Art Market in the Frame of Money Laundering

The highly volatile finance and crypto sector is not appealing for many investors, so they turn to the less volatile marketplace – art. Investing in art not only reduces the risks but also ensures a higher value in the future. According to a report, the art market is the biggest business attracting both types of wealth; legal and illegal money. During the COVID-19 pandemic, the trend for art market investment increased and so did the FinCrime.

Unfortunately, the nature of art is an attraction for money launderers too. This market has been subject to money laundering and terror financing for quite some time. Given the more rigid regulations for other industries, financial crime is expected to skyrocket in this sector now. Although regulatory bodies have imposed laws on art sellers as well, criminals find loopholes in the system to achieve their illicit aims. Let’s take a look at the ‘what’ and ‘how’ of money laundering in the art market.

Why the Art Market Appeals Money Launderers

There are several features that make the art market an appeal for criminals. Here are a few pointers that might interest you:

- The anonymity of the buyer and seller is the most distinctive feature of this sector

- Private transactions categorise industries

- Offshore or foreign accounts are commonly used for transactions

- Authenticity is a major concern but not addressed in the art market

- This industry is not regulated in many regions of the world

- The value of the artwork is remarkably high but supply is limited making fraudulent activities pervasive

- Control on the transactions is limited i.e. confidentiality of the transacting parties

- Proxies or intermediaries are widely used for transactions

Money Laundering in the Art Market – How?

A fraudster advises an alternative investment fund for acquiring a masterpiece for its portfolio. The funding for the art piece is conducted through a foreign dealer who belongs to a country that has legalised transactions in the art market.

The piece of art is purchased and transported to any freeport or a high-security warehouse near airports. The artwork can be stored there for several years without the risk of damage or depreciation. Freeports generally exist in Singapore, Luxembourg and Switzerland, and make it easier for the launderer to vanish the paintings. Moreover, keeping the artwork in warehouses keeps them in transit and tax is avoided too.

Then, the artwork is privately and anonymously sold in freeports leaving almost no chances for regulatory authorities to identify the root of the transaction.

Fraudsters prefer multiple transactions across countries for a single piece of art which increases the complexity of tracing the buyer and seller.

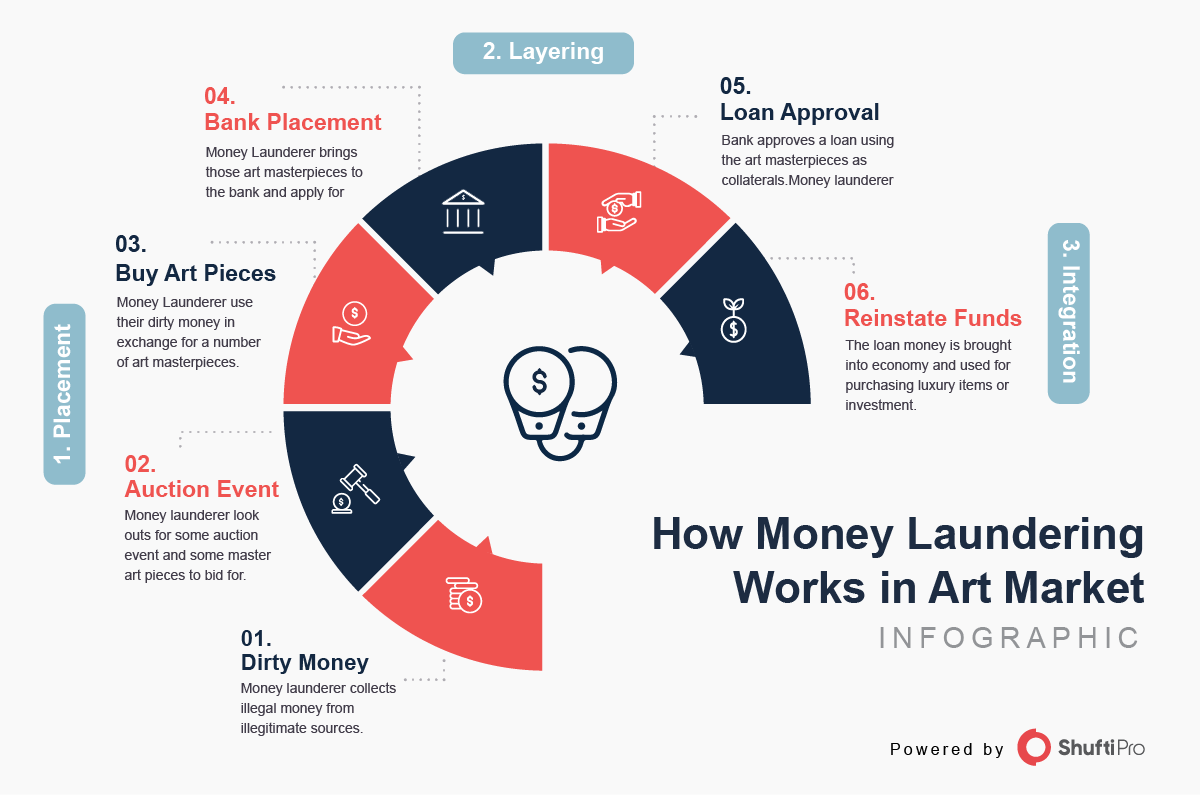

Let’s take a look at an example to understand how money laundering works in the art market:

