A Comprehensive Guide to AML Compliance [2020]

Anti-money laundering (AML) laws are the primary target of regulatory authorities. These regimes help to detect and report suspicious transaction activities that may lead to the punishable offences of money laundering and terrorist financing. The anti-money laundering laws are helping financial institutions to address weaknesses in the system through robust customer verification processes. A lack of proper anti-money laundering (AML) laws can leave countries vulnerable to high levels of risks, leading to weaker economies and an unsafe transaction environment.

What is Anti-Money Laundering (AML)

Anti-money laundering (AML) includes regulations and laws for preventing financial criminals from disguising funds obtained through illegitimate sources such as drug trafficking, smuggling, frauds, illegal gambling, etc. Money laundering, when not eliminated can have rather far-reaching implications.

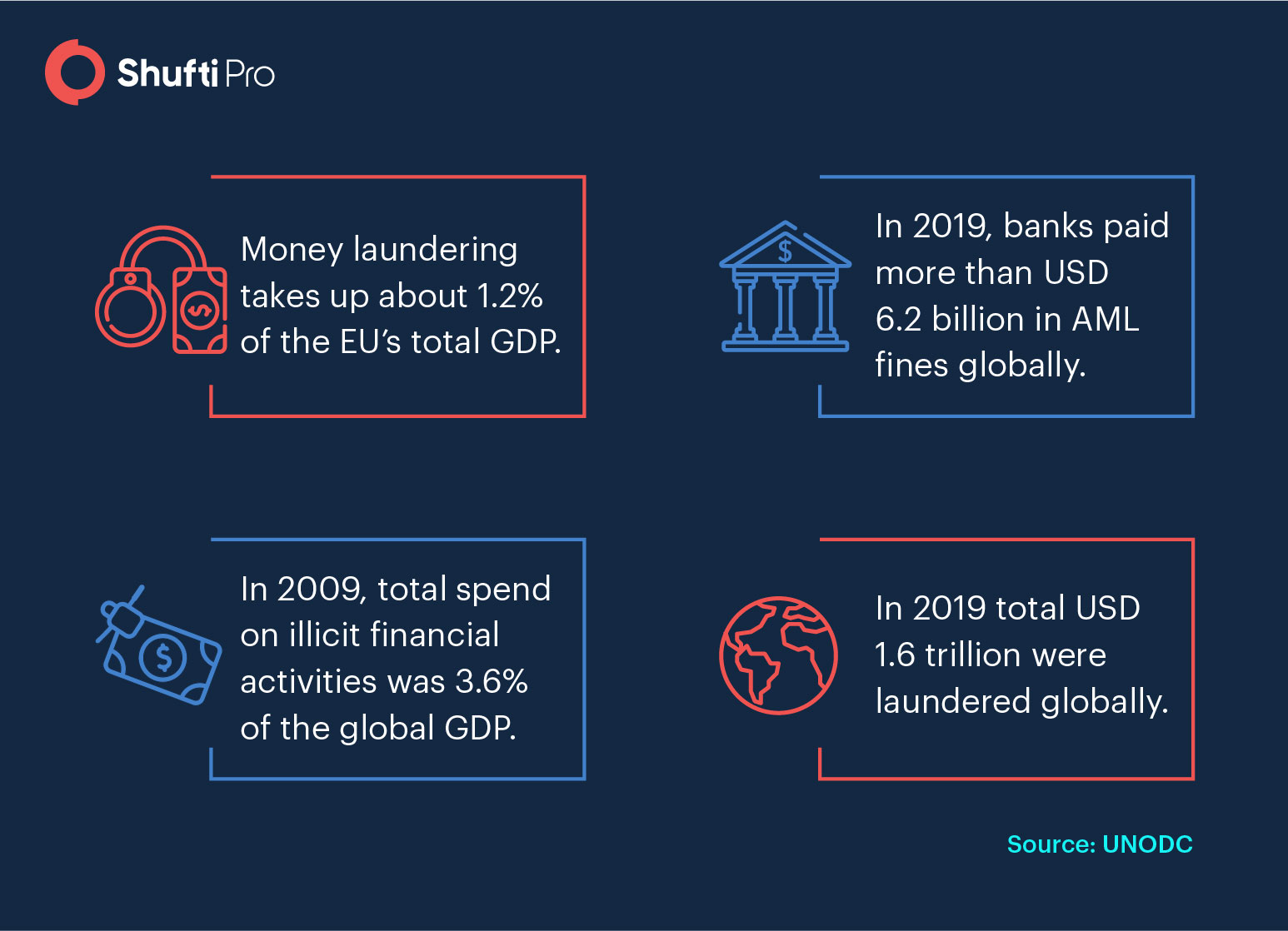

Anti-money laundering (AML) regulations require financial institutions to run thorough background checks to detect high-risk transactions and to ensure that no payment is aiding money laundering activities. The estimated amount of total money laundered annually around the world is 2-5% of the global GDP, about USD 8 billion to 2 trillion.

What is the Anti-Money Laundering Act

The strong AML procedures prevent money laundering from happening. Global industries, especially financial institutions are required to follow anti-money laundering practices, including KYC to understand the risk level associated with each individual customer. For example, a customer making a transaction can be on the sanction list. Having said that, global regulatory authorities are doing