Age Verification – Ultimate Online Protection for Minors

The rapid increase in the use of the internet is raising some major concerns for parents regarding the online protection of their children. With the world moving towards digitisation and smart devices, every child is now exposed to the digital world. Whether it’s about watching youtube videos or playing games online, the children are regularly using mobile phones and tablets. On the internet, no one knows who you are. The freedom of staying anonymous on the internet allows anyone to get registered on any website using any identity information.

Generally, to register on any site, we need an email address and some personal information like name, gender, date of birth, etc. For instance, Gmail, Outlook, and Yahoo provide easy access to free email accounts, without proper verification of the individuals. Any child can get a free email account and use it for age-restricted sites, i.e. dating and porn sites, gambling platforms, and online liquor stores, etc. by misinterpreting their age and identity. Similarly, the same thing goes for adults as well that they can access services and products by manipulating their age.

“Act your age” isn’t applicable anymore in the digital world

The widespread use of the internet and smart devices has exposed the minors to the dark side of the web. Although the existence of child predators, pedophiles, fraudsters and cybercriminals is not a new phenomenon, however, the ease of access to social networking and other online platforms has contributed in an unsupervised encounter between adults and minors. This has grabbed the attention of cybercriminals and fraudsters providing them another opportunity to exploit the identities of children.

Exposure of children to the internet has raised serious concerns for the parents. The curious nature of kids to explore everything online is landing them in a dark pit divulging in illegal activities. According to NHS survey of smoking, drinking and drug use among school children (11 to 15-year-olds) in England -in 2016, three percent said they were regular smokers, 74 percent said they find it very difficult to give up smoking and 6 percent said they were currently regular e-cigarette smokers.

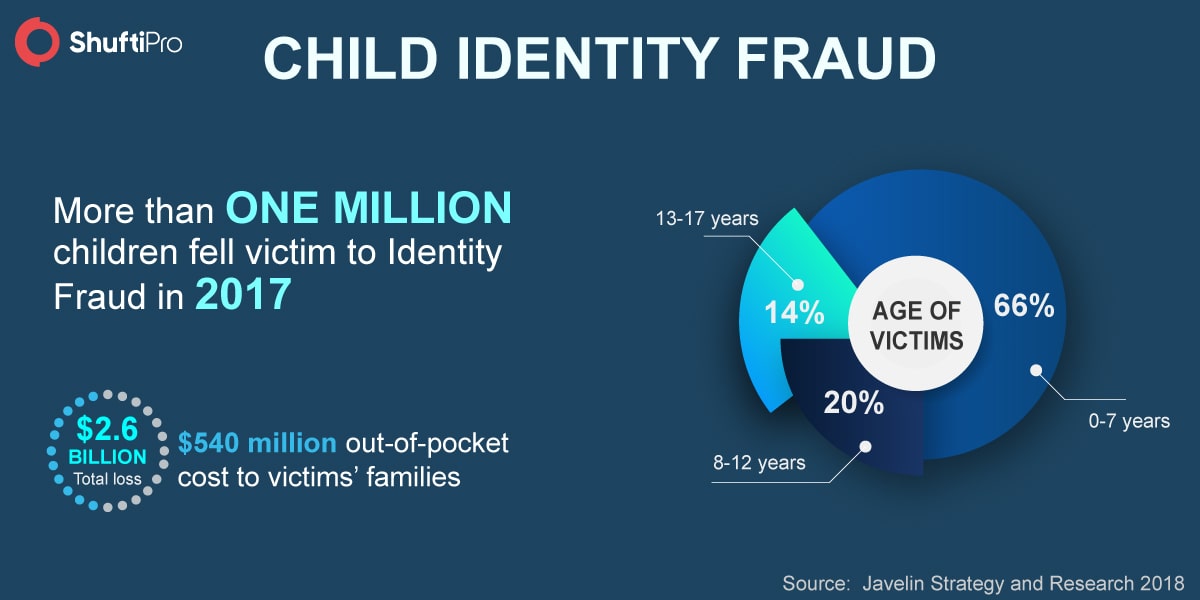

Moreover, minors are actively seen accessing social networking platforms and multiple age-restricted websites. The substantial risk associated with such platforms is the lack of proper age verification and authentication checks. According to the Young People and Gambling 2018 report, more than 450,000 children aged between 11 to 16 place bets regularly. Not to forget that gambling is illegal in most countries that too for minors. Furthermore, the presence of kids on the internet has resulted in increased Children Identity theft and fraud, eventually causing millions of losses for parents.

