Japanese FSA to Beef Up AML Systems from Fiscal 2021

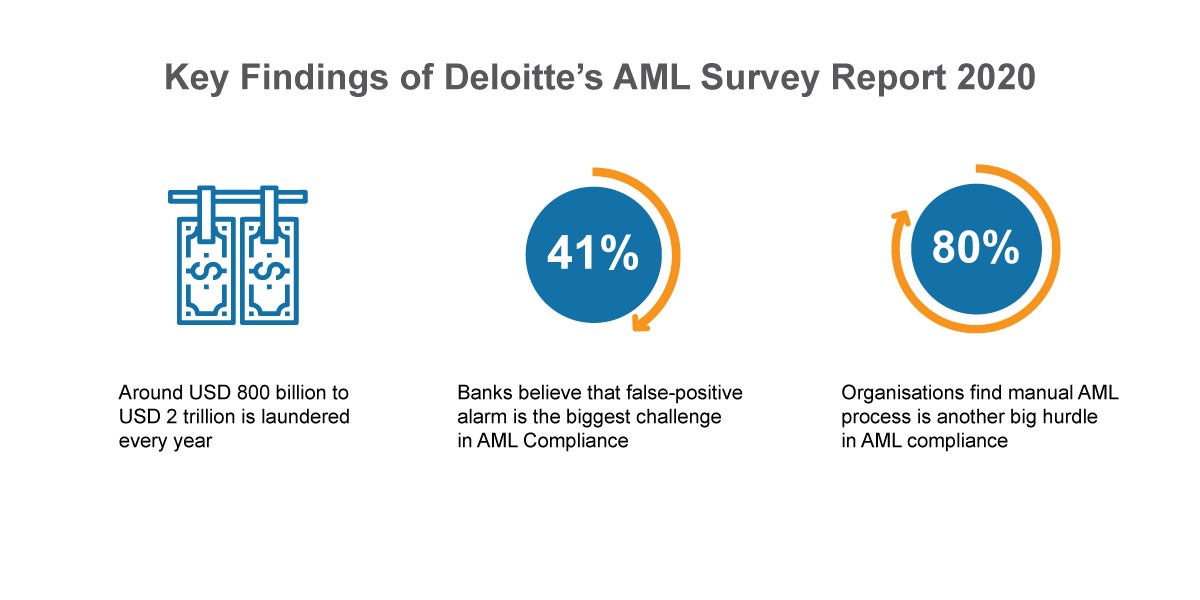

Growth in South Asia has far exceeded that in any other country over the past few years and digitisation has been the major contributor to this growth. However, criminal actions have significantly increased too and unfortunately, Japan has been the major target. Banks and other financial institutions are the primary target of fraudsters for crimes like money laundering and terrorist financing. According to UNODC, two to five per cent of the global GDP is laundered every year. Over time, Japan has become a major contributor to this number due to the rapid digitisation and adoption of cryptocurrencies, e-wallets and online payments systems. This means better AML compliance in Japan is the utmost need of the hour. Now, the Financial Service Agency (FSA) in Japan has rolled out new and enhanced AML systems which will be in action in FY 2021.

First things first. Take a look at what the laws have to say about ML/TF in Japan and what the new AML compliance program in Japan holds for banks and financial institutions.

What is the New AML System in Japan?

FSA in Japan has revealed that a new AML system will be rolled out in Japan in the fiscal year 2021. The new AML compliance program in Japan will be based on artificial intelligence algorithms for more efficient risk management and better compliance with the laws.

