Know Your Investor | Understanding Which Investors to Onboard

Investor onboarding is regarded as one of the most critical stages of the business’s lifecycle. It serves as the first point of contact between investment service providers and their investors. Because first impressions shape the rest of the relationship, they are strategically important for both individual and institutional clients. As a result, a streamlined and user-friendly onboarding process provides critical benefits to organisations.

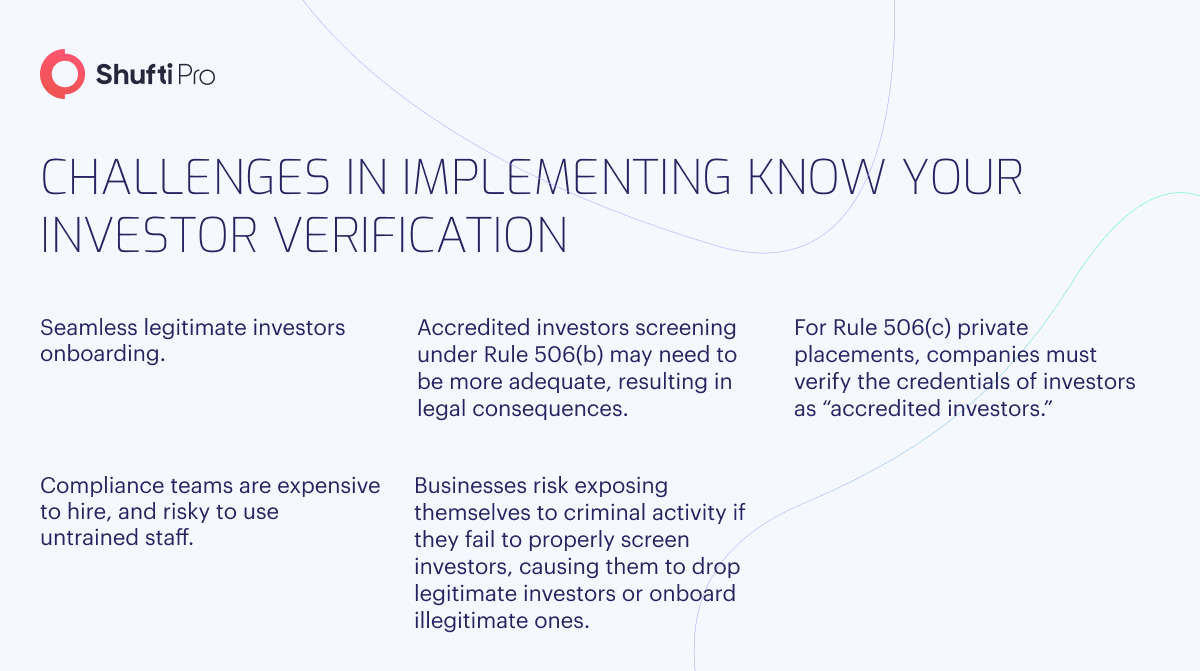

Since processes were automated, the world has undergone several fundamental changes. The intricacies and investment fraud have reached new heights, and digitisation has provided fraudsters with a gateway to a shelter of criminal operations. They now use advanced technology to engage in crimes, making it difficult to meet Know Your Investor requirements and confirm whether the investors onboarded for businesses are legitimate or not.

Companies must take appropriate procedures to onboard actual investors and conduct thorough due diligence checks whilst meeting the Know Your Investor (KYI) and Anti Money Laundering (AML) compliance obligations as the investing sector is a popular target for scammers.

What is Know Your Investor?

Know Your Investor (KYI) is a subset of Know Your Customer (KYC) that checks investors’ identities before onboarding them. Every business needs investment or capital from a third party or institute at some point to expand and thrive. As a result, businesses attract investors. Before accepting any investor, firms must investigate and verify if the investor is genuine or a fraudster. Know Your Investor checks are part of the due diligence method before enrolling investors. Investor verification assures that potential investors have the requisite market knowledge and can contribute to a company’s long-term success. It protects against possible threats and risks whilst remaining compliant.

How do Different Laws Categorise Investors?

Upon looking up the term “qualified investor” on the internet, several definitions that reference various sorts of investors with similar meanings – accredited, professional, expert, sophisticated, etc., will show. That, too, is not incorrect. Investors are classified differently in each country.

Investors who fall into a privileged category in Europe or Australia have the title of “sophisticated,” “qualified,” or “professional,” whereas, in the United States and Canada, they are “accredited” and are called “experts” in Singapore. Some jurisdictions define only one sort of special investor, whereas others define more than three. So, Know Your Investor and the conditions established by the jurisdiction.

Qualified Investor

A qualified investor, in general, is a legal person who has permission to invest in private assets, venture capital funds, hedge fund investments, and other privately placed investments through restricted bids. Like an accredited investor, a qualified investor has a high income and a net worth equal to or greater than the precise standards stipulated in the relevant statute. Individuals, financial institutions, enterprises, trusts, corporations, and non-profits can all be qualified investors.

