AML Compliance – Mitigating Money Laundering Risks in Insurance Companies

The huge influx of funds through insurance companies has led criminals to exploit the whole system using various fraudulent techniques. Unlike banks and other financial institutions, the insurance sector has not implemented stringent Anti-Money Laundering (AML) measures which have made it vulnerable to financial crimes. Fraudsters are using a myriad of techniques, particularly medicare fraud, life insurance fake policies, and annuity cash scams.

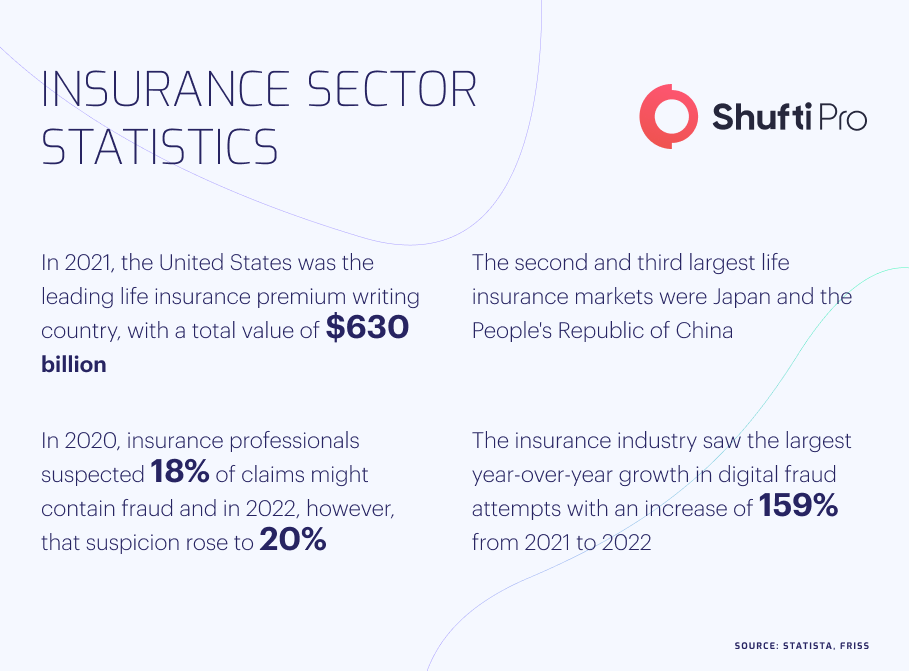

In the US alone, insurance fraud is costing $80 billion to consumers while in UK, numbers have gone up by 13% in 2021 as compared to the passing year. Fraudsters further use a variety of money laundering techniques to convert black money into legitimate cash. Eventually, the insurance firms and users are getting affected in the form of heavy financial losses which must be curbed through strict checks.

Money Laundering Risks Posed to Insurance Sector

Insurance companies are quite important for any monetary system as they are huge investors in the market ultimately securing the financial stability of users. Insurance firms are facing huge threats in the form of identity theft, money laundering, and terror financing. Two third of insurance companies have reported that they have faced financial fraud through several techniques in 2021. In the majority of cases, insurance companies have weak verification checks which are exploited by bad actors.

Corrupt politicians, business tycoons, and other criminal entities buy premium insurance policies and exploit them by making high-value purchases. They generally use dirty money to make the deals, claim them and get reimbursements through companies. Insurance loans are another important factor contributing to money laundering as firms usually do not have strict identity verification and anti-money laundering checks resulting in providing loans to money launderers.

Recent Fraud Cases in Insurance Companies

Eliminating fraud from the insurance sector has become quite crucial for the sustainability of system. Financial crimes are not only costing the firms billions of dollars but also leaving customers with a negative experience. Several cases have surfaced in the recent past where concerned authorities imposed heavy penalties on culprits to discourage all bad actors.