a great deal of work in fighting against money laundering and other financial crimes such as terrorism financing. Global governments have deployed extensive Anti-money laundering acts in the financial sector which provides the necessary tools to combat the growing problem. Anti-money laundering act considers money laundering as an act of crime; which gives the financial sector an opportunity to detect, trace, and report criminally derived transactions, ultimately leading to the confiscation of illegal assets. The financial sector and law enforcement authorities are working together to curb money laundering.

In 2012, FATF’s revised 40 recommendation lays down the groundwork for anti-money laundering and fighting against terrorist financing. G7 countries founded FATF in 1989, ever since FATF has brought forth extensive standards against financial crimes. The AML standards provided by FATF are now accepted globally as a benchmark to fight against money laundering and other financial crimes by the UN, IMF, World Bank, ADB, and other international regulatory bodies.

According to the FATF anti-money laundering act 2012; money laundering, terrorist financing, and proliferation were considered as criminal offences, when reported, all the assets leading to these activities should be confiscated at once. There should be financial intelligence units that are responsible for collecting, analyzing, and reporting suspicious transactions. As a part of anti-money laundering regulations, financial institutions are mandated to ensure customer due diligence to meet compliance and risk assessment. Global financial institutions that fall under the umbrella of FATF are supposed to have effective strategies in place to meet anti-money laundering compliance.

