Know Your Investor | Simplify the Onboarding Process

- 01 What is Know Your Investor?

- 02 What is Accredited Investor Verification?

- 03 Insight Over Investment Industry

- 04 Steps Involved in Streamlined Online Investor Onboarding

- 05 The Challenges in Implementing Know Your Investor Verification

- 06 Onboard Legitimate Investors with Shufti's Cutting-Edge KYI Solution

Businesses at any stage need to onboard credible partners and investors who bring in capital and benefit the company’s future perspective as well as participate in the growth. However, in our digital era and with the availability of artificial intelligence, the methods of theft or fraudulent activities have sharpened, raising security concerns for the investment sector; and making Know Your Investor Service a need.

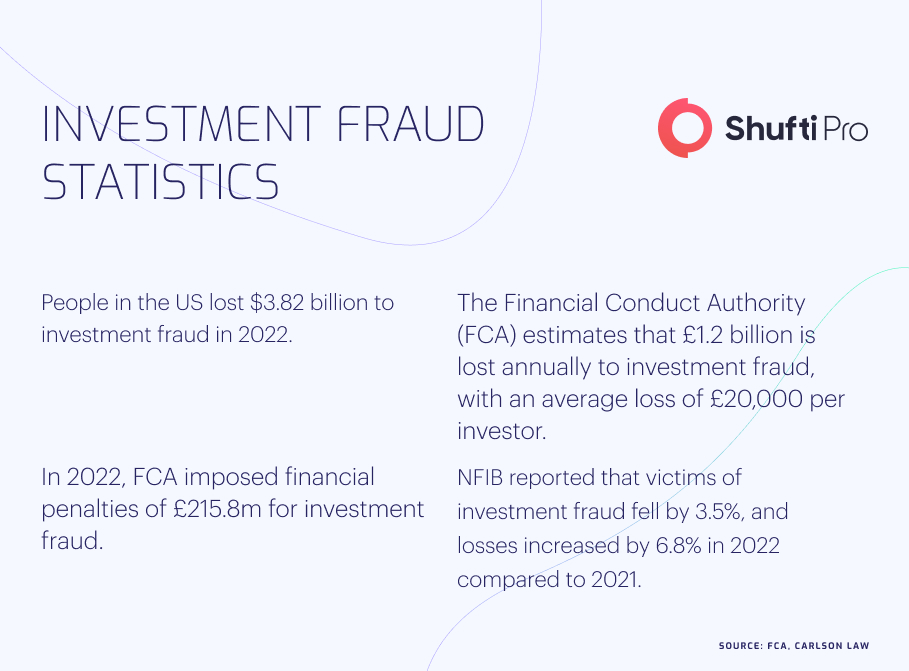

The world has experienced several significant transformations since processes have been automated. The complexities and investment fraud have risen unprecedentedly, and digitisation has provided fraudsters a portal to the haven of illicit activities. Now, they utilise modern technology to commit crimes, making it hard to meet Know Your Investor checks and verify whether the partner businesses are onboarding true. In 2022, the Financial Conduct Authority (FCA) in the United Kingdom imposed a £215.8 million penalty.

Since the investment sector is a prime target of fraudsters, companies need to implement suitable measures to onboard actual investors and conduct proper due diligence checks whilst meeting the compliance obligation of Know Your Investor (KYI) and Anti Money Laundering (AML).

What is Know Your Investor?

Know Your Investor (KYI) is a part of Know Your Customer (KYC), which verifies the identity of investors before onboarding them. At some stage, every company needs capital or funding for the company’s growth and expansion. For that reason, companies onboard investors. Before taking in any investor, businesses need to check and verify whether the investor is authentic or a fraudster. The due diligence process before onboarding investors is called Know Your Investor checks. Investor verification ensures potential stakeholders have the necessary market expertise and can contribute to the long-term prosperity of businesses. It safeguards against the potential threat whilst staying compliant.

What is Accredited Investor Verification?

