AML in Real Estate – Combating Property Scams at the Forefront

Real estate is deemed to be a profitable and safe business to invest in thanks to its ever-growing rate of inflation. However, there’s more to it than meets the eye, as real estate crimes have topped the table with a 300% increase since 2006. Considering the large amounts of money circulating through the real estate sector, opportunities for fraud never cease to exist.

Even though the coronavirus outbreak did not affect real estate as much as it damaged various other businesses, property and rental scams were still contributing to an overall problematic situation. According to the FBI, there were a staggering number of over 13,600 cases of real estate and rental fraud in 2020. As it turns out, real estate is ironically quite safe for money laundering and is, therefore, one of the most commonly used mediums for cleaning black money.

Which countries have the highest rate of real estate fraud?

Real estate is a stable business due to its direct linking with the economy and other industries. Research identifies Australia, Argentina, Denmark, Ireland, Norway, and Turkey to be among a total of 18 countries that have a high rate of real estate fraud.

Types of Real Estate Frauds

Obtaining money illegally is the basic motive behind every crime, and the unprecedented scams of opportunists targeting the real estate sector are aimed launder money. Commercial real estate dealings require precise communication and presentation of property details, the history of owners, any changes made, etc. Considering these decisive factors, the business deal can either be a great investment or ultimately result in a huge loss.

There are often left out facts like minor details about the property that remain tucked away throughout the dealing process. This is sometimes due to the negligence on part of the seller, but it can also be real estate fraud. Scammers purposely hold back significant details about the property to fool business investors into believing that the particular deal will benefit them.

Suspicious Transactions

Real estate transactions need careful monitoring in order to determine the sources used for money laundering. Some key characteristics that help identify suspicious activity and allow real estate businesses to analyse risk are connections to other crimes and links with top foreign officials or political parties. Other red flags include fraudulent investors reaching out to buy a particular property at odd times and with cash-only payments, where minimal information about their identity is exposed. Suspicious bank transactions are those that originate from offshore accounts or areas that are identified to be high-risk by the FATF.

Manipulation of Records

An alternative method for real estate fraud is the intentional misplacement of property records in order to sell them at a higher value. The history of real estate is a key factor when identifying its true value and how it will be presented in the future. Past records help real estate agencies determine if the property was achieved through legal means or through illegally obtained funds. The property bought from money laundering or drug trafficking can put the real estate business in complicated situations.

Failure to present the past records means the business or entity selling the property is trying to hide possible flaws and depriving the real estate company of the necessary information. Additionally, the history of possible crimes committed on the premises as well as the zone-based restrictions are also purposely subtracted by fraudsters while presenting property information.

Partnership Fraud

Business partnerships or the apparent grouping of investors to contribute in buying a certain property or investing in it often turn out to be scams. At the forefront, this activity doesn’t seem like fraud, but the contributing businesses being relatively unfamiliar with each other makes the deal vulnerable to fraud. In some scenarios, the main business entity in the partnership may take each partners’ share and additional fees without an actual investment plan, or even indulge businesses to invest in deals that are not favorable at all.

Money Laundering

According to a recent report, over $2.3 billion were laundered through US real estate, with Nigeria being among the countries sourcing the illegitimate funds. Money laundering is a common crime in real estate where fraudsters find it convenient to camouflage illegally obtained funds and make them appear legitimate. With property prices going up, opportunities for safe investments are created that allow money launderers to make the best of the derived assets.

Ill-gotten money is used to buy a property and then sold or rented to earn legitimate funds from real sources. Fraudsters looking to make money through real estate employ various methods to appear as legitimate entities, including hyped or degraded values, third parties pretending to be legal owners, and non-transparent financing schemes. Basic characteristics that indicate risks of money laundering in real estate are the geographical placement of the investing business and the location of the property in question.

Fake Real Estate Buyers

Apart from getting entangled with problematic transactions, real estate businesses also become victims of the tactics of fake real estate buyers. Fake buyers tend to show signs of urgency in order to finalize deals and make false offers for a property that they do not actually intend to buy. When the time comes to close the deal, they are nowhere to be seen. In most cases, this is not because the buyers don’t have a sufficient amount in their bank accounts, but because they are not willing to expose the source of their money. This being the case because the funds are obtained through illegal means and the factual purpose to invest in real estate is to launder money.

