Real Estate Industry Crimes and Strict AML Regulations – How Shufti Can Help

The real estate industry has long provided a safe way for fraudsters to secretly launder or invest illicit money into a legal system. Not only do high-valued apartments in London, Ibiza or Paris raise the bar on the social status of owners and also enhance the way of their lifestyle, but are also a primary source of hiding billions of dollars from financial regulators, tax authorities and other government agencies working to curb financial crimes.

However, in many cases, properties are purchased through shell companies or anonymous NGOs without undergoing a rigid set of due diligence checks by the real estate agents. This market loophole paves the opportunities for money launderers to launder or invest back money. Thus, to secure the real estate industry, FATF, the G20 countries and other financial watchdogs across the globe are collaborating to work together to curb money laundering activities and completely mitigate the root causes that provide criminals with a safe hand to carry out illicit activities.

The Real Estate Industry – A Secure Target For Money Launderers

The tightening of Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) regulations for the financial industry across the world has provoked money launderers to route toward the real estate industry. This is the reason the world’s premier commercial as well as financial hubs including New York, Vancouver, Dubai and many others are increasingly becoming the hub for money launderers. Money laundering through the real estate market is becoming a global concern, estimated to have reached $1.6 trillion each year.

In addition to this, the absence of rigid security checks makes it attractive for criminals, organized crime groups love the real estate market, while governments across the world are looking for solutions to find effective ways to stop them from exploiting the industry. Over recent years, money laundering lists of alleged criminals including Chinese gambling rings, Venezuela television, and various banks from various jurisdictions have been suspected of using or clearing the transactions gained from criminal proceedings for purchasing properties. Some of them include a C$22 million gabled mansion nestled in upscale Shaughnessy, a $8.85 million four-bedroom penthouse on Riverside Boulevard on the west side of Manhattan, and an £11.5 million, five-bedroom property in the tony London neighbourhood of Knightsbridge.

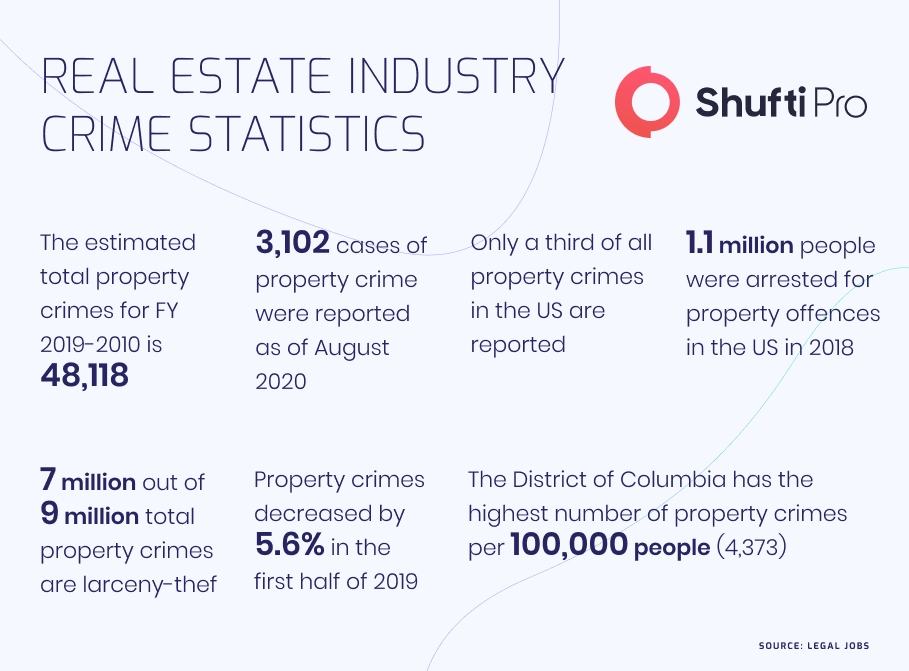

Like other countries, the US real industry has also been a prime target of money laundering. To curb the illicit activities, FinCEN, the country’s Treasury Department’s core investigation arm, reissued a directive last year which lowered the threshold required by title businesses to determine all the individuals at shell companies making transactions above $300,000. Following are some cases that become the reason for damaging the industry’s reputation and providing people chances to raise questions regardings its credibility.