Revised FATF Standards 2012

- The requirement for countries to undertake a national risk assessment

- Measures relating to proliferation financing

- Addition of tax crimes as predicate offences to money laundering

- Measures relating to domestic politically exposed persons

- The requirement for countries to ratify the UN Convention Against Corruption

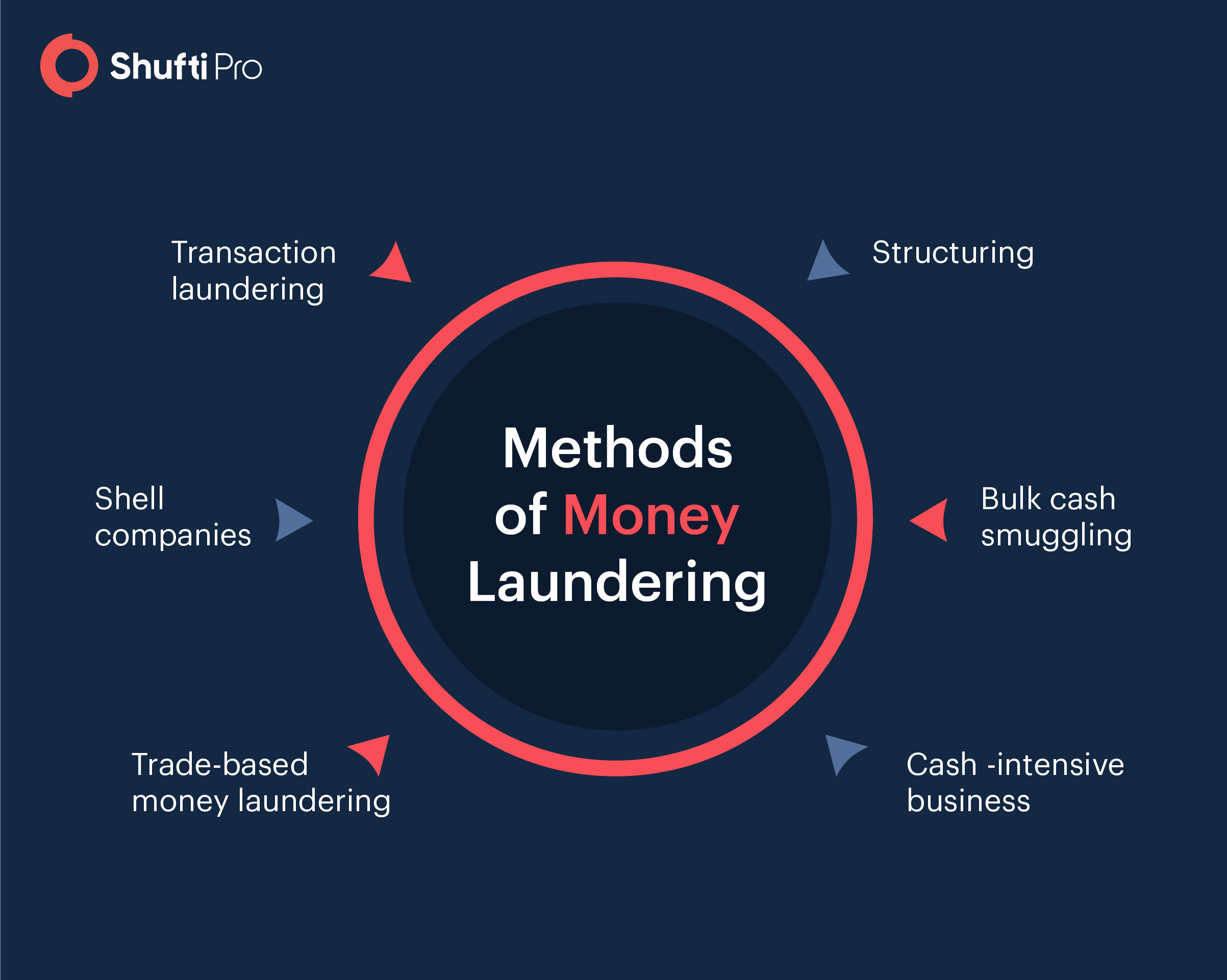

Methods of Money Laundering

Different methods of money laundering have been present but the most common money laundering techniques take place through financial systems. Say for example financial criminals making large transactions to disguise the illicit sources of funds.

Some common types of money laundering include:

Structuring: In this type of money laundering, huge volumes of cash is divided into smaller portions to avoid detection and money laundering suspicions.

Bulk Cash Smuggling: This involves physical movement of cash across borders, illegally and depositing it in banks.

Cash-Intensive Businesses: Here, criminals deposit proceeds of cash through legal cash-intensive businesses and proceeds of cash through illegal sources in a bank account of cash-intensive businesses to avoid detection.

Trade-Based Money Laundering: This type of money laundering leverages the weak trade system across borders and involves the exploitation of import and export of goods.

Shell Companies: These are the business entities that are used by criminals to hide the illegal sources of funding including the owners.

There are many other methods that are used for money laundering such as round-tripping, gambling, bank captures, and others. The reason why it is important for law enforcement and regulatory authorities to maintain a proper check and balance over financial institutions in order to deal with the problem. Among other things, customer due diligence and identification before onboarding them on financial platforms is also enabling financial institutions to manage risk and meet compliance simultaneously.

Trade-Based Money Laundering

Trade-based money laundering is considered one of the most sophisticated ways to hide illicit sources of money. In trade-based money laundering, criminals usually take advantage of the trading system which involves the exploitation of import and export of goods. This type of money laundering is mostly done where multiple parties are involved as it makes the entire due diligence and anti-money laundering (AML) screening process more difficult. Some TBML schemes include and are not limited to: over, under or multiple invoicing, shipping more or fewer goods than invoiced. Obfuscation of goods meaning shipping something, different from what is invoiced for or phantom shipping which includes empty shipment. Therefore, it comes down to the standards issued by FATF to combat money laundering. Effective anti-money laundering techniques are obligatory for financial institutions in order to stay updated with changing customer data and transaction history.

What are the Sanctions?

