Top 5 Reasons Why Businesses Need Transaction Monitoring Solution

Companies are moving towards digitisation, meanwhile, cybercriminals are mastering the art of exploiting businesses to fulfil their illicit intents. 2022 witnessed a 50% surge in money laundering fines. Worrisome statistics make the transaction monitoring process a new normal within the financial sector. Looking forward, it is estimated that the market of transaction monitoring software will reach $29.53 billion by 2027 globally, showing the Compound Annual Growth Rate (CAGR) of 14.60% between 2022 and 2027.

Digging Deeper into Transaction Monitoring

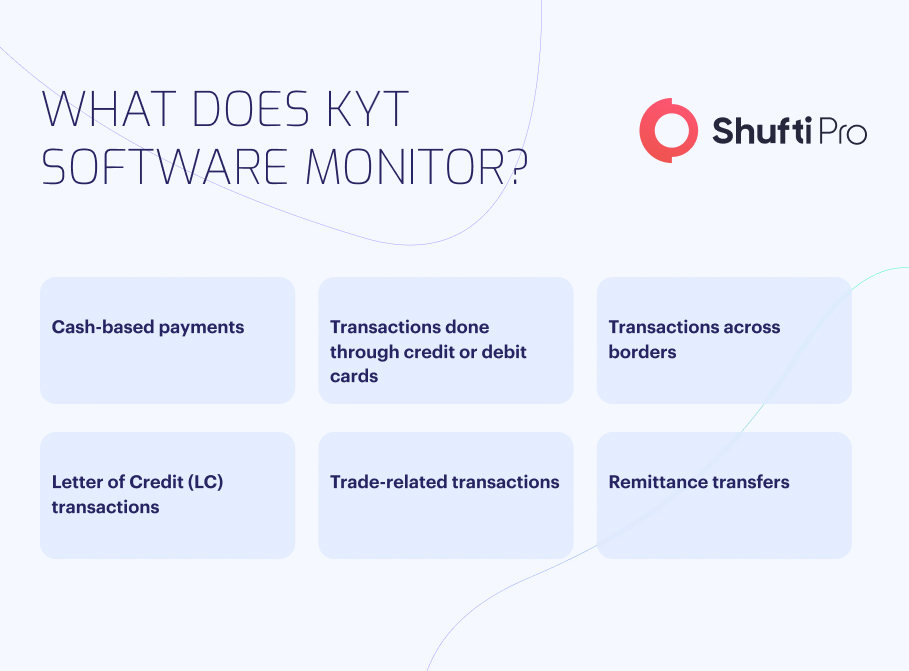

Know Your Transaction (KYT) means to proactively and reactively identify payments and business arrangements and flag suspicious transactions for manual review.

Transaction monitoring is a required practice for firms that move money on behalf of clients and businesses. It helps firms in preventing money laundering, terrorist financing, and other crimes that challenge safety across the globe.

Who Needs KYT Verification?

-

Money Services

-

Traditional Banks

-

Financial Services

-

FinTechs

-

Lending Companies

-

Exchanges

-

Cryptocurrencies

-

Brokerages

-

Insurance Companies

What Makes AML Transaction Monitoring Systems a Need of the Hour?

With the age of digitisation, companies are witnessing a spike in crimes such as money laundering, terrorism financing etc. To deter fraud and make premises safe and sound, it is essential to have robust KYT verification solutions in place.

Here is what makes transaction monitoring a must-have for businesses.

1. Money Laundering

Criminals are using sophisticated ways to launder money and use it for illegal activities.

They first take the money illegally and then place it in any financial institution (Placement). After that, they use different bookkeeping methods for covering up the infiltration of that ill-gotten money (Layering). Once they are successful in moving the money into a financial account, it is withdrawn and used for illicit purposes (Integration).

Here is a quick look at some of the latest fines for poor AML controls:

UK WATCHDOG FINES AL RAYAN BANK 4M POUNDS OVER AML CONTROL FAILURES

The Financial Conduct Authority (FCA) has charged Al Rayan Bank PLC with 4 million pounds over weak AML controls.

The bank allowed customers to pass finances and use them within the UK from April 1, 2015, to Nov 30, 2017.

“Al Rayan was aware of these weaknesses and failed to implement effective changes to fix them, despite the FCA raising concerns about the inadequacies of their systems,” the FCA said in a statement.

FIAU CHARGES ECCM BANK €310,000 FOR WEAK AML CONTROLS

The Financial Intelligence Analysis Unit (FIAU) has fined ECCM bank €310,000 over poor AML controls. FIAU revealed that the bank didn’t have any sufficient measures to assess the risk of customers and businesses.

“The ECCM assigned risk ratings for customers were not up to the mark as it did not consider all risk factors,” said the FIAU.

DUTCH CENTRAL BANK STRIKES COINBASE WITH €3.3 MILLION FINE OVER AML FAILINGS

The second biggest crypto exchange by volume, Coinbase has been charged €3.3 Million by the Dutch Central Bank. De Nederlandsche Bank has fined Coinbase for not complying with regulations and allowing crypto transactions to the unregistered clients in the country.

As per the DNB, “The fine was imposed because Coinbase provided crypto services in the Netherlands in the past without registration with DNB, which is in non-compliance with the law.”

2. Identity Theft

Hackers are making every effort to use others’ personally identifiable information like their names, credit card numbers, and social security numbers. The main goal of this heinous crime is to use their details for malicious intent.

Looking back at 2022, makes one astonish that approximately 15 million individual records were exposed globally through data breaches in the third quarter. The figure had jumped by 37% as compared to the previous quarter.

3. Terrorist Financing

It is not only money laundering but there are many other crimes like terrorism financing which puts a dent in any business’s reputation. Providing financial support to terrorists is what Terrorism Financing (TF) is all about. Every country has a list of businesses that are deemed as terrorist threats. The only purpose is to encourage them to establish standard Anti Money Laundering and Countering Terrorism Financing (AML/CTF) standards.

4. Drug Trafficking

From manufacturing to trading, drug trafficking includes everything related to drugs. Criminals are leaving no stone unturned when it comes to drug trafficking drugs despite stringent laws in place. Currently, the drug traffic market is worth $426 to $652 billion, raising concerns for businesses and customers.

5. Fraud

Fraud is when any individual or parties deceive others intentionally. When it comes to financial fraud, it occurs through:

- Dump schemes

- False insurance claims to get an insurance payout

- Identity theft to access any genuine person’s finances

There is no sector that hasn’t faced any kind of fraudulent activity. For example, the e-commerce sector lost nearly $41 billion globally in 2022 to digital payment fraud. The figure is estimated to grow to $48 billion by 2023.

How Shufti Fits in the Puzzle

To successfully navigate through this fraud pandemic era, financial firms ought to reexamine how to determine who is reliable and who is not. This is where Shufti takes the lead.

Shufti’s AML Transaction Monitoring is a complete solution that lets businesses streamline their due diligence processes. Detecting suspicious activity by screening against 1700+ global watchlists, supporting 150+ languages, and verifying identities in less than a second, is a wholesome technology to keep you ahead of cybercriminals.

Still, confused about how transaction monitoring software helps businesses fight financial crime?

Explore Now

Explore Now