B.C. Real Estate Firm Fined $230K for Anti-Money Laundering Violations

The Financial Transactions and Reports Analysis Center of Canada (FINTRAC) has imposed a fine of $230,423 on Nu Stream Realty Inc. for non-compliance with Federal Anti-Money Laundering laws. The company has failed to submit a suspicious activity report where there was a high risk of suspecting bogus transactions that were associated with money laundering activities. For instance, Nu Stream was found to have no designated professional to monitor compliance with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and regulations associated with it. In addition to this, the firm also failed to keep customer records, including failing to document a review every two years, to determine the effectiveness as well as the credibility of its policies, risk assessments and training programs.

Furthermore, according to the financial watchdog’s statement, Nu Stream also failed to enlist all obligatory information in receipt of funds and identification records and in client information records. However, as per the country’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act all real estate brokers and businesses are required to keep customer records, identify clients’ identities, build a compliance regime and report suspicious transactions to FinTRAC.

TIC Reveals Nearly $30 Billion Laundered Through Canada’s Real Estate

A joint study by Transparency International Canada and the End Snow Washing Coalition highlighted the risk of money laundering in the country’s real estate industry. Owning a house remains a dream of millions, as real estate prices are on rise due to an increase in money laundering activities. According to its previous study, billions of dollars were found that were linked to real estate transactions in the Greater Toronto Area alone. The publisher also revealed that $35 billion worth of residential mortgages were confiscated that were funded by shell businesses that failed to comply with the country’s anti-money laundering regulations. In addition to this, $9.8 billion in real estate was also obtained by the firms through cash payments or non-financial channels to avoid AML screening checks in which they are required to show the source of funds as well as disclose beneficial owners’ information. However, the government is making efforts to curb the instances of money laundering across the country. The federal government has also mentioned that they are planning to develop a new database for keeping records, probably to be introduced by 2025.

Global AML Regulation for Real Estate Sector

United Arab Emirates

Decree-Law No.20 of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organizations is the primary law for AML in UAE. The Cabinet Decision No. 10 of 2019 mandating the implementation of these regulations makes real estate brokers and agents subject to the country’s AML regulations. This means that, like financial firms, the real estate market also needs to stay put with the laws and standards to operate within the UAE. These sets of regulations are made necessary since the businesses have to stop paying attention to suspicious activities along with lowering the level of efforts to curb money laundering. In addition to this, the real estate industry is so diverse and laws associated with them are very few. This exposes the real estate businesses to money laundering and terrorist financing risks.

Furthermore, the Cabinet Decision has also provided a list of Designated Non-Financial Businesses and Professions (DNFBPs) that includes real estate agents and brokers. This further defines customer due diligence, suspicious transaction monitoring, reporting and identity verification obligations.

Europe

European Commission has developed various anti-money laundering directives that aim to overcome the risk of money laundering and terrorist financing. According to the EU’s Sixth Anti-Money Laundering Directive (6AMLD), real estate agents and brokers need to develop identity verification systems that should be streamlined with know your customer, know your business and ultimate beneficial owners verification checks. In addition to these countering measures, businesses also need to have control systems capable of monitoring transactions to determine suspicious activities and instantly send a report to the financial watchdogs. However, if the real estate companies fail to comply with the country’s AML regulations, they could face hefty fines and financial sanctions.

What Shufti Offers

Shufti’s state-of-the-art Anti-Money Laundering (AML) screening service is a viable solution for real estate brokers and agents as it allows them to stay compliant with regulatory standards as well as secure the company’s operations. Powered with thousands of AI algorithms Shufti’s AML screening solution also authenticates customers against 1700+ global financial watchlists in less than a second with 98.67% accuracy.

Want to learn more about AML screening solutions for the real estate sector?

Explore Now

Explore Now