An accredited investor verification validates a person or company meeting specific SEC criteria, allowing them to invest in less regulated options such as hedge funds or oil wells. An individual is considered an accredited investor if they meet the subsequent SEC criteria:

- Maintaining a net worth of $1 million or more, either alone or with a spouse, excluding the value of primary residence.

- Earning more than $200,000 in individual income (or $300,000 in combined income with a spouse) in the previous two years, with a reasonable probability of attaining the same income criterion in the current year.

Insight Over Investment Industry

The investment industry has seen unprecedented growth, bringing in revenue, security concerns, and scams. Between 2020 and 2022, the amount of money lost in investment scams among people over 60 in the United States ascended tenfold. Elderly victims of investment scams reported more than $990 million loss in the most recently investigated year, up from roughly $98 million in 2020. This alone is the stats for the United States; the surge in digitisation has globally impacted the sector. Since the technology involvement in the investment sector, the preceding year saw a significant increase in financial investment fraud of approximately 42%, led by a 59% increase in Ponzi schemes and a 57% increase in bond sale fraud.

Steps Involved in Streamlined Online Investor Onboarding

Long gone are the days when investor verification was done manually. Now, the verification and onboarding can be completed in seconds, making it easier for businesses to determine whom they should work with or avoid conducting any activity. Detecting associated fraud and safeguarding the company whilst finding the investor whose interest matches with the company is easier than ever.

Prior to the technological advancement, implementation of artificial intelligence, and machine learning, verification used to be done manually. Every investor was screened against the data books available, which took days, weeks, and even months to be verified. Now, when technology took over, these tasks have become more straightforward and error-free. It requires less time, effort, and resources. In seconds, companies can onboard investors whilst staying compliant, resulting in a decrease in fraud and a higher return on investment.

Onboarding the right investor requires the proper Know Your Investor checks and a streamlined procedure. Shufti offers the following four steps to automate investor verification and processes.

Obtaining Investor Information

First and foremost, the process begins with collecting the necessary information about the investor, including who they are, what they do, source of income, financial records, background and history, etc. It sounds simple and easy, but collecting and verifying all the helpful information for accurate findings is challenging. For smooth processes, it is essential to be sure what type of investor is being onboarded and then follow the remaining procedure. Once the investor type is selected, the investor uploads their government-issued ID and pertaining documents, the rest of the processes are continued.

Types of Investor Verification

Before onboarding an investor, it is essential to verify what type of investor it is and what role it plays in the business. Shufti verifies four kinds of qualified investors and others on demand, which are as follows:

Business Shareholders and UBOs

Business shareholders and Ultimate Beneficial Owners (UBOs) are the persons who own or control the business and (in some cases) take part in the management and decision-making. In a company, UBO status can be defined as:

- Someone who has at least a 25% stake in the capital.

- Someone who has at least 25% voting rights.

- Someone with at least 25% of the capital of the legal entity beneficiaries.

On the contrary, shareholder’s criteria depend on the company policy and standards set. Shareholders are business owners but do not participate in everyday activities. Those daily affairs are left to the directors and management; notably, directors can also be company shareholders.

Company Directors

Company directors are the internal regulatory bodies of the business who are responsible for managing smooth affairs and are legally responsible for running the business. Most companies appoint their investors as directors. Not only do they bring in revenue, but they also stay updated about the daily internal affairs of the company.

Private Equity Holders

Investment in non-publicly traded or listed companies is known as private equity. It is a type of investment capital from firms that buy holdings in private or public companies with aspirations to make them better and are high-valued. The primary purpose of a private equity holder is to invest; only some holders play an active role in the management and internal affairs.

High-Net-Worth Individuals

The high-net-worth individuals are considered to be the ones who have $1,000,000 in cash or assets. The primary purpose of those individuals is to invest in businesses that seem profitable. They don’t actively participate in business affairs or daily activities but keep a keen eye on internal financial affairs.

