Adverse Media Screening Requirements and Why Do FIs Need It?

The financial services industry is under a lot of regulatory requirements recently, and for all the right reasons. The surge in COVID-19 pandemic last year led to increased adoption in digitisation, which opened new doors for perpetrators to execute their malicious plans. That being said, banks and top-level financial organisations are faced with stringent obligations by watchdogs to minimise illegitimate associations, and safeguard the legal financial system. These recent changes aim to create better opportunities for companies to implement KYC/AML policies and procedures and deal with high-risk entities much more effectively.

The blog focuses on why adverse media screening is essential to tailor to the regulatory needs of financial institutions (FIs), how it creates better transparency between the business and clients, and compliance with state-of-the-art regulations.

What is Adverse Media Screening?

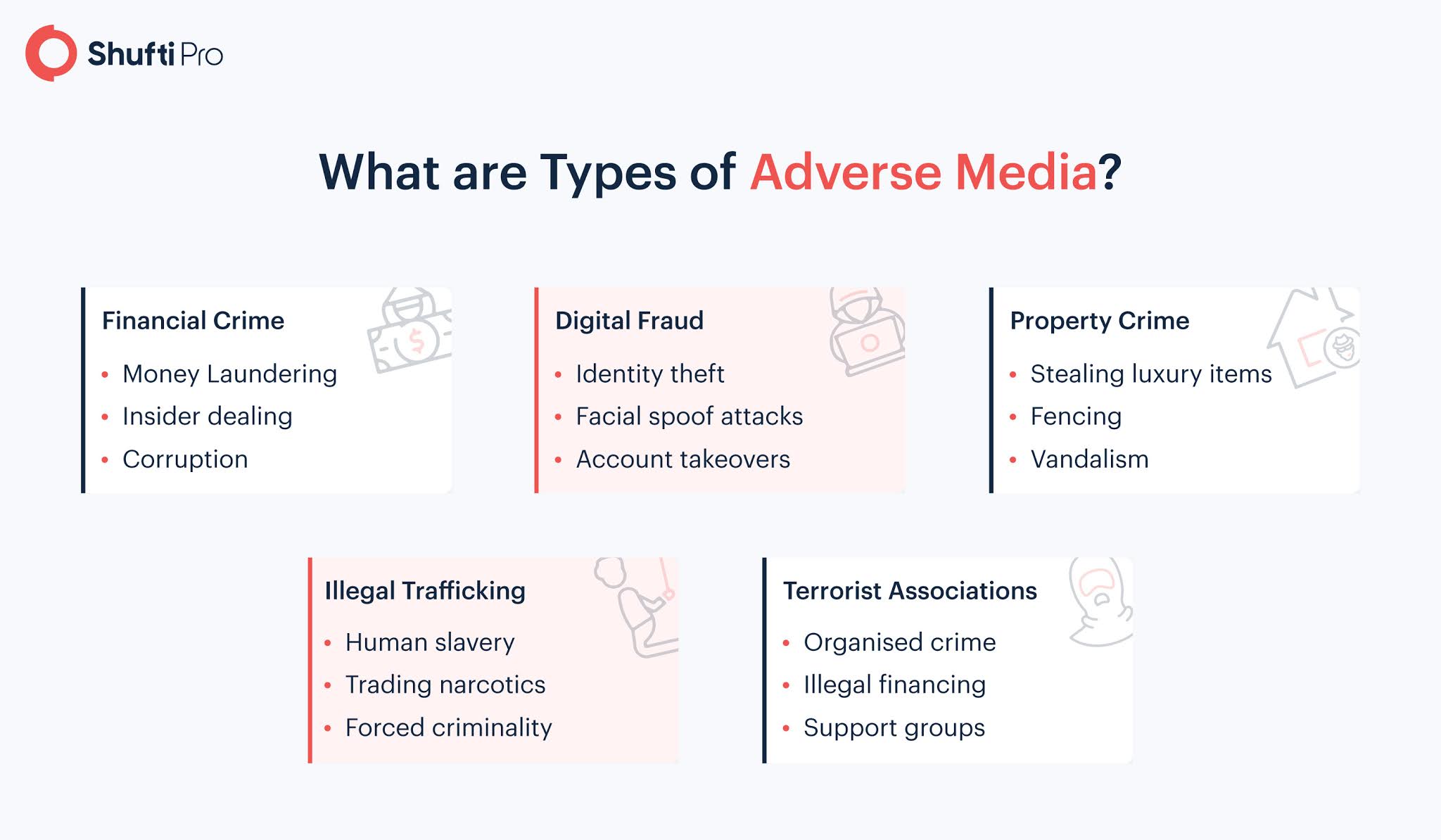

Financial organisations scrap the news, online media sources, and global watchlists provided by regulatory bodies to screen potentially high-risk risk customers known as negative news checks or adverse media screening. As an integral part of the AML compliance program, these checks allow businesses to combat financial crime effectively.