AML Screening

Considering the aforementioned situation, implementing verification checks in real estate dealings is inevitable to put an end to crimes like money laundering. Just like financial institutions, real estate companies are structured to process large amounts of money, where loopholes can result in the company losing major assets. Since their processes are similar to banks, real estate businesses are also obliged to incorporate digital identity verification as well as AML screening solutions.

Conducting customer due diligence allows the real estate sector to eliminate fraud by ensuring transparency in business transactions. In addition to the damages resulting from crimes, AML policy violation fines also add to the burden. AML compliance allows real estate businesses to keep an eye on their customers by providing tools for screening against global watchlists. High-risk entities are required to undergo enhanced due diligence, where extensive background checks are performed to determine possible political connections.

Regulations to Counter Real Estate Scams

Updated AML regulations oblige real estate agencies and property agents to conduct customer due diligence, where all entities involved in property dealings and transactions including legal firms, real estate agents, and insurance firms. The FATF (Financial Action Task Force) has also formulated guidelines to free the real estate of money laundering and tax evasion. The regulations prominently shed light on the standards of customer due diligence. According to the guidelines, real estate dealers are required to implement strategies for client transaction monitoring.

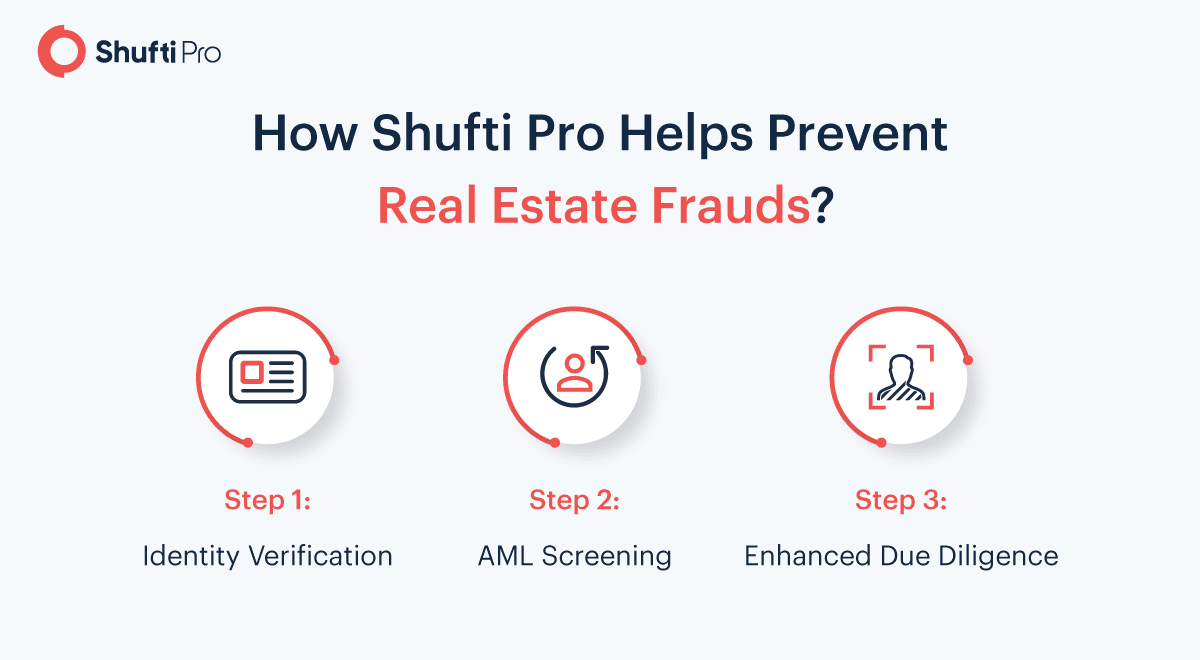

How Shufti Prevents Real Estate Frauds

Operations being carried out through digital platforms are prone to various challenges and also face the additional risks of cybercrime. This is true for real estate businesses that come under financial obligations. Here, Shufti provides AI-based AML screening to eliminate fraud in the real estate sector while allowing property businesses to comply with AML guidelines. Shufti identifies high-risk entities with background screening against 1700+ watchlists.

Learn more about global compliance regulations for the real estate sector!

Explore Now

Explore Now