Risk-Based Approach for AML and CFT in Japan

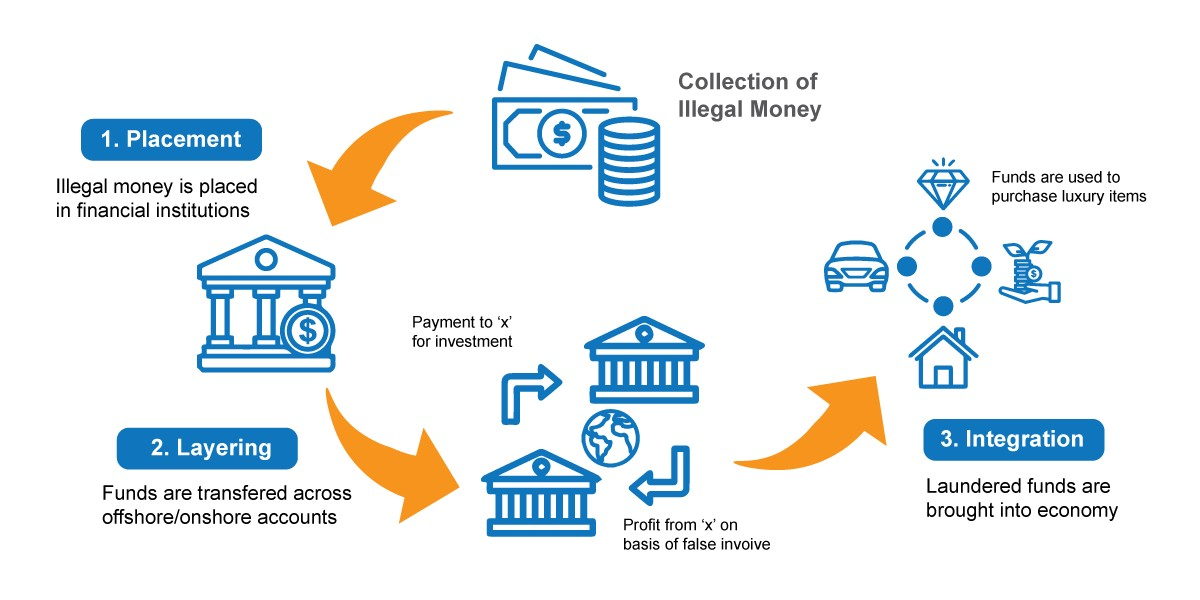

Money laundering is completed in three stages and the complexity of identifying the origin of black money increases in every stage. The documentation for the risk-based approach in Japan reveals that banks and other financial institutions must take necessary steps to identify potential money laundering and terrorist financing activities. Furthermore, entities in the finance sector must implement effective measures to confront these activities.

Given the rise in fincrime in Japan, the Financial Service Agency (FSA) has structured guidelines to identify, assess and mitigate the risk of ML/TF. Certain actions have made compulsory while some are suggested to keep the businesses in this sector secure. Let’s take a look at the required actions for risk identification and mitigation.

Required Actions for Identifying Risk

According to the FSA, the following actions are required by financial institutions for identifying ML/TF risks:

- Evaluate the risks involved in products or services offered, type of transactions, countries, customer attributes, geographic areas of transactions, and any other relevant factors associated.

- During the comprehensive evaluation, consider outcomes from national risk assessment and simultaneously take geographic attributes of the business region, environment, etc. under consideration.

- Risk assessment measures must not overlook the direct and indirect relationship between transactions, and high-risk countries and territories defined by FATF.

- Evaluate the ML/TF risks before offering any new products or services. Moreover, transactions conducted with advanced technology shall be assessed as well.