Sanctions are considered crucial for the financial industry to prevent crimes. Countries around the globe are using sanctions to limit the spread of crimes, to settle conflicts, or to counter human rights violations and counter-terrorism. Individuals and businesses involved in illegal criminal activities can end up in these sanctions lists.

Such criminal activities may involve money laundering, terrorist financing, drug trafficking, human rights violations, arms proliferation, and violation of international treaties. Global sanctions may fall under different categories such as:

- Economic

- Political

- Sports

- Military etc.

Some examples of possible sanctions may include a ban on weapons, a ban on certain types of exports or imports or even technology that could otherwise produce deadly weapons of mass destruction, loan restriction for certain individuals, confiscation and freezing of assets, travel restrictions, etc.

Nowadays, global industries are required to check individuals or companies against such sanction lists to save themselves from non-compliance penalties and other future complexities. The global sanctions are used to bring the financial crime rate under control which otherwise endangers global peace and security.

Anti-money Laundering Regulations

AML regulations are basically the rules for financial businesses and institutions to eliminate money laundering and terrorism financing activities. Moreover, an anti-money laundering policy is initially implemented to control the illegal sources of funds coming from drug trafficking, smuggling, and other crimes. But lately, crime has become advanced the reason why strict anti-money laundering policies were, therefore, implemented. AML/CFT has now become an international concern. Every country has its own anti-money laundering regulations, but the most followed is the 40 recommendations of FATF. Having said that, AML laws are implemented all over the world and have remarkably changed the financial landscape.

The commandments by FATF set out a comprehensive framework that lays down the measures that countries should be fulfilling to combat money-related crimes. These legal and operational frameworks differ from country to country. Money laundering can happen anywhere in the world. Financial criminals do not really need to belong to one particular area but mostly money laundering crimes look for areas where there are low risks of being detected and unstable financial institutions with ineffective policies to address the issue when reported.

FATF, The financial action task force is an independent intergovernmental body that assists the policies to safeguard the global financial system against financial crimes. The 40 recommendations by FATF are recognized around the globe as anti-money laundering policy to counter money laundering and terrorist financing.

What is AML Compliance?

AML compliance is the process of background screening and ongoing monitoring of customers to identify and eliminate financial crimes such as money laundering. The customer is screened against global watchlists, sanctions, and PEPs lists for risk assessment.

As mentioned earlier, the financial industry is most impacted by the crimes of money laundering since it involves a massive volume of money flow on a daily basis. Therefore, AML compliance is considered stringent by local and international regulators. It does not only include the customer identity verification but complete background checks are also performed to ensure that customers undergoing verification were not a part of any criminal activity before or currently. Anti-money laundering checks are performed on each customer against government-issued sanction lists, black-lists, and PEPs.

Read more: Implementation of AML compliance – Challenges and fundamentals

AML Monitoring

AML monitoring allows financial institutions to monitor customer transactional history on a regular basis for continuous risk assessment. Transactional history assessment is then combined with customer’s background history which as a result gives a more holistic view of customer’s profiles and risk level associated with each individual that would otherwise lead to crimes of money laundering and others. Regular anti-money laundering monitoring identifies the suspicious customer behaviour projected through transaction history. Companies are nowadays automating their processes to address regulatory priorities. These automated solutions are bringing in more effectiveness and trust.

Countries are liable to follow the AML monitoring policies to ensure adequate and timely reporting in case of incidents. The credibility of financial institutions is based on their ethical standards. Having said that, business reputation is considered one of the most important assets for a financial institution. If a particular institution is subjected to crime, it not only loses its integrity but also increases the customer drop off rates and undermines law enforcement agencies.

AML Client Onboarding Process

AML client onboarding is the initial stage that leads to a relationship between a customer and a financial institution. During onboarding, a company collects as much customer information as possible in order to know their customer or for customer due diligence purposes. AML/ CFT is crucial before onboarding customers because at this stage the customer is going to make the very first contact with the organization. After the onboarding, a customer decides if it’s something that they may want to use or refer to other people, in short, initial onboarding influences customers’ future decisions. Anti-money laundering onboarding allows financial institutions to analyze customer data which is important for on-going AML and transaction monitoring.

It is obligatory by law, for financial companies to know their customer before onboarding. Performing customer due diligence is the responsibility of expert compliance officers as it is considered a critical process.