Let’s take a look at an example to understand how money laundering works in the art market:

Fraudsters have a sum of two million dollars black money in cash. They will search for an online sale or an auction with exquisite pieces of art to bid. Then, the launderer will use the two million dollars and buy many masterpieces in cash. Lastly, the criminal entity will use this artwork as collateral to loan some amount, say 1.5 million dollars from the bank. The money launderer is free from black money and has clean money at hand.

Art and Money Laundering – A Recent Case

Last year, the former chairman of a Spanish Bank, Jaime Botin, was fined 52 million Euros for smuggling a Pablo Picasso painting. The painting was designated as a national treasure a few days back. The guilty was sentenced to 18-year imprisonment, however, he cannot serve the period due to his advanced age.

The painting was named “Head of a Young Woman” and the 1906 painting was worth 26 million Euros. The customs officials found the painting on Botin’s yacht during a search on the French island of Corsica in 2015. Spanish prosecutors accused Botin of trying to sell the painting and exploiting the cultural significance of the country.

According to the Spanish prosecutors, Botin was storing the masterpiece for a long time to conceal the origin of illegally earned money.

Art Market and the Regulations

The art market in the European Union has been regulated by Anti-Money Laundering Directives (AMLD). Currently, the sixth directive is in action (6AMLD) that covers obliged entities to individuals trading in art, acting as a third-party in the art trade or storing art in freeports. As per the directive, if the transaction value or any linking transactions equal €10,000 or more have to be verified. The 6AMLD has made Anti-Money Laundering (AML) screening and Customer Due Diligence (CDD) compulsory for all the sellers in the art market.

According to the EU AML Directives:

- Obliged entities are the ones who trade or act as third-parties in art trading. This includes art galleries and auction houses where the transaction value or linking transactions amounts to EUR 10,000 or higher.

- Individuals trading, storing artwork or carrying out transactions via freeports and the value of transactions is more than or equal to EUR 10,000.

Suggested: How does CDD effectively help with AML Compliance?

In the United States, the Bank Secrecy Act (BSA) is already regulating precious metals/commodities and jewels. The dealers have to file Suspicious Activity Reports and comply with other due diligence and Anti-Money Laundering (AML) obligations. However, art dealers are free from such regulations.

FinCEN can expect a robust notice if it extends the BSA requirements to art dealers. The existing AML guidelines will result in customer screening and transaction monitoring of every artwork that is sold.

The Responsible Art Market (RAM) is an organisation formed in 2015 in Geneva to control money laundering through the art market. The organisation is responsible for spanning the entire art market, including the dealers, auction houses, service providers, galleries, and legal entities associated with the industry. According to RAM,

- An art dealer has to comply with the KYC procedure

- Managing risk profiles to monitor purpose and process background

- Dealers must know how to act in case of risk/doubts

- Record-keeping is necessary

- Research artwork to know everything about the origin and owner

How To Combat Money Laundering in the Art Market

Due Diligence and Anti-Money Laundering (AML) screening is the key to combating money laundering in the art market. All dealers must follow the risk-based approach and employ AML checks to ensure that illegal money has not been used for purchasing artwork. Moreover, ongoing AML and transaction monitoring can assist organisations in maintaining an updated risk profile of every buyer making compliance with the regulations easier. AML screening checks the background of buyers against several sanction lists and PEPs.

With Shufti AML compliance solution, you can validate every buyer and ensure that black money is not used for the transactions. Furthermore, our ongoing transaction monitoring allows businesses to keep a check on every transaction being conducted by the customers.

Key Takeaways

The art market is an easy target for money launderers due to the anonymity of transactions. Nobody can suspect the source of money and if freeports are involved the chances of tracing the origin of money are nearly zero. The EU has imposed the Sixth Anti-Money Laundering Directive (6AMLD). However, the majority of the regions of the world have no regulations to tackle ML/TF in the art market.

Strict regulations must be enforced to reduce criminal activities, and CDD and AML checks must be employed to verify the legitimacy of the transacting parties.

Get in touch with our experts and know about Shufti’s AML suite.

Explore Now

Explore Now