The Role of Negative News Checks in FIs

When we talk about businesses operating in the financial industry, specific checks are mandatory while new account openings, carry out large-scale transactions, etc. The purpose of these regulatory checks is three-fold:

(i) Incorporate Know Your Customer (KYC) procedures while customer onboarding

(ii) Stay compliant with Anti Money Laundering (AML) requirements

(iii) Risk-profiling of customers to mitigate financial crime

But when it comes to customers who are either a Politically Exposed Person (PEP); a business either operating in a high-risk industry or with frequent large transactions, or any other entity posing a significant amount of risk to the financial service provider, due diligence practices need to be defined accordingly.

Suggested Read: High-Risk Transactions – How Can Enhanced Due Diligence (EDD) Help?

An Approach Based on Risk Profiling

It is important to note that adverse media screening is part of a greater AML compliance program that consists of various internal controls, policies and procedures. Financial institutions develop in-house teams to cater to the needs of global AML standards to tackle monetary crime including money laundering and funding of terrorist groups. The Financial Action Task Force (FATF) emphasizes that businesses should develop a “risk-based approach” for businesses when carrying out customer onboarding processes.

Such infrastructure will allow responsible entities to properly understand, identify, and evaluate different levels of risks associated with different types of customers and industries, allowing them to address these challenges. FATF specifically describes “verifiable adverse media searches” as part of Enhanced Due Diligence (EDD) methods for financial institutions in the guidance document for the banking sector.

Additional Due Diligence Standards

Considering the 40 Recommendations by the FATF, the US regulatory watchdog, Financial Crimes Enforcement Network (FinCEN) has its own set of requirements for performing user onboarding procedures. The legislation known as the CDD Final Rule directs financial businesses to develop risk-based strategies while carrying out Customer Due Diligence (CDD). Apart from that, ongoing monitoring of customer behaviour and reporting suspicious transactional data is mandatory as per the text of the rule.

FinCEN’s CDD Rule implies that financial institutions must fully comprehend the purpose and nature of a business entity willing to establish relations with them. For this purpose, they should utilise watchlists issued by OFAC, UN, EU and; publicly available adverse media sources, negative news available on the internet, and consider global sanctions to screen potentially high-risk clients, thereby ensuring enhanced due diligence.

Focusing on Transparent Relations

Adverse media screening is a great way to develop trust and transparency among businesses relationships where they are B2C or B2B. Not only that, financial organisations that incorporate negative news checks in their daily operations are considered much more trustworthy than those that don’t adopt these extended due diligence practices. While these screening procedures save an enterprise from reputational risk, they are primarily intended to perform comprehensive identity verification of customers.

Due to the increasing monetary crime, regulatory bodies are constantly insisting on ownership transparency regardless of the business type (shell companies, LLC, sole proprietorship, joint ventures, corporations, etc.), and viable methods to prevent tax evasion in the long run. Although the European Union’s 6AMLD does not specifically include guidelines regarding negative media screening, it lists various other requirements that can greatly help in reinforcing AML compliance.

Banking on AI-driven Tools

The ever-increasing burden from financial authorities in the past few years has pushed businesses to adopt regulatory technology (RegTech) solutions. Detailed adverse media checks have become a need of the hour to monitor high-risk transactions and to prevent bad actors from misusing financial institutions for their nefarious objectives. In this regard, corporate and financial are allowed to develop their methods (either in-house or using a third-party service provider) to enforce AML compliance.

With a human workforce and manual search operations, meeting obligatory compliance targets are a frequent challenge for FIs. Since search operations against a wide array of negative media sources are time-consuming and tedious, it directly impacts customer experience as well as service delivery. Using automated AI-powered RegTech tools can enable financial companies to achieve much-needed customer trust and conformity with KYC/AML obligations.

What does Shufti Have to Offer?

Shufti is a UK-based global identity verification provider that allows businesses to perform effortless authentication of their customers in real-time using thousands of artificial intelligence (AI) models. With Shufti’s automated AML screening solution, financial institutions (FIs) can perform verification against more than 1700 global watchlists and numerous adverse media sources to perform effective risk profiling and ongoing monitoring of clients keeping intact global AML/KYC compliance standards.

Want to know more about quick and effortless watchlist screening solutions?

Explore Now

Explore Now