- Automated KYC Solution

It’s up to the company to choose the KYC solution, either they want to move forward with the automated solution or the manual KYC. Even though KYC solutions are automated for better results and to speed up the entire customer onboarding process.

- Collect Personal Information

Next step is to collect customer personal information from the merchants. KYC and AML checks go hand in hand. Therefore, before performing AML for risk assessment, KYC is performed.

- Verification through Sanction Lists

In order to meet anti-money laundering compliance, customers are checked against government-issued global blacklists, sanctions and PEPs (politically exposed persons) lists to ensure risk-free transactions.

- Dispatching Results

After all the KYC and AML checks are done successfully customers are onboarded.

AML Client Onboarding process requires organisations to collect customer data for customer due diligence. The collected customer data is significant for ongoing AML. Ongoing AML is regular transaction monitoring to develop delated risk profiles which as a result strengthen financial infrastructure and prevents fraud.

AML Compliance Solutions

AML compliance solutions are used by companies to detect and report suspicious transactions. It is the process of screening backgrounds and monitoring customers to eliminate any acts of money laundering. Automated AML solutions enable global businesses to comply with AML regulations, local and international. Companies should choose an AML solution that has data from global databases without any room for discrepancy. In the modern era, funds can be easily transferred from one continent to another in a matter of minutes. Due to the same reason, financial risk analysis and due diligence are vital. Moreover, customer satisfaction is essential which may not be possible with the manual AML solutions. AML compliance is imperative for many sectors, including fintech, banks, foreign exchanges, stock exchange, art and precious metal dealers, gaming, cryptocurrency, and real estate.

What is AML in Banking?

AML in banking refers to identifying money launderers and secure financial institutions from terrorist financing and other financial crimes. It ensures that the financial institutions are secure for all the customers. Financial institutions are the first target of criminals. It is important for the finance sector to identify money laundering and handle it appropriately.

Money Laundering Risk in Foreign Exchange

The forex industry has become a potential target for criminals to hide their illegally earned money. Forex trading has many opportunities for the money launderers to stay safe from regulatory authorities; therefore, currency exchanges are at greater risk of money laundering. Due to the same reason, regulations in this sector have increased as well. The foreign exchange regulations ensure how the customers are using the platforms in the sector. For detecting money laundering, the forex industry must be fully aware of the essential AML/CFT vulnerabilities related to the foreign exchange sector.

AML for Forex Industry

According to Reuters, five trillion USD is the average dollar value of the trades in the foreign exchange sector. With a contribution from different regions of the world including G10 countries, the currency exchange has become a vibrant space. Market competition has increased significantly. Unfortunately, fraudulent activities have increased as well and the need for anti-money laundering compliance is the need of the hour. AML for foreign exchange is mandatory as per the foreign exchange regulations and robust identity verification is crucial. It assists all the entities of currency exchange to prevent money launderers from causing any trouble. Forex trading is a global activity which makes AML and KYC an obligation for swift and secure operations. Moreover, the FATF has enforced regulations on all the foreign exchange companies and brokers to follow anti-money laundering compliance.

Risk Mitigation for Businesses with AML Compliance

The risk of money laundering for different sectors is on edge. Real estate, finance, gambling, and e-gaming are the highlight targeted sectors. All these industries need a robust solution that can help businesses in fighting money laundering, terrorist financing, and other illegal activities. With the help of anti-money laundering compliance, all these sectors can mitigate the risk of being the target of money launderers. AML for business ensures that every customer that a business onboards is legitimate. The verification procedure lets businesses identify criminals that are in different sanction lists. The solution cross-checks an individual’s identity with PEPs, sanctions, etc.

Recommended: Need for Identity Verification To Deal With Money Laundering Threats in Real Estate Sector

AI-Powered AML Solutions

The manual mode of performing anti-money laundering checks is time-consuming and prone to human errors. Ensuring timely verification and legitimate onboarding is difficult for all the organisations, so a digital procedure can help. An Artificial Intelligence-based AML solution is one of the ideal ways that can help your business in fighting fraud. It takes less than a minute to verify all the identities. Moreover, the chances of error are greatly reduced. Advanced AI algorithms make it convenient for businesses to verify customers with sanction lists and build secure relationships with all the clients.

How to Prevent P2P Money Laundering?

