Anti-Money Laundering Screening – Enabling Financial Institutions to Handle Suspicious Activities

Financial crime is becoming a global concern, yet it’s often tough to spot. That is why governments across the world are demanding from financial institutions that they must take steps or integrate Anti-Money Laundering (AML) systems to detect suspicious transactions. Of course, this is a sensitive task, as transactions that appear suspicious may be entirely legal, while illicit transactions may appear to be lawful at times.

Thus, its the responsibility of banks and other payment service providers to report suspicious transactions to financial watchdogs to avoid criminal activities such as money laundering and terrorism financing. In most countries, suspicious activity is reported by submitting a Suspicious Activity Report (SAR), a document provided to the proper government by a financial institution in accordance with compliance laws.

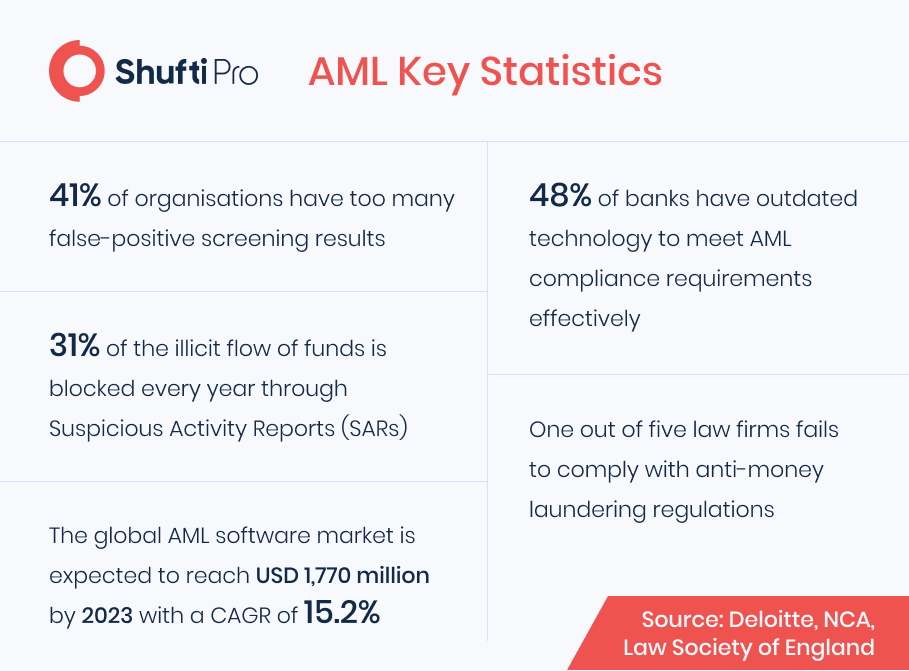

Insight into Global Financial Industry

Financial crimes have turned into a nightmare for banks and other financial firms all around the world. While calculating the costs of crimes can be difficult because they include significant regulatory fines, financial losses, and reputational damage. It is undeniable that dealing with financial crimes is becoming more difficult.

In addition to this, money laundering and terrorist financing are becoming a more serious threat to all financial institutions, thus, AML screening solutions and regulations remain a top priority as crime grows in magnitude, sophistication, and frequency. As a result, it’s evident that technology-based protection systems alone aren’t enough to combat rising crime rates and defend financial institutions’ reputations.

However financial crimes have become more sophisticated in terms of both technology and complexity, to the point where even financial institutions are finding it difficult to detect and eradicate the threat of unlawful operations. As a result, financial regulators are putting more pressure on banks to improve their anti-money laundering systems. As a result, financial organisations have a number of obstacles in implementing strict control systems and adhering to regulatory requirements. Thus, identifying and analysing suspicious activity is the only way to verify transactions. In the battle against financial crimes like money laundering, a Suspicious Activity Report (SAR) holds great significance. All financial institutions need to implement a suspicious activity detection and reporting system, according to the Financial Action Task Force (FATF), a worldwide anti-money laundering body.

