KYC Verification – Ensuring Regulatory Compliance in Sports Betting Platforms

With the growth in organised crime and its infiltration into the sports betting market, businesses are facing the challenges of regulatory compliance. The ever-evolving landscape of sports betting has proliferated to become a multi-billion dollar industry. However, this growth is also accompanied by increased scrutiny from regulatory authorities due to the surge in financial crimes.

Money launderers see the betting industry as the ideal place to spend their illegally obtained funds to take advantage of the relatively weak KYC (Know Your Customer) and AML controls. In light of the record-breaking cases of money laundering and other types of financial crime in recent years, regulatory authorities are taking steps to ensure the implementation of robust KYC procedures.

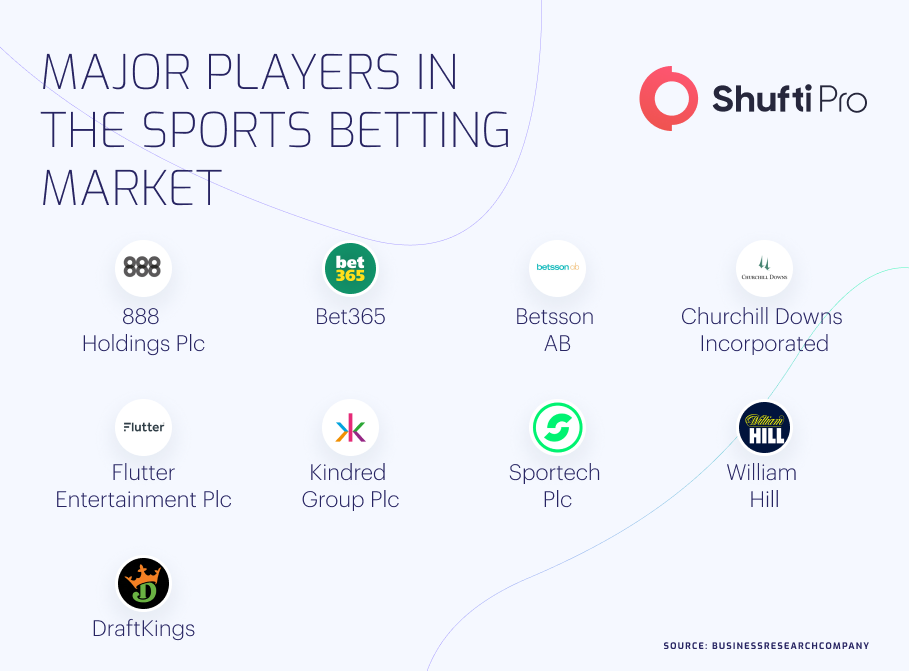

Overview of the Sports Betting Market

Considering the fierce competition and the unpredictable nature of businesses in the sports betting market, it is clear why bookmakers often unwantedly assist money launderers in their illicit motives. Sports betting involves gambling activities that predict the outcomes of sports events, encouraging those who have dirty money to spend large amounts at one time. On top of that, online betting in popular sports like horse racing, football, and baseball has shot up significantly after the Covid pandemic. These sports not only catch the eye of enthusiasts but also media channels, betting, and merchandising companies, hence making revenue of billions.

Sports betting businesses are among the biggest sponsors of sports teams and are categorised according to their types and platforms. For instance, online sports betting is dominant in terms of traffic and the number of bets placed, including in-game bets, fixed bets, spread betting, exchange betting, daily fantasy, and e-sports. The advancements in modern mobile applications and AI-based technologies have changed the way sports betting works. That being said, the mass digitisation in online platforms does not come free of risks.

The introduction of AI-driven systems and blockchain technology in the online betting sector has significantly contributed to the rise in popularity of such platforms. Blockchain technology has both automated and added to the accuracy of sports betting applications through smart contracts. As a result, payments and bet confirmations along with other operations in sports betting are sufficiently improved by blockchain solutions. For this reason, sports betting businesses require effective and scalable KYC solutions to authenticate their customers while they spend large amounts on promotions to bring in more spectators.

Financial Crime in Sports Betting

Its no secret that sports betting platforms have always been used by financial criminals to succeed in their illicit motives. Not only organised criminal groups but also shell companies and businesses created with criminal intentions wash their proceeds of crime through betting platforms. Therefore, the concerns of fraud, financial crimes in the form of money laundering, corruption, and embezzlement are prevalent in the sector which is home to drug cartels and mafias. In the absence of robust, AI-driven solutions for identity verification, sports betting platforms have a tough time preventing fraud and money laundering.

Apart from money laundering risks, sports betting platforms also face the concerns of the money from their business being used in criminal activities like drug traficking. Sports betting also contributes to a variety of big movies in the same way as it assists money launderers in cleaning their dirty money. The sports sector is not new to money launderers and experiences more than $2 trillion dollars worth of illicit financing throughout the world every year. With frauds surging past previous records thanks to new and evolving techniques to evade screening checks, it’s high time that sports betting platforms ramp up their efforts to stay one step ahead.

The sports betting sector sees more types of fraud than banks and financial institutions. Bookmakers are often deceived by the fixture of the results of a game. For instance, a high-stakes sports gambler, Rob Gorodetsky was sentenced to prison for up to 20 years for defrauding an investor of approximately $10 million, committing wire fraud, and tax evasion or avoidance.

Regulations & Fines for the Sports Betting Sector

For quite some time now, regulators and law enforcers have begun taking action against fraudulent schemes and financial crimes in the betting industry. Failure to comply with AML regulations usually leads sports betting platforms into trouble – mostly in the form of hefty penalties that can lead them to bankruptcy. In addition to these concerns, sports betting platforms also fear getting their services banned along with reputational damages. The disastrous effect of non-compliance urges sports betting platforms to ensure the implementation of effective KYC verification.

In case of market abuse and financial crime cases, personal liability and accountability authorities hold the firms accountable for failing to detect suspicious activities. For instance, three members of the senior management team at Caesars were forced to give up their licenses due to the company’s involvement in a financial crime case. Considering the high vulnerability of bookmakers and sports betting platforms towards money laundering and other types of financial crime, regulatory authroities and watchdogs have set the bar up high. The Financial Action Task Force (FATF) – an intergovernmental financial watchdog established a comprehensive framework of regulations termed ‘The FATF 2012 Recommendations’, which every country is required to implement for combating fraud, money laundering, and other predicate offences.

One of the key requirements of the FATF Recommendations is for sports betting platforms to adopt a risk-based approach and analyse the risks brought forth by the customers they deal with. KYC verification has emerged as a fundamental measure taken by banks and financial institutions to streamline their operations and comply with international regulations by implementing customer due diligence (CDD) measures. This implies that businesses operating in the sports betting sector need to verify the identity of their customers and perform ongoing screening of business transactions and entities.

Key Takeaways

Identifying and eliminating the risk of financial crimes particularly money laundering, identity theft, and terrorist financing requires the gaming industry to implement robust security measures. New and emerging technologies like AI are enhancing identity verification as well as background screening measures, ensuring that gaming services remain secure.

Shufti’s state-of-the-art identity verification solution is an ideal solution to safeguard online gaming service providers and prevent the risk of financial crime including money laundering and terrorist financing. Powered by thousands of AI algorithms, Shufti’s IDV verifies true identities in less than a second with 98.67% accuracy, making it a perfect fit for the rapidly growing online gambling industry.

Want to know more about KYC services for the sports betting industry?

Explore Now

Explore Now