or on automated platforms. Advanced analytics, machine learning (ML), and artificial intelligence (AI) systems can automate data gathering, analysis, and risk assessment. These tools help organisations make better decisions and avoid risk by enabling faster and more extensive due diligence.

SDD Becoming the Initial Screening Process in All Industries

As cyber threats increase, organisations are placing a greater emphasis on assessing the risks associated with new investments, partnerships, or acquisitions. To avoid costly data breaches and reputational damage, it is becoming increasingly important to evaluate the target company’s SDD, data security policies, and incident response strategies. The goal is not merely to respond to cyber threats but also to mitigate risks and protect the organisation’s digital landscape.

Environmental, Social, and Governance (ESG) Due Diligence will Set New Standards

ESG factors have rapidly grown in importance in the past few years. The social and environmental effect of investments is becoming increasingly relevant to investors, businesses, and authorities. Evaluating a company’s CSR, diversity, and inclusion practices, moral principles, and sustainability practices is part of ESG due diligence.

Country and Geopolitical Risk Due Diligence

Given the geopolitical tensions and economic uncertainty, it is critical to recognise country-specific risks. As part of the SDD process, political stability, governmental institutions, economic data, and potential geopolitical concerns in the target market will be evaluated. Organisations can use this assessment to lower the likelihood of potential risk and make informed decisions.

Human Rights SDD will be Prevalent

“Human rights” concerns are becoming increasingly essential in due diligence. Organisations are increasingly weighing the impact of possible associates or investments on labour standards, human rights, and supply chain efficiency. Organisations can avoid connections with parties implicated in constitutional violations or unethical practices by adding human rights due diligence into their assessment method. This trend emphasises the increasing significance of ethical issues in corporate partnerships and investments.

SDD Checklist

SDD checklist is a document containing the necessary information that highlights the steps businesses must ensure to fulfill the due diligence requirement. The checklist usually includes the information that is required to be collected from the individual or entities as well as the type of due diligence process or type of verification method that must be performed on the individual or organisation. SDD checklist usually includes:

- Customer type

- Occupation

- Jurisdiction or country of origin

- Products or services offered

- Account type

- Business structure

The checklist is not only limited to these details and may vary depending on the regulatory requirements of each jurisdiction or industry.

How Can Shufti Help?

An effective, simplified due diligence process ultimately depends on the combination of technology and expertise. As technology advances, so does the customer risk and threat, and firms need to be prepared for what’s ahead. Shufti offers simplified due diligence solutions to financial and other organisations. We offer KYC and SDD services that verify the identities in real-time whilst maintaining global and industrial compliance requirements. Secure your business operations and work with trusted entities and individuals.

Want to secure your business operation whilst assessing the risk in real-time and maintaining compliance?

Explore Now

Explore Now