Age Verification – the need for Online Businesses

The anonymity on the internet and negligence of the businesses to confirm the age of their users is proving harmful not just for the kids and their families but for businesses as well. In the past few years, some deadly events took place due to a lack of age verification checks on the retailing stores. In 2014, a 16-year-old boy murdered the schoolfellow by brutally stabbing him with a knife. When investigated, he claimed to order a knife online from Amazon. That wasn’t the only case.

The rapid-increase of such pernicious incidents and children’s identity theft has propelled government and regulatory agencies to take steps against such incidents and come up with measures to avoid them in the future. To protect minors’ identities online and safeguarding them from age-restricted content, products, and services, the government has strictly imposed legal penalities for the businesses that fail to verify the age of their users before allowing them access to mature content.

The businesses that don’t confirm the age of their customers before allowing access to age-restricted content can face up to two years of imprisonment and fine. According to the Digital Economy Act 2017, the commercially operated age-restricted websites must ensure that their users are 18+. In the case of failure to comply, the regulators are empowered to fine them up to £250,000 (or up to 5% of their turnover) and order the blocking of non-compliant websites.

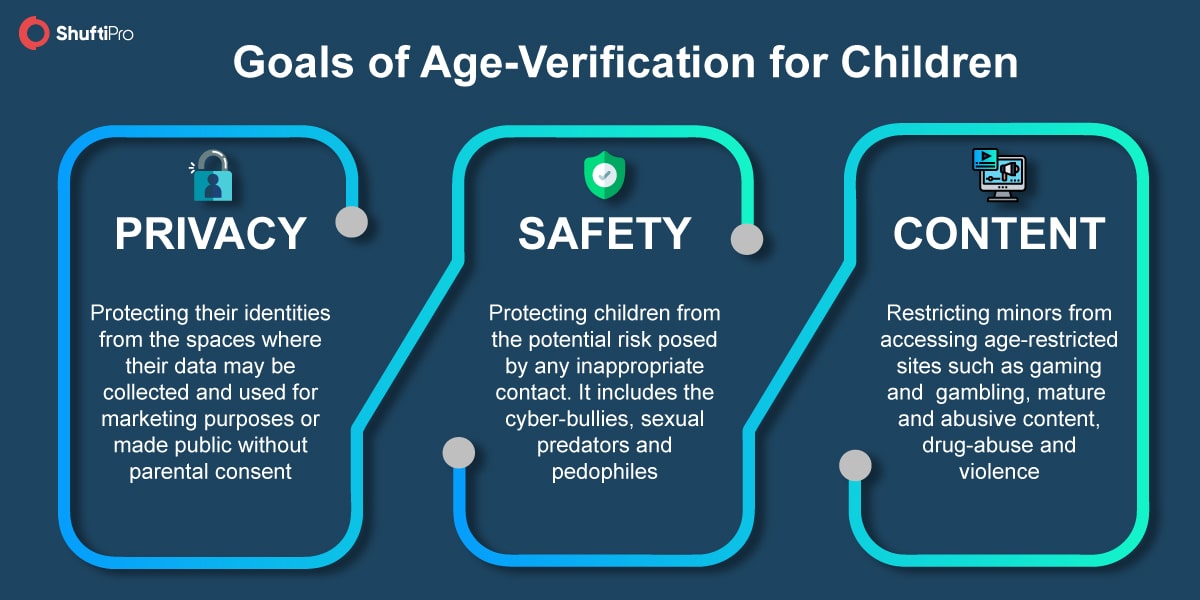

Goals of Age Verification for Children:

Performing age verification online is essential to protect children’s privacy, ensuring their safety from cyberbullies and assuring that they don’t gain access to inappropriate and mature content.

Read this white paper on age verification to learn more.

Performing age verification online is hampered by the fact that children generally lack credentials and proof to verify their age themselves. Therefore, access to age-restricted websites and mature content is limited to the users who can prove they are adults. If the user fails to verify their age and identity, the will be straightforwardly denied access. Moreover, there are some websites that perform identity authentication for adults and on the basis of their authority as a legal guardian, age verification of their children can be performed. In this way, the parents can track their children online as well.

Explore Now

Explore Now