The Criteria to Become a Qualified Investor

Businesses of any size necessitate prudential thinking. Even if the investor is verified or qualified by others, conducting Know Your Investor checks never hurts before entering into any agreements. Companies, to be more specific, are required to do so. But how do businesses know if the investor fits the category they are seeking?

The most important criterion for people is their yearly revenue or, alternatively, their total assets (individual or partner). Net worth is usually calculated in relation to legal entities. Regional laws determine the thresholds, for example:

- In the United States, an individual (or with a partner) must have a net worth of more than $1,000,000 or a yearly income of more than $200,000 (or a combined income of more than $300,000 with a partner) for the previous two years, with a prediction of a similar income in the current year.

- In Canada, an individual (or with a partner) must own $1 million in assets or a total wealth of more than $5 million, or a person’s net income before taxes must be more than $200,000 (or $300,000 with a partner) in the most recent years, with a prediction of a similar income in the current year.

- In the United Kingdom, a person must earn at least 100,000 GBP annually or at least 250,000 GBP in assets to qualify as a qualified investor.

Aside from financial holdings, a person or institution should thoroughly understand the market and have prior experience dealing with securities or regulatory bodies. Qualified investors verification must be able to analyse and assess the risks that are associated with their investments. A person’s work and educational history can also be considered for determining eligibility.

In the EU, for example, the MiFID says that a person must meet at least two of these requirements to be designated an “elective” professional client:

- An individual must have completed at least EUR 50,000 in business transactions in the appropriate industry with a standard rate of 10 times per quarter over the previous four quarters;

- a person’s investment portfolio, including funds deposited, must exceed EUR 500,000;

- at least a year of employment experience in a position that requires understanding related to the investment or transactions.

Sophisticated Investors

Investors are deemed competent if they have adequate funds, net worth, and investing experience to engage in higher-level investment activities. If the investor complies with the sophisticated investor thresholds, they are qualified for greater chances and special advantages, such as:

- potential investments;

- confidential government or private offerings;

- additional deals that “standard” investors never see;

- organisational offers.

Looking for a general description of a sophisticated investor? It doesn’t exist in the real world. It differs depending on the nation’s standard, legal understanding, or under a specific case.

The Criteria to Become a Sophisticated Investor

The SEC defines sophisticated investor criteria as someone who has comprehensive business and financial knowledge that allows them to make proficient investment decisions, potential offers, merit and risk evaluations. A sophisticated investor can be an expert in academia or an investment expert with financial market knowledge but have insufficient revenue to claim accreditation.

Accredited Investors

According to the Securities and Exchange Commission (SEC), an accredited investor is an individual or corporation permitted to buy and sell securities without registering with financial regulatory agencies. Accredited SEC investors can invest in exclusive investments of stock, hedge funds, equity crowdfunding, and venture capital, which are not available to the general public.

Accredited investors are appealing to firms since only they can be provided unregistered securities. In simple terms, an accredited investor’s role is to assist in financing an enterprise by investing in it. Choosing not to register the company with financial authorities saves a significant amount of money in filing fees. The accredited investor and company have a wonderful possibility to earn highly. Still, the accredited investor must also recognise and be prepared to deal with any financial or credibility losses since they are not on the watchlist of investor regulatory bodies. However, businesses must report suspicious activity related to investors to the authorities.

The Criteria to Become an Accredited Investor

The accredited restrictions were implemented to ensure that anyone interested in unregistered securities understands the dangers involved and is willing to lose money.

- over $200,000 yearly revenue for two years (or $300,000 together with a partner) with the same income streaming for the current year;

- over $1 million gross assets separately or together with a partner, excluding the residence;

- aside from wealthy people, SEC-certified investors can include certain trusts and corporations;

- a trust with more than $5 million in total assets founded for a purpose other than specifically purchasing the subject securities;

- a company in which all shareholders are accredited investors.

The 3 Steps to Investor Verification

This brief checklist is only a summary of the process of Know Your Investor service, which will vary depending on the jurisdiction and case, with more stringent or lax standards.

Personal Data: Potential investors provide basic personal information such as their name, address, fax, email address, etc.

Identity Verification: Investors are asked several questions to validate their status, such as the person’s job or business, academic record, partners’ capital, net worth, total assets, etc.

Evidence Submission: According to the type of investment, the individual must provide proof of their financial standing or asset details.

Know Your Investor With Shufti

Even though many global regulations have been enacted and the investment sector has made great efforts, the current crime cases are having a negative impact on the industry. Before onboarding an investor, it is critical to understand who they are and their criteria under the laws of the country in question. As a result, banking institutions and other investment firms must verify investors; that they only accept legitimate ones. By implementing Know Your Investor (KYI) checks in the company’s customer identification verification systems, fraudulent actions can be discovered, operations can be safeguarded, and investors’ money can be protected.

Shufti provides a cutting-edge Know Your Investor solution that demands no manual effort, is quick, and cost-effective. Our uncomplicated SDK and API are simple to incorporate into our client’s existing system. Quick and simple questionnaires show accurate findings, and our skilled MLROs deliver complete reports and screen for risks as well as fraud whilst maintaining compliance.

Struggling to securely onboard investors whilst being within your country’s legislation?

Explore Now

Explore Now