Documents Needed

To ensure secure, seamless onboarding and compliance with KYI checks and AML, Shufti verifies several crucial documents to verify an investor’s identity and accreditation status:

- Articles of association

- Registers of directors

- Proof of address

- Credit reports

- Registers of directors

- Bank statement

- Registers of shareholders

- Certificate of incorporation

- Bank details

- Source of funds/wealth

- Signed and dated ownership structure

UK Investor Document Requirement

The United Kingdom regulation typically requires several essential documents to verify an investor’s identity and accreditation status. These documents include but are not limited to:

- ID document

- Income or net worth proof

- Self-certification form

- KYC form

- AML documentation

- PEP check

USA Investor Document Requirement

According to the United States regulations, an investor’s identity and accreditation status are verified depending on the investment context. These document differs from the UK and include:

- Government-issued ID

- Income proof or net worth

- Accreditation verification form

- W-9 form

- KYC/AML documentation

- Investment advisor registration documents

Verifying Investors Data

Once the investor data and all relevant documents are received, they are scanned against the sanction or watchlist, government, and private databases to validate their authenticity. Our expert MLROs validate investors’ documents and ensure businesses never regret taking money from investors, and all documents are verified based on regional legal and compliance requirements.

Verification Through Our MLROs

Shufti takes the hassle out of the client’s work. Our MLROs and compliance officers conduct a real-time identification process with respect to investors’ IDs and corporate documents.

Verification Through Your Own Team

If anyone wishes to verify investors manually, our customised solution offers verification through team services in which we collect data for our client, and they can manually, with their team, decide whether they want to onboard the investor or not.

Onboarding Investors

The decision-making comes once MLROs validate all the documents provided and screen them against possible threats or fraud. In this stage, if the provided information matches the criteria, the investor is considered compatible and onboarded. If the investors fail to provide information on time and fail to pass, they are rejected and informed.

Continuous Monitoring

Once the investor is verified, the resulting information is saved in the back office. It does not end with the data storage; after the completion of the process, the data is continuously updated, and the investor is screened or monitored in case of any possible threat that may occur in the future.

The Challenges in Implementing Know Your Investor Verification

Businesses face many challenges whilst integrating or implementing

- Seamless legitimate investors onboarding.

- Accredited investors screening under Rule 506(b) may need to be more adequate, resulting in legal consequences.

- For Rule 506(c) private placements, companies are required to verify the credentials of investors as “accredited investors.”

- Compliance teams are expensive to hire, and risky to use untrained staff.

- Businesses risk exposing themselves to criminal activity if they fail to properly screen investors, causing them to drop legitimate investors or onboard illegitimate ones.

Onboard Legitimate Investors with Shufti’s Cutting-Edge KYI Solution

Onboarding the right investor for the company who possesses no risk and is beneficial for business processes in the automated digital era is complicated and full of complex processes. Shufti offers a state-of-the-art Know Your Investor solution that requires no manual hassle, is time and budget-friendly, as well as is simple whilst maintaining compliance. Our simple SDK and API can be easily integrated into our client’s existing system. Quick and easy questionnaires provide accurate results, and our expert MLROs offer comprehensive reports, monitoring against threats and fraud. With our advanced solution, businesses can detect true investor identities, authenticate documents, and identify risks associated with staying compliant with Rule 506(b), 506(c), and KYC/AML features.

Ready to simplify your complex onboarding processes?

![Money laundering and UAE’s KYC/AML Regulatory Regime [2022 Update] Money laundering and UAE’s KYC/AML Regulatory Regime [2022 Update]](https://shuftipro.com/wp-content/uploads/b-img-money-2.png)

![A Year In Review of the FinTech Industry [2021 Update] A Year In Review of the FinTech Industry [2021 Update]](https://shuftipro.com/wp-content/uploads/FINTECH-01.png)

![AUSTRAC’s ML/TF Risk Assessment Report on Foreign Bank Branches [Part 3] AUSTRAC’s ML/TF Risk Assessment Report on Foreign Bank Branches [Part 3]](https://shuftipro.com/wp-content/uploads/image-17-2.png)