London Insurance Firms Probed for Bribery and Corruption by UK

UK’s regulatory authorities are investigating a London-based insurance firm that was involved in several corrupt practices. The company has been charged for not complying with AML regulations and providing chances to money launderers to carry out financial crimes using their platform.

During the investigation, it has also been observed that several officials of law-enforcement agencies are also involved and criminals were bribing them. Regulatory authorities have taken two other firms into account while probing all the allegations and court is yet to penalize the culprits.

Chicago Court Charged 23 Defendants in $26 Million Insurance Fraud Case

The federal court in Chicago has indicted 23 defendants due to their involvement in $26 million insurance fraud. The criminals took insurance policies by stealing the identities of several users further claiming health and death insurance on their names. The criminals had been involved in corrupt practices since 2013 and during this time, they used several techniques to fraudulently claim insurance.

FBI has stated that they will not allow the abuse of insurance companies for financial gains and money laundering. FBI has also vowed to make this case an example for all the bad actors exploiting insurance sector.

Global Regulations to Curb Money Laundering in Insurance Sector

Regulatory authorities around the world are working tirelessly to eradicate money laundering and identity theft risks from insurance organizations. Due to high vulnerability to monetary crimes, insurance sector is under strict scrutiny; the majority of state governments and global watchdogs have legislated new laws or amended existing rules associated with this industry.

Bank Secrecy Act (BSA)

Financial Crimes Enforcement Network (FinCEN) is the major regulatory authority in USA working under the guidelines of BSA. Bank Secrecy Act sets rules for monitoring insurance policies, particularly life insurance, annuity contracts, and products with cash values or investment features.

FinCEN has recommended all insurance companies report any suspicious activity connected to covered products. FinCEN has further set the threshold of $5000 to consider it a suspicious transaction and report it to concerned authorities.

Risk Based Approach Guidance by FATF

The Financial Action Task Force (FATF) has termed insurance companies to be the first choice of money launderers. Due to the high risks of money laundering and terror financing, FATF has made it mandatory for all insurance firms to implement strict anti-money laundering measures to keep criminals away from the system.

FATF has further recommended implementing an effective Risk Based Approach (RBA) to curb financial crimes. The risk-based guidance for the life insurance sector highlights the nature and level of money laundering and terrorist financing risks posed to the sector. It has been made imperative for all the countries to follow these guidelines and failing to do so can result in falling into grey or black lists.

Insurance Fraud Bureau of Australia (IFBA)

IFBA has estimated that insurance fraud is costing more than $2 billion annually to consumers in Australia. Considering these alarming facts, IFBA has recommended all insurance firms implement robust identity verification and AML screening solutions to restrain bad actors onboarding the system.

IFBA has made a framework to investigate all the loopholes which are exploited by criminals and take firm steps to fix them by following the model of UK and other jurisdictions.

Need for AML Screening and Customer Due Diligence in Insurance Sector

With emerging threats of money laundering and other financial crimes, a viable AML screening solution has become imperative for insurance companies. FATF and Interpol have collected huge data on money launderers and accumulated in the form of sanctions and Politically Exposed Persons (PEPs) lists. Insurance companies must adopt a system that has access to all these lists and screen their customer’s data against them. Through an efficient AML solution, money laundering risks can be reduced and criminals can be penalized.

Customer Due Diligence (CDD) is also crucial for the insurance sector as it will assist in determining the risk levels of customers. By determining risk factors, regulators can make a framework to curb criminal activities and secure consumers from financial losses.

What Shufti can Offer?

To stay compliant with AML regulations, insurance companies must incorporate effective solutions to not only verify the identity of customers but also monitor financial transactions. Shufti’s state-of-the-art AML screening measures help insurance firms to implement robust AML measures and report any suspicious activity. Powered by thousands of AI algorithms, it will help the insurance sector to meet global regulatory obligations. Shufti’s AML screening solution has access to 1700+ global watchlists and screens data against them in less than a second with 98.67% accuracy.

Want to know more about Anti-Money Laundering screening solutions for insurance firms?

Explore Now

Explore Now