Risk Mitigation Measures for FIs in Japan

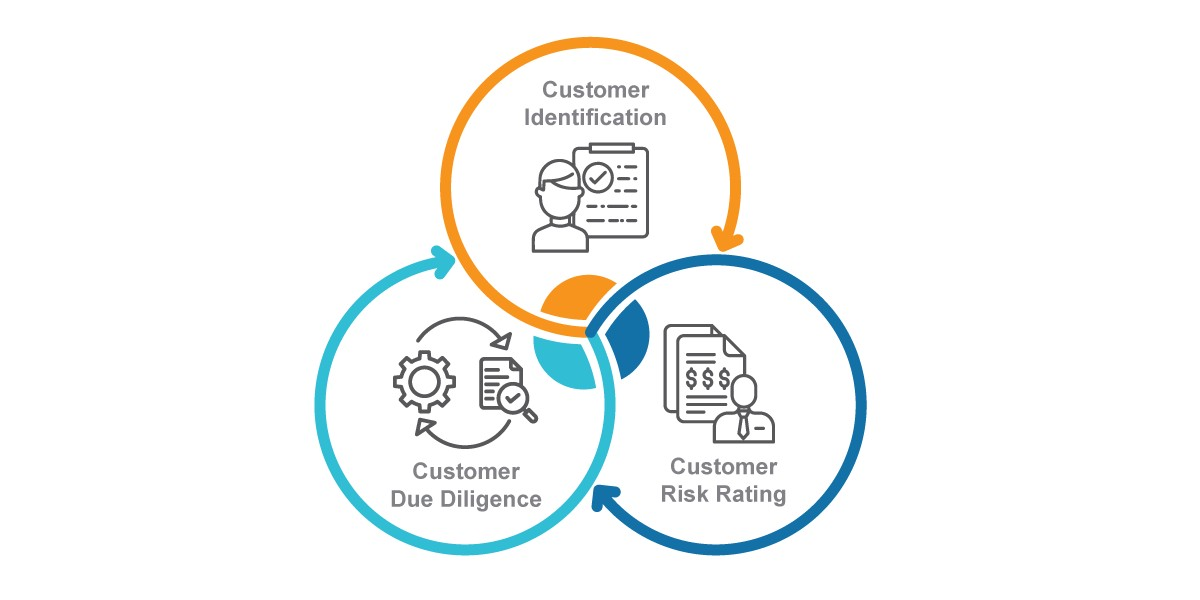

Under the risk-based approach, all financial institutions must verify the identities of customers and in case any risk is identified, effective measures must be taken to mitigate the risks.

Customer Due Diligence (CDD) is a mandatory process that can not be overlooked. In case a bank or FI encounters a high-risk customer, Enhanced Due Diligence (EDD) checks must be performed before onboarding them. On the other hand, if low risks are identified with a customer, Simplified Due Diligence (SDD) would suffice.

Suggested: High-Risk Transactions – How Can Enhanced Due Diligence (EDD) Help?

Digital World and the New AML System in Japan

The advent of technology has brought numerous conveniences and streamlined business operations. Enhanced technology is now being used for developing solutions that commensurate with the ever-growing fraudulent activities. Since criminals have become highly sophisticated in their job, financial institutions must develop better methodologies to fight them. The exact reason has encouraged regulatory authorities in Japan to structure a new AML system that uses man-made brainpower to identify, assess and mitigate the risk of money laundering and terrorist financing. The bigger question is, will financial institutions in Japan be able to follow the new system proficiently?

Shufti’s Ongoing AML for Better Compliance

The above question leaves everyone in ambiguity because digital advancements in the KYC/AML systems requires a lot of skilled people who know everything about technology along with sound knowledge of the AML compliance program in Japan. The requirements sound pretty easy but when it comes to execution, authorities might face several surprises and obstacles. A better alternative is to employ existing AI-driven AML systems developed by companies who know all about the regulations and have the capacity to satisfy the emerging requirements.

Shufti’s ongoing AML system is an all-in-one solution that all companies in the Japanese finance sector can utilize. Regular monitoring of customers can help financial institutions in ensuring that they are not involved in any fraudulent activities. Optimise customer onboarding process, develop comprehensive risk profiles of end-users and prevent frauds.

Summing It Up…

Japan is taking all necessary steps to combat fincrime in the country. For the same reason, the FSA in Japan has put forward a new AML system. The initiative will employ artificial intelligence models to ensure higher levels of accuracy and better compliance with the guidelines suggested by FSA. The new system requires highly advanced technology that can screen all business prospects in the least possible time and the results are reliable too. However, developing such a product that can perform various risk assessment processes is not easy. So, an ongoing AML process that deploys thousands of artificial intelligence models can help. Fortunately, Shufti offers this solution and all the financial entities can benefit from it.

To know more about our Anti-Money Laundering compliance solution, get in touch with our experts.

Explore Now

Explore Now