Identity theft is the most common type of fraud in the P2P sector, and it is also resulting in a rise in other P2P lending risks like money laundering. All the peer-to-peer platforms have to be more vigilant and employ anti-money laundering checks to ensure money launderers stay away. Mitigating such crimes is not a piece of cake, so there is a dire need for a robust solution that can verify all identities in real-time and reduce human efforts too.

With the help of anti-money laundering screening, the P2P economy can greatly reduce the risk of forged identities, money laundering, and terrorist financing. Banks, insurance companies, real estate, and many other sectors have added the AML compliance solution to ensure integrity of platforms, and secure all the customers and transactions.

Why Cryptocurrencies Need AML Compliance?

Cryptocurrencies are decentralised digital currencies that have anonymous transactions. Due to their anonymous and transparent nature, it is easier for the money launderers to achieve their illegal goals. A 2019 report from Technology Review stated, approximately USD 2.8 billion were laundered by money mules using crypto exchanges. A significant rise in money laundering has been observed this year and the pandemic fanned the flame.

A month ago, Iossifov, the owner of a crypto exchange giant, RGCoins, was arrested for being involved in money laundering through crypto. The reports stated that the scam victimised more than 900 Americans.

Digital currencies are expected to replace fiat money in the world that completely relies on technology now. Criminals are also figuring out their way through these advancements and the crypto market is at stake. Considering the increasing risks and challenges for this industry, AML compliance is greatly needed. The compliance solution can cater to the needs of all platforms dealing with cryptocurrencies in combating not only money laundering but other financial crimes as well.

Digital Identity Verification and AML

Everybody is fond of using digital platforms and the virtual space has penetrated every corner of the world. Verifying criminals should be digitized as well. It is not only convenient for the companies but digital identity verification ensures more security than the manual methods. Anti-money laundering identification can also be conducted remotely through digital means.

Digital identity checks have many options for businesses and some of these include:

- Face verification

- Document verification

- Knowledge-based authentication

- Consent verification

All these have many benefits for businesses, including better compliance, high accuracy, time efficiency, and above all enhanced customer experience.

What is Ongoing AML?

Clients with a high-risk level pose greater threats to financial institutions. They need thorough risk assessment during the customer onboarding process that can check them in different global sanction lists, blacklists, PEPs, and the like. Ongoing AML checks are performed to prevent high-risk customers from causing any damage to the infrastructure.

Shufti pro’s ongoing AML solution provides all financial and non-financial institutions to perform continuous customer checks and monitor them for a certain time. This AI-powered solution deploys a wide range of algorithms for in-depth monitoring of the clients and develops comprehensive risk profiles that can prevent financial crimes like money laundering. Staying one step ahead of the criminals is what every firm needs and an ongoing AML solution can help companies in achieving the goal.

Why is Ongoing Monitoring Important?

Anticipating problems is the only way that can help companies in combating crime. However, it is impossible without robust identification measures. Any discrepancies in the anti-money laundering solutions can result in severe financial loss. Hence, an ongoing anti-money laundering solution is vital for businesses. It assists businesses in onboarding the right customers and continually monitoring them to secure businesses as long as possible. The global AML screening has many benefits including:

- Identity assurance

- AML onboarding solutions

- Accurate risk profiling

- Reduce false positives

- Updated risk status

- Enhanced compliance screening

- High-security standards, and

- Reduced cost of compliance

How Shufti’s AML Compliance Solutions Can Help?

Money laundering, terrorist financing, and other criminal activities have significantly increased. The forex exchanges, P2P economy, banking, and various other sectors are facing the rise in money laundering. In order to prevent money laundering, there is a dire need for AML compliance solutions. These solutions mitigate the risk and make sure launderers stay away from businesses. Shufti’s enhanced anti-money laundering screening and ongoing AML can help companies in different sectors to fight criminals and keep a check on all the transactions.

- The AI-powered ongoing anti-money laundering monitoring solution is all what a financial entity needs. Within a matter of seconds, your business can identify fraudsters.

- Building strong relationships with partners, affiliates, and vendors comes with great risks. However, Shufti’s AML for businesses can help you mitigate the risk of money laundering through your business.

- Shufti’s ongoing AML for businesses ensures that you deal with the right entities every time.

- Our AML dataset verifies all the customers and businesses by using different global sanction lists.

Need further assistance on AML compliance? Get in touch with our experts.

Explore Now

Explore Now