Secure Online Gambling through Identity and Age Verification

Gambling is a very profitable business for big players and owners alike. According to research, the global gambling industry is expected to reach an estimated US$647.9 billion, constantly increasing at an annual rate of 5.6% through 2022-2027. However, has it been a priority for this sector to employ Identity and age verification for securer practices? Probably not. Online gambling by many is considered to be a quick way to earn easy money with minimal effort, provided they know their tactics right. Attractive offers and fancy marketing are a neat way to attract individuals to various gambling platforms. Alarmingly, many of these individuals are children and minors, a percentage of which has skyrocketed recently. A study by the UK Gambling Commission highlighted the number of children betting, having crossed the 400,000 marks. This is worrying because most of the children are below the ages of 16.

Why Age Verification is Important to Protect Your Children

Since the rise in home computer access and internet usage, more children are using the internet to interact and socialize globally. Almost 71 percent of the children aged 11-17 have access to the internet. It is important for parents to keep minor children off gambling platforms as a reflection of responsible parenting. While no 100 percent restrictions can be placed on children, the responsibility should be professionally taken on by gambling platforms by implementing gambling compliance including age verification, and social responsibility regulations to better deter underage gambling from taking place. For the Gambling industry, it keeps the businesses sound from the regulatory bodies and any unforeseeable financial consequences.

Age Verification allows an online gambling business to:

- Confirm a person’s Identity

- Onboard legitimate customers

- Confirm if a person is of legal age to gamble

- Be regulatory compliant

- Steer clear of financial penalties and legal issues

- Prevent viewership of over-age content

Age Verification & Online IDV – The Perfect Pair

Traditional identity verification processes are not sufficient for the demanding and rapidly changing global gambling industry. Age verification is ideally suited to be employed right after the completion of Online Identity verification. The process usually involves the verification of the identity through a primary identification document. Where an individual’s KYC information is compared against identity particulars found on the identification document. Unfortunately, these identification documents can be stolen and bought off the dark web. In 2018, 6% of children had gambled online using a parent or guardian’s account. In order to ensure further security and gambling compliance, some providers offer the service to verify oneself through live video verification or a selfie upload. This allows further fraud mitigation by verifying a person, who they claim to be through a pictorial comparison involving two images – one on the ID document and the other provided in real-time. Once the Identity of the customer is confirmed first, the next step towards age verification can be performed.

From a gambling scenario, the identity of the individual will confirm the legitimacy of the person during the account opening/registration process. Once the account is opened, the individual cannot carry out gambling activities until the age has been verified and confirmed. While the platform has no issue with the legitimacy of the person in question, age verification enables the suitability of the person to carry out activities on the platform. Even if the identity has been confirmed and not the age, the account in question will be kept suspended.

Achieving AML compliance in gambling

KYC and AML go hand in hand. Undoubtedly, the evolution of the global gambling industry has brought massive opportunities for big players and operators but on the other hand, it has also given rise to online crimes. The environment these business operations take place is much more complex which has made it difficult for regulating the industry and uncovering possible criminal activities. The reason why international AML regulations and gambling compliances are becoming rigorous. Financial criminals mostly abuse the gambling sector for money laundering. Therefore, AML regulations in online gambling keep money laundering and illegal finances at bay. It is mandatory for the gambling industry to perform enhanced due diligence on customers placing bets of 2,000 euros or more within 24 hours. The gambling industry must comply with the AML frameworks to prevent themselves from potential AML, criminals activities including terrorist financing. Gambling operators need a powerful identity verification solution that not only verifies age but provides a complete solution that thoroughly screens customers based on background history as well.

Making it Even Better

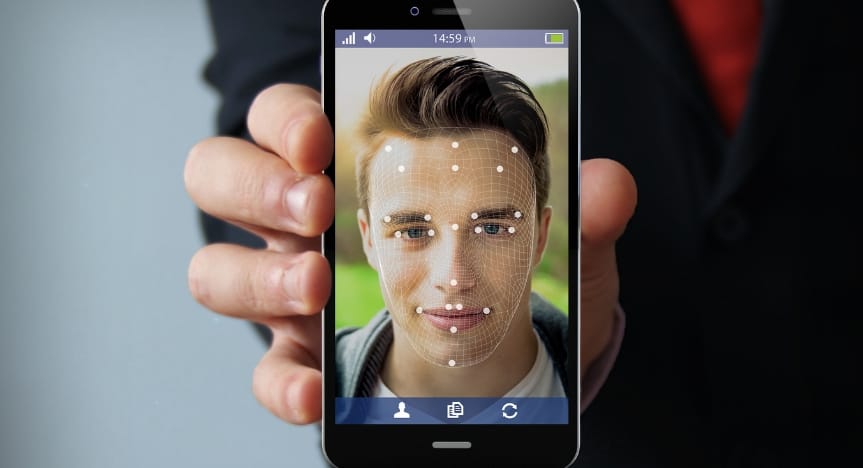

Online Identity Verification has greatly improved, keeping in mind the recent regulatory requirements that call for improvements to be made in detecting human-presence. This human presence is assured through Shufti’s liveness Detection. The entire process of Online Identity Verification and Age Verification is considered together to fight Spoofing Fraud. Scammers are using spoofing attacks as a way to gain access privileges to others accounts, through realistic image masks, 2D images, HD video playback. In order to combat fraud at a much greater scale, Gambling platforms need to look into advanced Identity Verification over traditional age and identity verification.

Techniques Involved for Advanced IDV

- Image Distortion Analysis

- 3D Sensing Techniques

- Skin Texture Analysis

Above mentioned techniques are incorporated into the liveness Detection that runs on a machine learning engine for optimal 3D depth analysis. The process is carried out through adequate comparison information. Based on computational Algorithm, different points on the image are compared to that of a previously digitized template. Shufti’s liveness detection proves a person’s legitimate presence as well as prevent from facial spoof attacks.

Where to Go Next

The Global Gambling Industry is a lucrative and growing commercial sector, whether for leisure or economy specific jurisdictions. The sector needs to quickly consider the growing number of young users it attracts that is causing the social disturbance and regulatory displacement. Social responsibility plays a huge part in responsible gambling. It encourages that crime should be kept at bay, gambling should be transparent and most importantly vulnerable people including children should be protected from gambling exploitation. The chances of underage people becoming involved in gambling are 300% more likely to become addicted.

In order to ensure sound operations, gambling companies, betting platforms, casinos, and other services need to employ the right identity verification services and age verification solutions to meet gambling compliance in order to better protect the system from fraud and the growing number of scam individuals.

The regulators need to look into services and providers that are established on the motives to fight fraud through innovation and protect the innocent and the system altogether.