Banks Ordered by BSP to Enhance the Filing of Suspicious Reports

The Bangko Sentral ng Pilipinas (BSP) has instructed banks and other financial institutions to increase the filing of Suspicious Transaction Reports (STRs) with the Anti-Money Laundering Council (AMLC) in an effort to fight financial crimes.

Following the outcomes of the AMLC’s 2021 STR Quality Review, the BSP, the Philippines’ central bank, was urged to adopt this move. Chuchi Fonacier, the BSP’s Deputy Governor, indicated that BSP-supervised financial institutions (BSFIs) have been misreporting fraud schemes and operations on a regular basis.

“In view of the foregoing, BSFIs are reminded to further enhance their suspicious transaction reporting process and ensure proper filing of STRs using the appropriate suspicious indicator or predicate crimes,” she said.

In addition to this, suspicious transaction reporting is crucial for reducing the instance of criminal activities particularly money laundering and terrorist financing. Banks and other payment service providers are strictly ordered by BSP to comply with SAR regulations. While extending the guidance, the regulatory authorities are hoping that businesses will stay put with the orders to lower the risk of non-compliant fines and the risk of crimes.

FinCEN Mandates Banks to Submit SARs to Affiliates Under AML Act 2021

The Financial Crimes Enforcement Network (FinCEN) legislated new law to mandate banks and financial firms to share suspicious transactions information with foreign financial watchdogs to curb the risk of money laundering and terrorist financing. This new law is mandated under the Anti-Money Laundering Act that emerged last January. Himamauli Das, FinCEN’s acting director said, “will assist financial institutions in further combating illicit finance risks.”

Chair of the banking group at Debevoise & Plimpton LLP, Satish Kini said, “Institutions have been seeking to do this as a means of better managing their anti-money-laundering risks globally. It will facilitate more ready risk management because folks [abroad] will know that a SAR has been filed in the United States.”

Daniel Stipano, partner at Davis Polk & Wardwell LLP stated, “Being able to effectively prevent and deter money laundering really depends heavily on being able to share information. If information is siloed…nobody has the full picture.”

Global Suspicious Activity Reporting (SAR) Requirements

United States of America (USA)

Suspicious activity reports are an essential part of the US’s anti-money laundering regulations, which have become more rigid after the world trade centre tragedy. In addition to this, Patriot Act further expands the SARs requirements in order to reduce the risk of money laundering and terrorist financing. However, financial firms failing to file SARs can face hefty fines or sanctions. Suspicious activity reports enable the financial watchdogs to identify the patterns of unusual transactions. In the US, all kinds of businesses involving transactions, particularly banks are required to file SARs if they detect unusual transactions. It is also mandatory if a firm identifies evidence of a data breach or a customer using money services illegally. Thus, the businesses also need to keep the suspicious transaction records for five years from the date of reporting.

United Kingdom (UK)

In the UK, suspicious activity reports need to be submitted to the National Crime Agency (NCA), the financial watchdog governing all monetary services in the country. Having in mind the suspicious transaction reporting obligation, banks’ designated officers should restrict the flagged unusual transaction before filling the SARs report. However, businesses can submit the reports in both forms, physical as well as on the online portal.

Canada

The financial institutions operating in Canada need to submit the suspicious transaction reports to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) by a Reporting Entity (RE) if there are reasonable grounds to suspect customer transactions that tend to violate money laundering and terrorist financing regulations. However, FINTRAC comes under the authority of PCMLTFA and other associated regulations. Its aim is to detect and mitigate financial crimes while ensuring that the customers’ information is kept under secure databases.

How Shufti Can Help

With an increase in money laundering and terrorist financing activities, suspicious activity reporting is made mandatory for all financial institutions across the globe. However, criminals, as well as money laundering techniques, are getting sophisticated banks are in dire need of technology-driven solutions to secure their operations

Shufti’s anti-money laundering screening solution helps financial service providers in performing ongoing client monitoring. Powered by thousands of artificial intelligence algorithms, Shufti’s AML Screening Solution enables businesses to develop customer risk profiles, verify them against 1700+ watchlists and effectively prevent financial crimes like money laundering and terrorist financing.

Want to learn more about AML compliance?

Explore Now

Explore Now